Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ray Sports Products wants to expand its business by selling a new type of soccer ball that is more durable than its current offering.

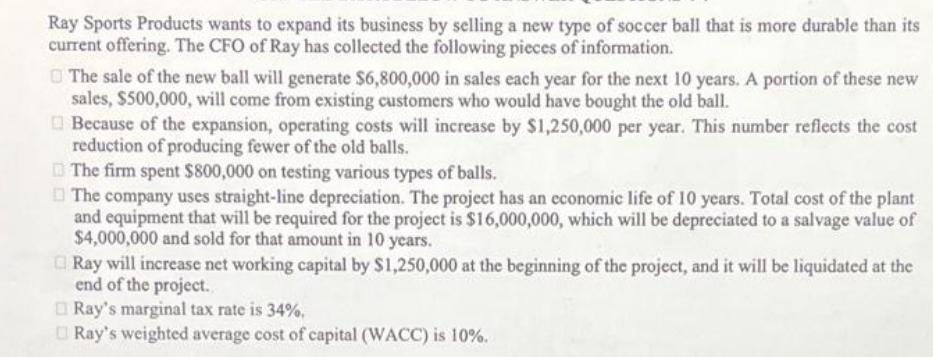

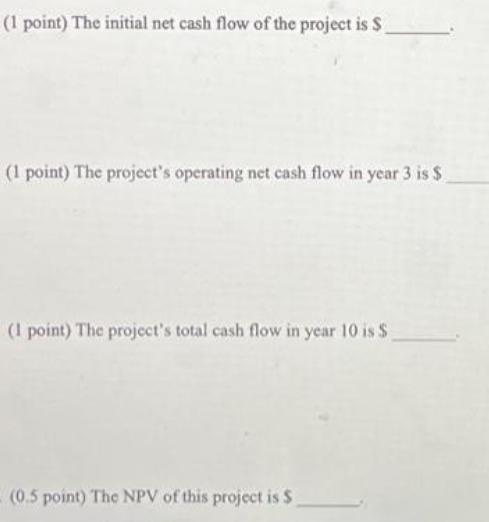

Ray Sports Products wants to expand its business by selling a new type of soccer ball that is more durable than its current offering. The CFO of Ray has collected the following pieces of information. The sale of the new ball will generate $6,800,000 in sales each year for the next 10 years. A portion of these new sales, $500,000, will come from existing customers who would have bought the old ball. Because of the expansion, operating costs will increase by $1,250,000 per year. This number reflects the cost reduction of producing fewer of the old balls. The firm spent $800,000 on testing various types of balls. The company uses straight-line depreciation. The project has an economic life of 10 years. Total cost of the plant and equipment that will be required for the project is $16,000,000, which will be depreciated to a salvage value of $4,000,000 and sold for that amount in 10 years. Ray will increase net working capital by $1,250,000 at the beginning of the project, and it will be liquidated at the end of the project. Ray's marginal tax rate is 34%. Ray's weighted average cost of capital (WACC) is 10%. (1 point) The initial net cash flow of the project is $ (1 point) The project's operating net cash flow in year 3 is $ (1 point) The project's total cash flow in year 10 is S (0.5 point) The NPV of this project is $

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various cash flows and the net present value NPV of the project well consider the information provided Lets calculate each component ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started