Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steve Moore, Tracy Regis, and Bonnie Northrup formed a partnership, Schafer Merchandising on May 1, 2022 by investing $140,000, $140,000, and $120,000 respectively. The

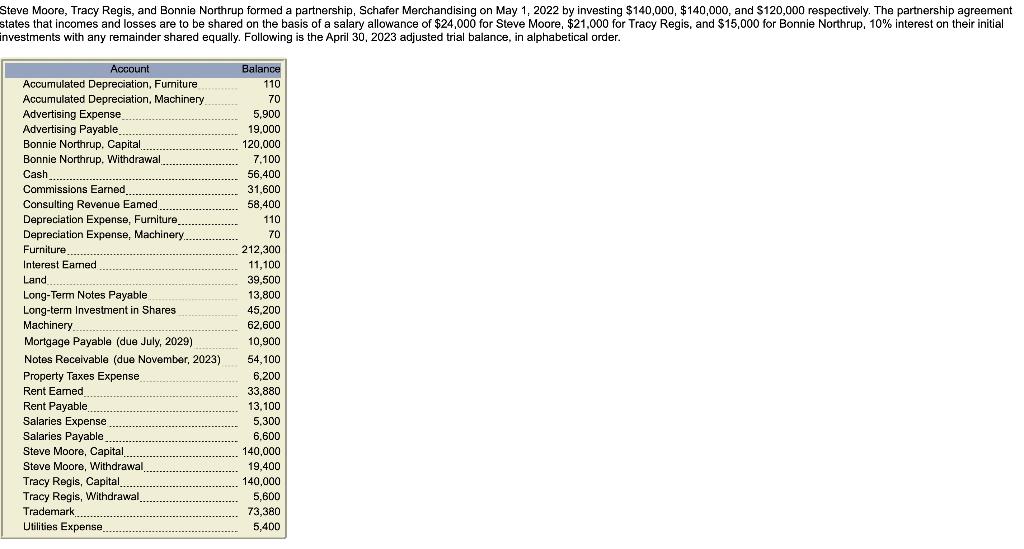

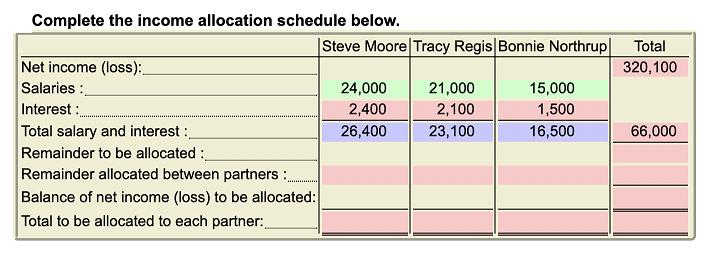

Steve Moore, Tracy Regis, and Bonnie Northrup formed a partnership, Schafer Merchandising on May 1, 2022 by investing $140,000, $140,000, and $120,000 respectively. The partnership agreement states that incomes and losses are to be shared on the basis of a salary allowance of $24,000 for Steve Moore, $21,000 for Tracy Regis, and $15,000 for Bonnie Northrup, 10% interest on their initial investments with any remainder shared equally. Following is the April 30, 2023 adjusted trial balance, in alphabetical order. Account Accumulated Depreciation, Furniture Accumulated Depreciation, Machinery Advertising Expense Advertising Payable Bonnie Northrup, Capital, Bonnie Northrup. Withdrawal Cash Commissions Earned Consulting Revenue Eamed Depreciation Expense, Furniture_ Depreciation Expense, Machinery. Furniture Interest Eamed Land Long-Term Notes Payable Long-term Investment in Shares Machinery, Mortgage Payable (due July, 2029) Notes Receivable (due November, 2023) Property Taxes Expense Rent Earned Rent Payable Salaries Expense Salaries Payable Steve Moore, Capital, Steve Moore, Withdrawal Tracy Regis, Capital Tracy Regis, Withdrawal Trademark Utilities Expense... Balance 110 70 5.900 19,000 120,000 7,100 56,400 31,600 58,400 110 70 212,300 11,100 39,500 13,800 45,200 62,600 10,900 54,100 6,200 33,880 13,100 5,300 6,600 140,000 19,400 140,000 5,600 73,380 5,400 Complete the income allocation schedule below. Net income (loss):__ Salaries: Interest: Total salary and interest:_ Remainder to be allocated:_ Remainder allocated between partners: Balance of net income (loss) to be allocated: Total to be allocated to each partner: Steve Moore Tracy Regis Bonnie Northrup Total 320,100 24,000 2,400 26,400 21,000 2,100 23,100 15,000 1,500 16,500 66,000

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Net income loss 320100 Salaries 24000 21000 15000 Interest 2400 2100 1500 Total salary and interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started