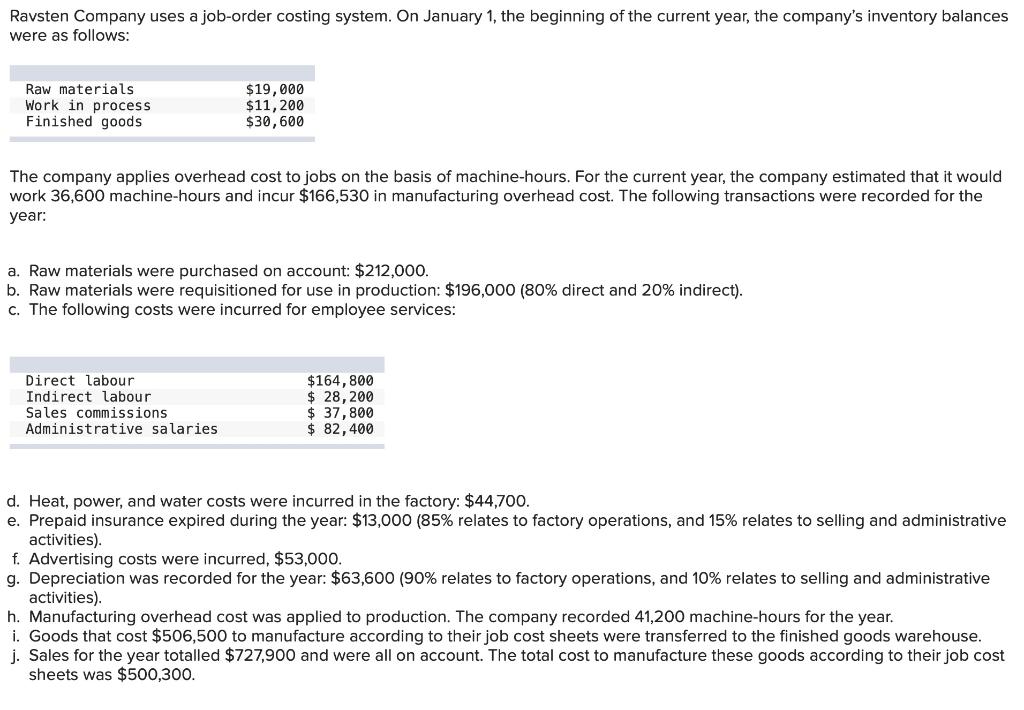

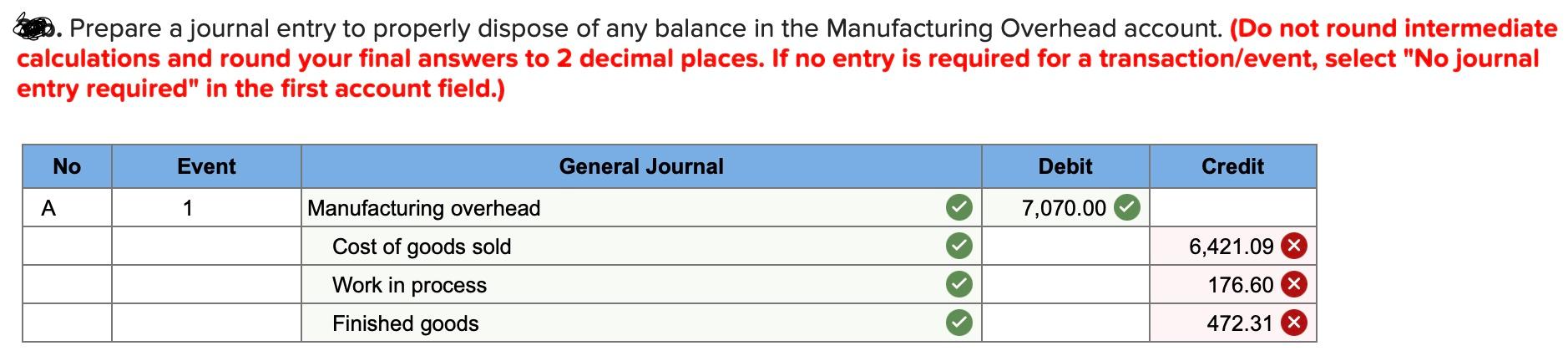

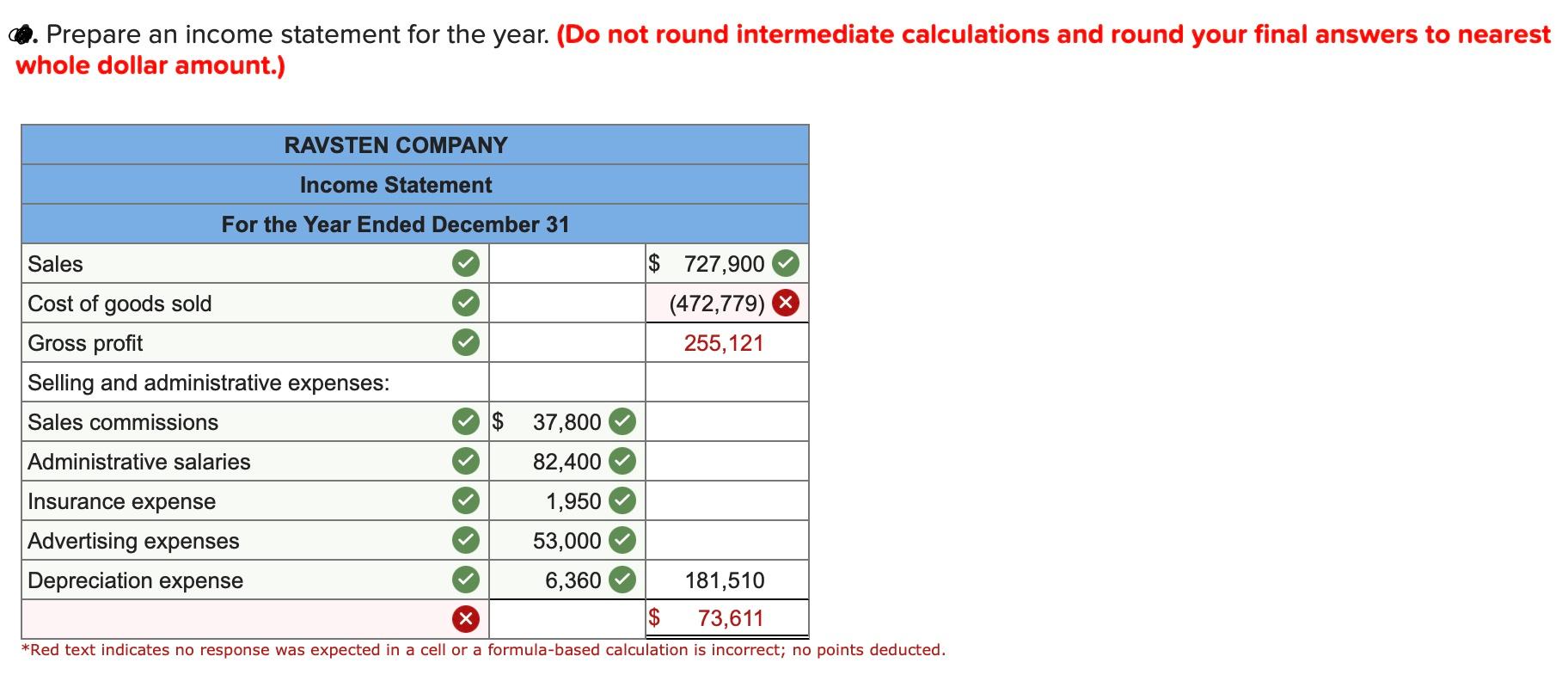

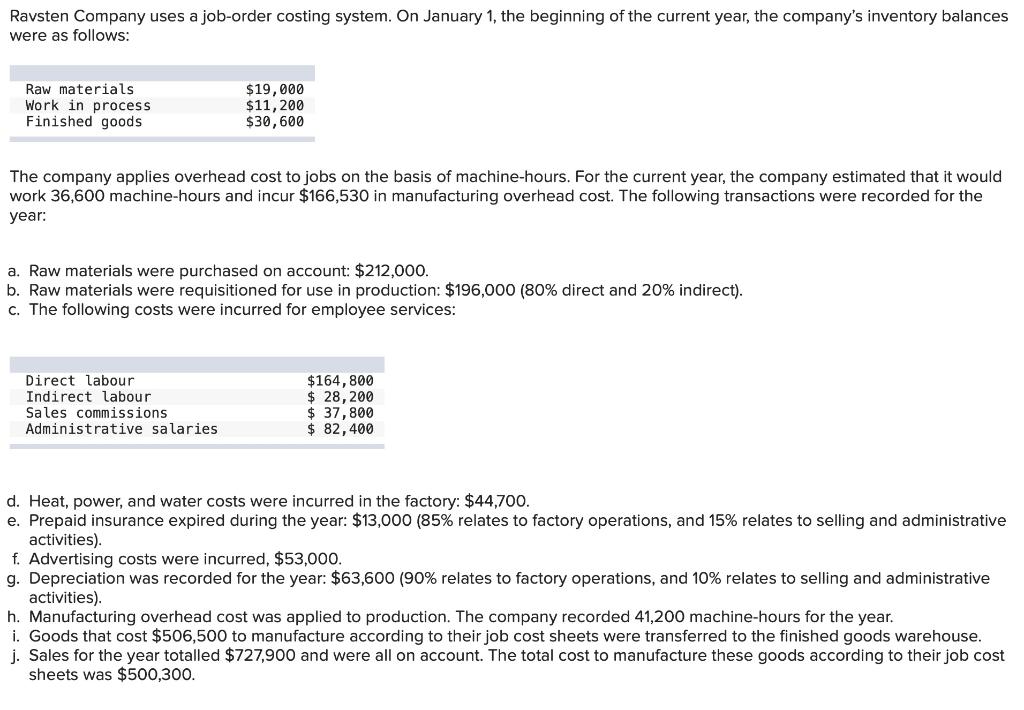

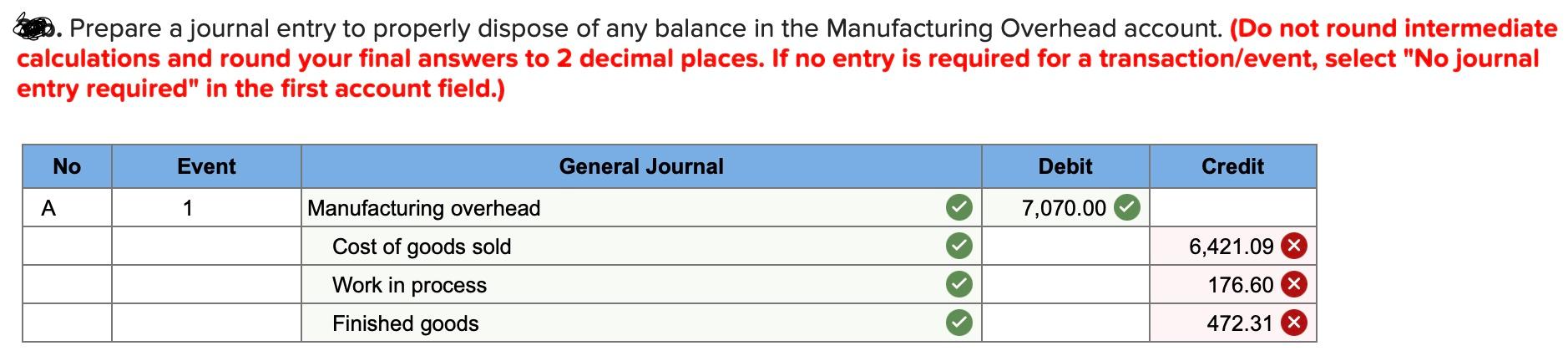

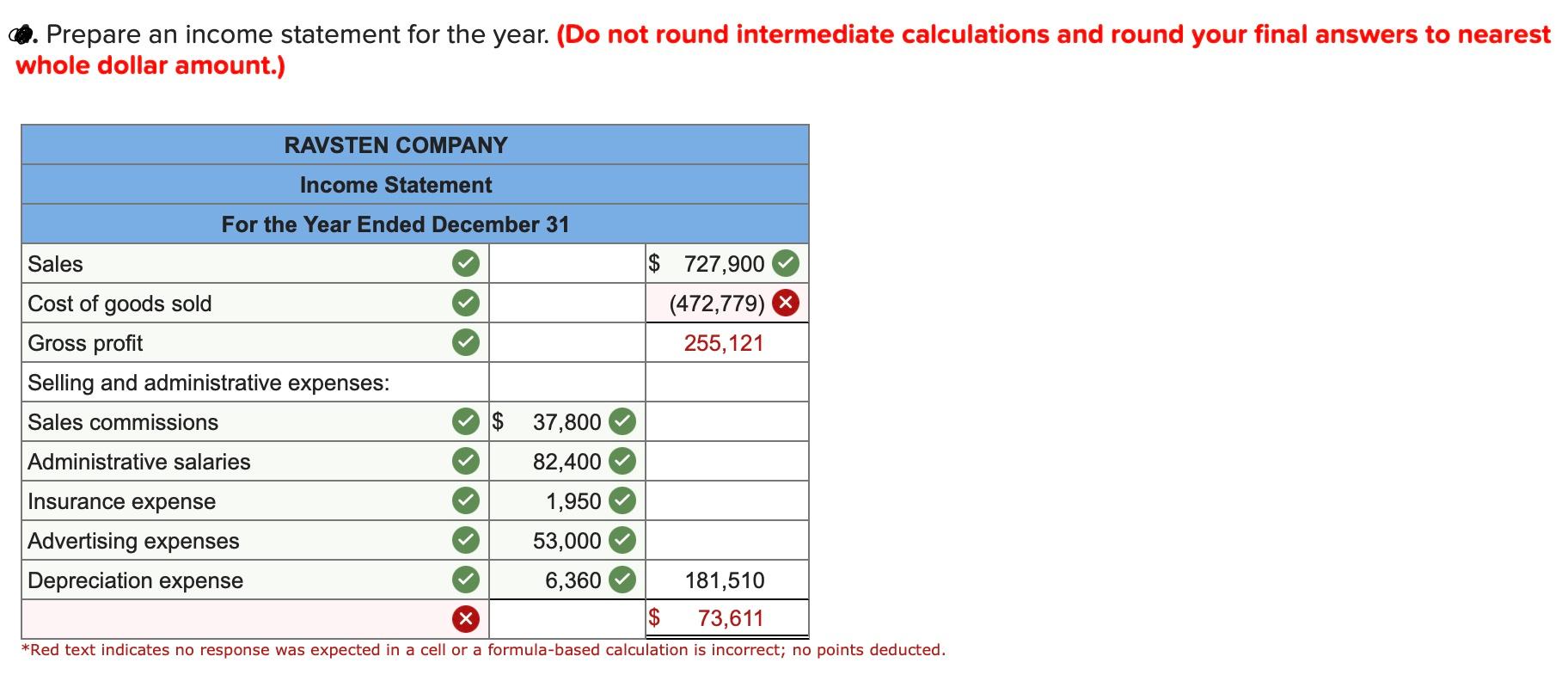

Ravsten Company uses a job-order costing system. On January 1, the beginning of the current year, the company's inventory balances were as follows: Raw materials Work in process Finished goods $19,000 $11,200 $30, 600 The company applies overhead cost to jobs on the basis of machine-hours. For the current year, the company estimated that it would work 36,600 machine-hours and incur $166,530 in