Question

RCo, a transnational company sets a wholly owned subsidiar SubA in coun try X, X's income tax rate is 25%, withholding tax rate is

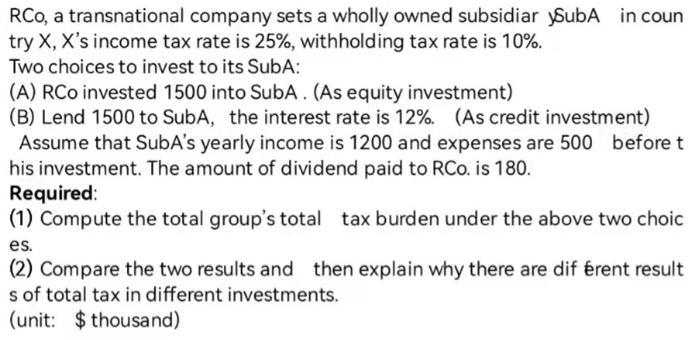

RCo, a transnational company sets a wholly owned subsidiar SubA in coun try X, X's income tax rate is 25%, withholding tax rate is 10%. Two choices to invest to its SubA: (A) RCo invested 1500 into SubA. (As equity investment) (B) Lend 1500 to SubA, the interest rate is 12%. (As credit investment) Assume that SubA's yearly income is 1200 and expenses are 500 before t his investment. The amount of dividend paid to RCo. is 180. Required: (1) Compute the total group's total tax burden under the above two choic es. (2) Compare the two results and then explain why there are diffrent result s of total tax in different investments. (unit: $thousand)

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Particulars Option A Option B Total Income 1200 1200 Less Expenses 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App