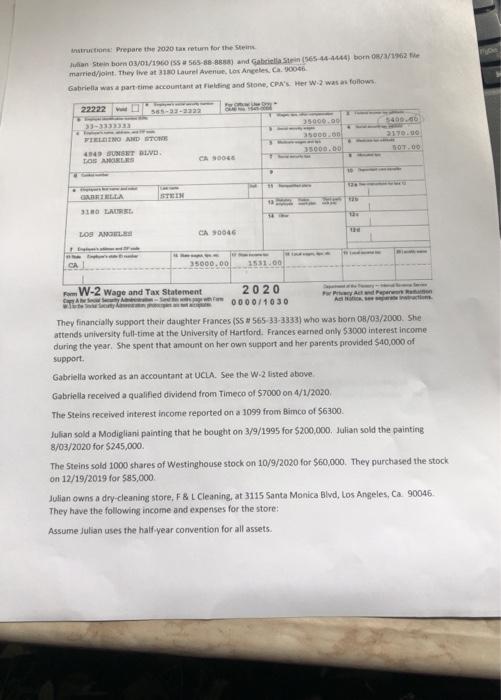

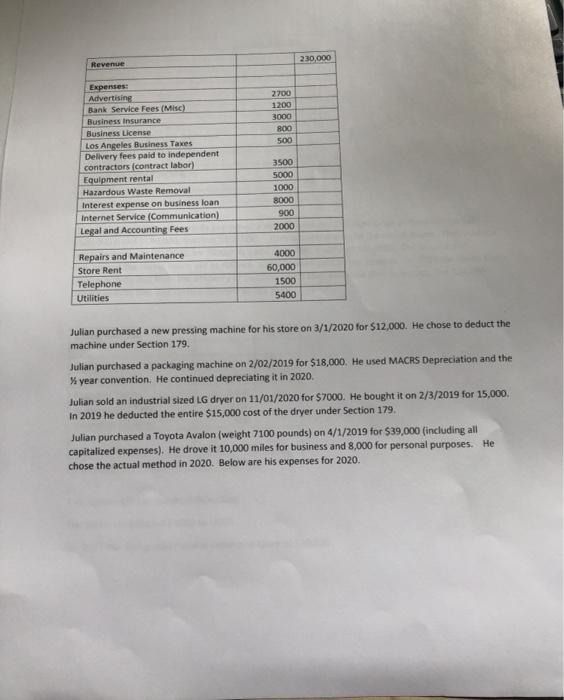

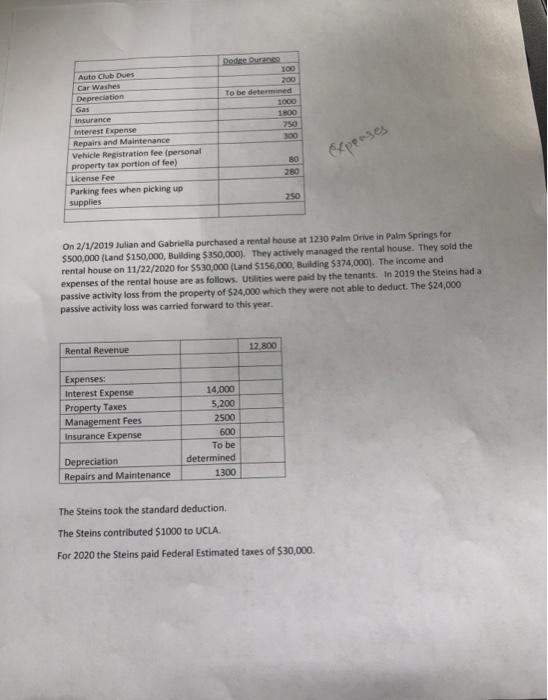

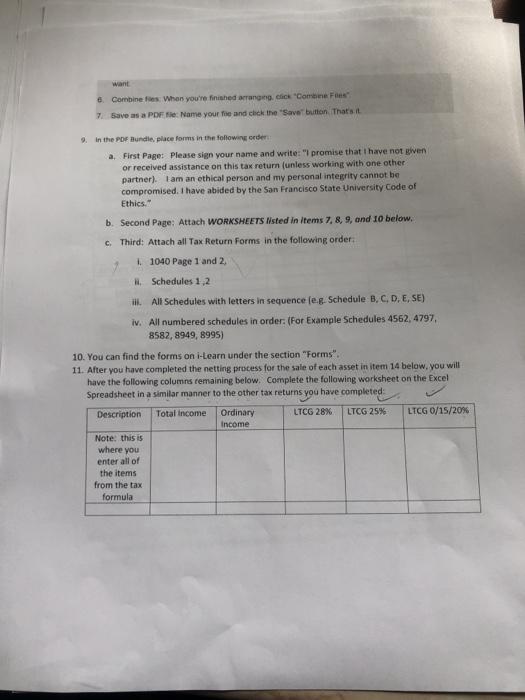

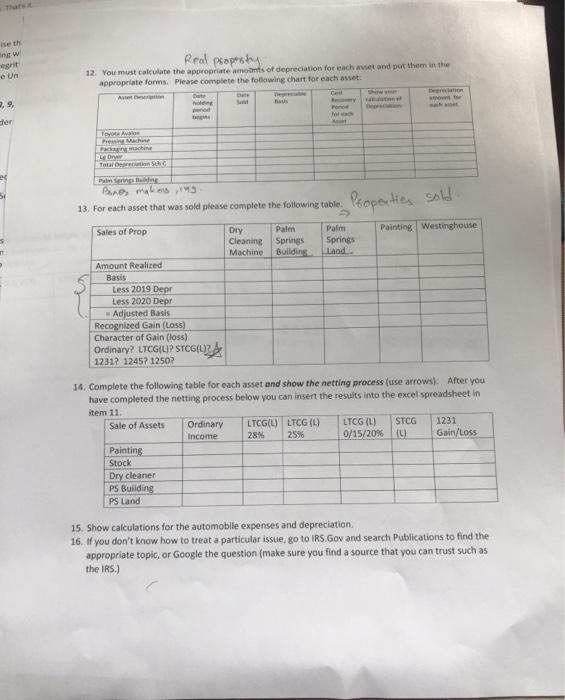

Re: Prepare the 2020 tax return for the in Stein om 03/01/1960 SS 565-88 88) and Gabrielle Stein (56544-4444 bomo//1962 married/joint. They live at 310 Laurel Avenue, Los Angeles, Cal 900 Gabriella was a part time accountant at Filding and Stone, CPA's Her W-2 was as follows 22222 58531 25000.00 35000 400.00 2170.00 FRENO AND STOS 44 SUNST BIVE TOMERS 35000.00 ST-00 STEIN LOS ANGELES CA 90046 35000.00 1551.00 W-2 Wage and Tax Statement 2020 0000/1030 They financially support their daughter Frances (SS #565-33-3333) who was hom 08/03/2000, She attends university full-time at the University of Hartford, Frances earned only 53000 interest income during the year. She spent that amount on her own support and her parents provided $40,000 of support Gabriella worked as an accountant at UCLA. See the W-2 listed above Gabriella received a qualified dividend from Timeco of 57000 on 4/1/2020 The Steins received interest income reported on a 1099 from Bimce of $6300 Julian sold a Modigliani painting that he bought on 3/9/1995 for $200,000. Julian sold the painting 8/03/2020 for $245,000. The Steins sold 1000 shares of Westinghouse stock on 10/9/2020 for $60,000. They purchased the stock on 12/19/2019 for $85,000 Julian owns a dry-cleaning store, F & Cleaning, at 3115 Santa Monica Blvd, Los Angeles, Ca. 90046. They have the following income and expenses for the store: Assume Julian uses the half year convention for all assets. 230.000 Revenue 2200 1200 3000 800 500 Expenses Advertising Bank Service Fees (Misc) Business Insurance Business License Los Angeles Business Taxes Delivery fees paid to independent contractors (contract labor) Equipment rental Hazardous Waste Removal Interest expense on business loan Internet Service (Communication) Legal and Accounting Fees 3500 5000 1000 8000 900 2000 Repairs and Maintenance Store Rent Telephone Utilities 4000 60,000 1500 5400 Julian purchased a new pressing machine for his store on 3/1/2020 for $12,000. He chose to deduct the machine under Section 179 Julian purchased a packaging machine on 2/02/2019 for $18,000. He used MACRS Depreciation and the % year convention. He continued depreciating it in 2020. Julian sold an industrial sized LG dryer on 11/01/2020 for $7000. He bought it on 2/3/2019 for 15,000. In 2019 he deducted the entire $15,000 cost of the dryer under Section 179. Julian purchased a Toyota Avalon (weight 7100 pounds) on 4/1/2019 for $39,000 (including all capitalized expenses). He drove it 10,000 miles for business and 8,000 for personal purposes. He chose the actual method in 2020. Below are his expenses for 2020. 