Answered step by step

Verified Expert Solution

Question

1 Approved Answer

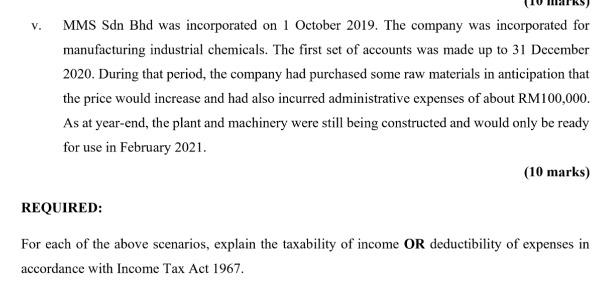

? V. MMS Sdn Bhd was incorporated on 1 October 2019. The company was incorporated for manufacturing industrial chemicals. The first set of accounts was

?

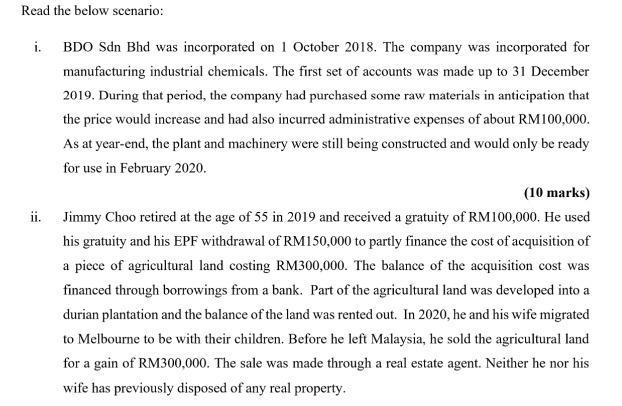

? V. MMS Sdn Bhd was incorporated on 1 October 2019. The company was incorporated for manufacturing industrial chemicals. The first set of accounts was made up to 31 December 2020. During that period, the company had purchased some raw materials in anticipation that the price would increase and had also incurred administrative expenses of about RM100,000. As at year-end, the plant and machinery were still being constructed and would only be ready for use in February 2021. (10 marks) REQUIRED: For each of the above scenarios, explain the taxability of income OR deductibility of expenses in accordance with Income Tax Act 1967. Read the below scenario: i. BDO Sdn Bhd was incorporated on 1 October 2018. The company was incorporated for manufacturing industrial chemicals. The first set of accounts was made up to 31 December 2019. During that period, the company had purchased some raw materials in anticipation that the price would increase and had also incurred administrative expenses of about RM100,000. As at year-end, the plant and machinery were still being constructed and would only be ready for use in February 2020. (10 marks) ii. Jimmy Choo retired at the age of 55 in 2019 and received a gratuity of RM100,000. He used his gratuity and his EPF withdrawal of RM150,000 to partly finance the cost of acquisition of a piece of agricultural land costing RM300,000. The balance of the acquisition cost was financed through borrowings from a bank. Part of the agricultural land was developed into a durian plantation and the balance of the land was rented out. In 2020, he and his wife migrated to Melbourne to be with their children. Before he left Malaysia, he sold the agricultural land for a gain of RM300,000. The sale was made through a real estate agent. Neither he nor his wife has previously disposed of any real property.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i 1 The tax ability of income for B DO S dn Bh d would be based on the company s accounting period F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started