Read attached Case Study Nissan Motor Company Ltd.: Building Operational Resiliency

William Schmidt, David Simchi-Levi

Case Discussion Questions

- The case identifies several aspects of the Nissan response that were particularly beneficial. Expand on the points made in the case to identify the potential costs and benefits of these actions.

- What else could Nissan have done to prepare for and respond to the disaster? Try to articulate the costs and benefits of your suggestions.

- What could Nissan have done to assess the risk of disruption in their supply chain?

- How did Nissan's product line strategy help or hurt its ability to respond to and recover from the disaster?

5. How will the operational changes announced in 2012 affect Nissan's exposure to future disruptions? How will it affect its steady-state operations? What trade-offs is management making and why?

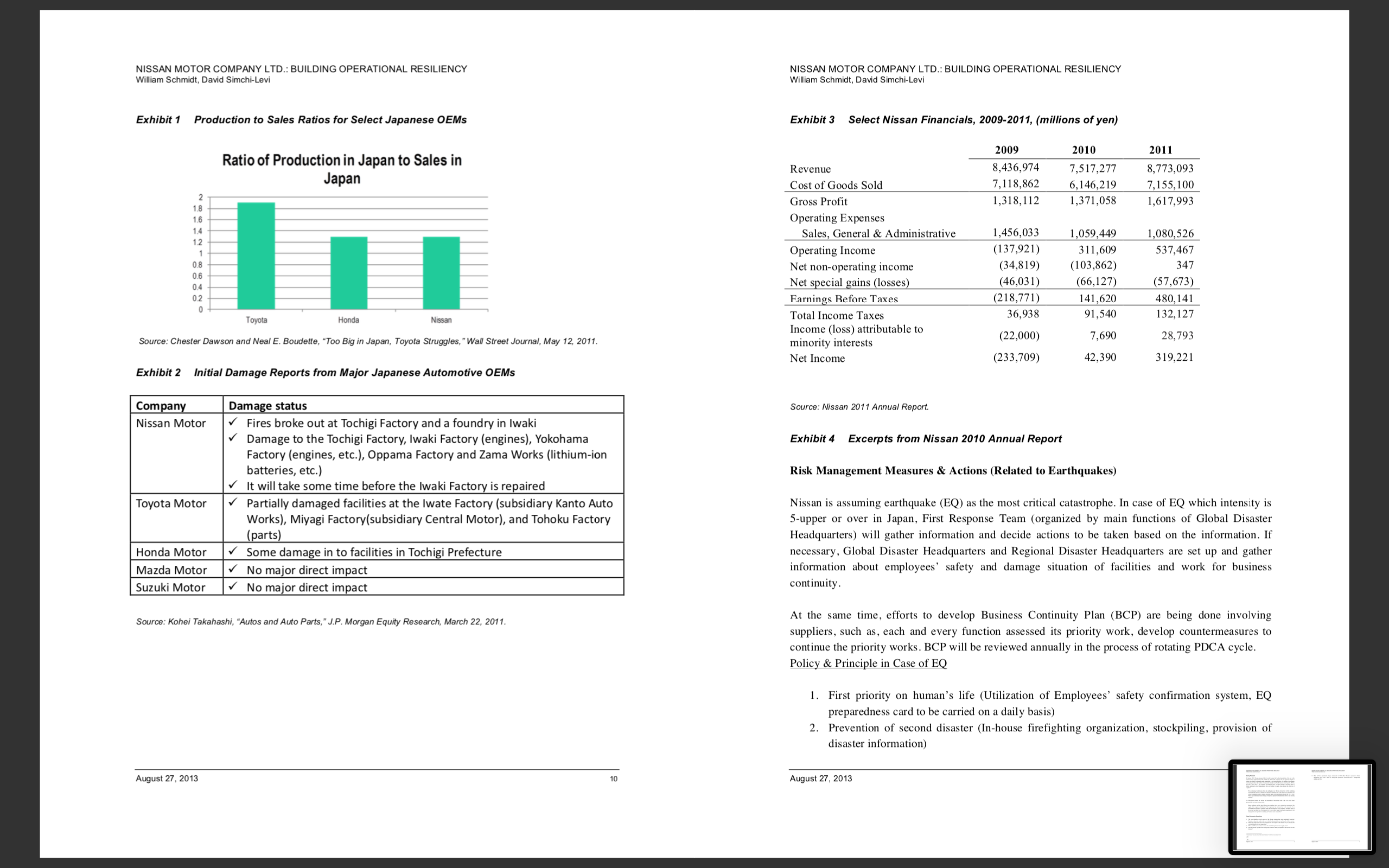

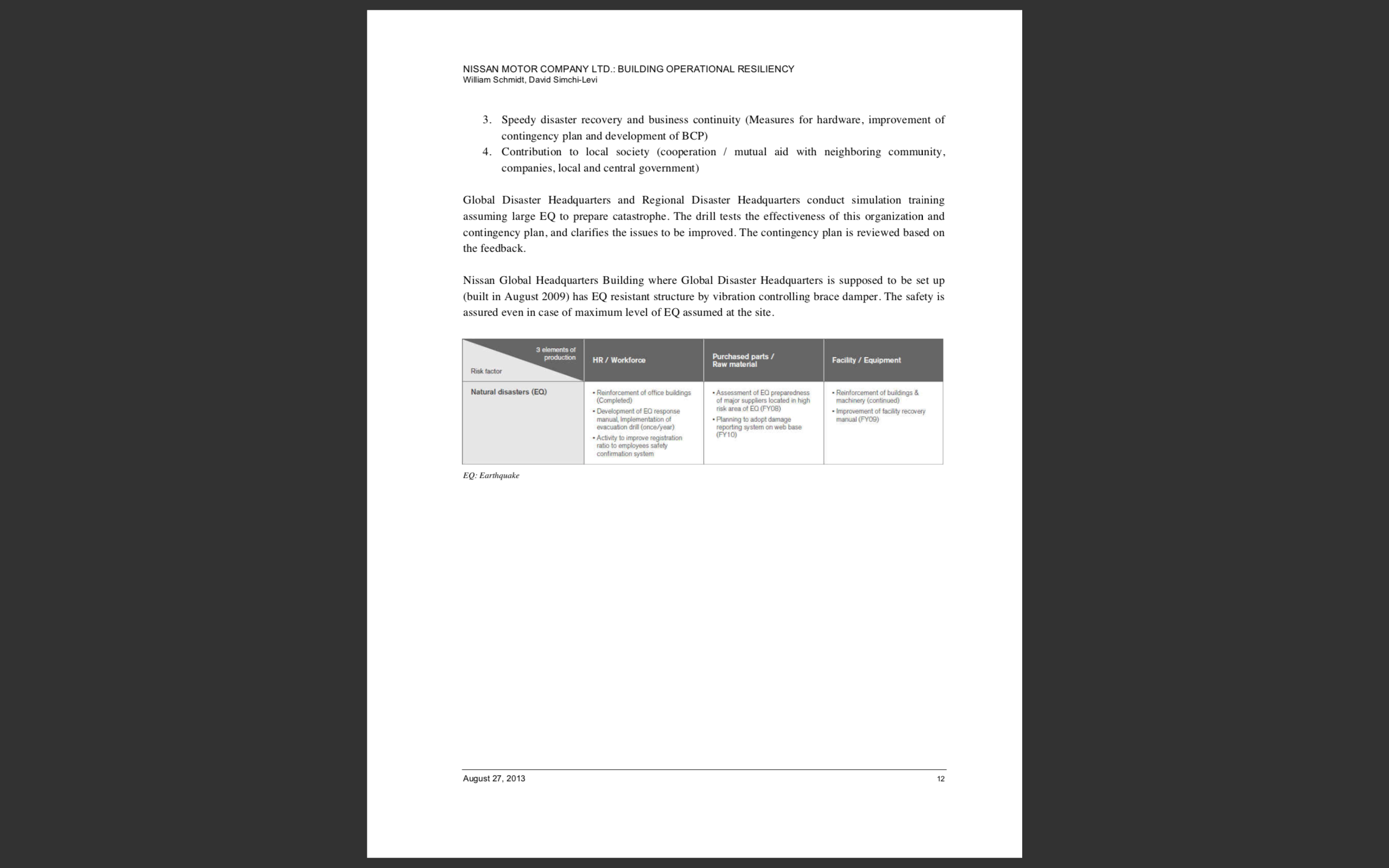

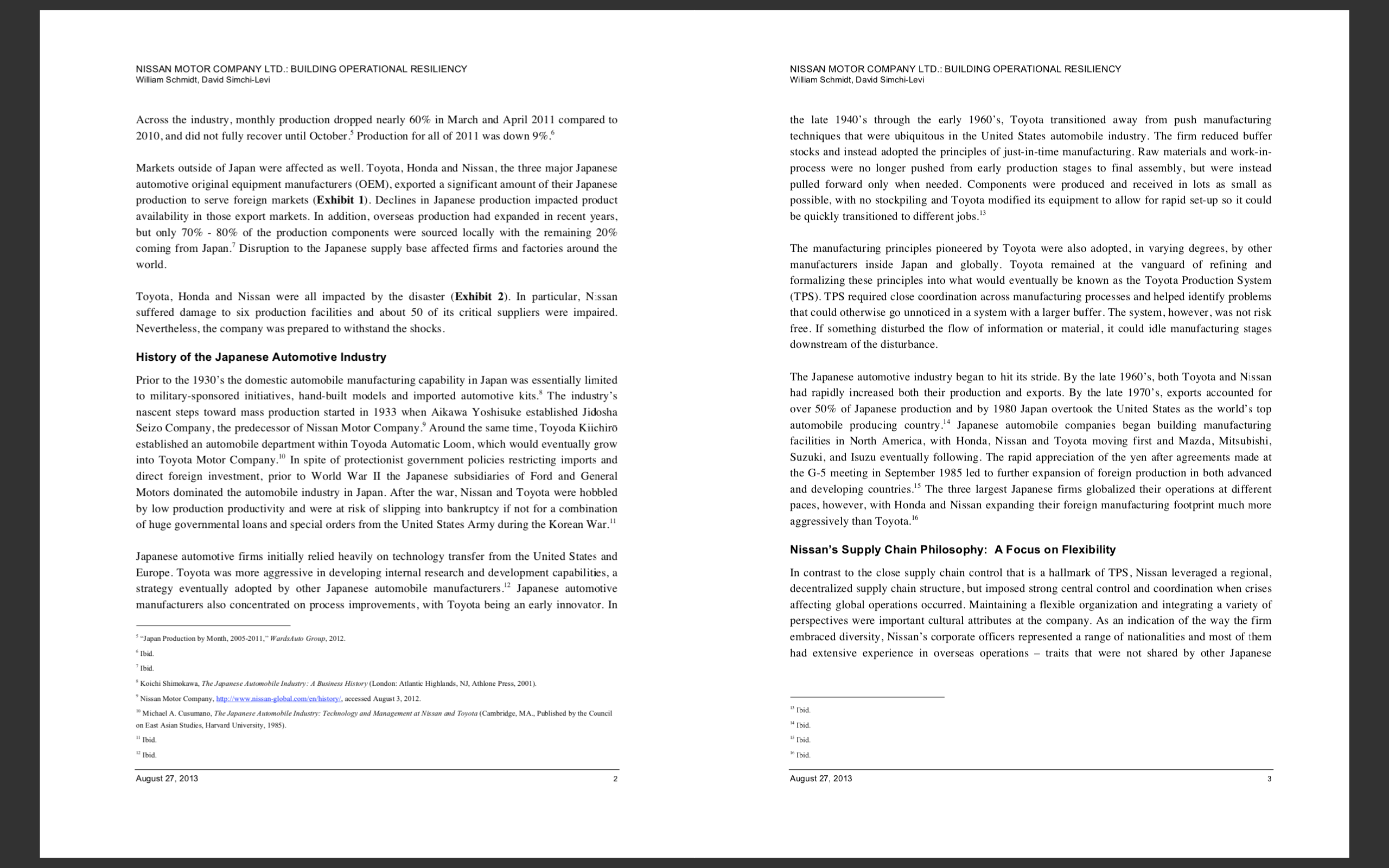

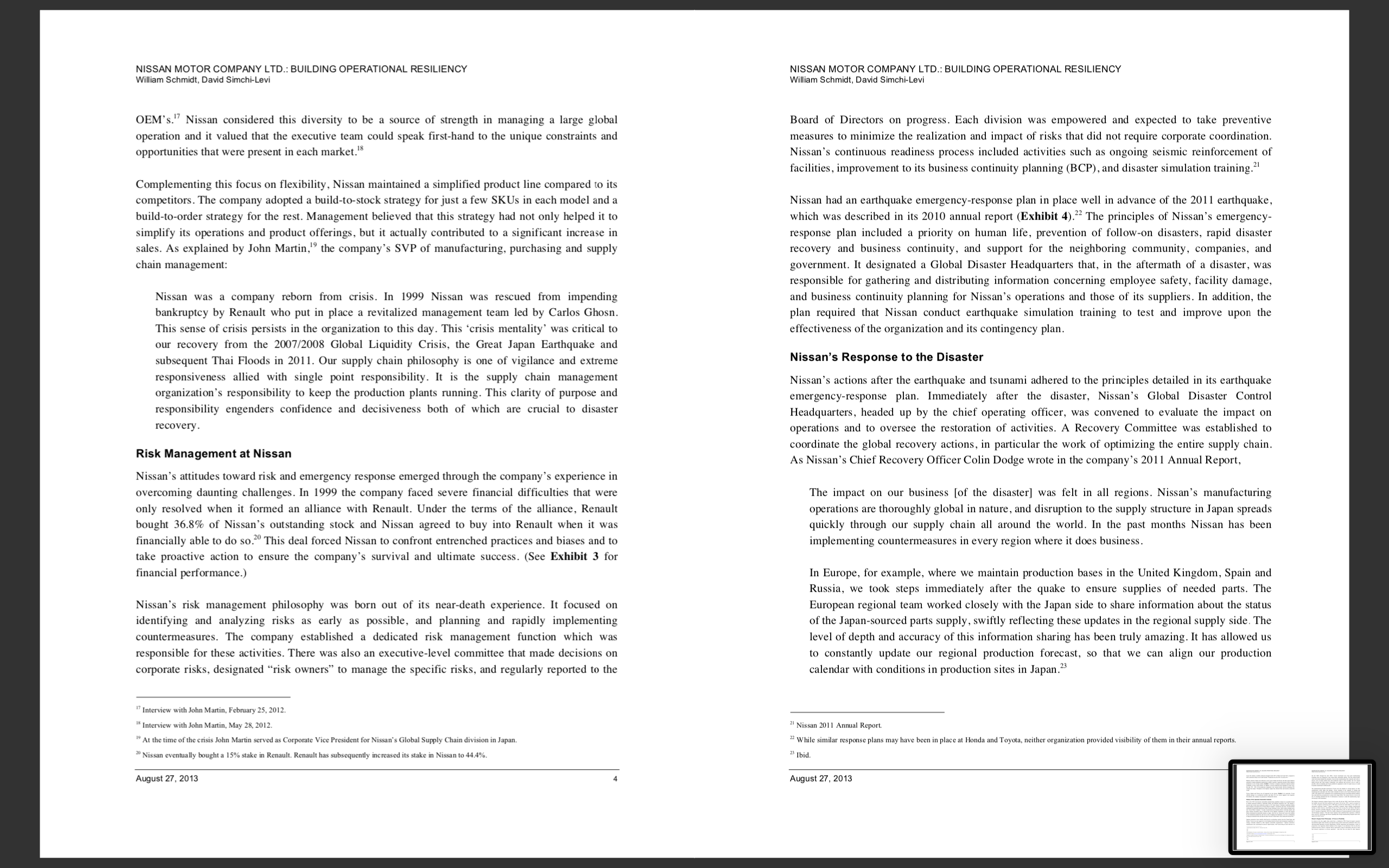

NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY William Schmidt, David Simchi-Levi William Schmidt, David Simchi-Levi Exhibit 1 Production to Sales Ratios for Select Japanese OEMs Exhibit 3 Select Nissan Financials, 2009-2011, (millions of yen) 2009 2010 2011 Ratio of Production in Japan to Sales in Revenue 3,436,974 7,517,277 3,773,093 Japan Cost of Goods Sold 7,118,862 , 146,219 7,155, 100 Gross Profit 1,318,112 1,371,058 1,617,993 Operating Expenses 12 Sales, General & Administrative 1,456,033 ,059,449 1,080,526 Operating Income (137,921) 311,609 537,467 0.8 Net non-operating income (34,819) (103,862) 347 06 0.4 Net special gains (losses) (46,031) (66, 127) (57,673) 02 Earnings Before Taxes (218,771) 141,620 480,141 Toyota Honda Total Income Taxes 36,938 91,540 132, 127 Income (loss) attributable to Source: Chester Dawson and Neal E. Boudette, "Too Big in Japan, Toyota Struggles, " Wall Street Journal, May 12, 2011. (22,000) 7,690 28,793 minority interests Net Income (233,709) 42,390 319,221 Exhibit 2 Initial Damage Reports from Major Japanese Automotive OEMs Company Damage status Source: Nissan 2011 Annual Report. Nissan Motor Fires broke out at Tochigi Factory and a foundry in Iwaki Damage to the Tochigi Factory, Iwaki Factory (engines), Yokohama Exhibit 4 Excerpts from Nissan 2010 Annual Report Factory (engines, etc.), Oppama Factory and Zama Works (lithium-ion batteries, etc.) Risk Management Measures & Actions (Related to Earthquakes) It will take some time before the lwaki Factory is repaired Toyota Motor Partially damaged facilities at the Iwate Factory (subsidiary Kanto Auto Nissan is assuming earthquake (EQ) as the most critical catastrophe. In case of EQ which intensity is Works), Miyagi Factory(subsidiary Central Motor), and Tohoku Factory 5-upper or over in Japan, First Response Team (organized by main functions of Global Disaster (parts) Headquarters) will gather information and decide actions to be taken based on the information. If Honda Motor Some damage in to facilities in Tochigi Prefecture necessary, Global Disaster Headquarters and Regional Disaster Headquarters are set up and gather Mazda Motor No major direct impact information about employees' safety and damage situation of facilities and work for business Suzuki Motor No major direct impact continuity Source: Kohei Takahashi, "Autos and Auto Parts," J.P. Morgan Equity Research, March 22, 2011. At the same time, efforts to develop Business Continuity Plan (BCP) are being done involving