Question

Read the case and answer the following questions: 1) Identify the time of the case. Analyze the current situation. 2) What is the key question/problem

Read the case and answer the following questions:

1) Identify the time of the case. Analyze the current situation. 2) What is the key question/problem in the case that you are solving? 3) Conduct an external analysis of P&G (PESTELDG, Five Forces, Competitive analysis, O/T 4) Conduct an internal analysis of P&G (functional analysis, tangible and intangible resources, VRIO) 5) Assess leadership at Procter and Gamble. (Strengths and Weaknesses) 6) What were the major organizational changes leadership made at P&G, and what challenges does the current leadership face now? 7) What intangible resources does P&G have that can be used to enact strategies? 8) How should they address the key challenge(s) and move forward?

What recommendations could be made for P&G based on the Strategic Analysis?

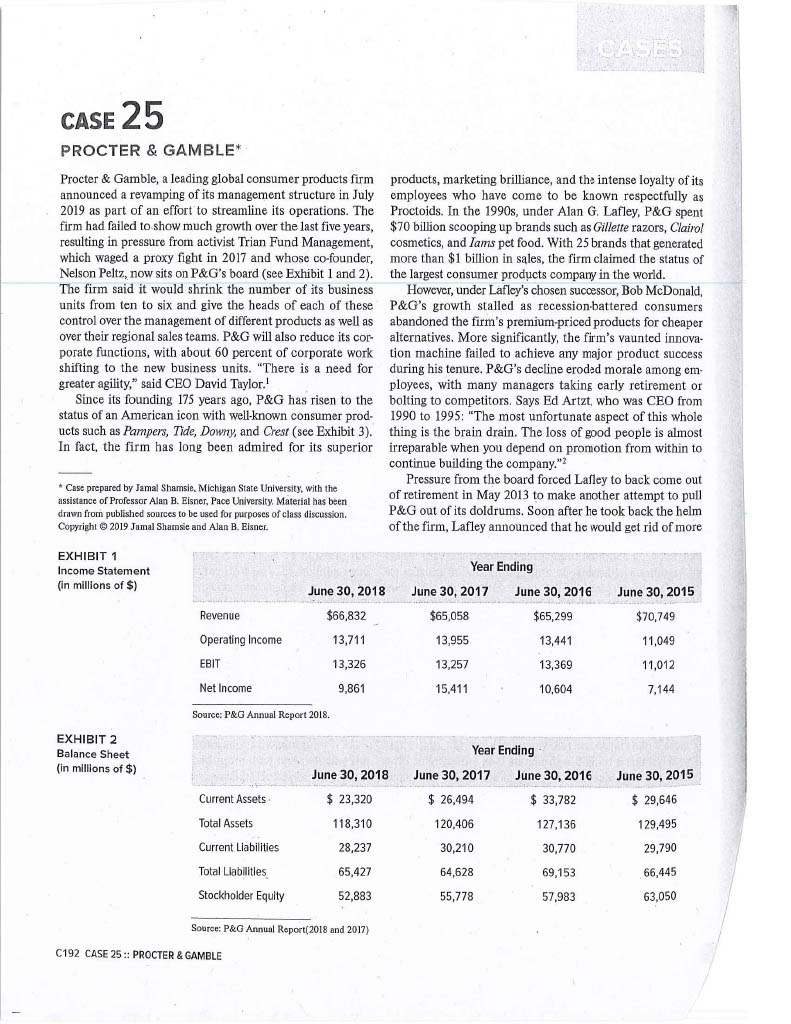

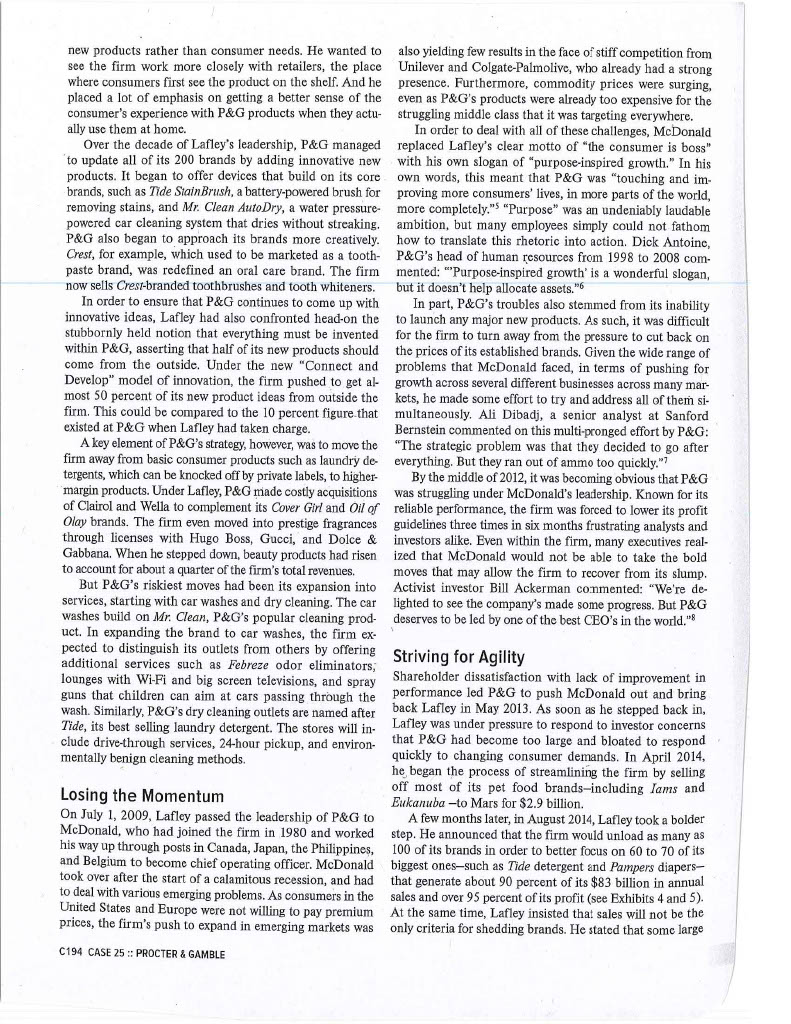

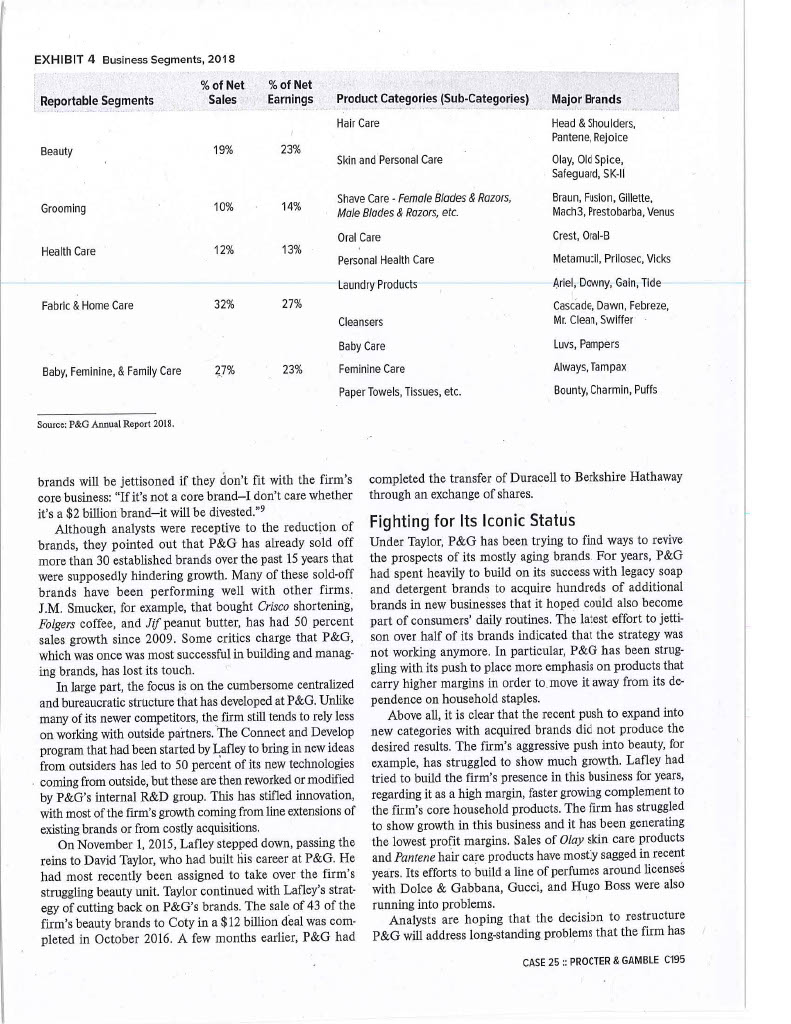

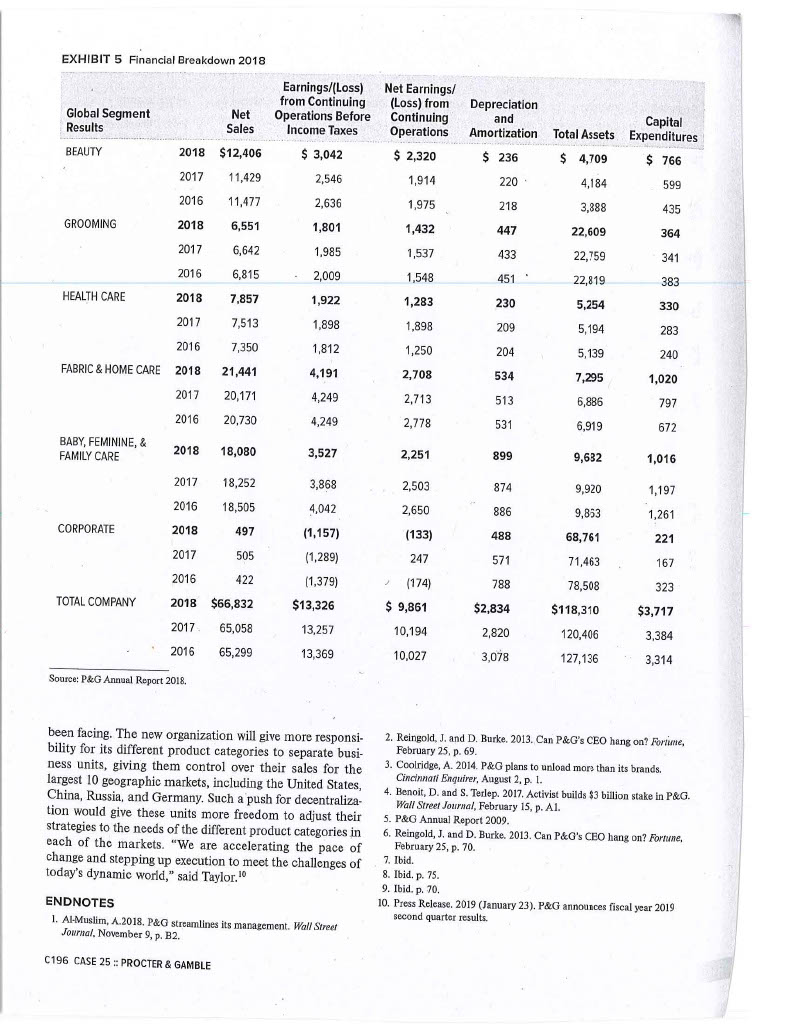

PROCTER \& GAMBLE* Procter \& Gamble, a leading global consumer products firm announced a revamping of its management structure in July 2019 as part of an effort to streamline its operations. The firm had failed to show much growth over the last five years, resulting in pressure from activist Trian Fund Management, which waged a proxy fight in 2017 and whose co-founder, Nelson Peltz, now sits on P\&G's board (see Exhibit 1 and 2). The firm said it would shrink the number of its business units from ten to six and give the heads of each of these control over the management of different products as well as over their regional sales teams. P&G will also reduce its corporate functions, with about 60 percent of corporate work shifting to the new business units. "There is a need for greater agility," said CEO David Taylor." Since its founding 175 years ago, P\&G has risen to the status of an American icon with well-known consumer products such as Pampers, Tide, Dowry, and Crest (see Exhibit 3). In fact, the firm has long been admired for its superior * Case prepared by Jamal Shamsie, Michigan State University, with the assistance of Professor Alan B. Eisner, Pace University. Material has been drawn from published sources to be used for purposes of class discussion. Copyright (\&) 2019 Jamal Shamsie and Alan B. Eisner. EXHIBIT 1 Income Statement (in millions of \$) EXHIBIT 2 Balance Sheet (in millions of \$) products, marketing brilliance, and the intense loyalty of its employees who have come to be known respectfully as Proctoids. In the 1990s, under Alan G. Lafley, P\&G spent $70 billion scooping up brands such as Gillette razors, Clairol cosmetics, and Iams pet food. With 25 brands that