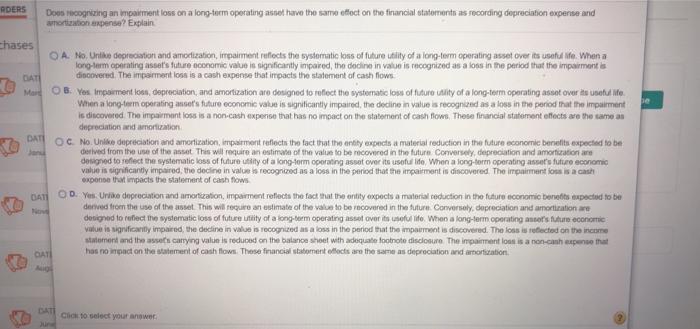

RDERS Do recognizing an impairment loss on a long-term operating astot have the same effect on the financial statemeritn as recording depreciation expense and amortization expense? Explain Chases OA. NoUnlike depreciation and amodization, impairment reflects the systematic kons of future utility of a long-term operating asset over its useful fe. When a long-term aparating asset's future economic value is significantly impared the decline in value is recognized as a fons in the period that the impairments DAT discovered. The impairmention is a cash expense that impacts the statement of cash flows D Mart B. Yes Impormento, depreciation, and amortization are designed to reflect the systematic loss of futuro clity of a long-term operating asset over de unetulle When a long-term operating anset's future economic value is significantly impaired, the decline in value is recognized as a loss in the period that the impairment is discovered. The impairment loss is a non-cash expense that has no impact on the statement of cash flows. These financial statement effects are the same as depreciation and amortization DATI OC. No Unlike depreciation and amortization, impament reflects the fact that the entity expects a material reduction in the future economic benefits expected to be derived from the use of the asset. This will require an estimate of the value to be covered in the future Conversely, depreciation and amortization and designed to reflect the systematic loss of future utility of a long-term operating asset over its useful life When a long-term operating asset's future economic value in significantly impaired the decine in value is recognized as a loss in the period that the impairment is discovered. The impairment for is a cash expone that impacts the statement of cash flows DAN OD. Yen Urie depreciation and amortization, impairment reflects the fact that the entity expects a material reduction in the future economic benefits expected to be derived from the use of the asset. This will require an estimate of the value to be recovered in the future. Conversely, depreciation and amortiration are designed to reflect the systematic loss of future utility of a long-term operating asset over its useful life. When a long-term operating anser's future economie value in significantly impaired, the decline in value is recognized as a loss in the period that the impourmet is discovered. The loss is reflected on the income statement and the scanty ng value is reduced on the balance sheet with adequate footnote disclosure. The impairmentlos is a non-canh sepen that DATI has no impact on the statement of cash flows. These financial statement effects are the same as depreciation and arorigation Click to select your