Rayovac has been busy pursuing extensive diversification with mergers and acquisitions.What is your assessment of Rayovac's diversification strategy?What do you think about Remington? United? Tetra?

Think about their strategy and identify problems and make recommendations for them to improve.If you like what they are doing, recommend how they can improve.If you do not like what they are doing, consider how they can organize changing their strategy towards your recommendations.

Create aExecutive Summary to the CEO of Rayovac.

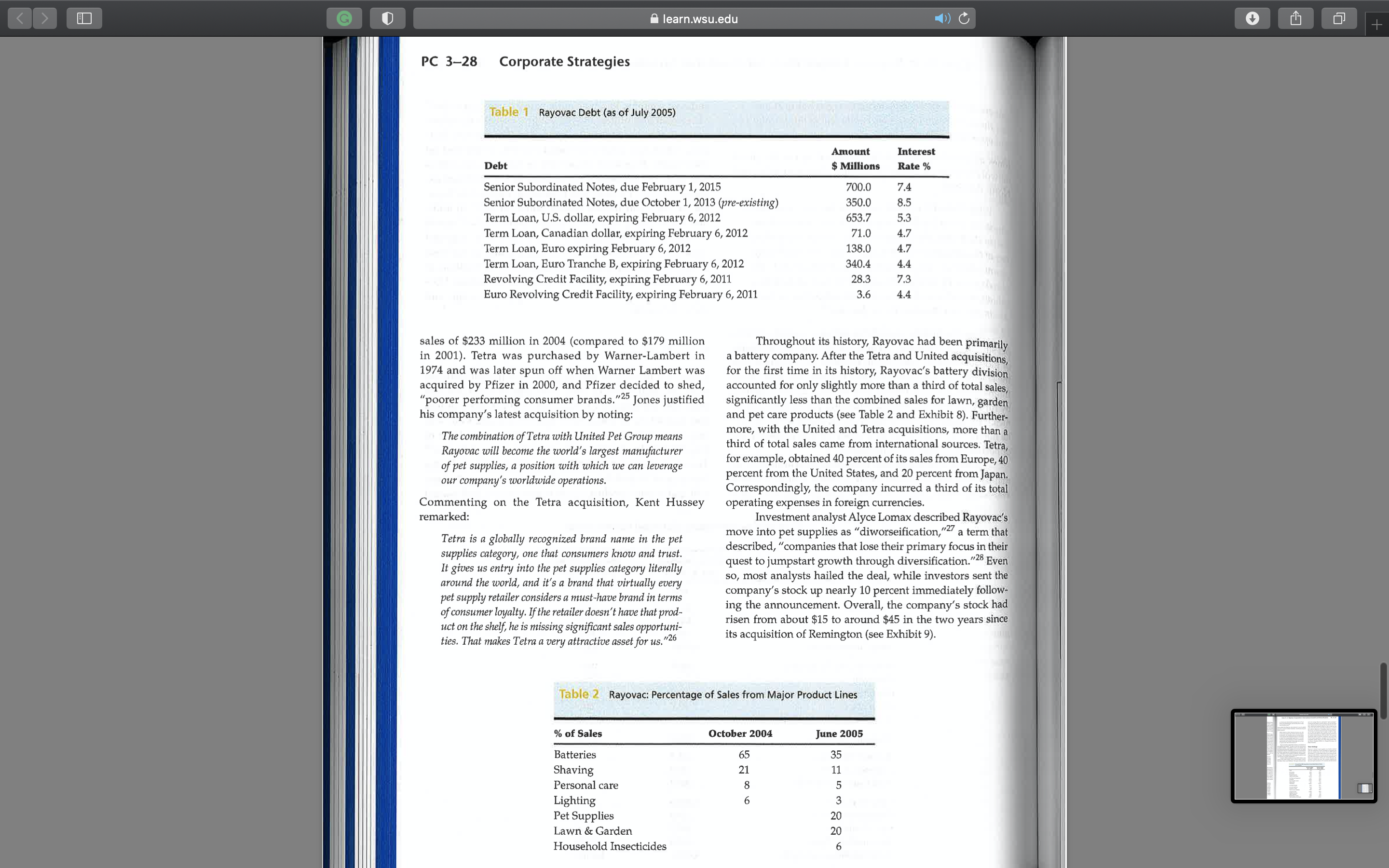

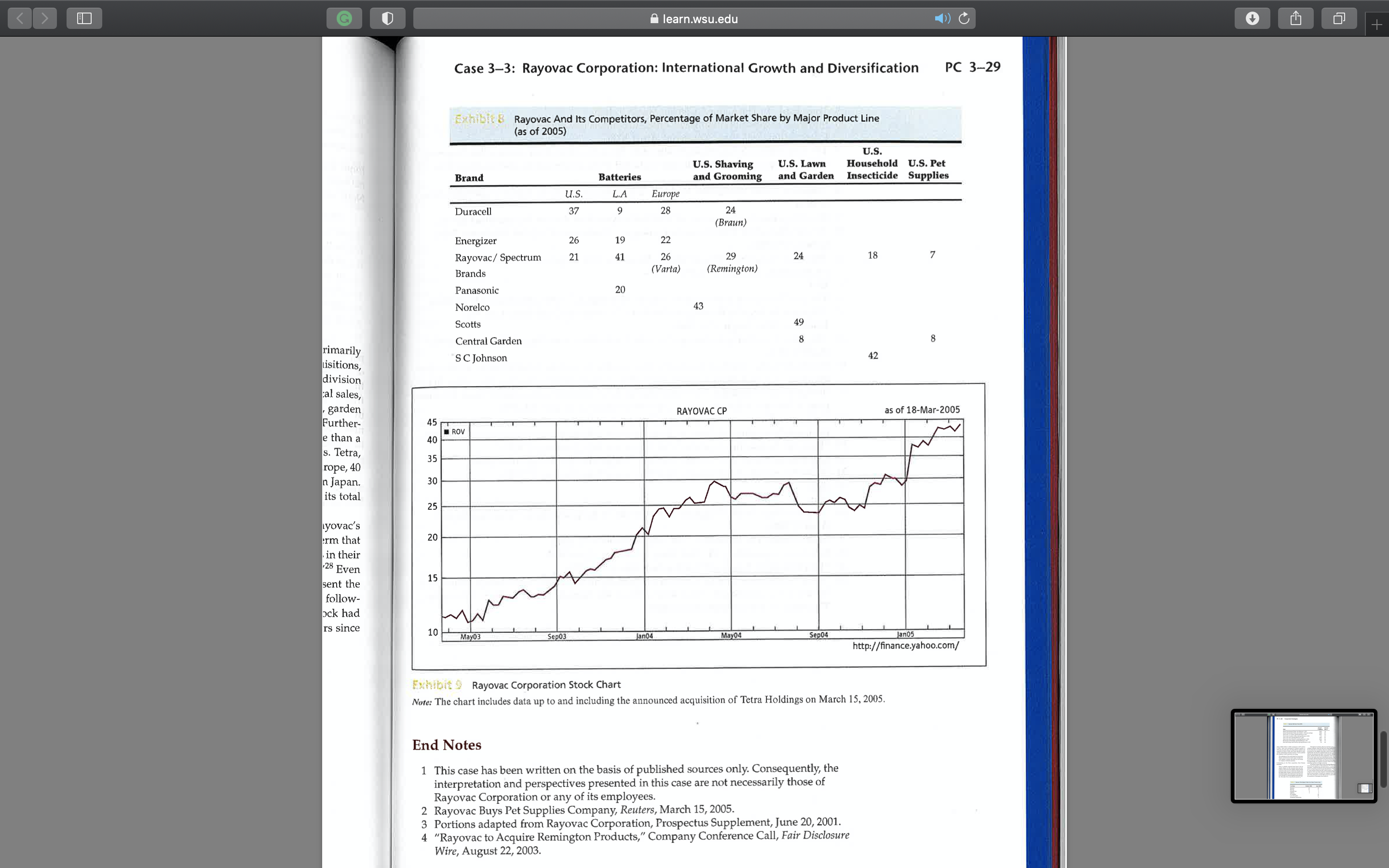

G learn.wsu.edu wire, ABC Case 3-3: Rayovac Corporation : s-global- International Growth and " as i / clareo- Diversification Through Acquisitionsl as-it-aims- School of Business David T.A. Wesley prepared this case under the supervi- sion of Professor Ravi Sarathy solely to provide material for class discussion. The authors do not intend to illustrate ess Week, D'Amore-McKim either effective or ineffective handling of a managerial situ- nuts-next- Northeastern University ation. The authors may have disguised certain names and other identifying information to protect confidentiality. IVEY Publishing Ivey Management Services is the exclusive representative of the copyright holder and prohibits any form of reproduc- tion, storage or transmittal without its written permission. Reproduction of this material is not covered under author rization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Management Services, clo Richard Ivey School of Business, The University of Western Ontario, London, Ontario, Canada, N6A 3K7; phone (519) 661-3208; fax (519) 661-3882; e-mail cases@ivey.uwo.ca. Copyright 2006, Northeastern University, College of Business Administration Version: (A) 2009-09-21 In 2005, Rayovac announced acquisitions totalling $1.5 bil- Rayovac brand name by growing the company through lion, which encompassed the purchases of United Industries acquisitions. Initially, acquisitions focused on the battery and of Tetra Holdings and aimed at making Rayovac the business, but later included businesses focused on shaving most, "significant global player in the pet supplies indus- products and personal care. This strategy met with some try." These acquisitions were the latest in a series, going back to 1999, that gave Rayovac significant market pres- success as Rayovac increased its U.S. market share from 27 percent to 34 percent between 1996 and 2001. ence in new product categories, including lawn and garden Historically, most of the company's growth had been care, household insecticides and pet foods (see Exhibit 1). Through such acquisitions, Rayovac grew from $400 mil- in North America. However, beginning in 2002, the com- lion in sales in 1996 to approximately $2.8 billion in 2005. pany began to selectively acquire battery manufacturers and distributors in key foreign markets in an effort to establish a In recognition of this major shift in both composition and strong global presence. Then in 2003, the company acquired direction, the company changed its name from Rayovac to Remington Products in its first move to diversify away from Spectrum Brands. consumer batteries. According to David A. Jones, chief executive officer (CEO) of Rayovac Corporation, the company's diversifica Company Background tion efforts had only begun. He explained: We set out consciously for the first five or six years to Rayovac was established in Madison, Wisconsin, in 1906 as globalize the battery and lighting business, which we've the French Dry Battery Company. After changing its name done, and we have consciously now, for some period of to Rayovac in 1921, the company became one of the best time, been looking for the right diversification moves known battery brands in the United States and quickly . . . There are other things that, over time, we'll become established itself as the leading marketer of value-brand interested in and you'll probably see us move towards.4 batteries in North America. In 1996, after seeing its market share steadily eroded by Duracell, Energizer, and Panasonic (owned by Matsu- The Global Battery Business shita), the company was purchased by private equity firm In 2003, the global battery market was worth approximately Thomas H. Lee Partners (THL). At the time, revenues were $24 billion, with the United States accounting for about approximately $400 million. THL sought to revive the one-third of total consumption. Between 1990 and 2000, the G O learn.wsu.edu PC 3-20 Corporate Strategies Exhibit 1 Rayovac Acquisitions (1999 to 2005) (in $ millions) Year Company Acquired Price Paid EBITDA Key characteristics of acquired company 1999 ROV Ltd. 155 41.0 Leading Latin-American battery manufacturer (except Brazil) Oct. 2002 Varta 258 41.2 Leading Europe-based battery manufacturer of general bat- teries and the market leader in Germany and Latin America Sept. 2003 Remington Products 322 48.8 Largest selling brand in the United States in the combined dry shaving and personal-grooming products categories, on the basis of units sold; share similar distribution channels, sales outlets. Mid-tier brand competes with Braun, not wet shavers. Jan. 2004 Ningbo Baowang 31 3.4 (for 85% stake) Manufactures alkaline and heavy-duty batteries in China Battery Co., China June 2004 Microlite Brazil 38 (6.4) Owned Rayovac brand name in Brazil; leading Brazilian brand with 49% market share in alkaline and zinc carbon segments Jan. 2005 United Industries 1,504 150.0 Significant presence in lawn and garden care products, and pet supplies April 2005 Tetra Holding 555 52.9 Pet food for fish and reptiles, aquarium accessories; No. 1 or No. 2 in