generated more than $1 billion in sales, the firm claimed the status of the largest consumer products compary in the world. However, under Lafley's chosen successor, Bob McDonald, P\&G's growth stalled as recessionbattered consumers abandoned the firm's premium-priced products for cheaper alternatives. More significantly, the firm's vaunted innovation machine failed to achieve any major product success during his tenure. P\&G's decline eroded morale among employees, with many managers taking early retirement or bolting to competitors. Says Ed Artzt, who was CEO from 1990 to 1995: "The most unfortunate aspect of this whole thing is the brain drain. The loss of good people is almost irreparable when you depend on promotion from within to continue building the company."2 Pressure from the board forced Lafley to back come out of retirement in May 2013 to make another attempt to pull P\&G out of its doldrums. Soon after he took back the helm of the firm, Lafley announced that he would get rid of more Source: P\&G Annual Report(2018 and 2017) C192 CASE 25:: PROCTER \& GAMBLE - Tide was the first heavy-duty laundry detergent. EXHIBIT 3 - Crest was the first fluoride toothpaste clinically proven to prevent tooth decay. Significant Innovations - Downy was the first ultra-concentrated rinse-add fabric softener. - Pert Plus was the first 2 -in-1 shampoo and conditioner. - Head \& Shoulders was the first pleasant-to-use shampoo effective against dandruff. - Pampers was the first affordable, mass-marketed disposable diaper. - Bounty was the first three-dimensional paper towel. - Always was the first feminine protection pad with an innovative, dry-weave top sheet. - Febreze was the first fabric and air care product that actually removed odors from fabrics and the air. - Crest White Strips were the first patented in-home teeth whitening technology. Source: P\&G Innovations. than half of its brands. Over the next three years, the firm sold off many of the brands it had acquired, capped by the $11.6 billion sale of dozens of beauty brands to Coty. He announced that the company would narrow its focus to 65 or 70 of its biggest brands such as Tide, Crest, and Pampers. "Less will be more," Lafley told analysts. "The objective is growth and much more reliable generation of cash and profit." 3 David S. Taylor, who had spent years managing P\&G's businesses finally took over as chairman and CEO of the firm in November 2015. He has made moves to resurrect the firm but has opted against launching new brands or making new acquisitions. "I understand the desire for faster growth and for a single-minded short-term objective, but we've seen this movie before x he said at a meeting with analysts soon after he had taken over. Fighting off a Decline For most of its long history, P\&G has been one of America's preeminent