Answered step by step

Verified Expert Solution

Question

1 Approved Answer

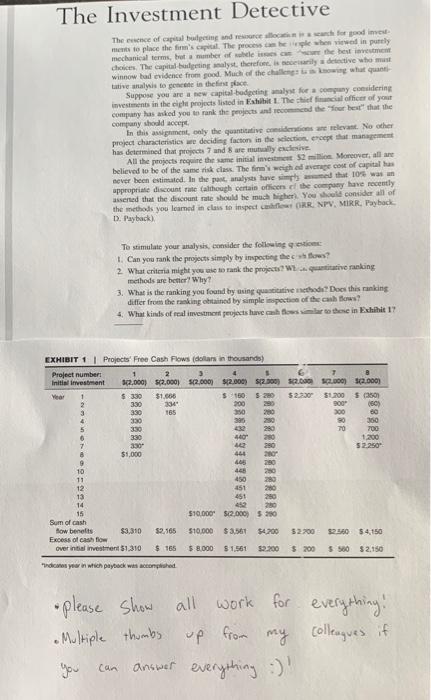

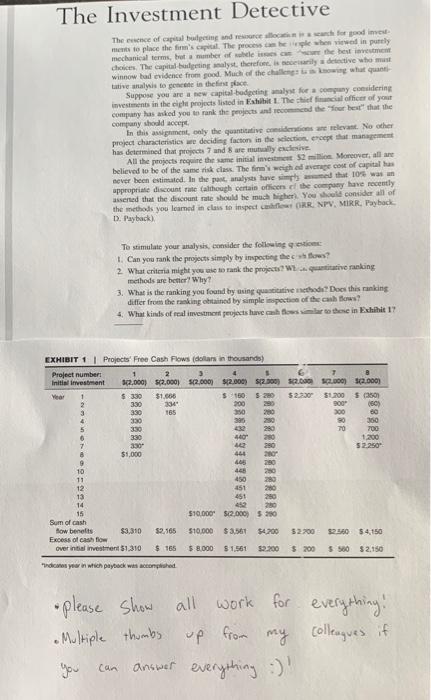

Read the case carefully, then compute NPV, IRR, MIRR, Payback Period, and Discounted Payback Period for each of the investments (this is the answer for

Read the case carefully, then compute NPV, IRR, MIRR, Payback Period, and Discounted Payback Period for each of the investments (this is the answer for question 3). Answer Questions 1-4 and show all of your work! (Hint: Question 4 asks you to imagine what types of investments are given, this could be anything with similar cash flows. For example, project 1 looks like a bond with a 33% coupon rate.

The Investment Detective meats to place the finm's capiet. The process in be lirple aben vioved in purtl Suppose you are a new capical bodgetint analyot foe a concuny considering company showld accest. has detertained the ntegect 7 and 8 are mutvally cuchase All the projocts reguire the same initial investineat 52 milien. Mooreover, all any believed to be of the same tiak clask. The fanm'i meiph ad avenuec cost of cipital ham oever been estimated. In the paoc, aralyses have serrlly anctel that 10 o wat an the methols you loamed in class to inspet castleat (iRR. NPV, MiRR. Payback 1. Payback) Te stimulate your analysis, eanider the forlowing q eriche: 1. Can you rank the projects simply by insported the c n th Boes? 2. What eriteria might yoe aie to rank the project? Wt \& cqurtitative raeking methods are besticr?" Why? 3. What is the ranking you foand ty acine cuascitutive taethodrt Doos this ranking differ frow the ranking ohrtaintd by simple inopection of the call Blowi? 4. What kinks of ecal imesuncen ;rojects have cahh foes wim lar so tene in Walahie 17 ridions yti in which payteck wat acenghthed - please Show all work for everything! - Multiple thumbs up from my collegagues if You can answer everything:)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started