market share in every major segment and market- United States, Japan, Germany, United Kingdom and France Source: Company files. United States achieved an annual growth rate of 7.4 percent high quality products. But once you have that, certainly in alkaline battery products. Rayovac Corporation accom- our point of differentiation is value. You can buy our panied this trend but lagged behind Duracell and Energizer in the United States. The intensely competitive U.S. battery products for 10 percent to 15 percent lower than our competitors . . . . We're actively outselling our value market led to considerable price discounting and required proposition, because we've tried to create a business significant advertising and promotion expenditures. Rayo- model and a business plan different from Duracell and vac, as the No. 3 player, had to carefully choose its competi- Energizer. Our products are as good as those two fine tive strategy, its product line composition and features, its companies but sell at value price. price points, its cost position, its distribution channels and its advertising strategy in order to be able to close the com- For several years, battery manufacturers experienced petitive gap. strong growth worldwide due to the increased use of per- Gillette, owner of the Duracell brand, had annual rev- sonal electronic devices, such as portable music players, enues of $9 billion, followed by Energizer Holdings, with fitness monitors, handheld computers (PDAs) and gaming revenues of $1.7 billion. Although Rayovac was in third devices. Portable lighting was another significant Rayovac place in the United States, globally, it was the worldwide product category, with 2003 global sales approaching $3 leader in hearing aid batteries, the leading manufacturer of billion, of which flashlights represented about half of the zinc carbon household batteries in North America and Latin market. America, and the leading marketer of rechargeable batteries With the proliferation of personal electronic devices, and batterypowered lights in the United States. average household battery consumption increased from Both Energizer and Duracell produced premium approximately 23 batteries per year in 1986 to 44 batteries brands that sold for approximately 15 percent above compa- per year in 2000. As incomes grew, consumption in devel- rable Rayovac products. Jones believed that Rayovac's value oped countries switched from zinc carbon to the better per- position distinguished it from its premium brand competi- forming and higher-priced alkaline batteries, a trend that tors. He explained: Rayovac expected to be duplicated in emerging markets According to Rayovac, the company's strategy of raising For any brand, whether it's a value brand or premium brand, you have to have high quality products. And brand awareness and increasing the number of distribu- tion channels allowed it to take better advantage of market the facts are on our side. Our products are very good, growth than its competitors. Kent Hussey, Rayovac chief G learn.wsu.edu Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-21 operating officer (COO), underlined the central role of of large retailers that controlled access to large numbers of brands, noting: consumers. Wal-Mart Stores, Inc., alone accounted for 21 We believe that brands are very important. Being able to percent of Rayovac's annual sales. Other significant outlets easily identify high-quality products that deliver on the were Home Depot, Lowe's, and Target. Rayovac also sold cept Brazil) value proposition and have recognizable brand names through discount channels such as "dollar stores." neral bat- is very important in terms of marketing to consumers. America Having that brand name that the consumer can identify mbined and find on the shelf is key. We think that one of Rayo- Acquisitions gories, on hannels, vac's core competencies is our expertise in marketing not wet branded consumer products, and it's really the focus of Varta AG (Germany) our entire business.6 In 2002, Rayovac acquired the consumer battery business China From the 12 months ended September 30, 1996, through of Varta AG of Germany for $258 million.' Varta was the the 12 months ended April 1, 2001, Rayovac grew net sales leading European-based manufacturer of general batteries azilian and adjusted income from operations from $417.9 million with 2001 revenues of $390 million. Prior to the acquisition, carbon to $675.3 million and from $27 million to $83.3 million, 73 percent of Rayovac's revenues came from North America ucts, and respectively. This represented an 11.3 percent and 28.4 while 86 percent of Varta's revenues came from Europe. The percent compound annual growth rate in net sales and largest overlap was in Latin America where combined oper- adjusted income from operations, respectively. In addition, ations solidified Rayovac's market lead, excluding Brazil. s; No. 1 or market- adjusted income from operations margins improved from The acquisition allowed the two companies to consolidate nd France 6.5 percent for the 12 months ended September 30, 1996, production and distribution in Latin America and to close to 12.3 percent for the 12 months ended April 1, 2001 (see redundant manufacturing plants Exhibits 2 to 5). The complementary geographic distribution of the ertainly Rayovac's ability to distribute its products to cus- two companies' production facilities and distribution chan- uy our tomers was constrained to some extent by the emergence nels was expected to give greater access to global sourcing an ou value usiness ExitRayovac Financial Summary (for years ending September 30) (in $ millions) cell and 2004 2003 2002 2001 2000 wo fine Income Statement Net Sales 1,417.19 922.12 572.74 $16.17 630.91