companies. The firm has developed several well known brands such as Tide, one of the pioneers in laundry detergents, which was launched in 1946; and Pampers, the first disposable diaper, which was introduced in 1961. P\&G also built its brands through its innovative marketing techniques. But by the 1990s, P\&G was in danger of becoming another Eastman Kodak or Xerox, a once-great company that might have lost its way. Sales on most of its 18 top brands were slowing as it was being outhustled by more focused rivals such as Kimberly-Clark and Colgate-Palmolive. In 1999, P\&G decided to bring in Durk I. Jager to try and make the big changes that were obviously needed to get P\&G back on track. But the moves he made generally misfired, sinking the firm into deeper trouble. He introduced expensive new products that never caught on while letting existing brands drift. He also put in place a companywide reorganization that left many employees perplexed and preoccupied. During the fiscal year when he was in charge, earnings per share showed an anemic rise of just 3.5 percent, much lower than in previous years. And during that time, the share price slid 52 percent, cutting P\&G's total market capitalization by $85 billion. In 2000, the board of P\&G asked Lafley to take charge of the troubled firm. He began his tenure by breaking down the walls between management and employees. Since the 1950 s, all of the senior executives at P\&G used to be located on the 11th floor at the firm's corporate headquarters. Lafley changed this setup, moving all five division presidents to the same floors as their staff. He replaced more than half of the company's top 30 managers, more than any P&G boss in memory, and trimmed its workforce by as many as 9,600 jobs. He also movec more women into senior positions. In fact, Lafley skipped over 78 general managers with more seniority to name 42-year-old Deborah A. Henretta to head P\&G's then-troublei North American baby-care division. Lafley was simply acknowledging the importance of developing people, particularly those in managerial roles at P\&G. For years, the firm has been known to dispatch line managers rather than human resource siaffers to do much of its recruiting. For the few that get hired, their work life becomes a career-long development process. At every level, P&G has a different "college" to train individuals and every department has its own "university." The general manager's college holds a week-long school term once a year when there are a handful of newly promoted managers. Under Lafley, P\&G also continued with its efforts to maintain a comprehensive database for all of its more than 130,000 employees, each of which is tracked carefully through monthly and annual talent reviews. All managers are reviewed not only by their bosses but also by lateral