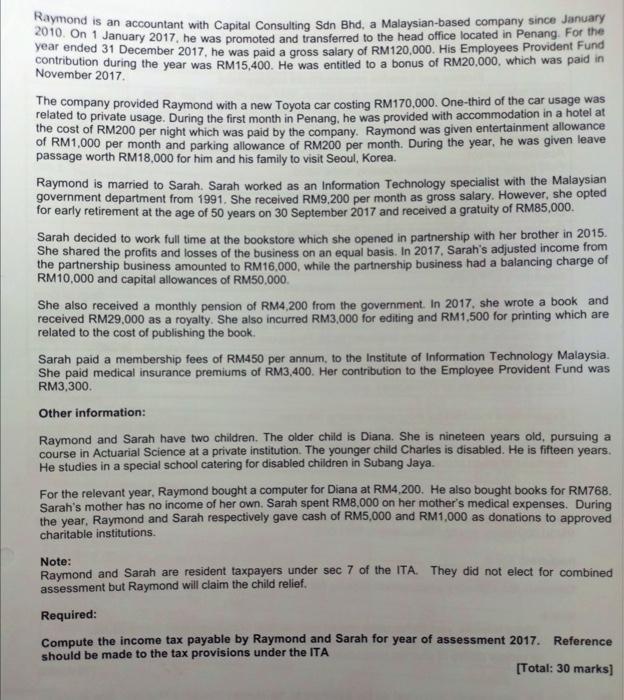

Raymond is an accountant with Capital Consulting Sdn Bhd, a Malaysian-based company since January 2010. On 1 January 2017, he was promoted and transferred to the head office located in Penang. For the year ended 31 December 2017, he was paid a gross salary of RM120,000. His Employees Provident Fund contribution during the year was RM15,400. He was entitled to a bonus of RM20,000, which was paid in November 2017. The company provided Raymond with a new Toyota car costing RM170,000. One-third of the car usage was related to private usage. During the first month in Penang, he was provided with accommodation in a hotel at the cost of RM200 per night which was paid by the company. Raymond was given entertainment allowance of RM1,000 per month and parking allowance of RM200 per month. During the year, he was given leave passage worth RM18,000 for him and his family to visit Seoul, Korea. Raymond is married to Sarah. Sarah worked as an Information Technology specialist with the Malaysian government department from 1991. She received RM9,200 per month as gross salary. However, she opted for early retirement at the age of 50 years on 30 September 2017 and received a gratuity of RM85,000. Sarah decided to work full time at the bookstore which she opened in partnership with her brother in 2015. She shared the profits and losses of the business on an equal basis. In 2017, Sarah's adjusted income from the partnership business amounted to RM16,000, while the partnership business had a balancing charge of RM 10,000 and capital allowances of RM50,000. She also received a monthly pension of RM4,200 from the government. In 2017, she wrote a book and received RM29,000 as a royalty. She also incurred RM3,000 for editing and RM1,500 for printing which are related to the cost of publishing the book. Sarah paid a membership fees of RM450 per annum, to the Institute of Information Technology Malaysia. She paid medical insurance premiums of RM3,400. Her contribution to the Employee Provident Fund was RM3,300. Other information: Raymond and Sarah have two children. The older child is Diana. She is nineteen years old, pursuing a course in Actuarial Science at a private institution. The younger child Charles is disabled. He is fifteen years. He studies in a special school catering for disabled children in Subang Jaya. For the relevant year, Raymond bought a computer for Diana at RM4,200. He also bought books for RM768. Sarah's mother has no income of her own. Sarah spent RM8,000 on her mother's medical expenses. During the year, Raymond and Sarah respectively gave cash of RM5,000 and RM1,000 as donations to approved charitable institutions. Note: Raymond and Sarah are resident taxpayers under sec7 of the ITA. They did not elect for combined assessment but Raymond will claim the child relief. Required: Compute the income tax payable by Raymond and Sarah for year of assessment 2017. Reference should be made to the tax provisions under the ITA [Total: 30 marks]