100 200 To be determined 300 Auto Club Dues Car Washes Depreciation Gas Insurance Interest Expense Repairs and Maintenance Vehicle Registration fee (personal property tax portion of fee) License Fee Parking fees when picking up supplies 80 280 On 2/1/2019 Julian and Gabriella purchased a rental house at 1230 Palm Drive in Palm Springs for $500,000 (Land $150,000, Building $350,000). They actively managed the rental house. They sold the rental house on 11/22/2020 for $530,000 (Land $156,000, Building $374,000). The income and expenses of the rental house are as follows. Utilities were paid by the tenants. In 2019 the Steins had a passive activity loss from the property of $24,000 which they were not able to deduct. The $24,000 passive activity loss was carried forward to this year Rental Revenue 12.800 Expenses: Interest Expense Property Taxes Management Fees Insurance Expense 14,000 5.200 2500 600 To be determined 1300 Depreciation Repairs and Maintenance The Steins took the standard deduction The Steins contributed $1000 to UCLA. For 2020 the Steins paid Federal Estimated taxes of $30,000 6. Combine fies. When you're finished arranging click "Come Fes" 7 save as a PDF File Name your tie and click the "Save button. That's it 9. in the PDF Bundle place forms in the following order a. First Page: Please sign your name and write: "I promise that I have not given or received assistance on this tax return (unless working with one other partner). I am an ethical person and my personal integrity cannot be compromised. I have abided by the San Francisco State University Code of Ethics. b. Second Page: Attach WORKSHEETS Nisted in Items 7, 8, 9, and 10 below. c. Third: Attach all Tax Return Forms in the following order 1. 1040 Page 1 and 2 Schedules 1,2 ill. All Schedules with letters in sequence leg. Schedule B, C, D, E, SE) iv. All numbered schedules in order: (For Example Schedules 4562, 4797, 8582, 8949, 8995) 10. You can find the forms on i-Learn under the section "Forms". 11. After you have completed the netting process for the sale of each asset in item 14 below, you will have the following columns remaining below. Complete the following worksheet on the Excel Spreadsheet in a similar manner to the other tax returns you have completed: Description Total income Ordinary LTCG 28% LTCG 25% LTCG 0/15/20% Income Note: this is where you enter all of the items from the tax formula new egrit Real propesty 12. You must calculate the appropriate amounts of depreciation for each wet and put them in the appropriate forms. Please complete the following chart for each anset: Asie pred Home der Pr Machine machine LED Panes males, 13. For each asset that was sold please complete the following table. Properties sold. Sales of Prop Painting Westinghouse Dry Palm Palm Cleaning Springs Springs Machine Building Land Amount Realized Basis Less 2019 Depr Less 2020 Depr Adjusted Basis Recognized Gain (Loss) Character of Gain (loss) Ordinary? LTCGILP STCG(L)2 12317 1245712507 14. Complete the following table for each asset and show the netting process (use arrows). After you have completed the netting process below you can insert the results into the excel spreadsheet in item 11 Sale of Assets Ordinary LTCGL LTCG (0) LTCG (L) STCG 1231 Income 28 25% 0/15/20% 10 Gain/Loss Painting Stock Dry cleaner PS Building PS Land 15. Show calculations for the automobile expenses and depreciation 16. If you don't know how to treat a particular issue, go to IRS.Gov and search Publications to find the