managers who have worked with them, as well as on their own direct reports. Every February, one entire board meeting is devoted to reviewing the high-level executives, with the goal of recommending at least three potential candidates for each of the 35 to 40 jobs at the top of the firm. Gambling on its Brands Above all, Lafley had been intent on shifting the focus of P&G back to its consumers. At every opportunity, he tried to drill his managers and employees to not lose sight of the consumer. He felt that P&G often let technology dictate its CASE 25 : PROCTER \& GAMBLE C193 new products rather than consumer needs. He wanted to see the firm work more closely with retailers, the place where consumers first see the product on the shelf. And he placed a lot of emphasis on getting a better sense of the consumer's experience with P\&G products when they actually use them at home. Over the decade of Lafley's leadership, P\&G managed to update all of its 200 brands by adding innovative new products. It began to offer devices that build on its core brands, such as Tide StainBrush, a battery-powered brush for removing stains, and Mr. Clean AutoDry, a water pressurepowered car cleaning system that dries without streaking. P\&G also began to approach its brands more creatively. Crest, for example, which used to be marketed as a toothpaste brand, was redefined an oral care brand. The firm now sells Crest-branded toothbrushes and tooth whiteners. In order to ensure that P&G continues to come up with innovative ideas, Lafley had also confronted head-on the stubbornly held notion that everything must be invented within P&G, asserting that half of its new products should come from the outside. Under the new "Connect and Develop" model of innovation, the firm pushed to get almost 50 percent of its new product ideas from outside the firm. This could be compared to the 10 percent figure-that existed at P&G when Lafley had taken charge. A key element of P\&G's strategy, however, was to move the firm away from basic consumer products such as laundry detergents, which can be knocked off by private labels, to highermargin products. Under Lafley, P\&G made costly acquisitions of Clairol and Wella to complement its Cover Girl and Oil of Olay brands. The firm even moved into prestige fragrances through licenses with Hugo Boss, Gucci, and Dolce \& Gabbana. When he stepped down, beauty products had risen to account for about a quarter of the firm's total revenues. But P\&G's riskiest moves had been its expansion into services, starting with car washes and dry cleaning. The car washes build on Mr. Clean, P\&G's popular cleaning product. In expanding the brand to car washes, the firm expected to distinguish its outlets from others by offering additional services such as Febreze odor eliminators; lounges with Wi-Fi and