G learn.wsu.edu PC 3-22 Corporate Strategies Exhibit 3 Rayovac Corporation and Subsidiaries Consolidated Balance Sheets (for years ending September 30) (in $ millions) 2004 2003 2002 2001 2000 Assets Cash 15.79 107.77 9.88 11.36 255.21 9.76 Receivables 269.98 128.93 160.94 Total Inventories 264.73 219.25 147.77 84.28 91.31 100.68 Other Current Assets 100.02 84.58 36.24 39.48 32.97 Total Current Assets 650.51 66.82 259.32 303.09 Property, Plant and Equipment 150.61 102.59 291.1' 182.40 107.26 111.90 Deferred Charges 60.38 76.61 51.90 651.25 37.08 119.07 43.84 Intangibles 742.68 119.43 122.11 Total Assets 1,635.97 1,545.29 533.23 566.50 569.02 Liabilities Accounts Payable 228.05 172.63 76.16 31.99 97.86 Current Long-Term Debt 23.90 72.85 13.40 24.44 44.82 Accrued Expense 56.44 41.47 22.09 38.12 43.81 Income Taxes 21.67 20.57 7.14 n/a n/a Other Current Liabilities 68.60 89.49 n/a n/a n/a Total Current Liabilities 398.66 397.01 118.78 144.54 186.48 Deferred Charges/Inc 7.27 n/a 20.96 7.43 8.24 Long-Term Debt 806.00 370.54 188.47 233.54 272.82 Other Long-Term Liabilities 106.61 30.23 1,318.55 75.73 358.44 23.40 20.78 Total Liabilities 1,343.29 408.91 188.32 Shareholders' Equity Minority Interest 1.38 n/a n/a n/a n/a Common Stock 0.64 0.62 0.62 0.62 0.57 Capital Surplus 224.96 185.56 180.82 220.48 149.22 180.75 104.20 Retained Earnings 164.70 119.98 108.4 Treasury Stock 130.07 130.07 130.07 130.07 129.98 Total Shareholders' Equity 316.04 202.00 174.79 157.59 80.70 Total Liabilities and Shareholders' Equity ,635.97 1,545.29 533.23 566.50 569.02 Source: Company 2004 Annual Report and distribution opportunities and generate cost savings of agreements with Ahold, Woolworths, Makro, and several between $30 million and $40 million through the consolida- tion of production plants and administration. As a direct other large supermarket and box-store chains. A large part of the company's growth came from its 1999 acquisition of result of the Varta acquisition, Rayovac became the market leader in consumer batteries in Germany and Austria and Miami-based ROV Limited for $155 million. ROV, which was spun off from Rayovac in 1982, was Rayovac's large the second leading producer in Europe. est distributor of batteries in Latin America, with approxi- mately $100 million in revenues, compared to Rayovac's ROV Ltd. and Microlite (Latin America) regional preacquisition revenues of less than $20 million. However, shortly after the ROV Limited acquisition, Rayovac was the leading producer of zinc carbon batter- Latin America sales took a turn for the worse. All three ies in Latin America, a region where the company enjoyed strong brand recognition. However, Latin America was major manufacturers saw declines of approximately 30 plagued by frequent economic downturns, and consumers percent. Rayovac also saw delinquent accounts increase to had relatively low purchasing power. Despite the region's nearly $5 million, which Rayovac attempted to mitigate by volatility, Latin America played an important role in the withholding future product shipments. As a result, Rayovac decreased receivables for Latin America from $50 million to company's geographic diversification strategy. In the late 1990s, Latin America was one of Rayo- $41 million. Fixed costs were also reduced by $12 million, including process rationalization and a reduction in staff vac's fastest growing markets, where it had distribution by 120 people. G learn.wsu.edu () C Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-23 $ millions) Exhibit + Rayovac Corporation and Subsidiaries Statement of Operations Data (for years ending September 30) (in $ millions) 2000 2004 2003 2002 2001 2000 1999 1998 9.76 Net sales 1,417.2 922. 147.77 572.7 616.2 703.9 564.3 495.7 100.68 Cost of goods sold 811.9 549.5 334.1 361.2 358.2 293.9 258.3 32.97 Other special charges (0.8) 21.1 1.2 22.1 1.3 291.17 Gross profit 606.1 351.5 237.4 232.9 345.7 269.1 237.4 111.90 43.84 Operating expenses: Selling expense 293.1 185.2 104.4 122.11 119.6 195.1 160.2 148.9 569.02 General and administrative expense 121.3 80. 56.9 46.6 50.5 37.4 32.4 Research and development expense 23.2 14.4 13.1 12.2 10.8 9.8 9.4 Other special charges 12.2 11.5 0.2 8.1 6.2 97.86 449.9 291.9 174.4 178.6 256.4 215.5 96.9 44.82 income from operations 156.2 59.6 63.0 54.4 89.3 53.6 40.5 43.81 Interest expense 65.7 37.2 16.0 27.2 30.6 16.3 15.7 n/a Non-operating expense 8.6 n/a 86.48 Other (income) expense, net 0.1 (3.6) 1.1 0.3 ) (0.2) 8.24 Income before income taxes and extraordinary item 90.5 23.0 45.7 17.5 58.0 37.6 25.0 272.82 Income tax expense 34.3 7.6 16.4 6.0 19.6 56.2 15.5 13.5 8.6 20.78 Income before extraordinary item 29.2 11.5 38.4 24.1 16.4 488.32 Extraordinary item (0.4) (2.0) Net income 55.8 15.5 29.2 11.5 38.4 24.1 14.4 n/a Notes: 0.57 Related to plant closings, restructuring, process rationalization and severance pay. 104.20 2Ibid. 108.45 'Loss from discontinued operations (2004) and expense associated with the repurchase of shares (1998). 129.98 Source: Company 2004 Annual Report 80.70 exhibit 5 Rayovac Corporation and Subsidiaries Consolidated Statements of Cash Flows (for years ending September 30) (in $ millions) 2004 2003 2002 2001 2000 and several Net Income (Loss) 55.78 38.35 large part Depreciation/ Amortization 15.48 44.75 36.95 quisition of Net Increase (Decrease) in Assets/ Liabilities 22.05 24.86 22.33 13.12 14.38 10.48 37.67) Cash Flow from Discontinued Operations (30.07) OV, which 0.38 na n/a 8.59 vac's large Other Adjustments-Net n/a 17.08 9.39 5.06 10.74 2.23 th approxi- Net Cash Flow from Operations 104.86 76.21 66.83 18.05 32.84 Rayovac's Increase (Decrease) in Prop. Plant and Equip (26.86) (25.99) (15.47) (18.83) (17.95) million. Acquisition) Disposal of Subsidiary. Business 41.71) (420.40) n/a n/a n/a acquisition ncrease (Decrease) in Securities Investments n/a 1/a n/a 0.56 n/a . All three Other Cash Flow from Investing (0.34) (0.24) n/a imately 30 Net Cash Flow from Investing (446.40) (15.47 (18.27 increase to mitigate by Issue (Repayment) of Debt (1.35) 29.93) n/a n/a na alt, Rayovac Increase (Decrease) in Borrowing (150.46) 501.61 (56.22) 3.90 (15.74) million to Net Cash Flow from Financing 131.02) 71.85 (56.71) 1.67 (16.00) 312 million, ion in staff Effect of Exchange Rate on Cash 2.75 (3.77) 3.88 .16 Cash or Equivalents at Year Start 9.88 11.07 Cash or Equivalents at Year End 11.36 15.79 107.77 9.88 11.36 9.76 Net Change in Cash or Equivalent 97.89 (1.48) 1.60 (1.31) G learn.wsu.edu C PC 3-24 Corporate Strategies In 2004, the company was able to offset this decline through its acquisition of Microlite S.A., the largest producer Dischingen in Germany (see Exhibit 6). Those plants of consumer batteries in Brazil and owner of the Rayovac are running near capacity and so, as alkaline grows brand name in Brazil, for $38 million. The Microlite acqui- around the world, all the future capacity needs are going to come out of that China plant. 12 sition allowed Rayovac to immediately realize a 50 percent market share in Latin America's largest consumer market." Rayovac replaced Microlite's management team with Rayo- Remington Products Company vac veterans who proceeded to reduce costs, increase effi- ciency, and improve product packaging. The latter allowed In 2003, Rayovac diversified its product offering by acquir Rayovac to increase prices by 16 percent. Regional competi- ing Remington Products for $322 million.Remington was tors, following Rayovac's lead, also raised prices. established in 1816 and was recognized as one of America's When Rayovac acquired Microlite, the business was oldest consumer brands. The company focused on personal undercapitalized and losing money. Its precarious situa- care products but was best known for its electric shavers. tion made it a high risk for lenders who, in turn, charged In this category, Remington was the No. 2 brand in North very high interest rates. Rayovac immediately proceeded America with 35 percent market share, compared with 40 to recapitalize the business and to replace high-rate debt percent for Norelco and less than 20 percent for Braun. with Rayovac-backed debentures. The reduction in interest Other "personal grooming" products included hair dryers, payments immediately improved the acquired company's curling irons and hot air brushes. In the four years leading financial results. According to Chief Executive Officer David up to its acquisition, Remington experienced a compound A. Jones, the results exceeded company expectations. annual growth rate in excess of 10 percent. In 2003, global sales of electric shaving and groom- We were frankly surprised by how fast the actions took ing products were around $3 billion, growing at about three hold. It didn't surprise us that we were going to make percent annually. The global market for other electric per- it profitable. I think in the future it's going to be a star sonal case products, such as hair dryers, curling irons, hot performer. Our numerical distribution is high because air brushes and lighted mirrors, was estimated at $2 billion, of the dominance of the brand in the marketplace. 10 with annual unit sales growth also at three percent. As a result of the Microlite acquisition, Rayovac Remington was considered a low-cost producer with expected to increase total Latin American revenues by capital expenditures of approximately one percent of rev- approximately 50 percent in 2005. enues. Production was mainly outsourced to low-cost Far East suppliers, particularly in mainland China. Therefore, any synergies between the two companies would be limited China to administration, purchasing, and distribution, with esti- In the same year that Rayovac acquired Microlite, the com- mated annual savings of approximately $23 million. Rayovac pany acquired 85 percent of Ningbo Baowang for $24 mil- also planned to use its established international distribution lion. Located in Ninghai, China, Ningbo Baowang was a network to expand the presence of Remington products out- major exporter of private label branded batteries with side North America, which accounted for 64 percent of that annual revenues of $6.4 million. The company also sold its company's sales in 2002. The Varta distribution network in own Baowang brand throughout China. particular would be used to increase the presence of Rem- By acquiring a Chinese manufacturer, Rayovac hoped ington products in Europe. According to Jones: to both increase its presence in the rapidly growing Asia mar- In 1996, we were selling our products in 36,000 stores ket and to add a low-cost manufacturing subsidiary from principally the United States. We are now selling in which to export Rayovac and Varta branded batteries to its over a million stores. Remington is selling in 20,000 global markets. Rayovac replaced Ningbo Baowang's exist stores in the United States. There are a lot more in the ing management with its own company managers in order United States. and a lot of retailers around the world to implement Rayovac process controls and management that we currently do business with. We think some of policies more efficiently. It also installed new manufacturing the Remington product line is applicable, and we think equipment that would allow it to produce one billion Rayovac because our sales organizations are on the ground and branded