appropriate topic, or Google the question (make sure you find a source that you can trust such as the IRS.) Re: Prepare the 2020 tax return for the in Stein om 03/01/1960 SS 565-88 88) and Gabrielle Stein (56544-4444 bomo//1962 married/joint. They live at 310 Laurel Avenue, Los Angeles, Cal 900 Gabriella was a part time accountant at Filding and Stone, CPA's Her W-2 was as follows 22222 58531 25000.00 35000 400.00 2170.00 FRENO AND STOS 44 SUNST BIVE TOMERS 35000.00 ST-00 STEIN LOS ANGELES CA 90046 35000.00 1551.00 W-2 Wage and Tax Statement 2020 0000/1030 They financially support their daughter Frances (SS #565-33-3333) who was hom 08/03/2000, She attends university full-time at the University of Hartford, Frances earned only 53000 interest income during the year. She spent that amount on her own support and her parents provided $40,000 of support Gabriella worked as an accountant at UCLA. See the W-2 listed above Gabriella received a qualified dividend from Timeco of 57000 on 4/1/2020 The Steins received interest income reported on a 1099 from Bimce of $6300 Julian sold a Modigliani painting that he bought on 3/9/1995 for $200,000. Julian sold the painting 8/03/2020 for $245,000. The Steins sold 1000 shares of Westinghouse stock on 10/9/2020 for $60,000. They purchased the stock on 12/19/2019 for $85,000 Julian owns a dry-cleaning store, F & Cleaning, at 3115 Santa Monica Blvd, Los Angeles, Ca. 90046. They have the following income and expenses for the store: Assume Julian uses the half year convention for all assets. 230.000 Revenue 2200 1200 3000 800 500 Expenses Advertising Bank Service Fees (Misc) Business Insurance Business License Los Angeles Business Taxes Delivery fees paid to independent contractors (contract labor) Equipment rental Hazardous Waste Removal Interest expense on business loan Internet Service (Communication) Legal and Accounting Fees 3500 5000 1000 8000 900 2000 Repairs and Maintenance Store Rent Telephone Utilities 4000 60,000 1500 5400 Julian purchased a new pressing machine for his store on 3/1/2020 for $12,000. He chose to deduct the machine under Section 179 Julian purchased a packaging machine on 2/02/2019 for $18,000. He used MACRS Depreciation and the % year convention. He continued depreciating it in 2020. Julian sold an industrial sized LG dryer on 11/01/2020 for $7000. He bought it on 2/3/2019 for 15,000. In 2019 he deducted the entire $15,000 cost of the dryer under Section 179. Julian purchased a Toyota Avalon (weight 7100 pounds) on 4/1/2019 for $39,000 (including all capitalized expenses). He drove it 10,000 miles for business and 8,000 for personal purposes. He chose the actual method in 2020. Below are his expenses for 2020. 