big screen televisions, and spray guns that children can aim at cars passing through the wash. Similarly, P\&G's dry cleaning outlets are named after Tide, its best selling laundry detergent. The stores will include drive-through services, 24-hour pickup, and environmentally benign cleaning methods. Losing the Momentum On July 1, 2009, Lafley passed the leadership of P\&G to McDonald, who had joined the firm in 1980 and worked his way up through posts in Canada, Japan, the Philippines, and Belgium to become chief operating officer. McDonald took over after the start of a calamitous recession, and had to deal with various emerging problems. As consumers in the United States and Europe were not willing to pay premium prices, the firm's push to expand in emerging markets was also yielding few results in the face of stiff competition from Unilever and Colgate-Palmolive, who already had a strong presence. Furthermore, commodity prices were surging, even as P&G 's products were already too expensive for the struggling middle class that it was targeting everywhere. In order to deal with all of these challenges, McDonald replaced Lafley's clear motto of "the consumer is boss" with his own slogan of "purpose-inspired growth." In his own words, this meant that P\&G was "touching and improving more consumers' lives, in more parts of the world, more completcly." "Purpose" was an undeniably laudable ambition, but many employees simply could not fathom how to translate this rhetoric into action. Dick Antoine, P\&G's head of human resources from 1998 to 2008 commented: "Purpose-inspired growth' is a wonderful slogan, but it doesn't help allocate assets. n6 In part, P&G s troubles also stemmed from its inability to launch any major new products. As such, it was difficult for the firm to turn away from the pressure to cut back on the prices of its established brands. Given the wide range of problems that McDonald faced, in terms of pushing for growth across several different businesses across many markets, he made some effort to try and address all of them simultaneously. Ali Dibadj, a senior analyst at Sanford Bernstein commented on this multi-pronged effort by P\&G: "The strategic problem was that they decided to go after everything. But they ran out of ammo too quickly., 7 By the middle of 2012 , it was becoming obvious that P\&G was struggling under McDonald's leadership. Known for its reliable performance, the firm was forced to lower its profit guidelines three times in six months frustrating analysts and investors alike. Even within the firm, many executives realized that McDonald would not be able to take the bold moves that may allow the firm to recover from its slump. Activist investor Bill Ackerman conmented: "We're delighted to see the company's made some progress. But P&G deserves to be led by