Question

Raymond Ryans purchased a 50-year-old flat in Melbourne on 15 September 2010 for $350,000 which he subsequently let out to tenants until 15 October

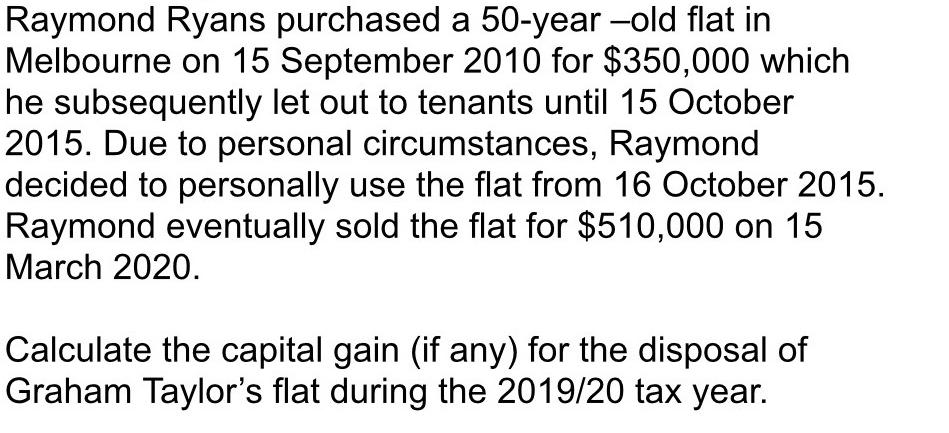

Raymond Ryans purchased a 50-year-old flat in Melbourne on 15 September 2010 for $350,000 which he subsequently let out to tenants until 15 October 2015. Due to personal circumstances, Raymond decided to personally use the flat from 16 October 2015. Raymond eventually sold the flat for $510,000 on 15 March 2020. Calculate the capital gain (if any) for the disposal of Graham Taylor's flat during the 2019/20 tax year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Capital Gain for Raymond Ryans Flat Sale To calculate the capital gain for Raymonds flat ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Marketing And Export Management

Authors: Gerald Albaum , Alexander Josiassen , Edwin Duerr

8th Edition

1292016922, 978-1292016924

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App