100 200 To be determined 300 Auto Club Dues Car Washes Depreciation Gas Insurance Interest Expense Repairs and Maintenance Vehicle Registration fee (personal property tax portion of fee) License Fee Parking fees when picking up supplies 80 280 On 2/1/2019 Julian and Gabriella purchased a rental house at 1230 Palm Drive in Palm Springs for $500,000 (Land $150,000, Building $350,000). They actively managed the rental house. They sold the rental house on 11/22/2020 for $530,000 (Land $156,000, Building $374,000). The income and expenses of the rental house are as follows. Utilities were paid by the tenants. In 2019 the Steins had a passive activity loss from the property of $24,000 which they were not able to deduct. The $24,000 passive activity loss was carried forward to this year Rental Revenue 12.800 Expenses: Interest Expense Property Taxes Management Fees Insurance Expense 14,000 5.200 2500 600 To be determined 1300 Depreciation Repairs and Maintenance The Steins took the standard deduction The Steins contributed $1000 to UCLA. For 2020 the Steins paid Federal Estimated taxes of $30,000 6. Combine fies. When you're finished arranging click "Come Fes" 7 save as a PDF File Name your tie and click the "Save button. That's it 9. in the PDF Bundle place forms in the following order a. First Page: Please sign your name and write: "I promise that I have not given or received assistance on this tax return (unless working with one other partner). I am an ethical person and my personal integrity cannot be compromised. I have abided by the San Francisco State University Code of Ethics. b. Second Page: Attach WORKSHEETS Nisted in Items 7, 8, 9, and 10 below. c. Third: Attach all Tax Return Forms in the following order 1. 1040 Page 1 and 2 Schedules 1,2 ill. All Schedules with letters in sequence leg. Schedule B, C, D, E, SE) iv. All numbered schedules in order: (For Example Schedules 4562, 4797, 8582, 8949, 8995) 10. You can find the forms on i-Learn under the section "Forms". 11. After you have completed the netting process for the sale of each asset in item 14 below, you will have the following columns remaining below. Complete the following worksheet on the Excel Spreadsheet in a similar manner to the other tax returns you have completed: Description Total income Ordinary LTCG 28% LTCG 25% LTCG 0/15/20% Income Note: this is where you enter all of the items from the tax formula new egrit Real propesty 12. You must calculate the appropriate amounts of depreciation for each wet and put them in the appropriate forms. Please complete the following chart for each anset: Asie pred Home der Pr Machine machine LED Panes males, 13. For each asset that was sold please complete the following table. Properties sold. Sales of Prop Painting Westinghouse Dry Palm Palm Cleaning Springs Springs Machine Building Land Amount Realized Basis Less 2019 Depr Less 2020 Depr Adjusted Basis Recognized Gain (Loss) Character of Gain (loss) Ordinary? LTCGILP STCG(L)2 12317 1245712507 14. Complete the following table for each asset and show the netting process (use arrows). After you have completed the netting process below you can insert the results into the excel spreadsheet in item 11 Sale of Assets Ordinary LTCGL LTCG (0) LTCG (L) STCG 1231 Income 28 25% 0/15/20% 10 Gain/Loss Painting Stock Dry cleaner PS Building PS Land 15. Show calculations for the automobile expenses and depreciation 16. If you don't know how to treat a particular issue, go to IRS.Gov and search Publications to find the appropriate topic, or Google the question (make sure you find a source that you can trust such as the IRS.)