one of the best CEO's in the world."8 Striving for Agility Shareholder dissatisfaction with lack of improvement in performance led P&G to push McDonald out and bring back Lafley in May 2013. As soon as he stepped back in, Lafley was under pressure to respond to investor concerns that P&G had become too large and bloated to respond quickly to changing consumer demands. In April 2014, he began the process of streamlining the firm by selling off most of its pet food brands-including Iams and Eukanuba -to Mars for \$2.9 billion. A few months later, in August 2014, Lafley took a bolder step. He announced that the firm would unload as many as 100 of its brands in order to better focus on 60 to 70 of its biggest ones-such as Tide detergent and Pampers diapersthat generate about 90 percent of its $83 billion in annual sales and over 95 percent of its profit (see Exhibits 4 and 5 ). At the same time, Lafley insisted that sales will not be the only criteria for shedding brands. He stated that some large C194 CASE 25 :: PROCTER \& GAMBLE EXHIBIT 4 Business Segments, 2018 Source: P\&G Annual Report 2018. brands will be jettisoned if they don't fit with the firm's core business: "If it's not a core brand-I don't care whether it's a $2 billion brand-it will be divested."9 Although analysts were receptive to the reduction of brands, they pointed out that P&G has already sold off more than 30 established brands over the past 15 years that were supposedly hindering growth. Many of these sold-off brands have been performing well with other firms. J.M. Smucker, for example, that bought Crisco shortening, Folgers coffee, and Jif peanut butter, has had 50 percent sales growth since 2009. Some critics charge that P\&G, which was once was most successful in building and managing brands, has lost its touch. In large part, the focus is on the cumbersome centralized and bureaucratic structure that has developed at P\&G. Unlike many of its newer competitors, the firm still tends to rely less on working with outside partners. The Connect and Develop program that had been started by Lafley to bring in new ideas from outsiders has led to 50 percent of its new technologies coming from outside, but these are then reworked or modified by P\&G's internal R\&D group. This has stifled innovation, with most of the firm's growth coming from line extensions of existing brands or from costly acquisitions. On November 1, 2015, Lafley stepped down, passing the reins to David Taylor, who had built his career at P\&G. He had most recently been assigned to take over the firm's struggling beauty unit. Taylor continued with Lafley's strategy of cutting back on P\&G's brands. The sale of 43 of the firm's beauty brands to Coty in a $12 billion deal was completed in October 2016. A few months earlier, P\&G had completed the transfer of