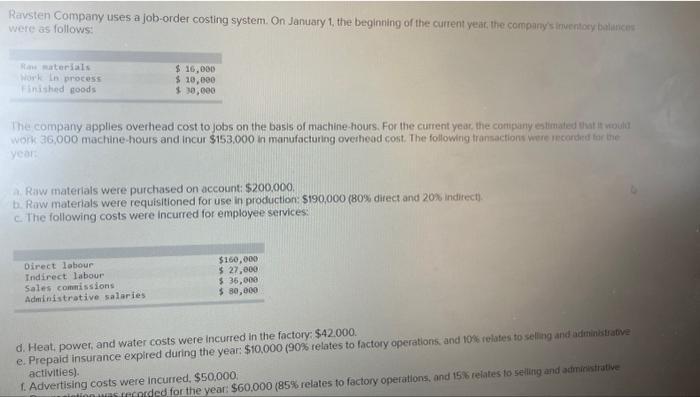

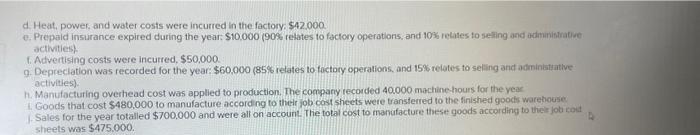

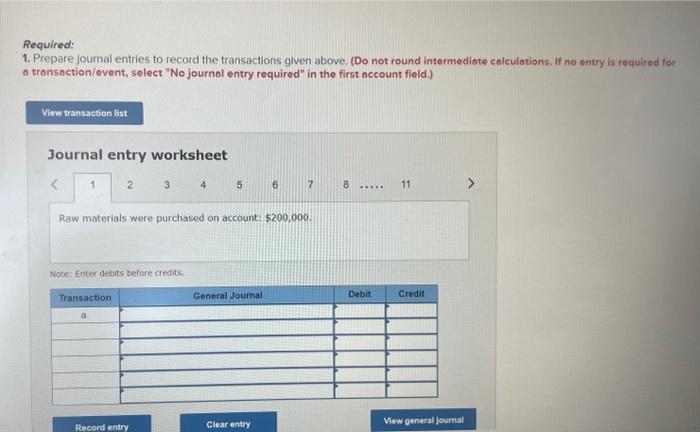

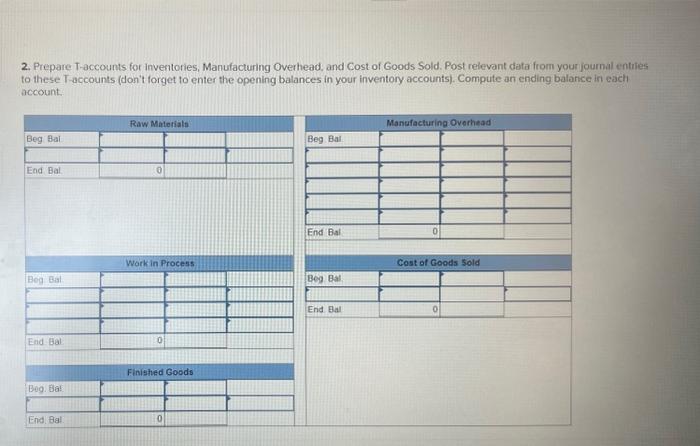

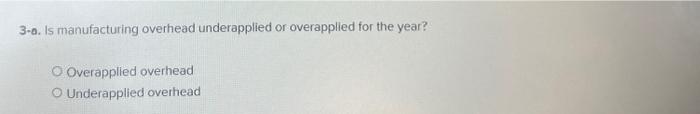

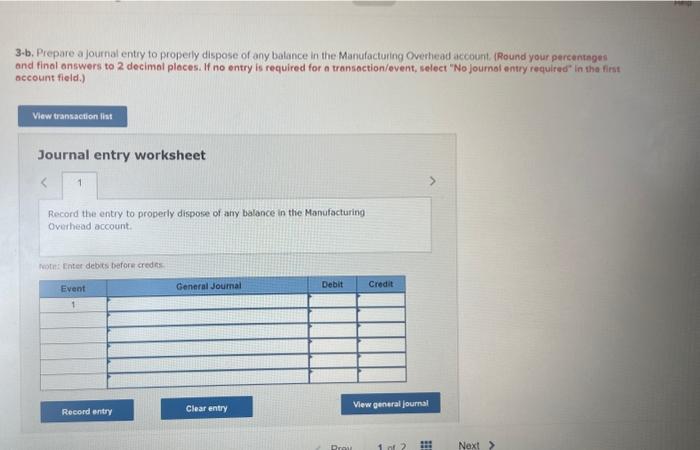

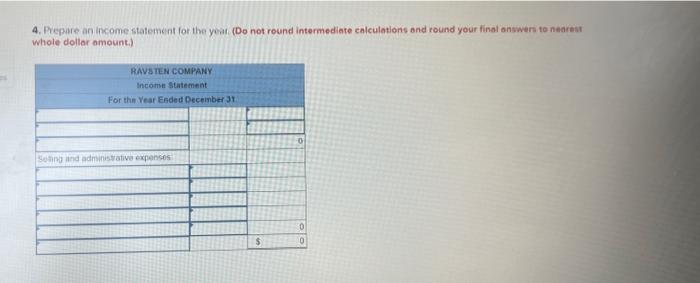

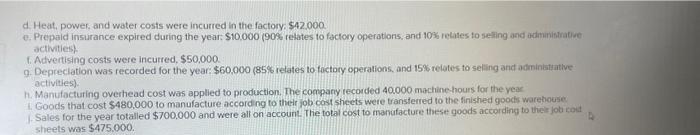

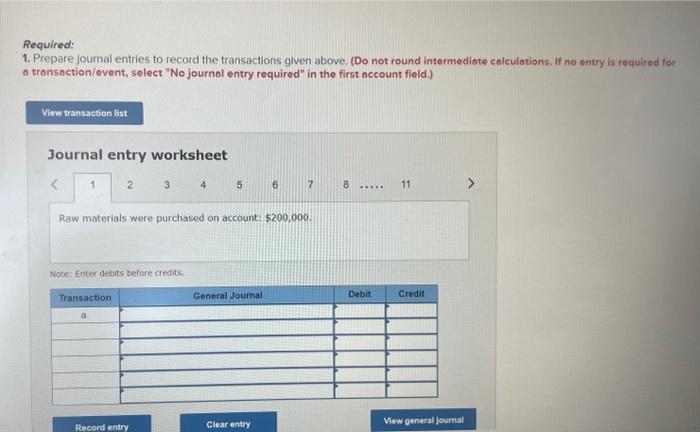

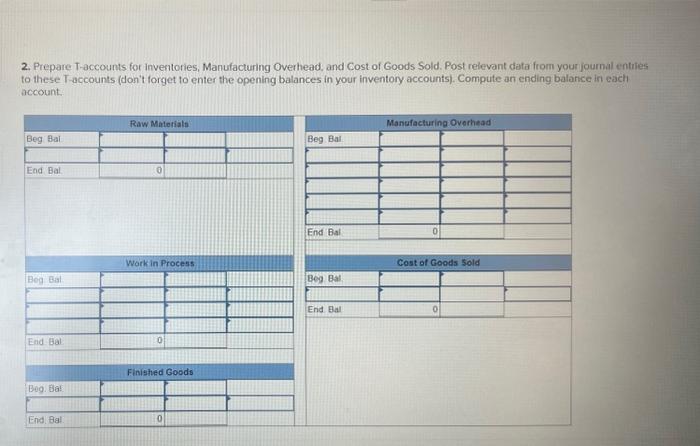

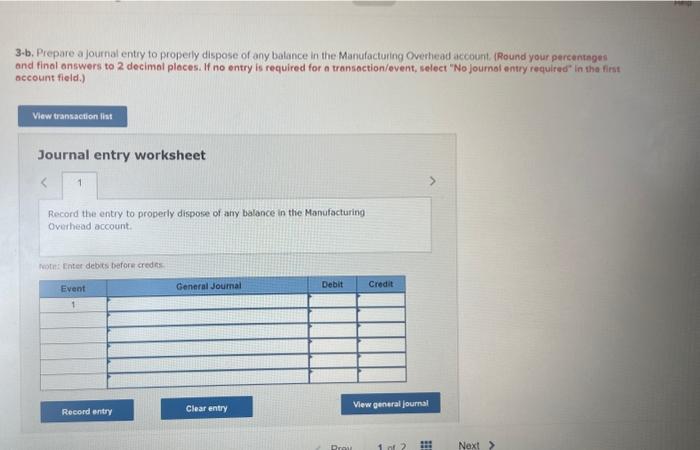

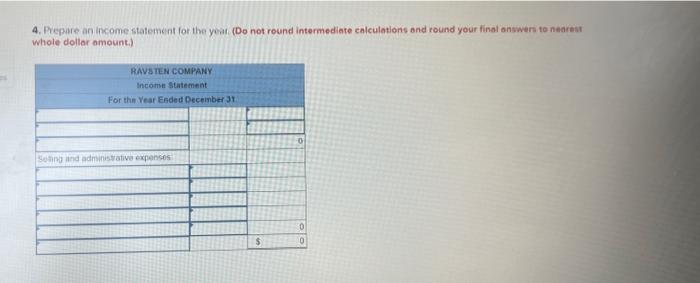

Ravsten Company uses a job-order costing system. On January 1 , the beginning of the curtent veak the company's iruentory balinces were: as follovis: The company applies overhead cost to jobs on the basis of machine-hours. For the current year. the conpuny eslimatided 1 iat is vipiat work 36,000 machine-hours and incur $153,000 in manufacturing oveihead cost. The following transactions weis incordird tar ine Raw materials were purchased on account $200.000 b. Raw materials were requisitioned for use in production: $190,000(80% direct and 20% indirect). c The following costs were incurred for employee services: d. Heat, power, and water costs were incurred in the factory, $42.000. activities). f. Advertising costs were incurred, $50,000 d. Heat, power, and water costs were incurred in the factory. $42.000 e. Prepaid insurance expired during the year $10,000 (908 relates to factory operations, and 10% retates to selling and admanithative activities f. Advertising costs were incutred, $50,000 9. Depreciation was recorded for the year: $60,000(85% relates to foctory operations, and 15% relates to selling and adininiatiative activities). h. Manufacturing overhead cost was applied to production. The company recorded 40000 machine hours for the year 1. Goods that cost $480,000 to manufacture accord ng to their job cost sheets were transterred to the finished goocts warehouse 1. Sales for the year totalled $700,000 and were all on account. The total cost to manufacture these goods according to their job cout sheets was $475.000. Required: 1. Prepare joumal entries to record the transactions given above. (Do not round intermediate calculations. If no entry is tequired for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. 2. Prepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't forget to enter the opening balances in your inventory accounts). Compute an ending balance in each account. 3-a. Is manufacturing overhead underapplied or overapplied for the year? Overapplied overhead Underapplied overhead 3-b. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. RRound your percentages and final answers to 2 decimal ploces. If no entry is required for a transaction/ovent, select "No journol entry required" in tha first account field.) Journal entry worksheet Record the entiy to properly dispose of any balance in the Manufacturing Overhead account. 4. Prepare an income statement for the yoar (Do not round intermediate calculatiens and round your final onswers to narest whole dollar amount.)