Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read Resource R1, How Much Are You Really Paying for that Car Loan? Then answer the questions below. You may use a calculator to

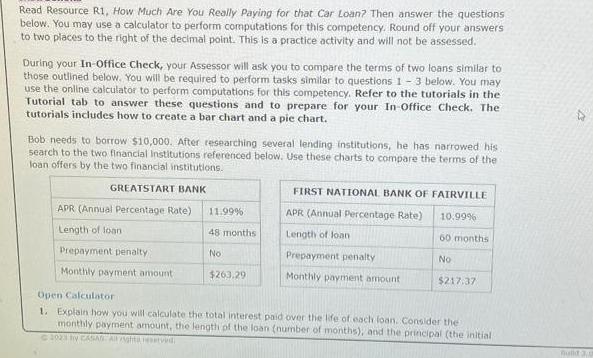

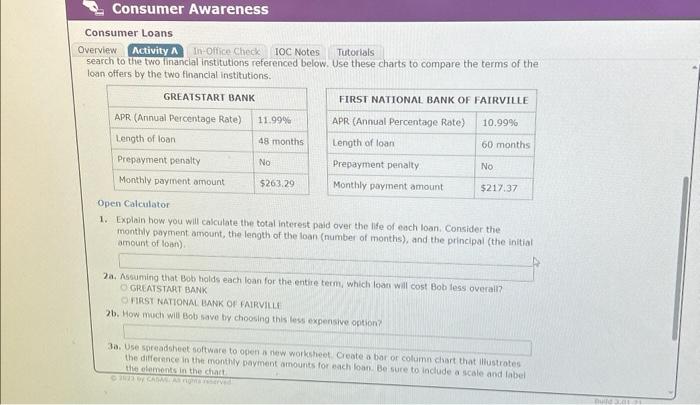

Read Resource R1, How Much Are You Really Paying for that Car Loan? Then answer the questions below. You may use a calculator to perform computations for this competency. Round off your answers to two places to the right of the decimal point. This is a practice activity and will not be assessed. During your In Office Check, your Assessor will ask you to compare the terms of two loans similar to those outlined below. You will be required to perform tasks similar to questions 1-3 below. You may use the online calculator to perform computations for this competency. Refer to the tutorials in the Tutorial tab to answer these questions and to prepare for your In Office Check. The tutorials includes how to create a bar chart and a pie chart. Bob needs to borrow $10,000. After researching several lending institutions, he has narrowed his. search to the two financial Institutions referenced below. Use these charts to compare the terms of the Joan offers by the two financial institutions. GREATSTART BANK APR (Annual Percentage Rate) Length of loan Prepayment penalty Monthly payment amount 11.99 % 48 months No $263.29 FIRST NATIONAL BANK OF FAIRVILLE APR (Annual Percentage Rate) Length of loan Prepayment penalty Monthly payment amount 10.99% 60 months No $217,37 Open Calculator 1. Explain how you will calculate the total interest paid over the life of each loan. Consider the monthly payment amount, the length of the loan (number of months), and the principal (the initial 2023 by CASAS Allghta reserved. Bulld 3.4 Consumer Awareness Consumer Loans Tutorials Overview Activity A In-Office Check IOC Notes search to the two financial institutions referenced below. Use these charts to compare the terms of the loan offers by the two financial institutions. GREATSTART BANK APR (Annual Percentage Rate) Length of loan Prepayment penalty Monthly payment amount 11.99% 48 months No $263.29 FIRST NATIONAL BANK OF FAIRVILLE APR (Annual Percentage Rate) 10.99% Length of loan Prepayment penalty Monthly payment amount 60 months No $217.37 Open Calculator 1. Explain how you will calculate the total interest paid over the life of each loan. Consider the monthly payment amount, the length of the loan (number of months), and the principal (the initial amount of loan). OFIRST NATIONAL BANK OF FAIRVILLE 2b. How much will Bob save by choosing this less expensive option? 2a. Assuming that Bob holds each loan for the entire term, which loan will cost Bob less overail? OGREATSTART BANK 3a. Use spreadsheet software to open a new worksheet. Create a bar or column chart that illustrates the difference in the monthly payment amounts for each loan. Be sure to include a scale and label the elements in the chart. 323 y CADAS. A rights reserved Build 3011

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total interest paid over the life of each loan For GreatStart Bank loan Monthly payment amount 22329 Length of loan 48 months Princip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started