Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RAVI has recently experienced a surge in demand for one product line. In order to be more productive, RAVI is analyzing two potential expansion projects.

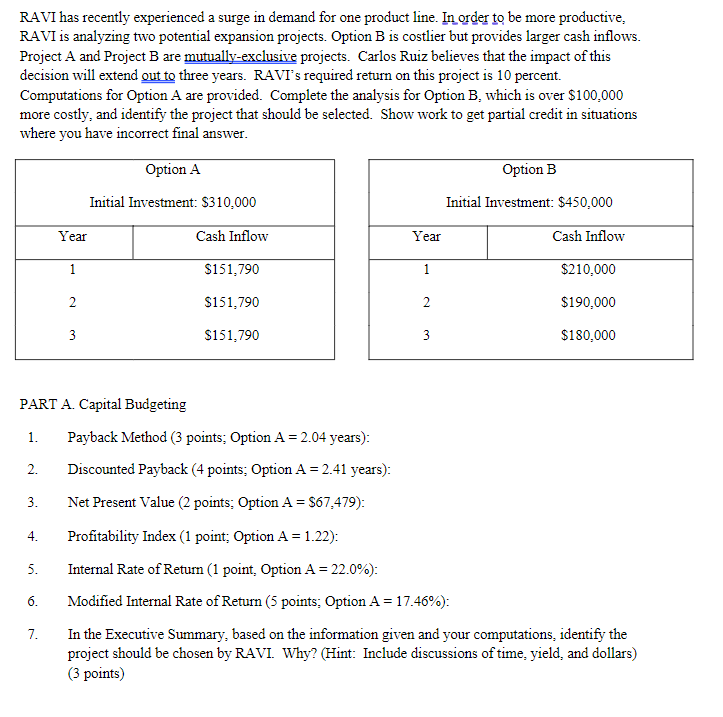

RAVI has recently experienced a surge in demand for one product line. In order to be more productive, RAVI is analyzing two potential expansion projects. Option B is costlier but provides larger cash inflows. Project A and Project B are mutually-exclusive projects. Carlos Ruiz believes that the impact of this decision will extend out to three years. RAVI's required return on this project is 10 percent. Computations for Option A are provided. Complete the analysis for Option B, which is over $100,000 more costly, and identify the project that should be selected. Show work to get partial credit in situations where you have incorrect final answer. PART A. Capital Budgeting 1. Payback Method ( 3 points; Option A=2.04 years): 2. Discounted Payback (4 points; Option A=2.41 years): 3. Net Present Value (2 points; Option A=$67,479) : 4. Profitability Index (1 point; Option A=1.22) : 5. Internal Rate of Return (1 point, Option A=22.0%) : 6. Modified Internal Rate of Return (5 points; Option A =17.46% ): 7. In the Executive Summary, based on the information given and your computations, identify the project should be chosen by RAVI. Why? (Hint: Include discussions of time, yield, and dollars) (3 points)

RAVI has recently experienced a surge in demand for one product line. In order to be more productive, RAVI is analyzing two potential expansion projects. Option B is costlier but provides larger cash inflows. Project A and Project B are mutually-exclusive projects. Carlos Ruiz believes that the impact of this decision will extend out to three years. RAVI's required return on this project is 10 percent. Computations for Option A are provided. Complete the analysis for Option B, which is over $100,000 more costly, and identify the project that should be selected. Show work to get partial credit in situations where you have incorrect final answer. PART A. Capital Budgeting 1. Payback Method ( 3 points; Option A=2.04 years): 2. Discounted Payback (4 points; Option A=2.41 years): 3. Net Present Value (2 points; Option A=$67,479) : 4. Profitability Index (1 point; Option A=1.22) : 5. Internal Rate of Return (1 point, Option A=22.0%) : 6. Modified Internal Rate of Return (5 points; Option A =17.46% ): 7. In the Executive Summary, based on the information given and your computations, identify the project should be chosen by RAVI. Why? (Hint: Include discussions of time, yield, and dollars) (3 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started