Answered step by step

Verified Expert Solution

Question

1 Approved Answer

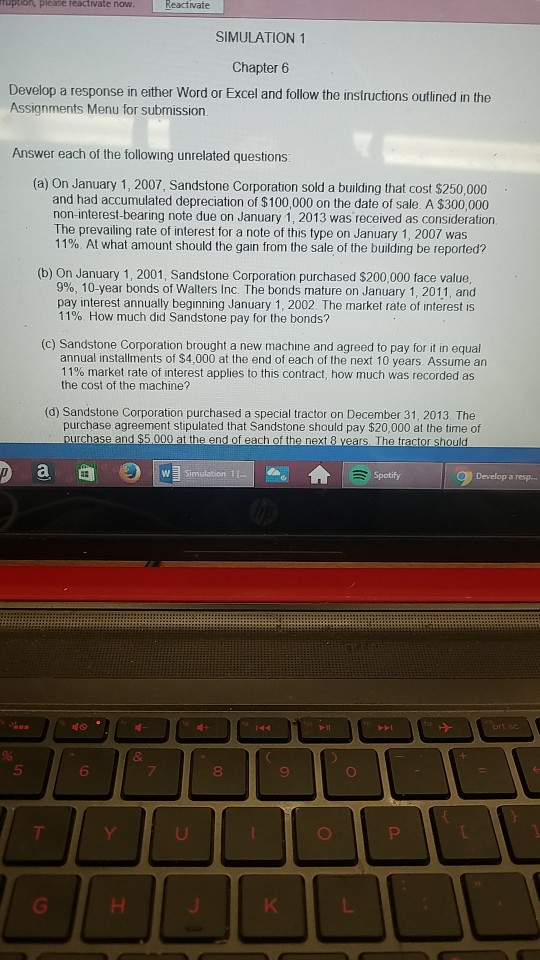

reactvate now Reactvate SIMULATION 1 Chapter 6 Develop a response in either Word or Excel and follow the instructions outlined in the Assignments Menu for

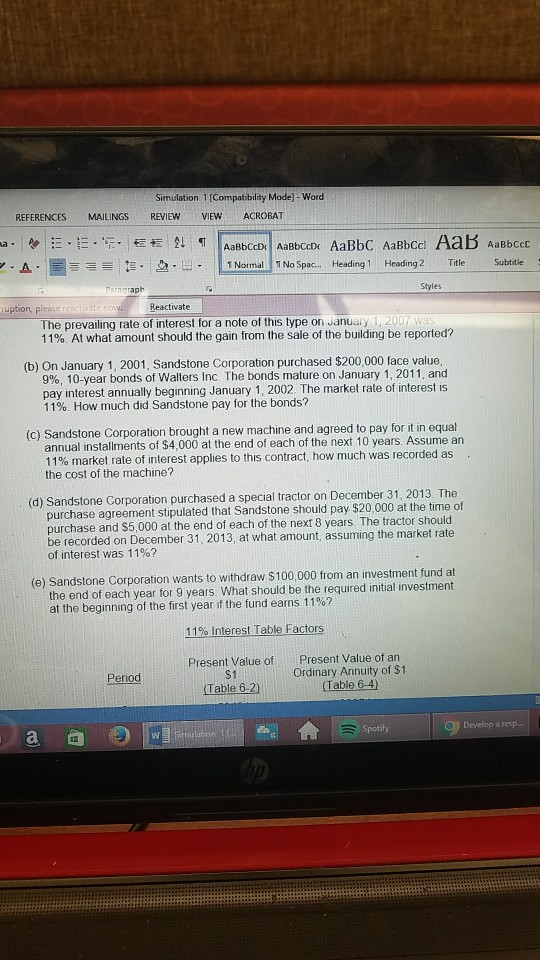

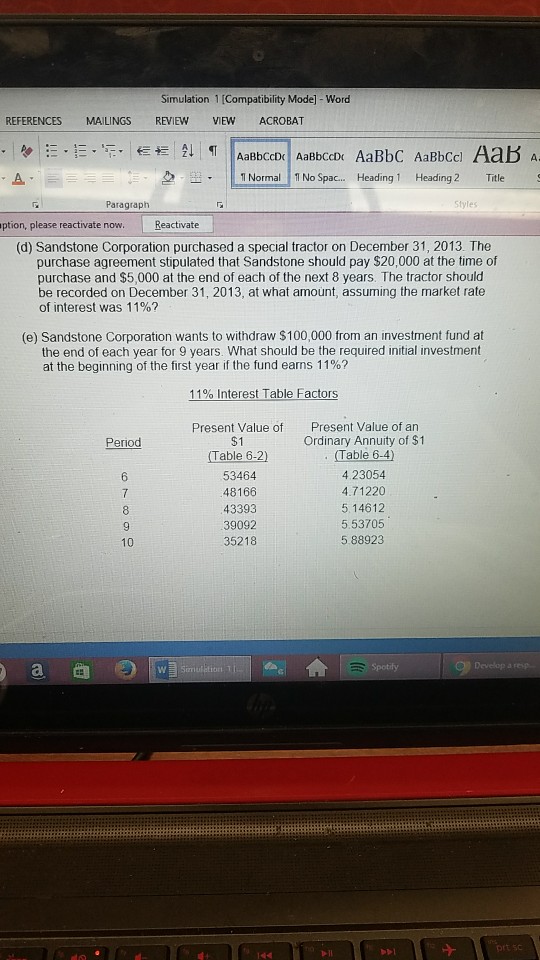

reactvate now Reactvate SIMULATION 1 Chapter 6 Develop a response in either Word or Excel and follow the instructions outlined in the Assignments Menu for submission Answer each of the following unrelated questions (a) On January 1, 2007, Sandstone Corporation sold a building that cost $250,000 and had accumulated depreciation of $100,000 on the date of sale. A $300,000 11% At what amount should the gain from the sale of the building be reported? 9%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2011, and non-interest-bearing note due on January 1, 2013 was received as consideration The prevailing rate of interest for a note of this type on January 1, 2007 was (b) On January 1, 2001, Sandstone Corporation purchased $200,000 face value pay interest annually beginning January 1, 2002. The market rate of interest is 1190 How much did Sandstone pay for the bonds? (c) Sandstone Corporation brought a new machine and agreed to pay for it in equal annual installments of $4,000 at the end of each of the next 10 years. Assume an 11% market rate of Interest applies to this contract, how much was recorded as the cost of the machine? (d) Sandstone Corporation purchased a special tractor on December 31, 2013. The purchase agreement stipulated that Sandstone should pay $20,000 at the time of Spotify Develop a resp. 5 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started