suppliers, such as, each and every function assessed its priority work, develop countermeasures to continue the priority works. BCP will be reviewed annually in the process of rotating PDCA cycle. Policy & Principle in Case of EQ 1. First priority on human's life (Utilization of Employees' safety confirmation system, EQ preparedness card to be carried on a daily basis) 2. Prevention of second disaster (In-house firefighting organization, stockpiling, provision of disaster information) August 27, 2013 August 27, 2013NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY William Schmidt, David Simchi-Levi 3. Speedy disaster recovery and business continuity (Measures for hardware, improvement of contingency plan and development of BCP) 4. Contribution to local society (cooperation / mutual aid with neighboring community, companies, local and central government) Global Disaster Headquarters and Regional Disaster Headquarters conduct simulation training assuming large EQ to prepare catastrophe. The drill tests the effectiveness of this organization and contingency plan, and clarifies the issues to be improved. The contingency plan is reviewed based on the feedback. Nissan Global Headquarters Building where Global Disaster Headquarters is supposed to be set up (built in August 2009) has EQ resistant structure by vibration controlling brace damper. The safety is assured even in case of maximum level of EQ assumed at the site. 3 elements of production HR / Workforce Risk factor Raw material Facility / Equipment Natural disasters (EO) Reinforcement of office buildings . Assessment of EO preparedness cement of buildings & (Completed) of major suppliers located in machinery (continued) Development of EQ response risk area of EQ (FY . Improvement of facility recovery manual, Implementation of . Planning to adopt damage manual (FY09) evacuation drill (once/year) reporting system on web base to improve registration ratio to employees safety confirmation system EQ: Earthquake August 27, 2013NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY William Schmidt, David Simchi-Levi William Schmidt, David Simchi-Levi Across the industry, monthly production dropped nearly 60% in March and April 2011 compared to the late 1940's through the early 1960's, Toyota transitioned away from push manufacturing 2010, and did not fully recover until October. Production for all of 201 1 was down 9%." techniques that were ubiquitous in the United States automobile industry. The firm reduced buffer stocks and instead adopted the principles of just-in-time manufacturing. Raw materials and work-in- Markets outside of Japan were affected as well. Toyota, Honda and Nissan, the three major Japanese process were no longer pushed from early production stages to final assembly, but were instead automotive original equipment manufacturers (OEM), exported a significant amount of their Japanese pulled forward only when needed. Components were produced and received in lots as small as production to serve foreign markets (Exhibit 1). Declines in Japanese production impacted product possible, with no stockpiling and Toyota modified its equipment to allow for rapid set-up so it could availability in those export markets. In addition, overseas production had expanded in recent years, be quickly transitioned to different jobs. but only 70% - 80% of the production components were sourced locally with the remaining 20% coming from Japan." Disruption to the Japanese supply base affected firms and factories around the The manufacturing principles