batteries a year beginning in 2005." Explained Jones: have strong relationships with retailers, we could build China is going to be the growth vehicle for all the the Remington brand name globally. alkaline capacity needs in the future. We have a very Remington represents a very logical diversification large plant in Fennimore; we have a very large plant in for Rayovac due to its product offerings, brand position- ing and customer similarities, and represents the first G learn.wsu.edu () C Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-25 Amazon.com Your Amazon.com order #114-5750927-3137809 h... e plants e grows Exhibit 6 Rayovac Corporation and Subsidiaries Manufacturing and Distribution Centers 2004 are going Facility Function F+2 North America Fennimore, Wisconsin Alkaline Battery Manufacturing 176,000 Portage, Wisconsin Zinc Air Button Cell and Lithium Coin Cell Battery Manufacturing and Foil Shaver 101,00 ig by acquir Component Manufacturing nington was Dixon, Illinois Packaging and Distribution of Batteries and Lighting Devices and Distribution of 576,000 of America's Electric Shaver and Personal Care Devices on personal Nashville, Tennessee Distribution of Batteries, Lighting Devices, Electric Shaver. and Personal Care 266,700 tric shavers. Devices nd in North Bridgeport, Connecticut1,3 Foil Cutting Systems and Accessories Manufacturing 167,000 tred with 40 for Braun. Asia hair dryers, Ninghai, China Zinc Carbon and Alkaline Battery Manufacturing & Distribution 274,000 ears leading Europe compound Dischingen, Germany? Alkaline Battery Manufacturing 186,000 Breitenbach, Francel Zinc Carbon Battery Manufacturing 165,000 and groom- about three Washington, UK2 Zinc Air Button Cell Battery Manufacturing & Distribution 53,000 electric per- Ellwangen, Germany? Battery Packaging and Distribution 312,000 ng irons, hot Latin America at $2 billion, Guatemala City, Guatemala Zinc Carbon Battery Manufacturing 105,000 cent Ipojuca, Brazil Zinc Carbon Battery Component Manufacturing 100,000 oducer with Jaboatoa, Brazil Zinc Carbon and Alkaline Battery Manufacturing 516,000 cent of rev- ow-cost Far Manizales, Colombia Zinc Carbon Battery Manufacturing 91,000 . Therefore, Facility is owned. d be limited Facility is leased. n, with esti- 3Facility closed September 30, 2004. on. Rayovac distribution step of hopefully several other diversification moves over the next few years as we build Rayovac into a much also focused on matching the product performance of its two major rivals, Braun and Norelco, in terms of consumer roducts out larger, more diversified consumer products company." attributes, features, functionality, and overall quality. rcent of that Integrating Remington into Rayovac involved clos- Following these acquisitions, Rayovac products were network in nce of Rem- ing several Remington manufacturing and distribution sold by 19 of the world's top 20 retailers and were available facilities, integrating all functional departments of the two in over one million stores in 120 countries. Company reve- nues increased to approximately $1.5 billion, and employees 10 stores companies and absorbing Remington's worldwide opera- tions into Rayovac's existing North American and Euro- numbered more than 6,500 worldwide. The company also elling in pean operations, thereby creating a global organization realized annual cost savings of more than three percent of 20,000 cost of goods sold. e in the and infrastructure. This included merging sales manage- e world ment, marketing, and field sales of the two companies into some of a single North American sales and marketing organiza- Lawn and Garden Care, Insecticides e think tion. Similarly, research and development (R&A) would be and and merged into Rayovac's research facility at the company's and Pet Supplies ld build headquarters in Wisconsin. From a total of 20 plants in 1996, Rayovac reduced its plants to nine by the end of 2004 while In 2005, Rayovac announced its intention to acquire two pet still quadrupling sales and unit volume. The number of supply companies for more than $2 billion and to change its ification name to Spectrum Brands. The first of these acquisitions was position- suppliers was reduced to 40 percent of 1996 levels, while United Industries Corporation, which Rayovac acquired for the first average procurement per supplier rose tenfold. Remington $1.5 billion, funded with cash payments of $1 billion, stock G learn.wsu.edu () C Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-25 e plants e grows Exhibit 6 Rayovac Corporation and Subsidiaries Manufacturing and Distribution Centers 2004 are going Facility Function F+2 North America Fennimore, Wisconsin Alkaline Battery Manufacturing 176,000 Portage, Wisconsin Zinc Air Button Cell and Lithium Coin Cell Battery Manufacturing and Foil Shaver 101,00 ig by acquir Component Manufacturing nington was Dixon, Illinois Packaging and Distribution of Batteries and Lighting Devices and Distribution of 576,000 of America's Electric Shaver and Personal Care Devices on personal Nashville, Tennessee Distribution of Batteries, Lighting Devices, Electric Shaver. and Personal Care 266,700 tric shavers. Devices nd in North Bridgeport, Connecticut1,3 Foil Cutting Systems and Accessories Manufacturing 167,000 tred with 40 for Braun. Asia hair dryers, Ninghai, China Zinc Carbon and Alkaline Battery Manufacturing & Distribution 274,000 ears leading Europe compound Dischingen, Germany? Alkaline Battery Manufacturing 186,000 Breitenbach, Francel Zinc Carbon Battery Manufacturing 165,000 and groom- about three Washington, UK2 Zinc Air Button Cell Battery Manufacturing & Distribution 53,000 electric per- Ellwangen, Germany? Battery