Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose on May 1, Boston Scientific Corp. has agreed to acquire a UK company that designs and develops cardiovascular imaging systems. Boston Scientific agreed

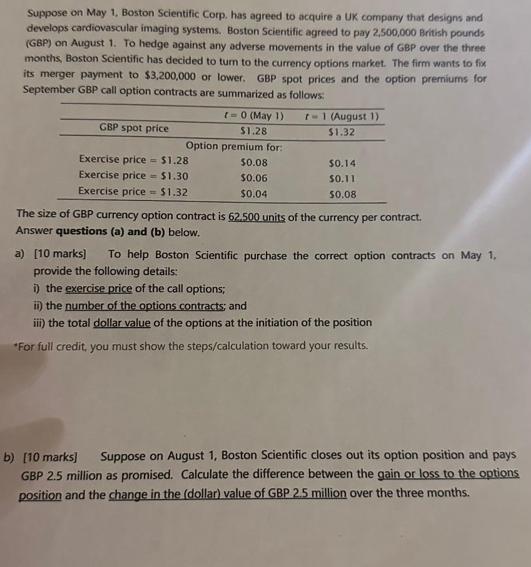

Suppose on May 1, Boston Scientific Corp. has agreed to acquire a UK company that designs and develops cardiovascular imaging systems. Boston Scientific agreed to pay 2,500,000 British pounds (GBP) on August 1. To hedge against any adverse movements in the value of GBP over the three months, Boston Scientific has decided to turn to the currency options market. The firm wants to fix its merger payment to $3,200,000 or lower. GBP spot prices and the option premiums for September GBP call option contracts are summarized as follows: GBP spot price t=0 (May 1) $1.28 Option premium for: $0.08 $0.06 $0.04 Exercise price = $1.28 Exercise price = $1.30 Exercise price $1.32 t-1 (August 1) $1.32 $0.14 $0.11 $0.08 The size of GBP currency option contract is 62.500 units of the currency per contract. Answer questions (a) and (b) below. a) [10 marks] To help Boston Scientific purchase the correct option contracts on May 1, provide the following details: i) the exercise price of the call options; ii) the number of the options contracts; and iii) the total dollar value of the options at the initiation of the position *For full credit, you must show the steps/calculation toward your results. b) [10 marks] Suppose on August 1, Boston Scientific closes out its option position and pays GBP 2.5 million as promised. Calculate the difference between the gain or loss to the options position and the change in the (dollar) value of GBP 2.5 million over the three months.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER IN DETAILS a To help Boston Scientific purchase the correct option contracts on May 1 we need to consider their objective of fixing the merger ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started