pioneered by Toyota were also adopted, in varying degrees, by other world. manufacturers inside Japan and globally. Toyota remained at the vanguard of refining and formalizing these principles into what would eventually be known as the Toyota Production System Toyota, Honda and Nissan were all impacted by the disaster (Exhibit 2). In particular, Nissan TPS). TPS required close coordination across manufacturing processes and helped identify problems suffered damage to six production facilities and about 50 of its critical suppliers were impaired. that could otherwise go unnoticed in a system with a larger buffer. The system, however, was not risk Nevertheless, the company was prepared to withstand the shocks. free. If something disturbed the flow of information or material, it could idle manufacturing stages downstream of the disturbance. History of the Japanese Automotive Industry Prior to the 1930's the domestic automobile manufacturing capability in Japan was essentially limited The Japanese automotive industry began to hit its stride. By the late 1960's, both Toyota and Nissan to military-sponsored initiatives, hand-built models and imported automotive kits. The industry's had rapidly increased both their production and exports. By the late 1970's, exports accounted for nascent steps toward mass production started in 1933 when Aikawa Yoshisuke established Jidosha over 50% of Japanese production and by 1980 Japan overtook the United States as the world's top Seizo Company, the predecessor of Nissan Motor Company." Around the same time, Toyoda Kiichiro automobile producing country." Japanese automobile companies began building manufacturing established an automobile department within Toyoda Automatic Loom, which would eventually grow acilities in North America, with Honda, Nissan and Toyota moving first and Mazda, Mitsubishi, into Toyota Motor Company." In spite of protectionist government policies restricting imports and Suzuki, and Isuzu eventually following. The rapid appreciation of the yen after agreements made at direct foreign investment, prior to World War II the Japanese subsidiaries of Ford and General the G-5 meeting in September 1985 led to further expansion of foreign production in both advanced Motors dominated the automobile industry in Japan. After the war, Nissan and Toyota were hobbled and developing countries." The three largest Japanese firms globalized their operations at different by low production productivity and were at risk of slipping into bankruptcy if not for a combination paces, however, with Honda and Nissan expanding their foreign manufacturing footprint much more of huge governmental loans and special orders from the United States Army during the Korean War." aggressively than Toyota." Japanese automotive firms initially relied heavily on technology transfer from the United States and Nissan's Supply Chain Philosophy: A Focus on Flexibility Europe. Toyota was more aggressive in developing internal research and development capabilities, a In contrast to the close supply chain control that is a hallmark of TPS, Nissan leveraged a regional, strategy eventually adopted by other Japanese automobile manufacturers." Japanese automotive decentralized supply chain structure, but imposed strong central control and coordination when crises manufacturers also concentrated on process improvements, with Toyota being an early innovator. In affecting global operations occurred. Maintaining a flexible organization and integrating a variety of perspectives were important cultural attributes at the company. As an indication of the way the firm "Japan Production by Month, 2005-201 1," WardsAuto Group, 2012. embraced diversity, Nissan's corporate officers represented a range of nationalities and most of them Ibid. had extensive experience in overseas operations - traits that were not shared by other Japanese 7 Ibid Koichi Shimokawa, The Japanese ry: A Business History (London: Atlantic Highlands, NJ, Athlone Press, 2001). Nissan Motor Company, http:/www.nis /en/history/, accessed August 3, 2012. Michael A. Cusumano, The Japanese Automobile Industry: Technology and Management at Nissan and Toyota (Cambridge, MA., Published by the Council Ibid. on East Asian Studies, Harvard University, 1985). " Ibid. Ibid. 15 Ibid. 12 Ibid. 16 Ibid. August 27, 2013 August 27, 2013NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY William Schmidt, David Simchi-Levi William Schmidt, David Simchi-Levi OEM's." Nissan considered this diversity to be a source of strength in managing a large global Board of Directors on progress. Each division was empowered and expected to take preventive operation and it valued that the executive team could speak first-hand to the unique constraints and measures to minimize the realization and impact of risks that did not require corporate coordination. opportunities that were present in each market." Nissan's continuous readiness process included activities such as ongoing seismic reinforcement of facilities, improvement to its business continuity planning (BCP), and disaster simulation training." Complementing this focus on flexibility, Nissan maintained a simplified product line compared to its competitors. The company adopted a build-to-stock strategy for just a few SKUs in each model and a Nissan had an earthquake emergency-response plan in place well in advance of the 2011 earthquake, build-to-order strategy for the rest. Management believed that this strategy had not only helped it to which was described in its 2010 annual report (Exhibit 4)." The principles of Nissan's emergency- simplify its operations and product offerings, but it actually contributed to a significant increase in response plan included a priority on human life, prevention of follow-on disasters, rapid disaster sales. As explained by John Martin," the company's SVP of manufacturing, purchasing and supply recovery and business continuity, and support for the neighboring community, companies, and chain management: government. It designated a Global Disaster Headquarters that, in the aftermath of a disaster, was responsible for gathering and distributing information concerning employee safety, facility damage, Nissan was a company reborn from crisis. In 1999 Nissan was rescued from impending and business continuity planning for Nissan's operations and those of its suppliers. In addition, the bankruptcy by Renault who put in place a revitalized management team led by Carlos Ghosn. plan required that Nissan conduct earthquake simulation training to test and improve upon the This sense of crisis persists in the organization to this day. This 'crisis mentality' was critical to effectiveness of the organization and its contingency plan. our recovery from the 2007/2008 Global Liquidity Crisis, the Great Japan Earthquake and subsequent Thai Floods in 2011. Our supply chain philosophy is one of vigilance and extreme Nissan's Response to the Disaster responsiveness allied with single point responsibility. It is the supply chain management Nissan's actions after the earthquake and tsunami adhered to the principles detailed in its earthquake organization's responsibility to keep the production plants running. This clarity of purpose and emergency-response plan. Immediately after the disaster, Nissan's Global Disaster Control responsibility engenders confidence and decisiveness both of which are crucial to disaster Headquarters, headed up by the chief operating officer, was convened to evaluate the impact on recovery . operations and to oversee the restoration of activities. A Recovery Committee was established to Risk Management at Nissan coordinate the global recovery actions, in particular the work of optimizing the entire supply chain. As Nissan's Chief Recovery Officer Colin Dodge wrote in the company's 201 1 Annual Report, Nissan's attitudes toward risk and emergency response emerged through the company's experience in overcoming daunting challenges. In 1999 the company faced severe financial difficulties that were The impact on our business [of the disaster] was felt in all regions. Nissan's manufacturing only resolved when it formed an alliance with Renault. Under the terms of the alliance, Renault operations are thoroughly global in nature, and disruption to the supply structure in Japan spreads bought 36.8% of Nissan's outstanding stock and Nissan agreed to buy into Renault when it was quickly through our supply chain all around the world. In the past months Nissan has been financially able to do so." This deal forced Nissan to confront entrenched practices and biases and to implementing countermeasures in every region where it does business. take proactive action to ensure the company's survival and ultimate success. (See Exhibit 3 for financial performance.) In Europe, for example, where we maintain production bases in the United Kingdom, Spain and Russia, we took steps immediately after the quake to ensure supplies of needed parts. The Nissan's risk management philosophy was born out of its near-death experience. It focused on European regional team worked closely with the Japan side to share information about the status dentifying and analyzing risks as early as possible, and planning and rapidly implementing of the Japan-sourced parts supply, swiftly reflecting these updates in the regional supply side. The countermeasures. The company established a dedicated risk management function which was level of depth and accuracy of this information sharing has been truly amazing. It has allowed us responsible for these activities. There was also an executive-level committee that made decisions on to constantly update our regional production forecast, so that we can align our production corporate risks, designated "risk owners" to manage the specific risks, and regularly reported to the calendar with conditions in production sites in Japan. 23 Interview with John Martin, February 25, 2012. Interview with John Martin, May 28, 2012. Nissan 201 1 Annual Report. "At the time of the crisis John Martin served as Corporate Vice President for Nissan's Global Supply Chain division in Japan. "While similar response plans may have been in place at Honda and Toyota, neither organization provided visibility of them in their annual reports. Nissan eventually bought a 15% stake in Renault. Renault has subsequently increased its stake in Nissan to 44.4%. 23 Ibid. August 27, 2013 August 27, 2013NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY Wiliam Schm'm. David sirtch'nL-vi NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCV William Schmidt, David simchi-ani Tire Recovery Committee emphasized a few simple yet meaningful practices in coordinating the company's response to the disaster: 4. Empowerlng action Nissan emphasized rapid and flexible action. Management was strnring information Nissan brought all of their global regions into the response process. Management recognized that the non-Japanese opemtions would want information, but the effort to provide it would be a distraction to those on the groutrd handling the on They also recognized information might be used selrrshly by dependent facilities optimizing against its own needs. To address these two concerns, each region was asked to send two staff members to Japan to gather their own information and to help solve problems holistically. instead of becoming a drain on the local response effort. the other regions and plants contributed to solutions. In addition. the regions had complete visibility into what was happening in Japan and could help the organization improve the response. Allocating mpply Given the capacity constraints in the weeks and months aer the disaster. and the dependencies that existed across the Nissan operational network, allocation of component pans was critical, The sales, marketing, and the regional supply chain management functions were brought together to identify how to globally allocate supplies to focus on highest margin goods. For example the supply of integrated Global Postttoning System (GPS) units was constrained by the disasters Nissan identied which car models required integrated GPS to meet customer demands, and allocated resources accordingly. Lowend models did not receive the allocation of available UPS since they did not have commensurately high margins. and customers were willing to purchase those models without an integrated GPS. This process was completed within two weeks of the earthquake and continually updated as the supply situation became clearer. Managing production Nissan slowed their production lines in a targeted way. Management closely considered in-stock and in-transit inventory within their network and slowed production upstream and downstream of a pared bottlenecks. For example, the company was able to ramp down production. and thereby decrease costly overtime, for empowered to make decisions in the eld without lengthy analysis from a central authority. To speed critical decision-making process on recovery-related issues, the company modied its delegation of authority rules for a limited period. The decisions were iterated upon as new information surfaced so that the company could course correct, if necessary. As Nissan's Chief Operating Ofcer Toshiyuki Shiga explained, The disaster response simulations we have carried out regularly served us particularly well, By envisioning a full range of potential situations arising from a major disaster and preparing for them, we successfully enabled ourselves to take prompt actions when the time came. At a time of disaster. it is essential to make speedy decisions while grasping the latest situation, including details on employees' safety and damage caused, and to take appropriate actions based on this, We launched the Global Disaster Control Headquarters just l5 minutes after the earthquake occurred. The learn immediately gathered and assessed damage while overseeing restoration efforts at various facilities.\" Recovery by the Big Thro Japanese Auto Manutacturers In the six months following the earthquake, production across all auto manufacturers in Japan declined 24.3% compared to forecast.