Answered step by step

Verified Expert Solution

Question

1 Approved Answer

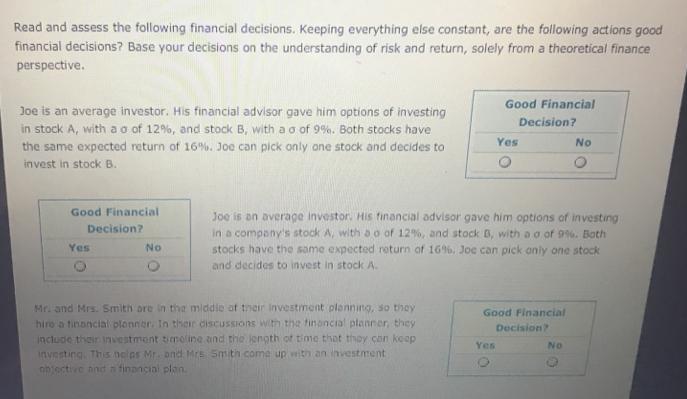

Read and assess the following financial decisions. Keeping everything else constant, are the following actions good financial decisions? Base your decisions on the understanding

Read and assess the following financial decisions. Keeping everything else constant, are the following actions good financial decisions? Base your decisions on the understanding of risk and return, solely from a theoretical finance perspective. Good Financial Joe is an average investor. His financial advisor gave him options of investing in stock A, with a o of 12%, and stock B, with a o of 9%. Both stocks have the same expected return of 16%. Joe can pick only ane stock and decides to Decision? Yes No invest in stock B. Good Financial Joe is an average investor. His financial advisor gave him options of investing in a company's stock A, with a o of 12%, and stock B, with a a of 9. Both stocks have the same expected return of 16%, Joe can pick anly one stock and decides to invest in stock A. Decision? Yes No Mr. and Mrs. Smith ore in the middie at tneir Investment planning, so they hiro a tinancial plonner. In their discussIOns With the finoncial planner, they include thair investment simoline and the length of time that thoy con keep nvesting. Ths neles Mr. ond Mrs Smith come up with an investment ohjective and n financial plan. Good Financial Decision Yes No Read and assess the following financial decisions. Keeping everything else constant, are the following actions good financial decisions? Base your decisions on the understanding of risk and return, solely from a theoretical finance perspective. Good Financial Joe is an average investor. His financial advisor gave him options of investing in stock A, with a o of 12%, and stock B, with a o of 9%. Both stocks have the same expected return of 16%. Joe can pick only ane stock and decides to Decision? Yes No invest in stock B. Good Financial Joe is an average investor. His financial advisor gave him options of investing in a company's stock A, with a o of 12%, and stock B, with a a of 9. Both stocks have the same expected return of 16%, Joe can pick anly one stock and decides to invest in stock A. Decision? Yes No Mr. and Mrs. Smith ore in the middie at tneir Investment planning, so they hiro a tinancial plonner. In their discussIOns With the finoncial planner, they include thair investment simoline and the length of time that thoy con keep nvesting. Ths neles Mr. ond Mrs Smith come up with an investment ohjective and n financial plan. Good Financial Decision Yes No Read and assess the following financial decisions. Keeping everything else constant, are the following actions good financial decisions? Base your decisions on the understanding of risk and return, solely from a theoretical finance perspective. Good Financial Joe is an average investor. His financial advisor gave him options of investing in stock A, with a o of 12%, and stock B, with a o of 9%. Both stocks have the same expected return of 16%. Joe can pick only ane stock and decides to Decision? Yes No invest in stock B. Good Financial Joe is an average investor. His financial advisor gave him options of investing in a company's stock A, with a o of 12%, and stock B, with a a of 9. Both stocks have the same expected return of 16%, Joe can pick anly one stock and decides to invest in stock A. Decision? Yes No Mr. and Mrs. Smith ore in the middie at tneir Investment planning, so they hiro a tinancial plonner. In their discussIOns With the finoncial planner, they include thair investment simoline and the length of time that thoy con keep nvesting. Ths neles Mr. ond Mrs Smith come up with an investment ohjective and n financial plan. Good Financial Decision Yes No

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

BILL Yes it is a good financial decision Since Bill has taken into consideration inflation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started