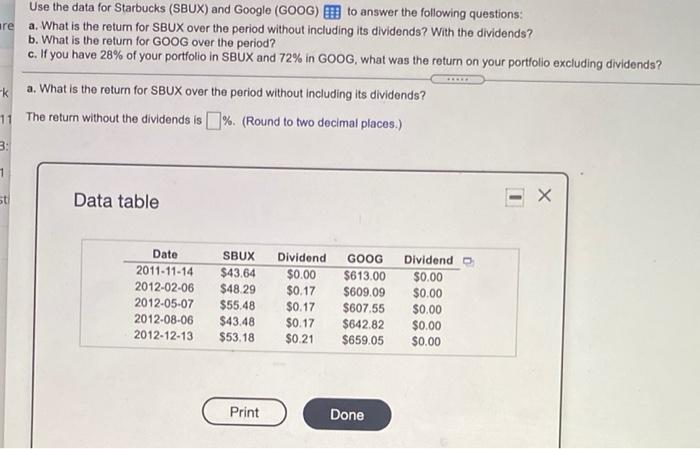

Question: re Use the data for Starbucks (SBUX) and Google (GOOG) I to answer the following questions: a. What is the return for SBUX over the

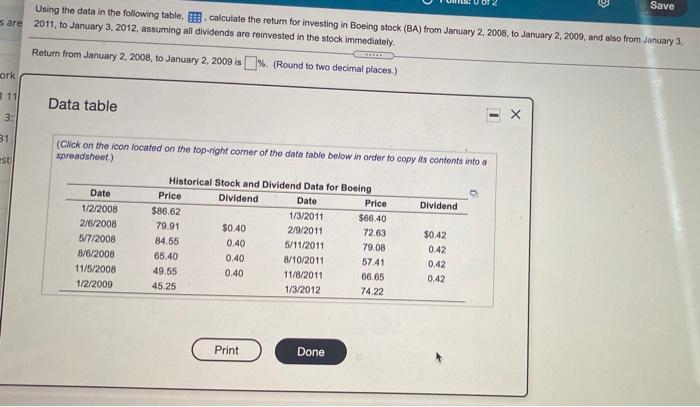

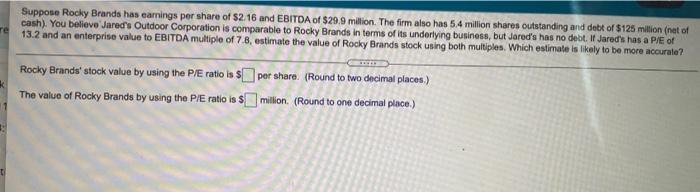

re Use the data for Starbucks (SBUX) and Google (GOOG) I to answer the following questions: a. What is the return for SBUX over the period without including its dividends? With the dividends? b. What is the return for GOOG over the period? c. If you have 28% of your portfolio in SBUX and 72% in GOOG, what was the return on your portfolio excluding dividends? -k a. What is the return for SBUX over the period without including its dividends? 11 The return without the dividends is % (Round to two decimal places.) 3: 1 st Data table - Date 2011-11-14 2012-02-06 2012-05-07 2012-08-06 2012-12-13 SBUX $43.64 $48.29 $55.48 $43.48 $53.18 Dividend $0.00 $0.17 $0.17 $0.17 $0.21 GOOG $613.00 $609.09 $607.55 $642.82 $659.05 Dividend $0.00 $0.00 $0.00 $0.00 $0.00 Print Done Save Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately sare Return from January 2, 2008, to January 2, 2009 is % (Round to two decimal places.) ork 11 Data table 1 3: 31 SU Date (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) Historical Stock and Dividend Data for Boeing Price Dividend Date Price Dividend 1/2/2008 $86.62 1/3/2011 $66.40 2/6/2008 79.91 $0.40 2/9/2011 72.63 $0.42 5/7/2008 84.55 0.40 5/11/2011 79.08 0.42 8/6/2008 65.40 0.40 8/10/2011 57.41 0.42 11/5/2008 49.55 0.40 11/8/2011 66.65 0.42 1/2/2009 45.25 1/3/2012 74.22 Print Done Suppose Rocky Brands has earnings per share of S2 16 and EBITDA of $29.9 million. The firm also has 5.4 million shares outstanding and debt of $125 million (net of cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a Ple of 13.2 and an enterprise value to EBITDA multiple of 78, estimate the value of Rocky Brands stock using both multiples. Which estimate is likely to be more accurate? Rocky Brands' stock value by using the P/E ratio is sper share. (Round to two decimal places) The value of Rocky Brands by using the P/E ratio is smilton (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts