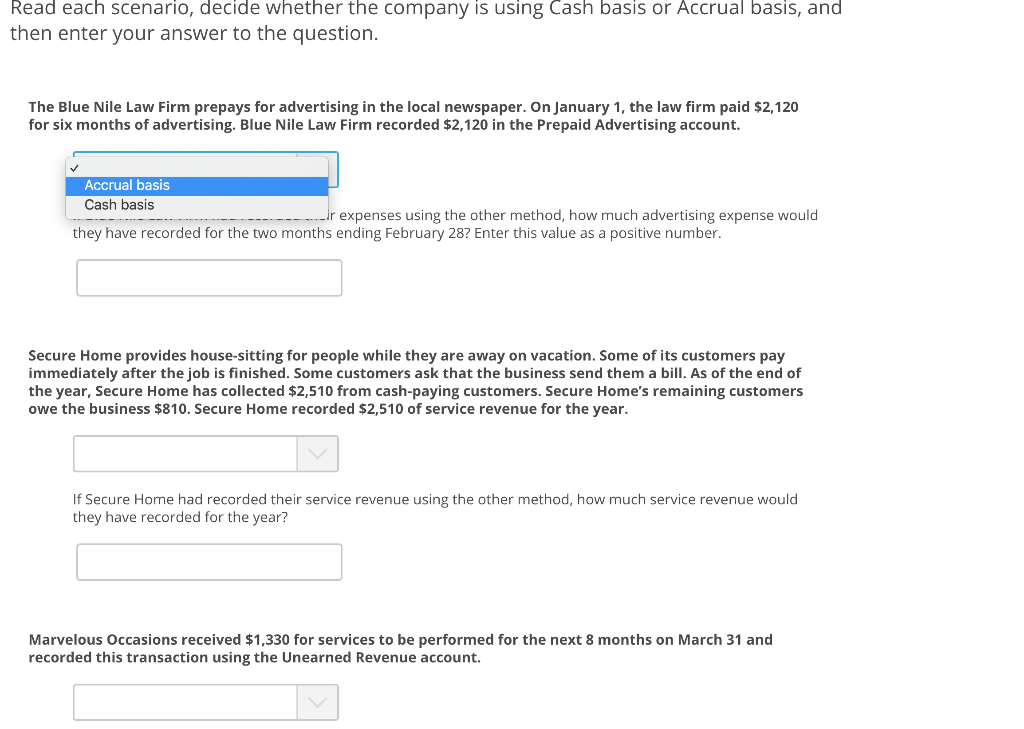

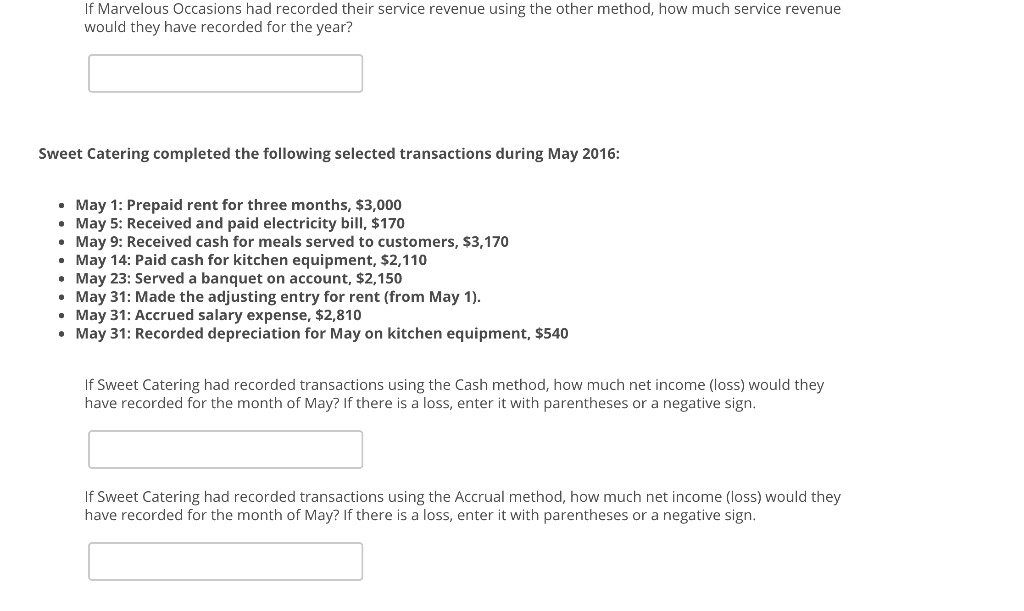

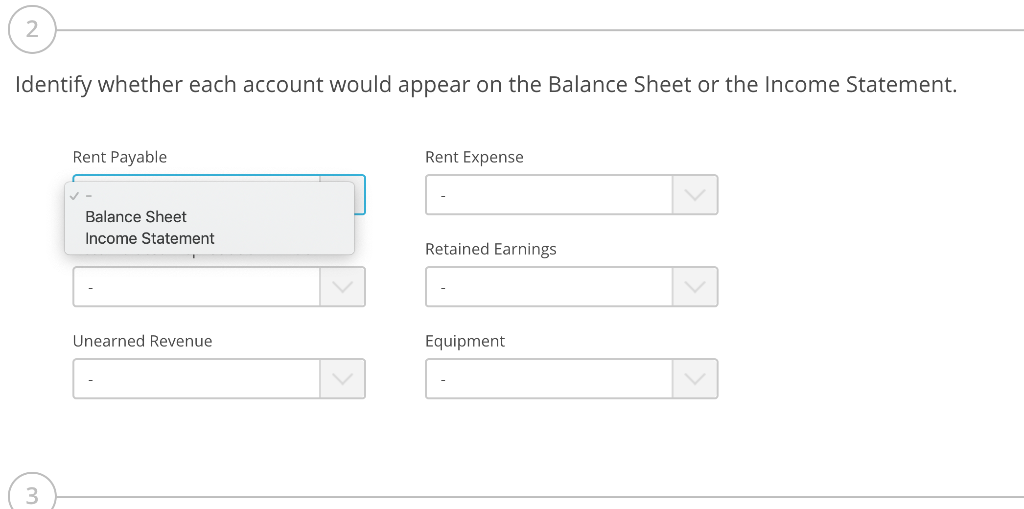

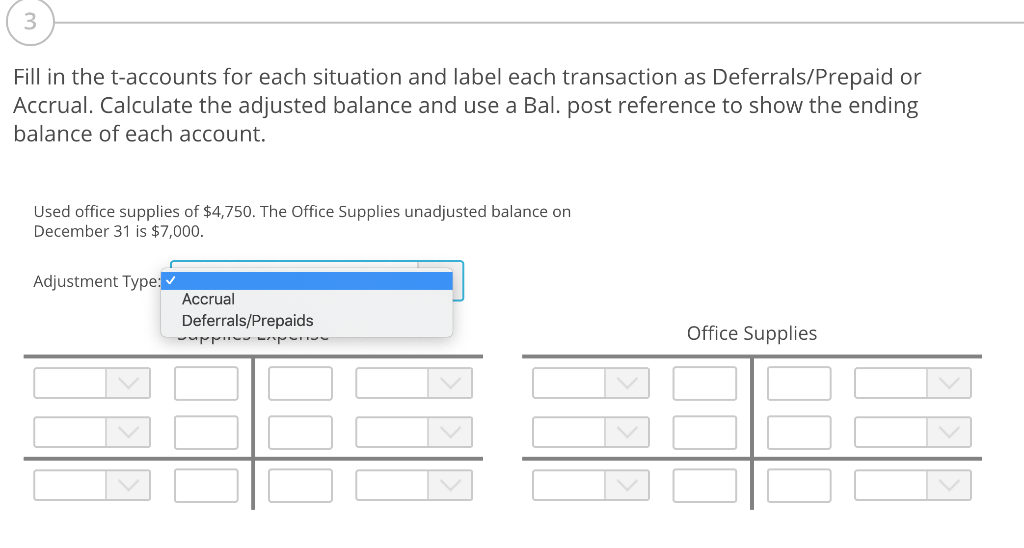

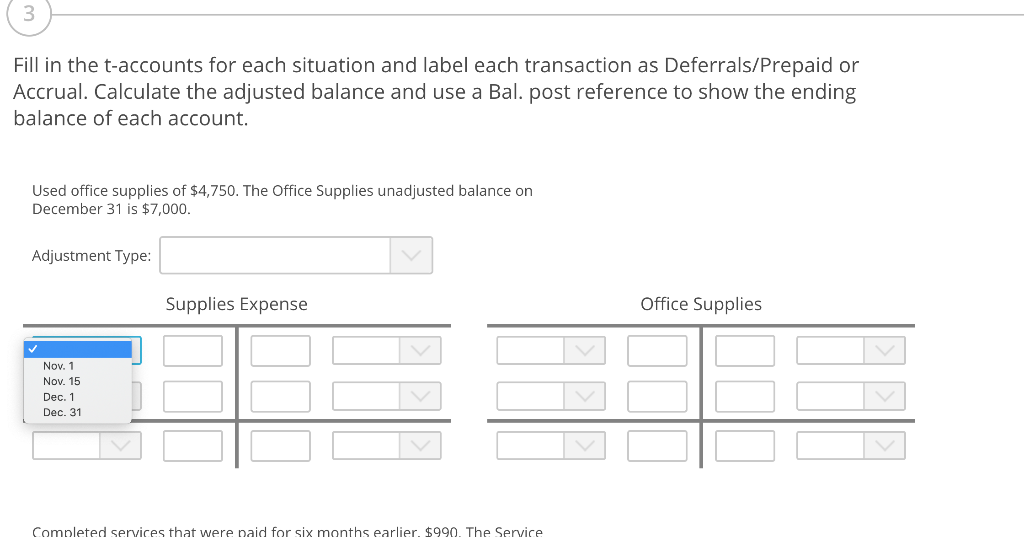

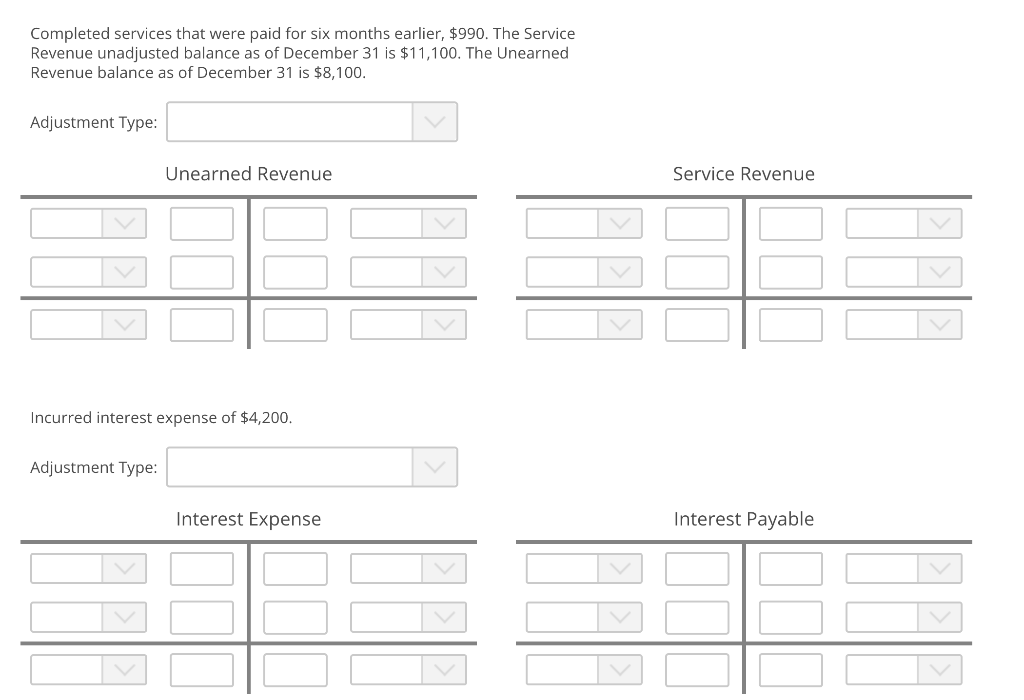

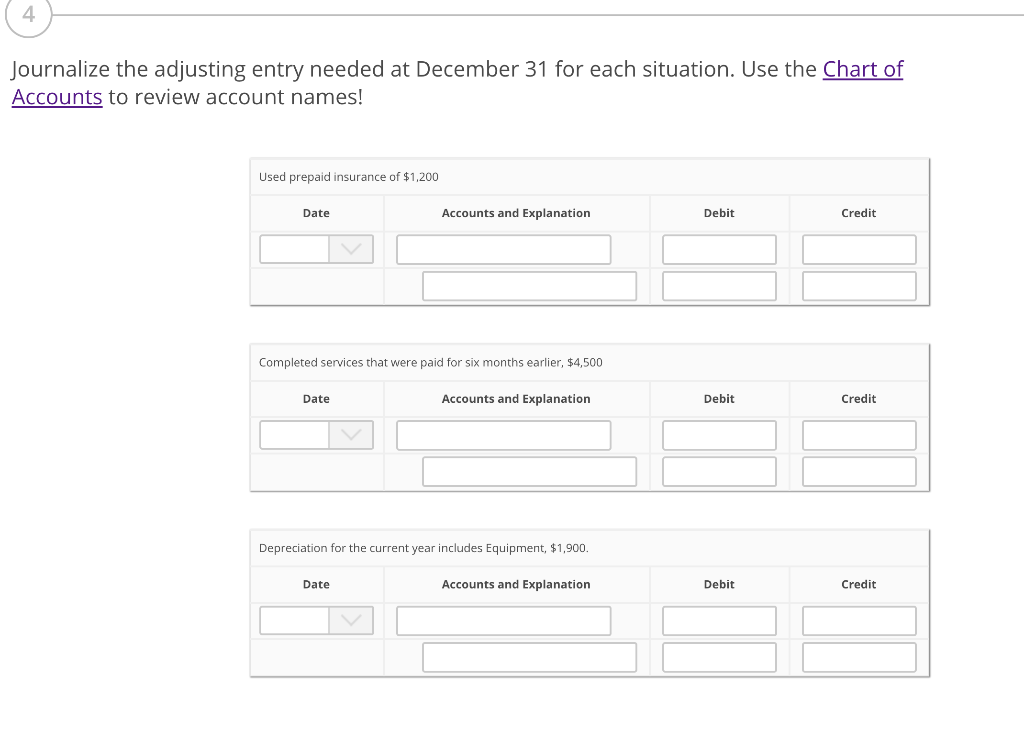

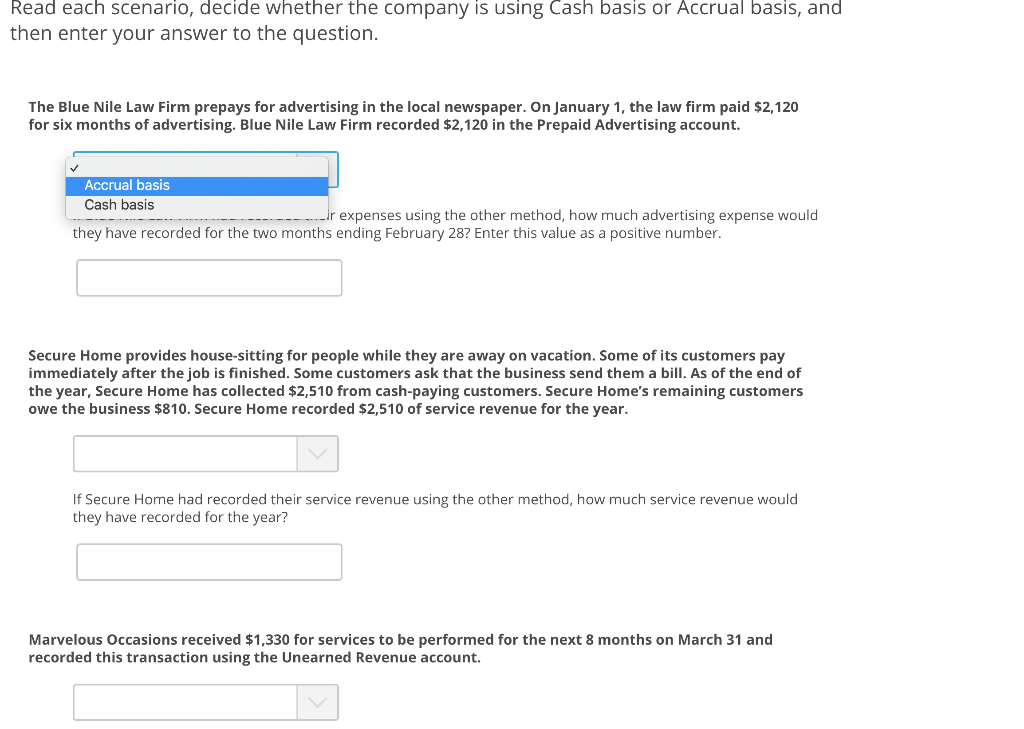

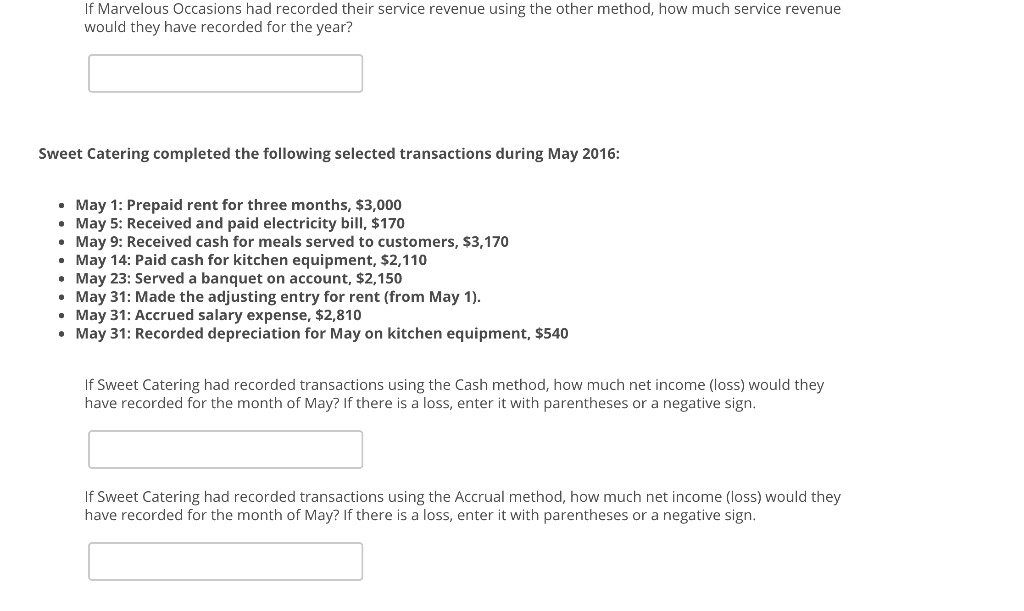

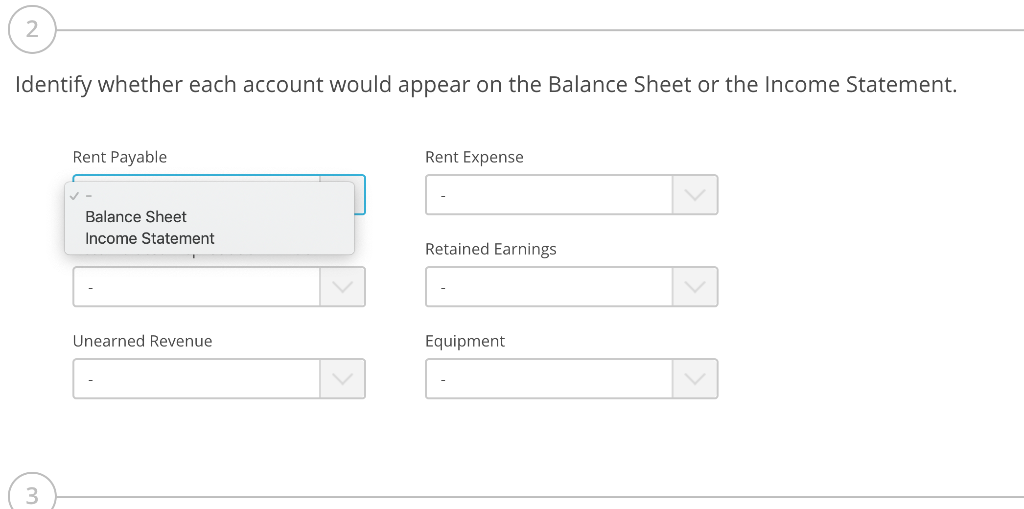

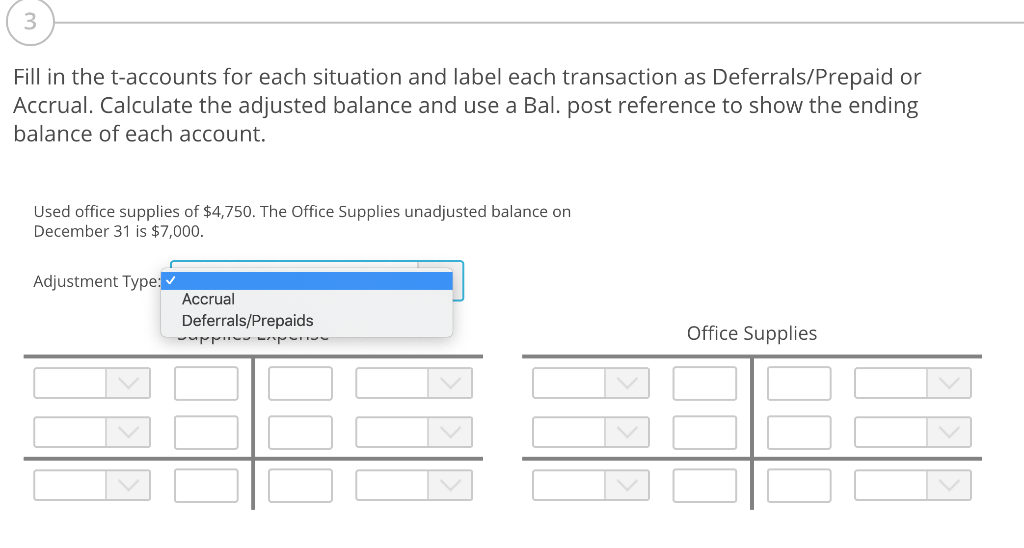