Duracell to Berkshire Hathaway through an exchange of shares. Fighting for Its Iconic Status Under Taylor, P\&G has been trying to find ways to revive the prospects of its mostly aging brands. For years, P\&G had spent heavily to build on its success with legacy soap and detergent brands to acquire hundreds of additional brands in new businesses that it hoped could also become part of consumers' daily routines. The latest effort to jettison over half of its brands indicated that the strategy was not working anymore. In particular, P&G has been struggling with its push to place more emphasis on products that carry higher margins in order to move it away from its dependence on household staples. Above all, it is clear that the recent push to expand into new categories with acquired brands dic not produce the desired results. The firm's aggressive push into beauty, for example, has struggled to show much growth. Lafley had tried to build the firm's presence in this business for years, regarding it as a high margin, faster growing complement to the firm's core household products. The firm has struggled to show growth in this business and it has been generating the lowest profit margins. Sales of Olay skin care products and Pantene hair care products have mosty sagged in recent years. Its efforts to build a line of perfumes around licenses with Dolce \& Gabbana, Gucci, and Hugo Boss were also running into problems. Analysts are hoping that the decision to restructure P\&G will address long-standing problems that the firm has CASE 25 :: PROCTER \& GAMBLE C195 been facing. The new organization will give more responsibility for its different product categories to separate business units, giving them control over their sales for the largest 10 geographic markets, including the United States, China, Russia, and Germany. Such a push for decentralization would give these units more freedom to adjust their strategies to the needs of the different product categories in each of the markets. "We are accelerating the pace of change and stepping up execution to meet the challenges of today's dynamic world," said Taylor. 10 ENDNOTES 1. Al-Muslim, A.2018, P\&G streamlines its management. Wall Street 2. Reingold, J, and D. Burke, 2013. Can P\&G's CEO hang on? Fortime, February 25, p. 69. 3. Coolridge, A. 2014. P\&G plans to unload more than its brands. Cincinnati Enguirer, August 2, p. 1. 4. Benoit, D. and S. Teflep. 2017. Activist builds $3 billion stake in P\&G. Wall Street Journal, February 15, p. Al. 5. P\&G Annual Report 2009. 6. Reingold, J, and D. Burke. 2013. Can P\&G's CEO hang on? Fortune, February 25, p. 70 . 7. Ibid. 8. Ibid. p. 75 . 9. Ibid, p. 70 . 10. Press Release. 2019 (January 23). P\&G announces fiscal year 2019 second quarter results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started