Packaging and Distribution 312,000 ng irons, hot Latin America at $2 billion, Guatemala City, Guatemala Zinc Carbon Battery Manufacturing 105,000 cent Ipojuca, Brazil Zinc Carbon Battery Component Manufacturing 100,000 oducer with 516,000 cent of rev- Jaboatoa, Brazil Zinc Carbon and Alkaline Battery Manufacturing ow-cost Far Manizales, Colombia Zinc Carbon Battery Manufacturing 91,000 . Therefore, Facility is owned. d be limited Facility is leased. n, with esti- 3Facility closed September 30, 2004. on. Rayovac distribution step of hopefully several other diversification moves over the next few years as we build Rayovac into a much also focused on matching the product performance of its two major rivals, Braun and Norelco, in terms of consumer roducts out larger, more diversified consumer products company." attributes, features, functionality, and overall quality. rcent of that Following these acquisitions, Rayovac products were network in Integrating Remington into Rayovac involved clos- nce of Rem- ing several Remington manufacturing and distribution sold by 19 of the world's top 20 retailers and were available facilities, integrating all functional departments of the two in over one million stores in 120 countries. Company reve- 10 stores companies and absorbing Remington's worldwide opera- nues increased to approximately $1.5 billion, and employees numbered more than 6,500 worldwide. The company also elling in tions into Rayovac's existing North American and Euro- 20,000 pean operations, thereby creating a global organization realized annual cost savings of more than three percent of e in the and infrastructure. This included merging sales manage- cost of goods sold. e world ment, marketing, and field sales of the two companies into some of a single North American sales and marketing organiza- Lawn and Garden Care, Insecticides e think tion. Similarly, research and development (R&A) would be merged into Rayovac's research facility at the company's and Pet Supplies and and ld build headquarters in Wisconsin. From a total of 20 plants in 1996, Rayovac reduced its plants to nine by the end of 2004 while In 2005, Rayovac announced its intention to acquire two pet ification still quadrupling sales and unit volume. The number of supply companies for more than $2 billion and to change its name to Spectrum Brands. The first of these acquisitions was position- suppliers was reduced to 40 percent of 1996 levels, while United Industries Corporation, which Rayovac acquired for the first average procurement per supplier rose tenfold. Remington $1.5 billion, funded with cash payments of $1 billion, stock G learn.wsu.edu - ) C PC 3-26 Corporate Strategies issued from Treasury totalling $439 million with acquisition related expenses, and assumed debt totalling $36 million. To Central Garden and Pet Company was a distant third, fund the acquisition, Rayovac issued $1.03 billion in new with $1.2 billion in annual revenues. Central Garden's pet long-term debt. 15 products included pet food, aquarium products, pest control products, cages, pet books, and other small animal products. United Industries Lawn and garden products included grass seed, wild bird food, herbicides, insecticides, and outdoor patio furniture. United Industries was the leading North American producer The company's products were sold under more than 16 dif- of consumer lawn and garden care products, household insect ferent brand names. 18 control products and specialty pet supplies. The company United itself had just completed two significant acqui- had about 24 percent market share in lawn products, such as sitions in 2004 as it expanded geographically and diversified fertilizers and pesticides, which it sold under the brand name away from its roots in pesticides. In 2004, it entered the pet Spectrum. In insect control (mosquito repellents), it had an supply business with its acquisition of United Pet Group, 18 percent market share. Retails sales of household insect Inc. (UPG) for $360 million. UPG derived approximately control products in the United States was approximately $1 half its sales from aquarium supplies, while the remainder billion in 2003, growing at four percent a year, with sales consisted of a variety of supplies for small household pets, likely to increase as public awareness increased of insect- excluding pet food. As United was still in the process of borne diseases such as the West Nile virus. integrating UPG when it was acquired by Rayovac, Jones The U.S. pet supplies market was estimated at $8 expected its integration to be considerably more compli- billion in 2004, while the European market was about $4 cated than previous acquisitions, taking up to three years billion. Annual growth in the pet supplies category was to complete (compared to less than one year for Remington between six percent and eight percent. With increased and Varta). Nevertheless, Jones reasoned that any company incomes, more households were likely to have pets and that sold its products through major retail chains, such as to treat them as household members, spending increasing Wal-Mart, was a fair acquisition target. He explained: amounts on feeding and care. The U.S. pet supplies indus- As a larger and more significant supplier of consumer try was highly fragmented, with over 500 manufacturers, products, we believe the postacquisition Rayovac will enjoy primarily small firms. The industry was not significantly stronger relationships with our most important global affected by business cycles. The rise of pet superstores, such retailer customers. For instance, United does a substantial as Petco and Pet Smart, provided a competitive opportunity business with Wal-Mart, Home Depot, and Lowe's, all of for larger companies, such as Rayovac, with strong distribu- whom are important relationships for Rayovac today and tion channels. all of whom will become even more significant. 