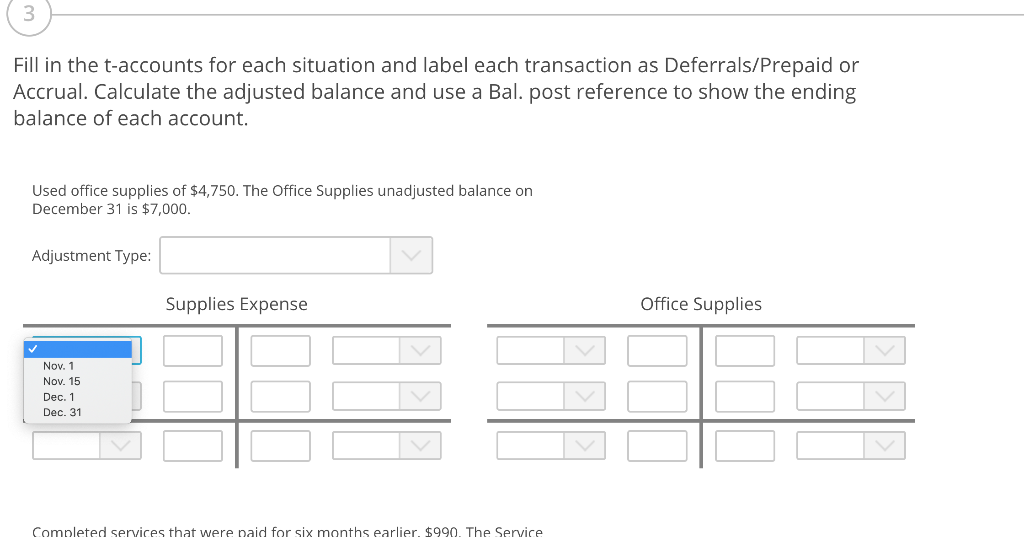

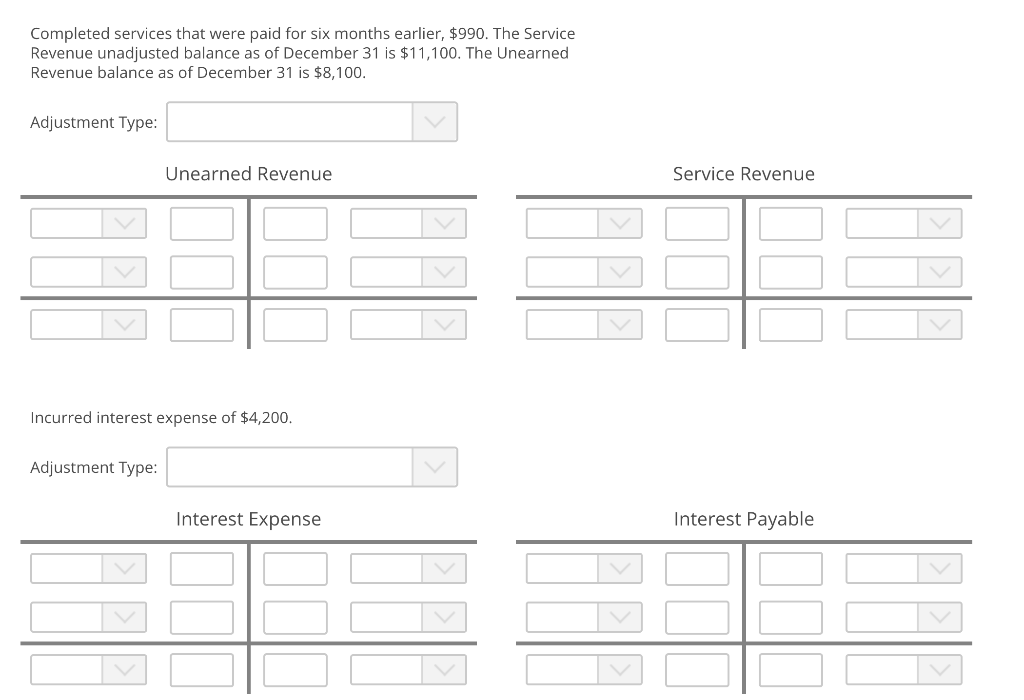

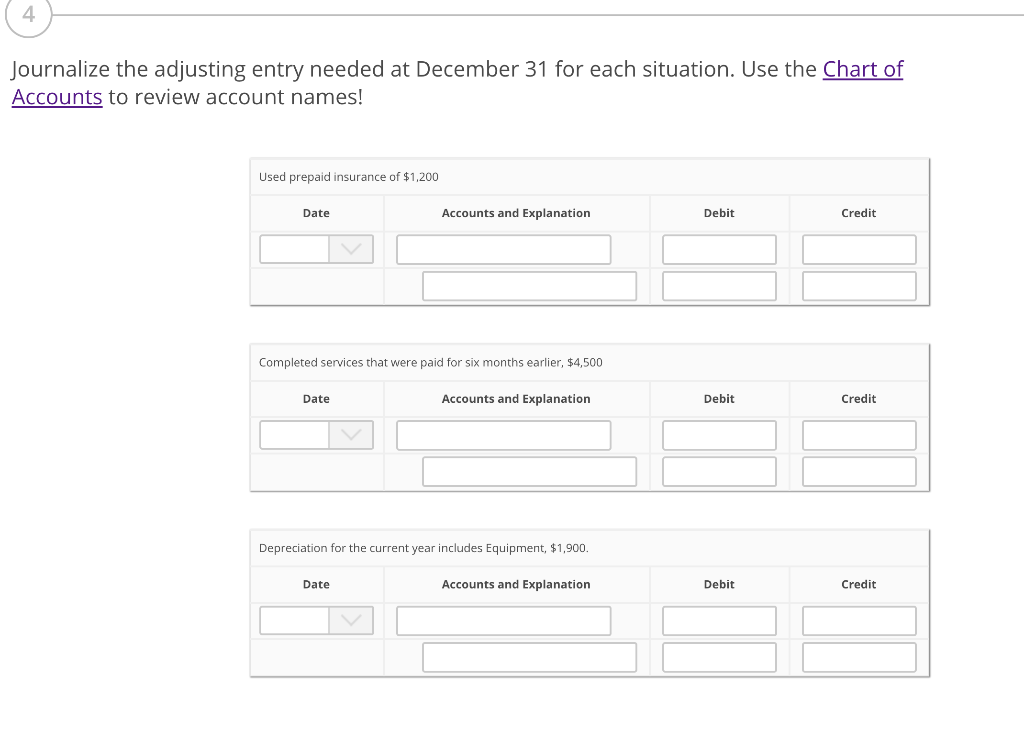

Read each scenario, decide whether the company is using Cash basis or Accrual basis, and then enter your answer to the question. The Blue Nile Law Firm prepays for advertising in the local newspaper. On January 1, the law firm paid $2,120 for six months of advertising. Blue Nile Law Firm recorded $2,120 in the Prepaid Advertising account. Accrual basis