Answered step by step

Verified Expert Solution

Question

1 Approved Answer

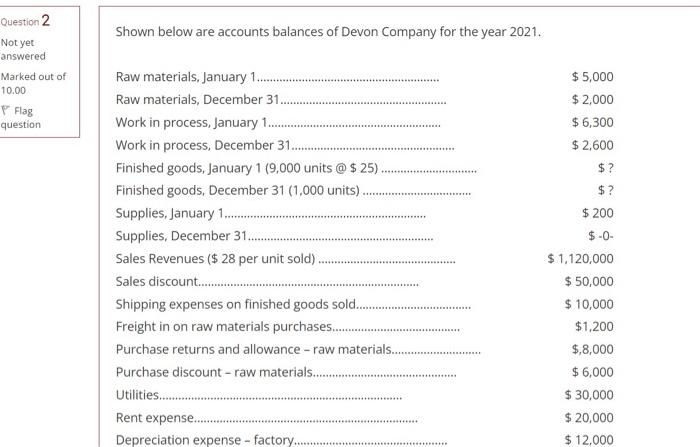

raw material Question 2 Shown below are accounts balances of Devon Company for the year 2021. Not yet answered Marked out of 10.00 Flag question

raw material

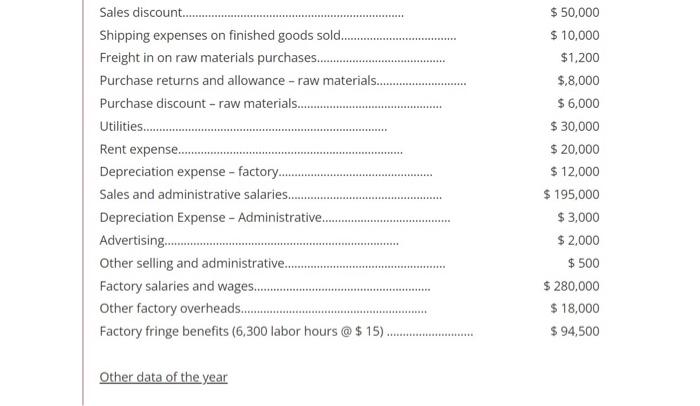

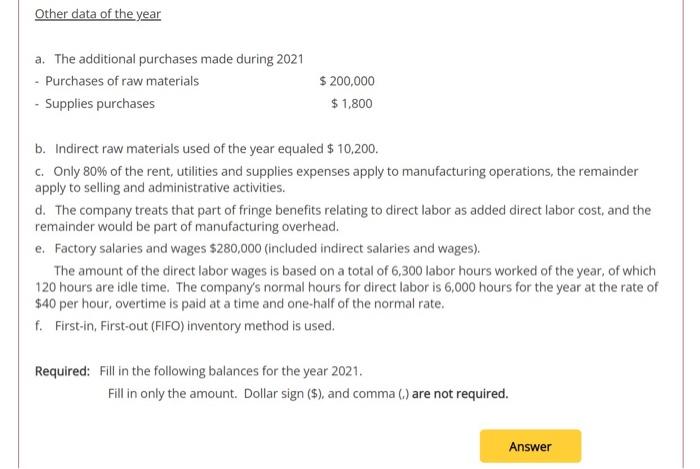

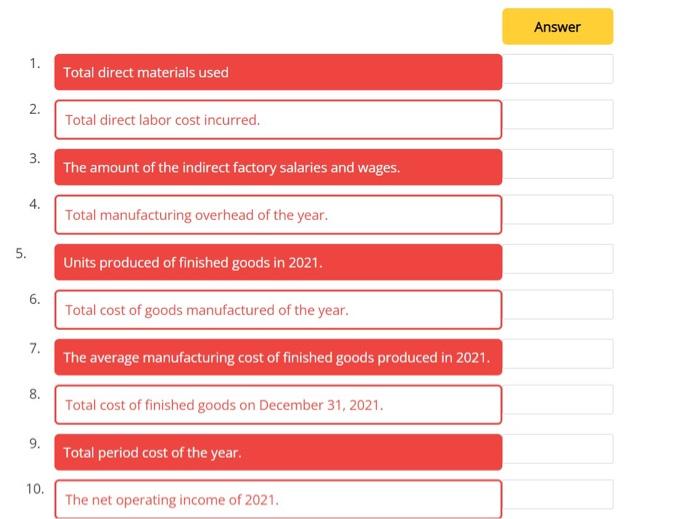

Question 2 Shown below are accounts balances of Devon Company for the year 2021. Not yet answered Marked out of 10.00 Flag question Raw materials, January 1... Raw materials, December 31... Work in process, January 1.......... Work in process, December 31.. Finished goods, January 1 (9,000 units @ $ 25). Finished goods, December 31 (1.000 units). Supplies, January 1......... Supplies, December 31.. Sales Revenues ($ 28 per unit sold). Sales discount... Shipping expenses on finished goods sold... Freight in on raw materials purchases...... Purchase returns and allowance - raw material... Purchase discount - raw materials...... Utilities...... Rent expense... Depreciation expense - factory......... $ 5,000 $ 2,000 $ 6,300 $ 2,600 $? $? $ 200 $-0- $ 1,120,000 $ 50,000 $10,000 $1,200 $ 8,000 $ 6,000 $ 30,000 $ 20,000 $ 12,000 Sales discount..... Shipping expenses on finished goods sold... Freight in on raw materials purchases. Purchase returns and allowance - raw materials... Purchase discount - raw material............ Utilities....... Rent expense... Depreciation expense - factory.... Sales and administrative salaries......... Depreciation Expense - Administrative... Advertising........... Other selling and administrative.... Factory salaries and wages......... Other factory overheads..... Factory fringe benefits (6,300 labor hours @ $ 15). $ 50,000 $ 10,000 $1,200 $68,000 $ 6,000 $ 30,000 $ 20,000 $ 12,000 $ 195,000 $3,000 $ 2,000 $ 500 $ 280,000 $ 18,000 $ 94,500 *** Other data of the year Other data of the year a. The additional purchases made during 2021 - Purchases of raw materials - Supplies purchases $ 200,000 $ 1,800 b. Indirect raw materials used of the year equaled $ 10,200. c. Only 80% of the rent utilities and supplies expenses apply to manufacturing operations, the remainder apply to selling and administrative activities. d. The company treats that part of fringe benefits relating to direct labor as added direct labor cost, and the remainder would be part of manufacturing overhead. e. Factory salaries and wages $280,000 (included indirect salaries and wages). The amount of the direct labor wages is based on a total of 6,300 labor hours worked of the year, of which 120 hours are idle time. The company's normal hours for direct labor is 6,000 hours for the year at the rate of $40 per hour, overtime is paid at a time and one-half of the normal rate. f. First-in, First-out (FIFO) inventory method is used. Required: Fill in the following balances for the year 2021. Fill in only the amount. Dollar sign ($), and comma ) are not required. Answer Answer 1. Total direct materials used 2. Total direct labor cost incurred. 3. The amount of the indirect factory salaries and wages. 4. Total manufacturing overhead of the year. 5. Units produced of finished goods in 2021. 6. Total cost of goods manufactured of the year. 7. The average manufacturing cost of finished goods produced in 2021. 8. Total cost of finished goods on December 31, 2021. 9. Total period cost of the year. 10. The net operating income of 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started