19 The lawn and garden segment also enjoyed favorable demographic trends. People over age 45 were more likely Many of the cost savings associated with the integra- to pursue gardening compared to the general population, tion of United Industries were expected in marketing and a group whose cohort was increasing as the North Ameri- distribution, as existing networks increased cross-selling to can, European, and Japanese populations increased in aver- department store customers. Other savings were expected age age. About 80 percent of U.S. households participated in administration and purchasing." According to Rayovac in some form of lawn and garden activity. In 2003, North Chief Operating Officer Kent Hussey, his company's strong American industry revenues were approximately $3.2 bil- presence in Asia and Europe provided it with more sophis- lion, growing at approximately four percent annually. Lawn ticated sourcing and distribution opportunities than those and garden care product sales, as well as insecticide sales, available to United, which had a limited presence outside were seasonal. Garden product sales typically fell off when of North America. Hussey explained: the weather was wet and cold. 16 Rayovac operates on a global scale. From a purchasing The Scotts Miracle-Gro Company was the largest pro- perspective, significant sourcing capabilities exist in the ducer of home gardening supplies, with annual net sales Far East. I think, with our experience and our infra- of $2 billion. Scotts led the market in almost every product structure, we can accelerate dramatically, purchasing category and every region in which it conducted business. leverage and sourcing in the Far East. And then finally, Its major brands included Scotts, Miracle-Gro, and Ortho in manufacturing in distribution, we can use our exper- fertilizers and herbicides. It was also the sole distributor tise very quickly to help rationalize, eliminate redun- in the home gardening segment for Monsanto's Roundup dancies and improve the efficiency of the overall supply brand herbicides. 17 chain. It really is very much operationally driven. There G learn.wsu.edu () C Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-27 distant third, are clearly some administrative synergies here in IT and and cost savings, Rayovac anticipated "gross synergies" Garden's pet finance and administration, but the bulk of this is really of between $70 million and $75 million over the first three , pest control operationally focused, 21 years. Boston-based private equity firm Thomas Lee Part- nal products. ners, which had acquired United in 1999, would end up ed, wild bird Jones added that Rayovac also planned to use its global network to expand United Industries' distribution beyond with nearly 25 percent ownership in Rayovac, as well as io furniture. North America. two seats on Rayovac's 10-member board of directors. e than 16 dif- Thomas H. Lee Partners had previously invested in Rayo- While United is a North American business now, that vac in 1995, and helped take it public in 1997. In addi- ificant acqui- is not to say it will be only a North American business tion, David Jones, Rayovac chairman and CEO, had served d diversified in the future. Our European teams are actively looking on United's board between 1999 and 2003. THL acquired tered the pe at the categories that United participates in and looking significant stakes in growth companies, and at the time 1 Pet Group, at where we can potentially expand there or in Latin of the United acquisition, managed over $12 billion of proximately America by taking advantage of obvious distribution committed capital. Some of its major deals include War- e remainder opportunities and customer relationships that we have ner Music, Houghton Mifflin Co., Snapple Beverage, and usehold pets, in regions other than North America.22 Fisher Scientific. e process of yovac, Jones Rayovac further argued that industry consolidation in ore compli- pet supplies was needed, "in order to meet the requirements Tetra Holdings three years of global retailers." According to Jones, pet supplies was r Remington the fastest growing retail category but one that was highly Rayovac's interest in pet supplies was further realized ny company fragmented. Rayovac intended to increase its participation with the acquisition of Tetra Holdings of Germany less ins, such as by further acquiring and consolidating pet supply compa- than two months after the United deal for $555 million lained: nies. "We think we can actually accelerate consolidation," (see Exhibit 7), of which $500 million was financed with he noted. "Pet is going to be a major growth platform and long-term debt (Table 1 summarizes Rayovac debt as of onsumer opportunity for further acquisitions." 23 July 2005, following the United and Tetra acquisitions). 