Cash basis r expenses using the other method, how much advertising expense would they have recorded for the two months ending February 28? Enter this value as a positive number. Secure Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Secure Home has collected $2,510 from cash-paying customers. Secure Home's remaining customers owe the business $810. Secure Home recorded $2,510 of service revenue for the year. If Secure Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Marvelous Occasions received $1,330 for services to be performed for the next months on March 31 and recorded this transaction using the Unearned Revenue account. If Marvelous Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $3,000 May 5: Received and paid electricity bill, $170 May 9: Received cash for meals served to customers, $3,170 May 14: Paid cash for kitchen equipment, $2,110 May 23: Served a banquet on account, $2,150 May 31: Made the adjusting entry for rent (from May 1) May 31: Accrued salary expense, $2,810 May 31: Recorded depreciation for May on kitchen equipment, $540 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. 2 Identify whether each account would appear on the Balance Sheet or the Income Statement. Rent Payable Rent Expense Balance Sheet Income Statement Retained Earnings Unearned Revenue Equipment 3 Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid or Accrual. Calculate the adjusted balance and use a Bal. post reference to show the ending balance of each account. Used office supplies of $4,750. The Office Supplies unadjusted balance on December 31 is $7,000 Adjustment Type: Accrual Deferrals/Prepaids Office Supplies 3 Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid or Accrual. Calculate the adjusted balance and use a Bal. post reference to show the ending balance of each account Used office supplies of $4,750. The Office Supplies unadjusted balance on December 31 is $7,000. Adjustment Type: Office Supplies Supplies Expense Nov. 1 Nov. 15 Dec. 1 Dec. 31 Completed services that were paid for six months earlier. $990. The Service Completed services that were paid for six months earlier, $990. The Service Revenue unadjusted balance as of December 31 is $11,100. The Unearned Revenue balance as of December 31 is $8,100. Adjustment Type: Unearned Revenue Service Revenue Incurred interest expense of $4,200. Adjustment Type: Interest Payable Interest Expense 4 Journalize the adjusting entry needed at December 31 for each situation. Use the Chart of Accounts to review account names! Used prepaid insurance of $1,200 Accounts and Explanation Debit Credit Date Completed services that were paid for six months earlier, $4,500 Accounts and Explanation Debit Credit Date Depreciation for the current year includes Equipment, $1,900. Accounts and Explanation Credit Date Debit