\" The big three Japanese manufacturers each contended with different issues associated with the disaster. Toyota had signicant exposure due to its large size and its high rate of Japanese production (including for export), Nissan had several plants in close proximity to the disaster area. While Honda was partly insulated due to its large localized U.S. production. recovery from the disaster was still slow. Honda attributed its production problems to constraints in its supply chain?\" a problem that Nissan had successfully insulated itself from, As Nissan's Chief Financial Officer Joseph Peter remarked, operations that were expected to be bottlenecked. Management also pulled vacation time into April and May in order to tree up capacity later in the summer when upstream bottlenecks were projected to have cleared. Most of the steps we have taken in response to the March 1] disaster have been cantinuations of strategies, priorities and plans that were already in place. One example of this is the localization strategy we have been pursuing to better balance our manufacturing and sourcing footprint to our sales footprint, Our actions in this area date back to the start of the nancial crisis in 2008, when our primary objectives were to reduce volatility from foreign currency movements, panicularly the appreciating yen, and to reduce cost.27 The company used the time bought by having in-transit inventory to identify and implement supply alternatives. For example, the lead-time for ocean transport from Japan to the west coast of the United States was [5 days, plus ve days to move material to plants in Tennessee and Mississippi, This meant that management had as many as 20 days to identify how to access alternative supplies of critical components. They were also able to secure air freight out of Japan so they could get critical pans out of the country faster and mitigate the reduction of in-transit stocks. y raid 5 "Julian Protlittlton to Month, Isms-2m I," Minimum mun, zatz, e oz 2m rtandr Motor Co Ltd Earring; rmentnrnn \" lhld August 27, 2013 August 21. 2013 NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY NISSAN MOTOR COMPANY LTD.: BUILDING OPERATIONAL RESILIENCY William Schmidt, David Simchi-Levi William Schmidt, David Simchi-Levi Going Forward 5. How will the operational changes announced in 2012 affect Nissan's exposure to future In January 2012, Nissan announced that it would increase the localized production of its cars in the disruptions? How will it affect its steady-state operations? What trade-offs is management Americas from approximately 70% to 90% by 2015." The company also set aggressive targets to making and why? reduce its reliance on Japanese-made components in its foreign factories. For instance, the company was hoping to reduce the number of components brought in to North America from Japan by 50% by the end of fiscal 2013." The company, according to Peter, was also making a concerted effort to better understand critical dependencies that exist within its supply chain beyond the first tier of suppliers: We are learning fresh lessons from the earthquake, too. Moving forward we will be modifying our purchasing process to enhance our business continuity plan at the parts level, particularly for critical components, and to mitigate potential supply risk concentration beyond the Tier 1 level. These are evolutionary kaizen changes, though, as opposed to fundamental shifts in our sourcing strategy. 30 As COO Shiga pointed out, despite its preparedness, Nissan had work to do to be even better protected the next time disaster struck: Many challenges still lie ahead. Some parts suppliers have yet to restore their operations. Our supply chain requires rehabilitation. This experience has instructed us in the necessity of an actionable BCP (business continuity plan) that encompasses all our suppliers, including those in the second and third tiers. Development of a more robust supply chain and comprehensive risk management are imperative in making our business more sustainable." Case Discussion Questions 1. The case identifies several aspects of the Nissan response that were particularly beneficial. Expand on the points made in the case to identify the potential costs and benefits of these actions. 2. What else could Nissan have done to prepare for and respond to the disaster? Try to articulate the costs and benefits of your suggestions 3. What could Nissan have done to assess the risk of disruption in their supply chain? 4. How did Nissan's product line strategy help or hurt its ability to respond to and recover from the disaster? Chester Dawson, "Nissan Aims to Boost North American Production," The Wall Street Journal, January 9, 2012. Ibid. Ibid. 3 Ibid. August 27, 2013 August 27, 201313-149 August 27, 2013 IIIIIIIIII MITSloan MANAGEMENT Nissan Motor Company Lid.: Building Operational Resiliency William Schmidt, David Simchi-Levi On March 11, 201 1 a 9.0-magnitude earthquake, among the five most powerful on record, struck off the coast of Japan. Tsunami waves in excess of 40 meters high traveled up to 10 kilometers inland and three nuclear reactors at Fukushima Dai-ichi experienced Level 7 meltdowns. The impact of this combined disaster was devastating, with over 25,000 people dead, missing or injured.' Governments, non-government agencies, corporations and individuals in Japan and around the world responded with relief teams, supplies and donations to help ease the suffering and support the recovery. In truth, the disaster was three calamities in one - an earthquake, a tsunami and a nuclear emergency. Recovering from such a catastrophe was unprecedented. The event was not just a humanitarian crisis, but also a heavy blow to the Japanese economy: 125,000 buildings were damaged and economic costs were expected to be Y16.9 trillion.' In the weeks following the disaster, approximately 80% of Japanese automotive plants suspended production and Mitsubishi UFJ Morgan Stanley Securities estimated utilization at other plants were below 10%.* Ministry of Foreign Affairs, Govem Vincidents/index2.html, accessed July 15, 2012. Ministry of Foreign Affairs, Goverment o p:/www.mofa.go.jp/j_info/visit/incidents/pdfs/r_goods.pdf, accessed July 15, 2012. Ministry of Economy, Trade and Industry, Go http:/www.kantei.go.jp/foreign/policy 12/_icsFiles/afieldfile/2012/03/07/road_to_recovery.pdf, accessed February 27, 2012. Tsuyoshi Mochimaru, "Auto sector: Our Sta nce in Wake of Recent Earthquake," Mitsubishi UFJ Morgan Stanley Securities Co., Lid., April 12, 2011. This case was prepared by David Simchi-Levi, MIT Professor of Civil and Enviormental Engineering and Engineering Systems and Co-Director, Leaders for Global Operations, and William Schmidt, PhD candidate, Harvard Business School. Copyright @ 2013, David Simchi-Levi and William Schmidt. This work is licensed under the Creative Commons Attribution- Noncommercial-No Derivative Works 3.0 Unported License. To view a copy of this license visit http://creativecommons.org/licenses/by-nc-nd/3.0/ or send a letter to Creative Commons, 171 Second Street, Suite 300, San Francisco, California, 94105, USA