Answered step by step

Verified Expert Solution

Question

1 Approved Answer

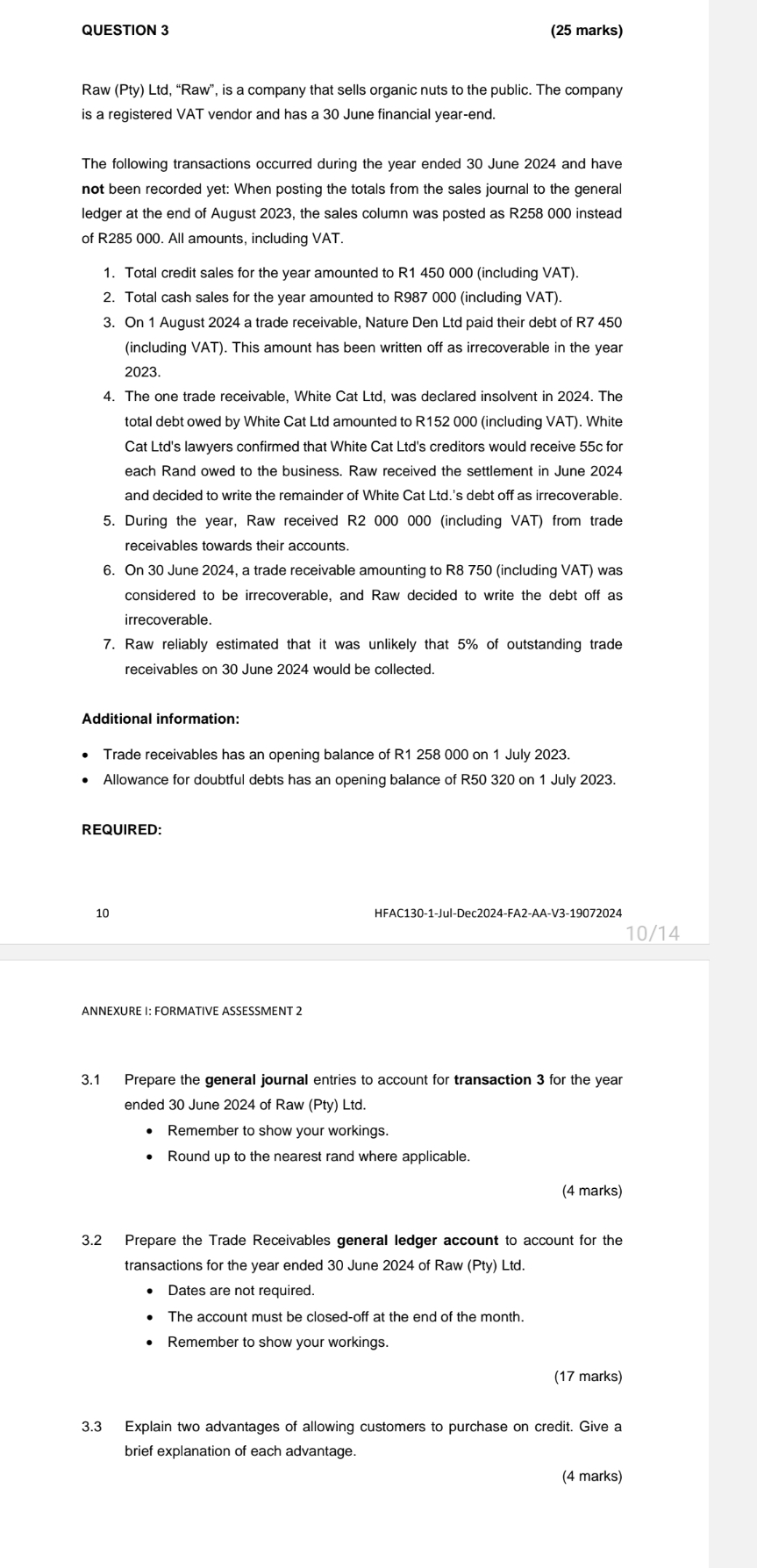

Raw ( Pty ) Ltd , Raw, is a company that sells organic nuts to the public. The company is a registered VAT vendor and

Raw Pty Ltd "Raw", is a company that sells organic nuts to the public. The company

is a registered VAT vendor and has a June financial yearend.

The following transactions occurred during the year ended June and have

not been recorded yet: When posting the totals from the sales journal to the general

ledger at the end of August the sales column was posted as R instead

of R All amounts, including VAT.

Total credit sales for the year amounted to Rincluding VAT

Total cash sales for the year amounted to Rincluding VAT

On August a trade receivable, Nature Den Ltd paid their debt of R

including VAT This amount has been written off as irrecoverable in the year

The one trade receivable, White Cat Ltd was declared insolvent in The

total debt owed by White Cat Ltd amounted to Rincluding VAT White

Cat Ltds lawyers confirmed that White Cat Ltds creditors would receive c for

each Rand owed to the business. Raw received the settlement in June

and decided to write the remainder of White Cat Ltds debt off as irrecoverable.

During the year, Raw received Rincluding VAT from trade

receivables towards their accounts.

On June a trade receivable amounting to Rincluding VAT was

considered to be irrecoverable, and Raw decided to write the debt off as

irrecoverable.

Raw reliably estimated that it was unlikely that of outstanding trade

receivables on June would be collected.

Additional information:

Trade receivables has an opening balance of R on July

Allowance for doubtful debts has an opening balance of R on July

REQUIRED:

ANNEXURE I: FORMATIVE ASSESSMENT

Prepare the general journal entries to account for transaction for the year

ended June of Raw Pty Ltd

Remember to show your workings.

Round up to the nearest rand where applicable.

Prepare the Trade Receivables general ledger account to account for the

transactions for the year ended June of Raw Pty Ltd

Dates are not required.

The account must be closedoff at the end of the month.

Remember to show your workings.

Explain two advantages of allowing customers to purchase on credit. Give a

brief explanation of each advantage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started