24 will enjoy United's 2004 revenues of around $950 million came Tetra was founded in 1955 by Dr. Ulrich Baensch, the it global mainly from major chains, such as Home Depot, Lowe's, inventor of flaked fish food. The company supplied pet bstantial Wal-Mart, Petco, and Petsmart. Through increased sales fish and reptile products in 90 countries and had annual e's, all of pday and Exhibit 7 Pre and Post 2005 Acquisitions Consolidated Balance Sheets (in $ millions) the integra- Period ending Period ending irketing and Jul 3, 2005 Sep 30, 2004 ss-selling to Cash 27.0 15.8 are expected Receivables 462.6 289.6 to Rayovac Inventories 170.3 264.7 any's strong Prepaid Expenses 99.6 80.4 ore sophis Total Current Assets 1,059.4 50.5 s than those Net Plant and Equipment 310.7 182.4 nce outside Goodwill 1,432.6 320.6 Net intangible Assets 1,169.7 422.1 Other assets 83.7 60.4 rchasing 1,636.0 ist in the Total assets 4,056.1 or infra- Accounts Payable 280.2 228.1 chasing Accrued Liabilities 261.2 146.7 finally Current L-T debt 38.8 23.9 r exper- Total Current Liabilities 580.2 398.7 redun- Long-term Debt 2,298.0 806.0 suppl Employee benefits 73.8 69.2 1. There Other Liabilities 259.2 44.6 Shareholders' Equity 845.0 316.0 Total Liabilities and Equity 4,056.1 1,636.0 G learn.wsu.edu ( ) C PC 3-28 Corporate Strategies Table 1 Rayovac Debt (as of July 2005) Amount Interest Debt $ Millions Rate % Senior Subordinated Notes, due February 1, 2015 700.0 7.4 Senior Subordinated Notes, due October 1, 2013 (pre-existing) 350.0 8.5 Term Loan, U.S. dollar, expiring February 6, 2012 653.7 5.3 Term Loan, Canadian dollar, expiring February 6, 2012 71.0 4.7 Term Loan, Euro expiring February 6, 2012 138.0 4.7 Term Loan, Euro Tranche B, expiring February 6, 2012 340.4 4.4 Revolving Credit Facility, expiring February 6, 2011 28.3 7.3 Euro Revolving Credit Facility, expiring February 6, 2011 3.6 14 sales of $233 million in 2004 (compared to $179 million Throughout its history, Rayovac had been primarily in 2001). Tetra was purchased by Warner-Lambert in 1974 and was later spun off when Warner Lambert was a battery company. After the Tetra and United acquisitions, for the first time in its history, Rayovac's battery division acquired by Pfizer in 2000, and Pfizer decided to shed, "poorer performing consumer brands."Jones justified accounted for only slightly more than a third of total sales, his company's latest acquisition by noting: significantly less than the combined sales for lawn, garden and pet care products (see Table 2 and Exhibit 8). Further- The combination of Tetra with United Pet Group means more, with the United and Tetra acquisitions, more than a Rayovac will become the world's largest manufacturer third of total sales came from international sources. Tetra, of pet supplies, a position with which we can leverage for example, obtained 40 percent of its sales from Europe, 40 our company's worldwide operations. percent from the United States, and 20 percent from Japan. Correspondingly, the company incurred a third of its total operating expenses in foreign currencies remarked: Commenting on the Tetra acquisition, Kent Hussey Investment analyst Alyce Lomax described Rayovac's Tetra is a globally recognized brand name in the pet move into pet supplies as "diworseification," a term that supplies category, one that consumers know and trust. described, "companies that lose their primary focus in their It gives us entry into the pet supplies category literally quest to jumpstart growth through diversification."28 Even around the world, and it's a brand that virtually every so, most analysts hailed the deal, while investors sent the pet supply retailer considers a must-have brand in terms company's stock up nearly 10 percent immediately follow- of consumer loyalty. If the retailer doesn't have that prod- ing the announcement. Overall, the company's stock had uct on the shelf, he is missing significant sales opportuni- risen from about $15 to around $45 in the two years since ties. That makes Tetra a very attractive asset for us. "26 its acquisition of Remington (see Exhibit 9). Table 2 Rayovac: Percentage of Sales from Major Product Lines % of Sales October 2004 June 2005 Batteries 65 35 Shaving Personal care Lighting Pet Supplies Lawn & Garden Household Insecticides G learn.wsu.edu Case 3-3: Rayovac Corporation: International Growth and Diversification PC 3-29 Exhibit & Rayovac And Its Competitors, Percentage of Market Share by Major Product Line (as of 2005 U.S. U.S. Shaving U.S. Lawn Household U.S. Pet Brand Batteries and Grooming and Garden Insecticide Supplies U.S L.A Europe Duracell 37 28 24 (Braun) Energizer 26 19 22 Rayovac/ Spectrum 1 41 26 29 24 Brand (Varta) (Remington) Panasonic Norelco 43 Scotts 49 rimarily Central Garden 42 isitions, SC Johnson division al sales, garden RAYOVAC CP as of 18-Mar-2005 Further- e than a 45 40 ROV s. Tetra, rope, 40 35 n Japan. 30 its total 25 yovac's rm that 20 in their 28 Even sent the follow - ck had rs since 10 May03 Mayo4 Sep04 Jan05 http://finance.yahoo.com/ Exhibit Rayovac Corporation Stock Chart Note: The chart includes data up to and including the announced acquisition of Tetra Holdings on March 15, 2005. End Notes 1 This case has been written on the basis of published sources only. Consequently, the interpretation and perspectives presented in this case are not necessarily those of Rayovac Corporation or any of its employees. 2 Rayovac Buys Pet Supplies Company, Reuters, March 15, 2005. 3 Portions adapted from Rayovac Corporation, Prospectus Supplement, June 20, 2001. "Rayovac to Acquire Remington Products," Company Conference Call, Fair Disclosure Wire, August 22, 2003.Rayovac has been busy pursuing extensive diversication with mergers and acquisitions. What is your assessment of Rayovac's diversication strategy? What do you think about Remington? United? Tetra? Think about their strategy and identify problems and make recommendations for them to improve. If you like what they are doing, recommend how they can improve. If you do not like what they are doing, consider how they can organize changing their strategy towards your recommendations. You are writing an Executive Summary Sample Document.docx to the CEO of Rayovac. Executive Summary: Executive Summary Sample Document NTRODUCTION OBJECTIVE PROBLEMS 1. 2 . 3. RECOMMENDATIONS PWNH CONCLUSION