manufacturing overhead cost. The following transactions were recorded for the year: a. Raw materials were purchased on account: $212,000. b. Raw materials were requisitioned for use in production: $196,000 (80% direct and 20% indirect). C. The following costs were incurred for employee services: Direct labour Indirect labour Sales commissions Administrative salaries $164,800 $ 28,200 $ 37,800 $ 82,400 d. Heat, power, and water costs were incurred in the factory: $44,700. e. Prepaid insurance expired during the year: $13,000 (85% relates to factory operations, and 15% relates to selling and administrative activities). f. Advertising costs were incurred, $53,000. g. Depreciation was recorded for the year: $63,600 (90% relates to factory operations, and 10% relates to selling and administrative activities). h. Manufacturing overhead cost was applied to production. The company recorded 41,200 machine-hours for the year. i. Goods that cost $506,500 to manufacture according to their job cost sheets were transferred to the finished goods warehouse. j. Sales for the year totalled $727,900 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $500,300. B. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. (Do not round intermediate calculations and round your final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit A 7,070.00 Manufacturing overhead Cost of goods sold 6,421.09 X 176.60 X Work in process Finished goods 472.31 X Prepare an income statement for the year. (Do not round intermediate calculations and round your final answers to nearest whole dollar amount.) RAVSTEN COMPANY Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross profit Selling and administrative expenses: $ 727,900 (472,779) 255,121 Sales commissions $ 37,800 Administrative salaries 82,400 Insurance expense 1,950 Advertising expenses 53,000 Depreciation expense 6,360 181,510 $ 73,611 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted