Read the Chapter 11 Case: "T-Mobile and Metropcs Complete a Multibillion Dollar Merger" and the Chapter 12 Case: "Softbank Places a Big Bet on the U.S. Telecom Market" from the textbook. In a minimum of 500 words, reference the cases and the findings in the assigned article, "Corporate Financing Decisions When Investors Take The Path of Least Resistance," with regards to stock-for-stock mergers. Provide an explanation of how their data compare with concepts presented in the textbook reading. Provide specific examples to support your statement. Prepare this assignment according to the guidelines found in the APA Style Guide, located in the Student Success Center. An abstract is not required. This assignment uses a grading rubric. Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.

Read the Chapter 11 Case: "T-Mobile and Metropcs Complete a Multibillion Dollar Merger" and the Chapter 12 Case: "Softbank Places a Big Bet on the U.S. Telecom Market" from the textbook. In a minimum of 500 words, reference the cases and the findings in the assigned article, "Corporate Financing Decisions When Investors Take The Path of Least Resistance," with regards to stock-for-stock mergers. Provide an explanation of how their data compare with concepts presented in the textbook reading. Provide specific examples to support your statement. Prepare this assignment according to the guidelines found in the APA Style Guide, located in the Student Success Center. An abstract is not required. This assignment uses a grading rubric. Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.

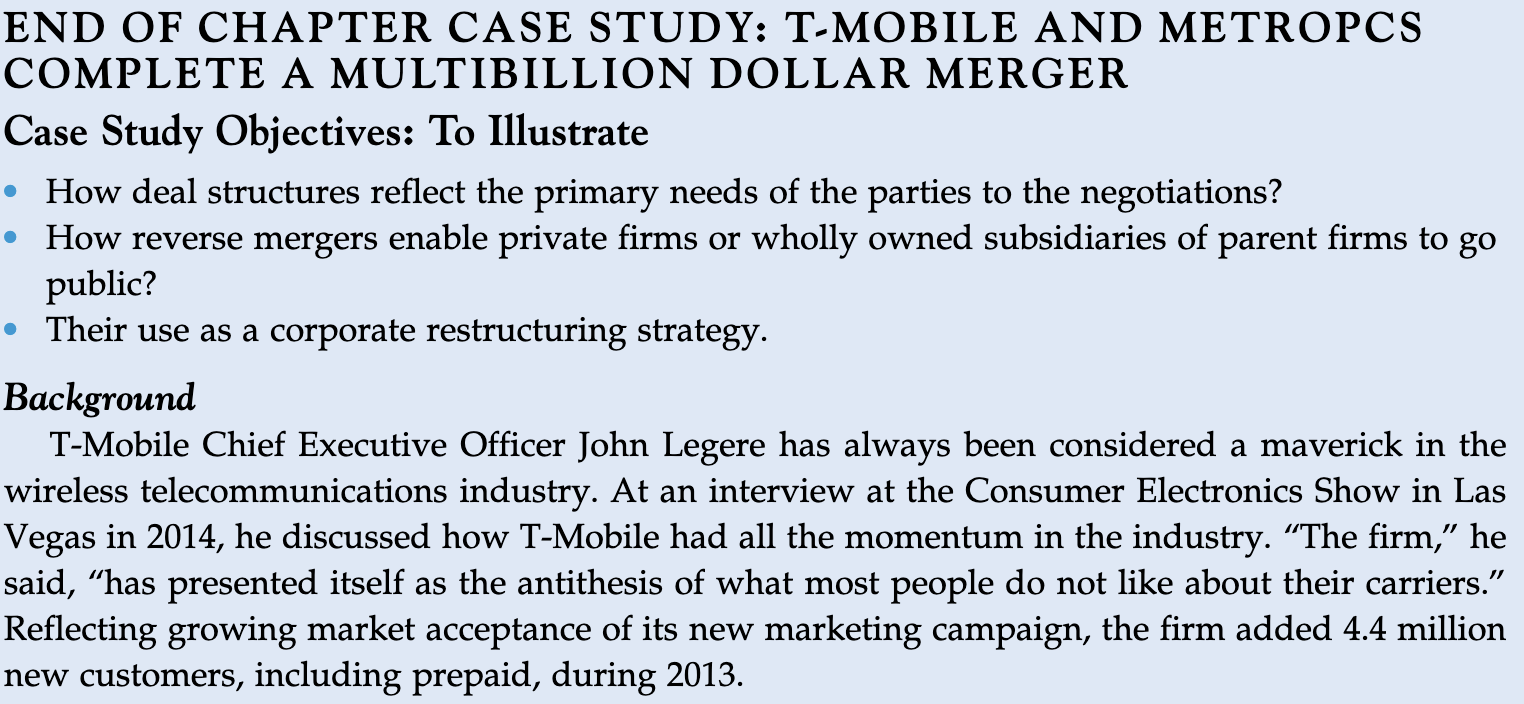

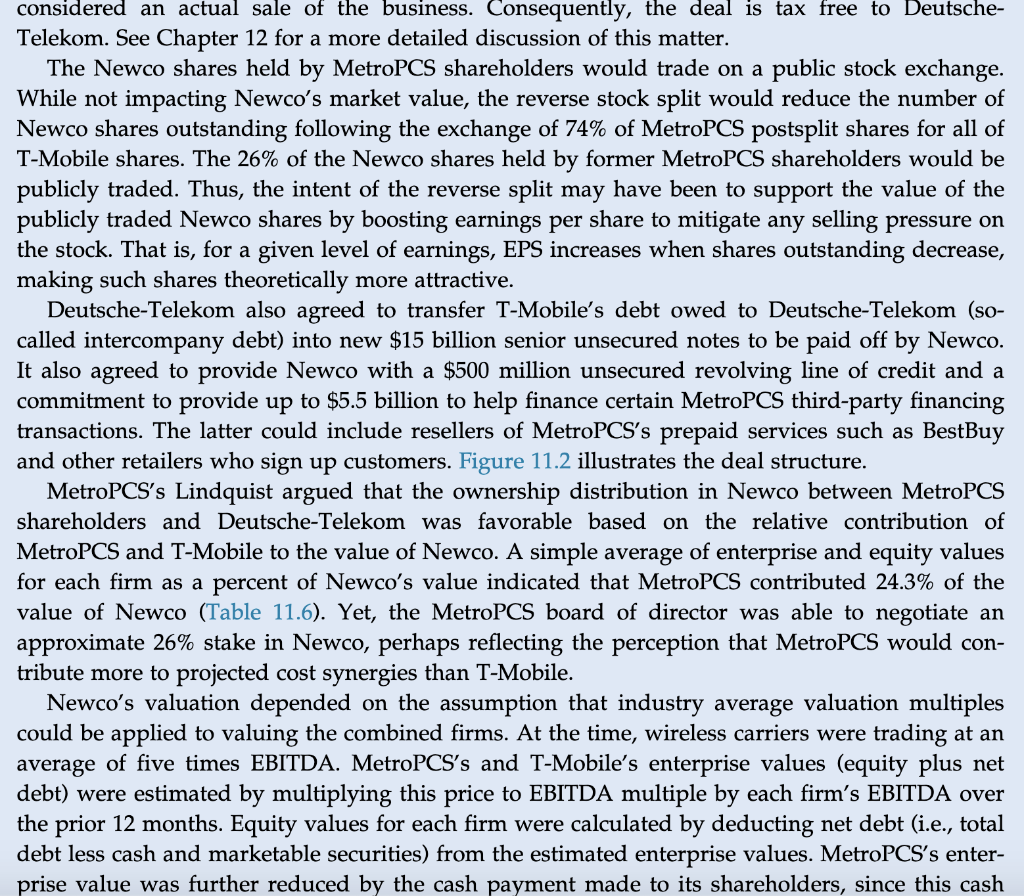

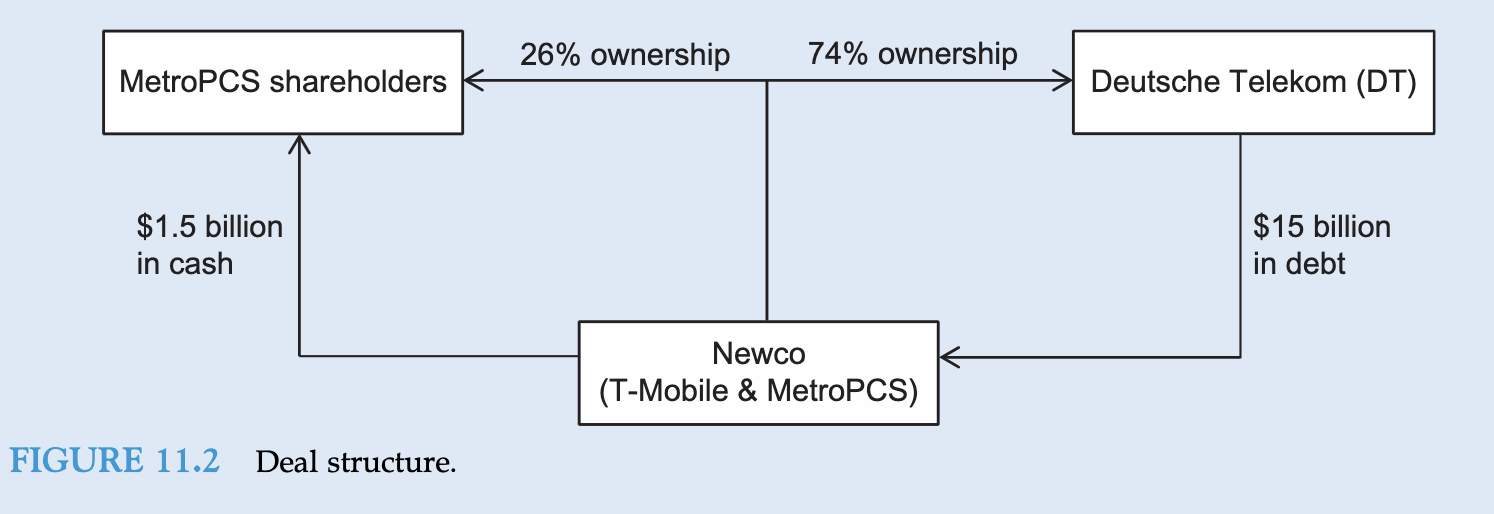

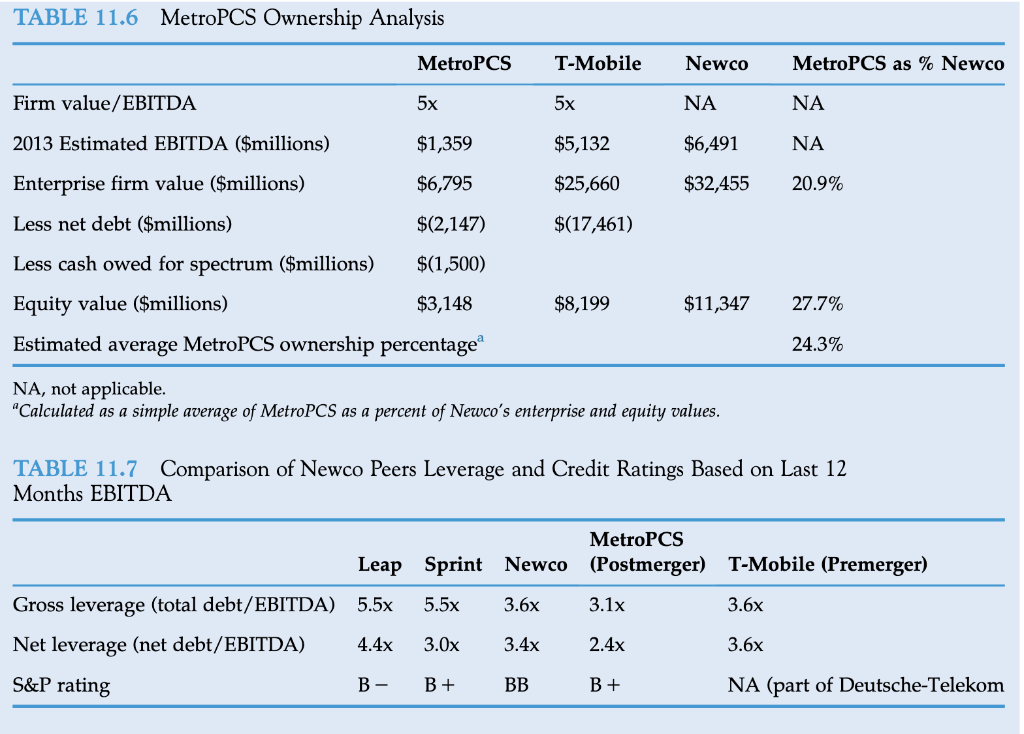

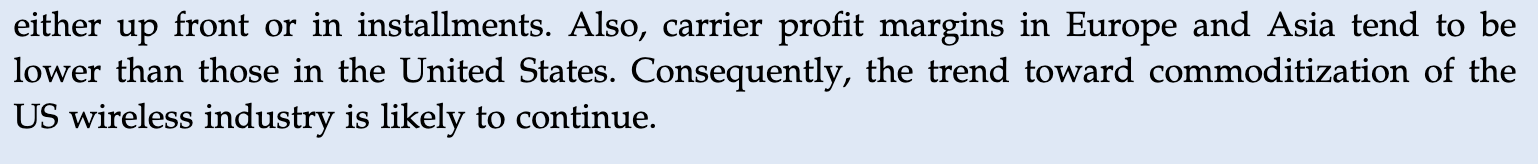

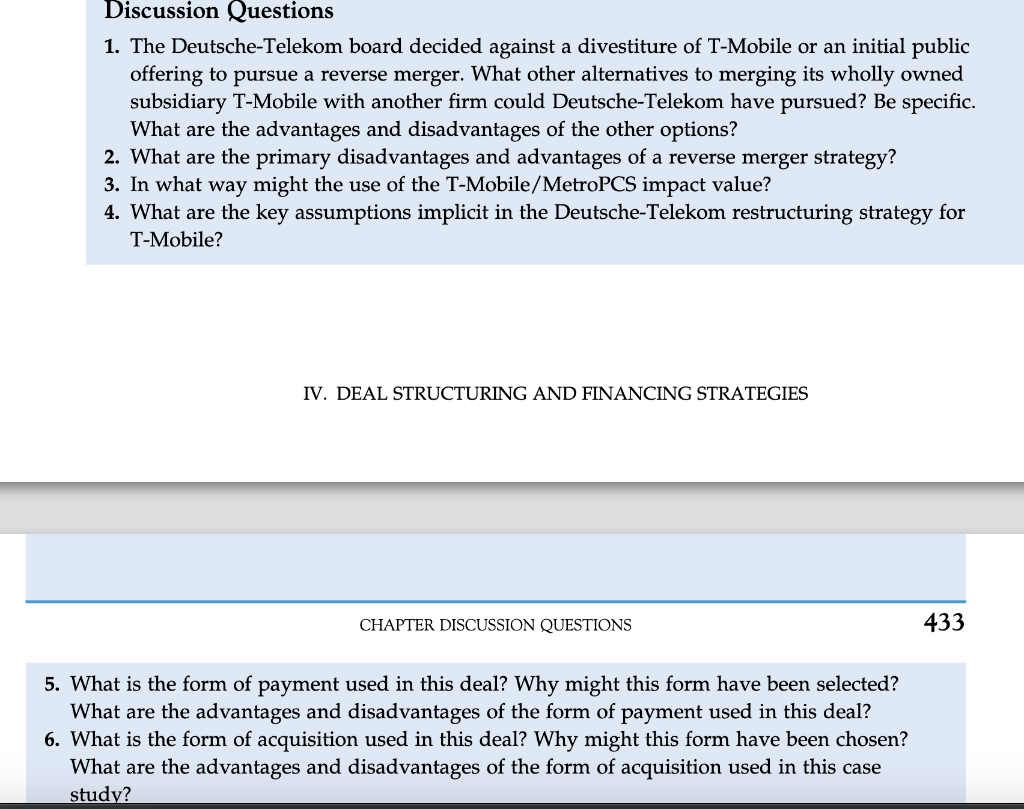

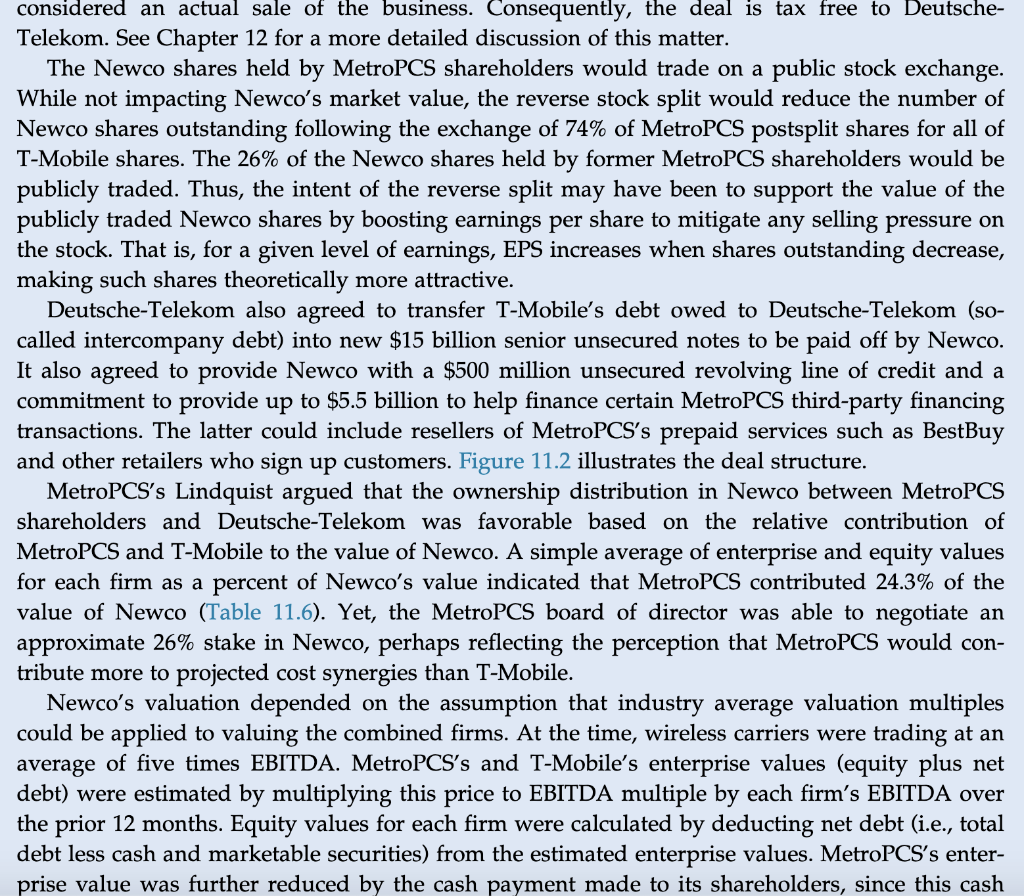

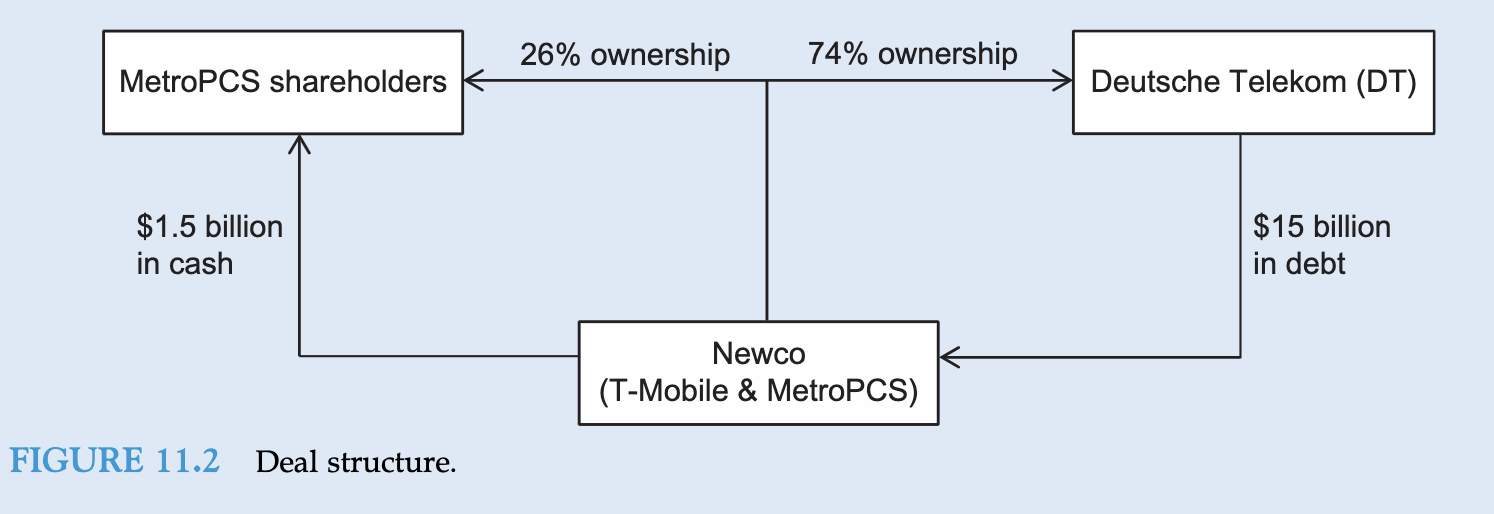

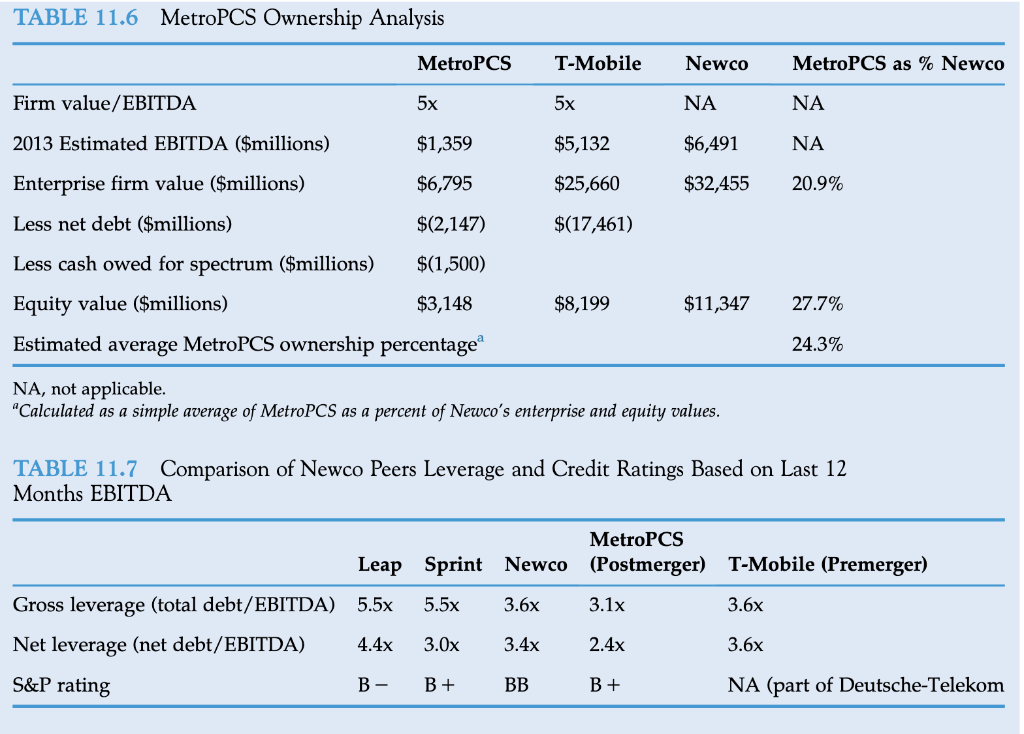

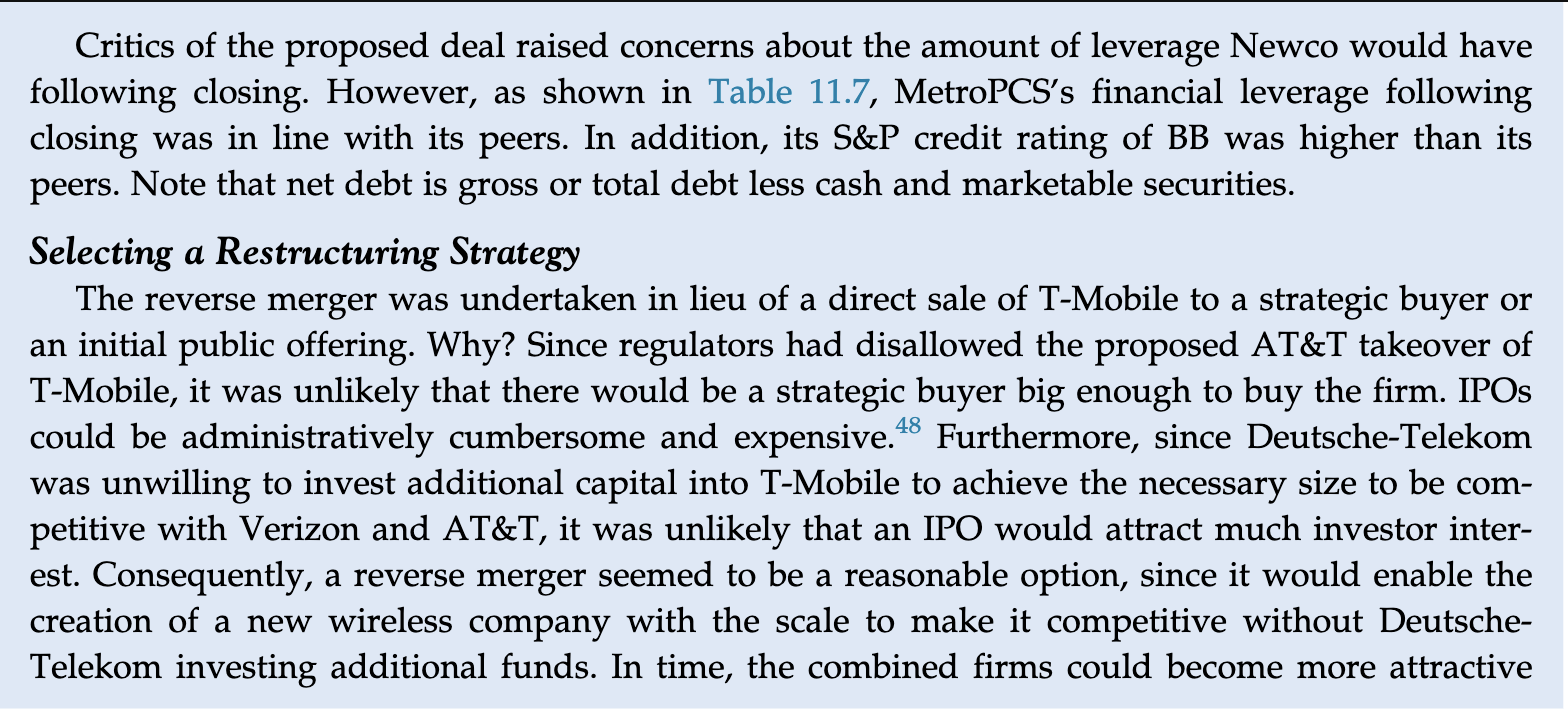

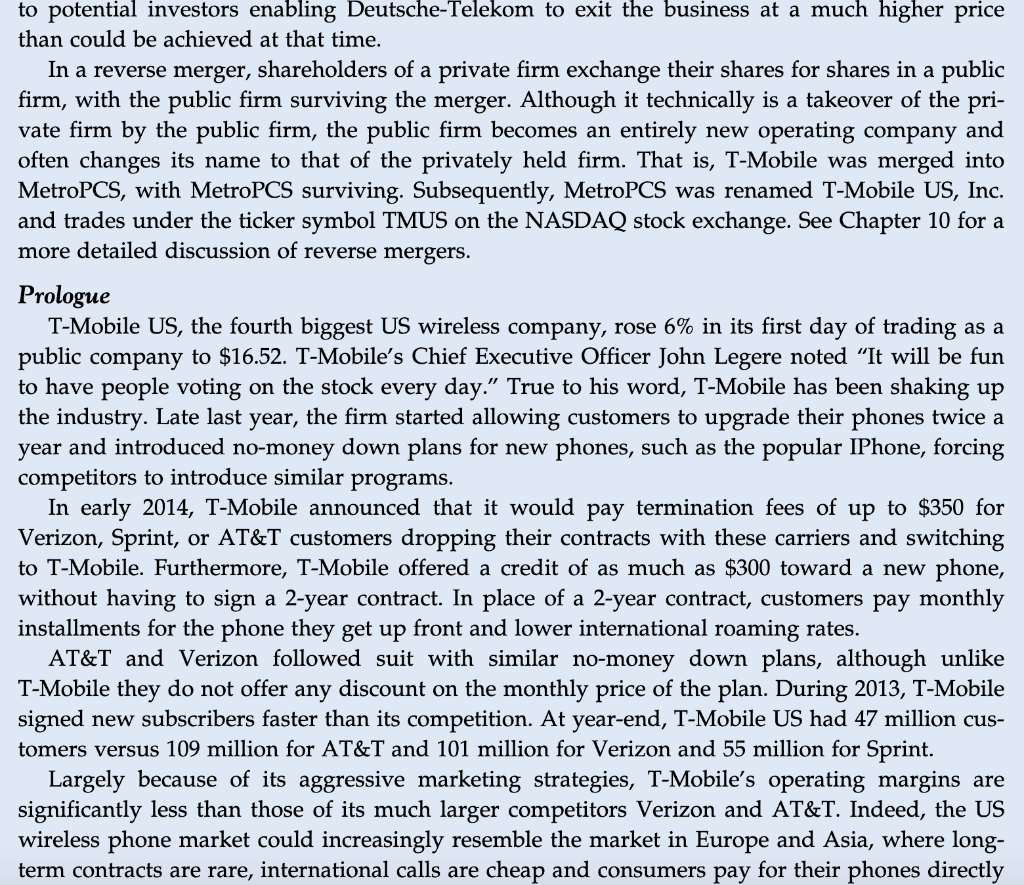

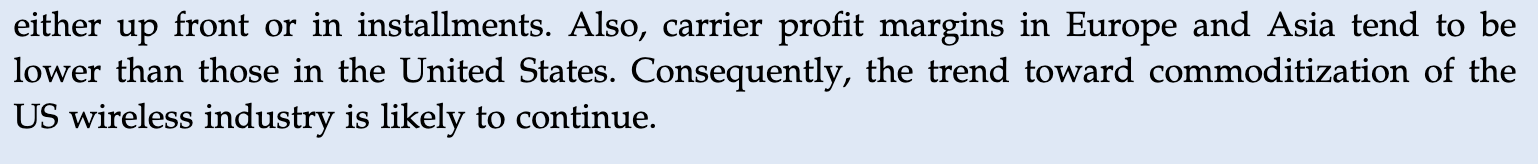

Discussion Questions 1. The Deutsche-Telekom board decided against a divestiture of T-Mobile or an initial public offering to pursue a reverse merger. What other alternatives to merging its wholly owned subsidiary T-Mobile with another firm could Deutsche-Telekom have pursued? Be specific. What are the advantages and disadvantages of the other options? 2. What are the primary disadvantages and advantages of a reverse merger strategy? 3. In what way might the use of the T-Mobile/MetroPCS impact value? 4. What are the key assumptions implicit in the Deutsche-Telekom restructuring strategy for T-Mobile? IV. DEAL STRUCTURING AND FINANCING STRATEGIES 433 CHAPTER DISCUSSION QUESTIONS 5. What is the form of payment used in this deal? Why might this form have been selected? What are the advantages and disadvantages of the form of payment used in this deal? 6. What is the form of acquisition used in this deal? Why might this form have been chosen? What are the advantages and disadvantages of the form of acquisition used in this case study? END OF CHAPTER CASE STUDY: T-MOBILE AND METROPCS COMPLETE A MULTIBILLION DOLLAR MERGER Case Study Objectives: To Illustrate How deal structures reflect the primary needs of the parties to the negotiations? How reverse mergers enable private firms or public? wholly owned subsidiaries of parent firms to go Their use as a corporate restructuring strategy. Background T-Mobile Chief Executive Officer John Legere has always been considered a maverick in the wireless telecommunications industry. At an interview at the Consumer Electronics Show in Las Vegas in 2014, he discussed how T-Mobile had all the momentum in the industry. "The firm," he said, "has presented itself as the antithesis of what most people do not like about their carriers." Reflecting growing market acceptance of its new new customers, including prepaid, during 2013. marketing campaign, the firm added 4.4 million But this torrid pace was new for the firm coming after years of operating profit losses and customer attrition. Legere noted that in the past industry consolidation had been driven largely by the need for competitors to accumulate spectrum (i.e., a collection of licenses to transmit sig- nals over slices of airwaves owned by the government). While the need to add spectrum will continue to be a factor driving consolidation, he opined that future deals are more likely to reflect brand promotion. Toward this end, Legere is positioning the T-Mobile brand as a change agent and wireless industry innovator capable of really shaking things up After US regulators nixed a $39 billion merger between T-Mobile and AT&T in late 2011 due to antitrust concerns, the outlook for T-Mobile, the nation's fourth largest cellular phone carrier, looked bleak. The firm was hemorrhaging customers to Verizon and AT&T once their contracts ended. Rene Obermann, CEO of T-Mobile's parent firm Deutsche-Telekom, made it clear that he was unwilling to increase significantly its investment in T-Mobile. Without a 4G LTE network and the ability to offer high-end smartphones like its competitors because of its lack of clout with handset vendors, the firm appeared destined to shrink amid an industry in flux. Wireless communications in the US market is transitioning to what the industry has fought against for two decades: a commodity business in which all competitors look the same and prices keep coming down. For 10 years, AT&T and Verizon, which together have one-half of the market by number of subscribers, have been quickest to roll out big, fast wireless networks. Their advertisements have focused more on quality than price. The basic business model in the wireless industry involved attracting customers with deeply discounted prices for handsets, locking them into 2-year service contracts, and limiting their ability to switch by imposing onerous contract termination fees. With 90% of US adults having a cellphone, the usefulness of this model is fading fast. The basis of competition is now to retaining existing customers and encouraging other customers to change their current wire- shifting from gaining market share less carrier. Sensitive to changing industry dynamics, the U.S. Justice Department and the Federal Communications Commission (FCC), which had not supported the aborted tie up between AT&T and T-Mobile, seem focused on maintaining three or four national competitors. This number of competitors in most developed countries appears to keep competition healthy and to hold prices down. Since rejecting AT&T's proposed acquisition of T-Mobile, the Justice Department and the FCC have approved several other deals driven in large spectrum. These deals included AT&T's purchase of Leap, holdings in cities. Sprint combined with Softbank in 2013 and later bought out its broadband partner Clearwire, ultimately giving the firm the biggest spectrum holdings among the four competitors. Not to be outdone, T-Mobile merged with MetroPCS on ture designed to allow T-Mobile's parent Deutsche-Telekom to exit T-Mobile over time, satisfy T-Mobile's and MetroPCS's need for additional spectrum, realize substantial cost synergies, and to provide a significant takeover premium for MetroPCS shareholders as an incentive to approve the deal. Although its geographic coverage is less than its larger competitors, this deal gave T-Mobile the fastest network in the United States. For Obermann, who after 7 years as CEO was succeeded by Chief Financial Officer Timotheus Hoettges at the end of 2013, the deal was bly his last chance to find a solution to the US business that had long eluded him. What follows measure to acquire prepaid service with spectrum a May 1, 2013, in a complex deal struc- proba- is a discussion of how reverse mergers can be used as part of a complex restructuring strategy to achieve these diverse strategic objectives for each of the three parties involved: Deutsche- Telekom, T-Mobile, and MetroPCS. The Shareholders' Dilemma In late 2012, T-Mobile announced that it had reached an agreement to merge with MetroPCS. Dallas-based MetroPCS is a low-cost, no-contract provider of prepaid data plans and inexpensive phones targeted at Americans who could not afford Verizon and AT&T's more ings. At the time, it was the fifth largest wireless carrier in the United States based on the num- ber of subscribers. According to Roger Linquist, Chairman and CEO of MetroPCS, the deal addresses the firm's need for additional spectrum and allows for expansion into underserved markets. The firm's shareholders in assessing the proposed deal were confronted with the usual dilemma: Do the proposed benefits of the combination represent a better alternative to remaining a standalone company? On paper, the proposal appeared to be attractive. The combined firm will have $24.6 billion in annual revenue, $6.4 billion of adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), and 44 million subscribers as of March 31, 2013, the deal's closing date. It would result in the biggest consolidation in the prepaid market in years. Prepaid cellphone users expensive offer- have increased at double digit pace compared to a much lower single digit clip for subscribers on contracts. Upon completion, the combination of T-Mobile and MetroPCS, along with Sprint and America Movil SAB unit TracFone, would account for three-quarters of the prepaid cell phone industry. Under the terms of the deal, MetroPCS shareholders would receive a combination of cash and stock in the combined firms (Newco), allowing them to participate in any upside appreciation in Newco's valuation. According to MetroPCS's independent financial advisors, including the cash payment and the estimated value of its stake in Newco (excluding synergy), the purchase price represented a 46% premium to MetroPCS's share price $10.38 on the announcement date based on an expected 6-7% annual growth rate of EBITDA. The premium could be as in cost savings is realized on a key underlving valuation assumptions were credible. on the New York Stock Exchange of high as 143% if the net present value of the anticipated $6 to $7 billion timely basis. The actual value of the deal depended on whether In addition, the deal structure was Deutsche-Telekom prior to the merger, was taken public through MetroPCS. The deal was recorded for financial reporting purposes as a MetroPCS. A recapitalization involves a number of shares outstanding and the amount of debt relative to equity. Prior to closing, MetroPCS would declare a 1 for 2 reverse stock split (shareholders would receive one new com- mon share for every two shares held prior to the split), make a cash payment of $1.5 billion to its shareholders (approximately $4.09 per share prior to the reverse stock split), and acquire all of T-Mobile's stock by issuing to Deutsche-Telekom 74% of MetroPCS' newly issued common stock. That is, MetroPCS exchanged almost three-fourths of its shares for 100% of T-Mobile's shares held by Deutsche-Telekom. Consequently, Deutsche-Telekom would own about 74% of Newco, with the remaining 26% owned by MetroPCS shareholders. A recapitalization is viewed as a financial reorganization in which Deutsche-Telekom would have a substantial continuing interest in Newco as a result of its exchange of T-Mobile shares for MetroPCS shares. T-Mobile's operations wholly owned subsidiary of complex. T-Mobile, a a reverse merger with recapitalization of change in a firm's capital structure: a change in the are unaffected; and, as such, a recapitalization is not considered an actual sale of the business. Consequently, the deal is tax free to Deutsche- Telekom. See Chapter 12 for a more detailed discussion of this matter. The Newco shares held by MetroPCS shareholders would trade on a While not impacting Newco's market value, the reverse stock split would reduce the number of Newco shares outstanding following the exchange of 74% of MetroPCS postsplit shares for all of T-Mobile shares. The 26% of the Newco shares held by former MetroPCS shareholders would be public stock exchange. publicly traded. Thus, the intent of the reverse split may have been to support the value of the publicly traded Newco shares by boosting earnings per share to mitigate any selling pressure on the stock. That is, for a given level of earnings, EPS increases when shares outstanding decrease, making such shares theoretically Deutsche-Telekom also agreed to transfer T-Mobile's debt owed to Deutsche-Telekom (so- called intercompany debt) into new $15 billion senior unsecured notes to be paid off by Newco. It also agreed to provide Newco with a $500 million unsecured revolving line of credit and a commitment to provide up to $5.5 billion to help finance certain MetroPCS third-party financing transactions. The latter could include resellers of MetroPCS's prepaid services such as and other retailers who sign up customers. Figure 11.2 illustrates the deal structure. MetroPCS's Lindquist argued that the ownership distribution in Newco between MetroPCS more attractive BestBuy shareholders and Deutsche-Telekom was favorable based on the relative contribution of MetroPCS and T-Mobile to the value of Newco. A simple average of enterprise and equity values for each firm as a percent of Newco's value indicated that MetroPCS contributed 24.3% of the value of Newco (Table 11.6). Yet, the MetroPCS board of director was able to negotiate approximate 26% stake in Newco, perhaps reflecting the perception that MetroPCS would con tribute more to projected cost synergies than T-Mobile. Newco's valuation depended an on the assumption that industry average valuation multiples trading at an average of five times EBITDA. MetroPCS's and T-Mobile's enterprise values (equity plus net debt) were estimated by multiplying this price to EBITDA multiple by each firm's EBITDA over the prior 12 months. Equity values for each firm were calculated by deducting net debt (i.e., total debt less cash and marketable securities) from the estimated enterprise values. MetroPCS's enter- prise value was further reduced by the cash payment made to its shareholders, since this cash could be applied to valuing the combined firms. At the time, wireless carriers were considered an actual sale of the business. Consequently, the deal is tax free to Deutsche- Telekom. See Chapter 12 for a more detailed discussion of this matter. The Newco shares held by MetroPCS shareholders would trade on a While not impacting Newco's market value, the reverse stock split would reduce the number of Newco shares outstanding following the exchange of 74% of MetroPCS postsplit shares for all of T-Mobile shares. The 26% of the Newco shares held by former MetroPCS shareholders would be public stock exchange. publicly traded. Thus, the intent of the reverse split may have been to support the value of the publicly traded Newco shares by boosting earnings per share to mitigate any selling pressure on the stock. That is, for a given level of earnings, EPS increases when shares outstanding decrease, making such shares theoretically Deutsche-Telekom also agreed to transfer T-Mobile's debt owed to Deutsche-Telekom (so- called intercompany debt) into new $15 billion senior unsecured notes to be paid off by Newco. It also agreed to provide Newco with a $500 million unsecured revolving line of credit and a commitment to provide up to $5.5 billion to help finance certain MetroPCS third-party financing transactions. The latter could include resellers of MetroPCS's prepaid services such as and other retailers who sign up customers. Figure 11.2 illustrates the deal structure. MetroPCS's Lindquist argued that the ownership distribution in Newco between MetroPCS more attractive BestBuy shareholders and Deutsche-Telekom was favorable based on the relative contribution of MetroPCS and T-Mobile to the value of Newco. A simple average of enterprise and equity values for each firm as a percent of Newco's value indicated that MetroPCS contributed 24.3% of the value of Newco (Table 11.6). Yet, the MetroPCS board of director was able to negotiate approximate 26% stake in Newco, perhaps reflecting the perception that MetroPCS would con tribute more to projected cost synergies than T-Mobile. Newco's valuation depended an on the assumption that industry average valuation multiples trading at an average of five times EBITDA. MetroPCS's and T-Mobile's enterprise values (equity plus net debt) were estimated by multiplying this price to EBITDA multiple by each firm's EBITDA over the prior 12 months. Equity values for each firm were calculated by deducting net debt (i.e., total debt less cash and marketable securities) from the estimated enterprise values. MetroPCS's enter- prise value was further reduced by the cash payment made to its shareholders, since this cash could be applied to valuing the combined firms. At the time, wireless carriers were 26% ownership 74% ownership Deutsche Telekom (DT) MetroPCS shareholders $1.5 billion in cash $15 billion in debt Newco (T-Mobile & MetroPCS) FIGURE 11.2 Deal structure. TABLE 11.6 MetroPCS Ownership Analysis MetroPCS T-Mobile MetroPCS as % Newco Newco Firm value/EBITDA NA NA 5 5x 2013 Estimated EBITDA ($millions) $1,359 $5,132 $6,491 NA $6,795 $32,455 Enterprise firm value ($millions) $25,660 20.9% Less net debt ($millions) $(2,147) $(17,461) Less cash owed for spectrum ($millions) $(1,500) $11,347 Equity value ($millions) $3,148 $8,199 27.7% Estimated average MetroPCS ownership percentage 24.3% NA, not applicable. "Calculated as a simple average of MetroPCS as a percent of Newco's enterprise and equity values. TABLE 11.7 Comparison of Newco Peers Leverage and Credit Ratings Based on Last 12 Months EBITDA MetroPCS Leap Sprint Newco (Postmerger) T-Mobile (Premerger) Gross leverage (total debt/EBITDA) 5.5x 5.5x 3.6x 3.1x 3.6x Net leverage (net debt/EBITDA) 3.4x 4.4x 3.0x 2.4x 3.6x S&P rating + B + BB NA (part of Deutsche-Telekom Critics of the proposed deal raised concerns about the amount of leverage Newco would have following closing. However, as shown in Table 11.7, MetroPCS's financial leverage following closing peers. Note that net debt is gross or total debt less cash and marketable securities. higher than its was in line with its peers. In addition, its S&P credit rating of BB was Selecting a Restructuring Strategy The reverse merger was undertaken in lieu of a direct sale of T-Mobile to a strategic buyer an initial public offering. Why? Since regulators had disallowed the proposed AT&T takeover of T-Mobile, it was or unlikely that there would be a strategic buyer big enough to buy the firm. IPOs 48 could be administratively cumbersome and expensive. Furthermore, since Deutsche-Telekom unwilling to invest additional capital into T-Mobile to achieve the necessary size to be com- petitive with Verizon and AT&T, it was est. Consequently creation of a new wireless company with the scale to make it competitive without Deutsche- Telekom investing additional funds. In time, the combined firms could become more attractive was unlikely that an IPO would attract much investor inter- a reverse merger seemed to be a reasonable option, since it would enable the to potential investors enabling Deutsche-Telekom to exit the business at a much higher price than could be achieved at that time. In a reverse merger, shareholders of a private firm exchange their shares for shares in a public firm, with the public firm surviving the merger. Although it technically is a takeover of the pri- vate firm by the public firm, the public firm becomes an often changes its name to that of the privately held firm. That is, T-Mobile was merged into MetroPCS, with MetroPCS surviving. Subsequently, MetroPCS was renamed T-Mobile US, Inc. and trades under the ticker symbol TMUS on the NASDAQ stock exchange. See Chapter 10 for a more detailed discussion of reverse mergers. entirely new operating company and Prologue T-Mobile US, the fourth biggest US wireless company, rose 6% in its first day of trading public company to $16.52. T-Mobile's Chief Executive Officer John Legere noted "It will be fun to have people voting on the stock every day." True to his word, T-Mobile has been shaking up the industry. Late last year, the firm started allowing customers to upgrade their phones twice a year and introduced no-money down plans for new competitors to introduce similar programs. In early 2014, T-Mobile announced that it would pay termination fees of up to $350 for Verizon, Sprint, to T-Mobile. Furthermore, T-Mobile offered a credit of as much as $300 toward a new as a phones, such as the popular IPhone, forcing or AT&T customers dropping their contracts with these carriers and switching phone, without having to sign a 2-year contract. In place of a 2-year contract, customers pay monthly installments for the phone they get up front and lower international roaming rates. AT&T and Verizon followed suit with similar no-money down plans, although unlike T-Mobile they do not offer any discount on the monthly price of the plan. During 2013, T-Mobile signed tomers versus 109 million for AT&T and 101 million for Verizon and 55 million for Sprint. Largely because of its aggressive marketing strategies, T-Mobile's operating margins significantly less than those of its much larger competitors Verizon and AT&T. Indeed, the US wireless phone market could increasingly resemble the market in Europe and Asia, where long- new subscribers faster than its competition. At year-end, T-Mobile US had 47 million cus- are term contracts are rare, international calls are cheap and consumers pay for their phones directly either up front or in installments. Also, carrier profit margins in Europe and Asia tend to be lower than those in the United States. Consequently, the trend toward commoditization of the US wireless industry is likely to continue Discussion Questions 1. The Deutsche-Telekom board decided against a divestiture of T-Mobile or an initial public offering to pursue a reverse merger. What other alternatives to merging its wholly owned subsidiary T-Mobile with another firm could Deutsche-Telekom have pursued? Be specific. What are the advantages and disadvantages of the other options? 2. What are the primary disadvantages and advantages of a reverse merger strategy? 3. In what way might the use of the T-Mobile/MetroPCS impact value? 4. What are the key assumptions implicit in the Deutsche-Telekom restructuring strategy for T-Mobile? IV. DEAL STRUCTURING AND FINANCING STRATEGIES 433 CHAPTER DISCUSSION QUESTIONS 5. What is the form of payment used in this deal? Why might this form have been selected? What are the advantages and disadvantages of the form of payment used in this deal? 6. What is the form of acquisition used in this deal? Why might this form have been chosen? What are the advantages and disadvantages of the form of acquisition used in this case study? END OF CHAPTER CASE STUDY: T-MOBILE AND METROPCS COMPLETE A MULTIBILLION DOLLAR MERGER Case Study Objectives: To Illustrate How deal structures reflect the primary needs of the parties to the negotiations? How reverse mergers enable private firms or public? wholly owned subsidiaries of parent firms to go Their use as a corporate restructuring strategy. Background T-Mobile Chief Executive Officer John Legere has always been considered a maverick in the wireless telecommunications industry. At an interview at the Consumer Electronics Show in Las Vegas in 2014, he discussed how T-Mobile had all the momentum in the industry. "The firm," he said, "has presented itself as the antithesis of what most people do not like about their carriers." Reflecting growing market acceptance of its new new customers, including prepaid, during 2013. marketing campaign, the firm added 4.4 million But this torrid pace was new for the firm coming after years of operating profit losses and customer attrition. Legere noted that in the past industry consolidation had been driven largely by the need for competitors to accumulate spectrum (i.e., a collection of licenses to transmit sig- nals over slices of airwaves owned by the government). While the need to add spectrum will continue to be a factor driving consolidation, he opined that future deals are more likely to reflect brand promotion. Toward this end, Legere is positioning the T-Mobile brand as a change agent and wireless industry innovator capable of really shaking things up After US regulators nixed a $39 billion merger between T-Mobile and AT&T in late 2011 due to antitrust concerns, the outlook for T-Mobile, the nation's fourth largest cellular phone carrier, looked bleak. The firm was hemorrhaging customers to Verizon and AT&T once their contracts ended. Rene Obermann, CEO of T-Mobile's parent firm Deutsche-Telekom, made it clear that he was unwilling to increase significantly its investment in T-Mobile. Without a 4G LTE network and the ability to offer high-end smartphones like its competitors because of its lack of clout with handset vendors, the firm appeared destined to shrink amid an industry in flux. Wireless communications in the US market is transitioning to what the industry has fought against for two decades: a commodity business in which all competitors look the same and prices keep coming down. For 10 years, AT&T and Verizon, which together have one-half of the market by number of subscribers, have been quickest to roll out big, fast wireless networks. Their advertisements have focused more on quality than price. The basic business model in the wireless industry involved attracting customers with deeply discounted prices for handsets, locking them into 2-year service contracts, and limiting their ability to switch by imposing onerous contract termination fees. With 90% of US adults having a cellphone, the usefulness of this model is fading fast. The basis of competition is now to retaining existing customers and encouraging other customers to change their current wire- shifting from gaining market share less carrier. Sensitive to changing industry dynamics, the U.S. Justice Department and the Federal Communications Commission (FCC), which had not supported the aborted tie up between AT&T and T-Mobile, seem focused on maintaining three or four national competitors. This number of competitors in most developed countries appears to keep competition healthy and to hold prices down. Since rejecting AT&T's proposed acquisition of T-Mobile, the Justice Department and the FCC have approved several other deals driven in large spectrum. These deals included AT&T's purchase of Leap, holdings in cities. Sprint combined with Softbank in 2013 and later bought out its broadband partner Clearwire, ultimately giving the firm the biggest spectrum holdings among the four competitors. Not to be outdone, T-Mobile merged with MetroPCS on ture designed to allow T-Mobile's parent Deutsche-Telekom to exit T-Mobile over time, satisfy T-Mobile's and MetroPCS's need for additional spectrum, realize substantial cost synergies, and to provide a significant takeover premium for MetroPCS shareholders as an incentive to approve the deal. Although its geographic coverage is less than its larger competitors, this deal gave T-Mobile the fastest network in the United States. For Obermann, who after 7 years as CEO was succeeded by Chief Financial Officer Timotheus Hoettges at the end of 2013, the deal was bly his last chance to find a solution to the US business that had long eluded him. What follows measure to acquire prepaid service with spectrum a May 1, 2013, in a complex deal struc- proba- is a discussion of how reverse mergers can be used as part of a complex restructuring strategy to achieve these diverse strategic objectives for each of the three parties involved: Deutsche- Telekom, T-Mobile, and MetroPCS. The Shareholders' Dilemma In late 2012, T-Mobile announced that it had reached an agreement to merge with MetroPCS. Dallas-based MetroPCS is a low-cost, no-contract provider of prepaid data plans and inexpensive phones targeted at Americans who could not afford Verizon and AT&T's more ings. At the time, it was the fifth largest wireless carrier in the United States based on the num- ber of subscribers. According to Roger Linquist, Chairman and CEO of MetroPCS, the deal addresses the firm's need for additional spectrum and allows for expansion into underserved markets. The firm's shareholders in assessing the proposed deal were confronted with the usual dilemma: Do the proposed benefits of the combination represent a better alternative to remaining a standalone company? On paper, the proposal appeared to be attractive. The combined firm will have $24.6 billion in annual revenue, $6.4 billion of adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), and 44 million subscribers as of March 31, 2013, the deal's closing date. It would result in the biggest consolidation in the prepaid market in years. Prepaid cellphone users expensive offer- have increased at double digit pace compared to a much lower single digit clip for subscribers on contracts. Upon completion, the combination of T-Mobile and MetroPCS, along with Sprint and America Movil SAB unit TracFone, would account for three-quarters of the prepaid cell phone industry. Under the terms of the deal, MetroPCS shareholders would receive a combination of cash and stock in the combined firms (Newco), allowing them to participate in any upside appreciation in Newco's valuation. According to MetroPCS's independent financial advisors, including the cash payment and the estimated value of its stake in Newco (excluding synergy), the purchase price represented a 46% premium to MetroPCS's share price $10.38 on the announcement date based on an expected 6-7% annual growth rate of EBITDA. The premium could be as in cost savings is realized on a key underlving valuation assumptions were credible. on the New York Stock Exchange of high as 143% if the net present value of the anticipated $6 to $7 billion timely basis. The actual value of the deal depended on whether In addition, the deal structure was Deutsche-Telekom prior to the merger, was taken public through MetroPCS. The deal was recorded for financial reporting purposes as a MetroPCS. A recapitalization involves a number of shares outstanding and the amount of debt relative to equity. Prior to closing, MetroPCS would declare a 1 for 2 reverse stock split (shareholders would receive one new com- mon share for every two shares held prior to the split), make a cash payment of $1.5 billion to its shareholders (approximately $4.09 per share prior to the reverse stock split), and acquire all of T-Mobile's stock by issuing to Deutsche-Telekom 74% of MetroPCS' newly issued common stock. That is, MetroPCS exchanged almost three-fourths of its shares for 100% of T-Mobile's shares held by Deutsche-Telekom. Consequently, Deutsche-Telekom would own about 74% of Newco, with the remaining 26% owned by MetroPCS shareholders. A recapitalization is viewed as a financial reorganization in which Deutsche-Telekom would have a substantial continuing interest in Newco as a result of its exchange of T-Mobile shares for MetroPCS shares. T-Mobile's operations wholly owned subsidiary of complex. T-Mobile, a a reverse merger with recapitalization of change in a firm's capital structure: a change in the are unaffected; and, as such, a recapitalization is not considered an actual sale of the business. Consequently, the deal is tax free to Deutsche- Telekom. See Chapter 12 for a more detailed discussion of this matter. The Newco shares held by MetroPCS shareholders would trade on a While not impacting Newco's market value, the reverse stock split would reduce the number of Newco shares outstanding following the exchange of 74% of MetroPCS postsplit shares for all of T-Mobile shares. The 26% of the Newco shares held by former MetroPCS shareholders would be public stock exchange. publicly traded. Thus, the intent of the reverse split may have been to support the value of the publicly traded Newco shares by boosting earnings per share to mitigate any selling pressure on the stock. That is, for a given level of earnings, EPS increases when shares outstanding decrease, making such shares theoretically Deutsche-Telekom also agreed to transfer T-Mobile's debt owed to Deutsche-Telekom (so- called intercompany debt) into new $15 billion senior unsecured notes to be paid off by Newco. It also agreed to provide Newco with a $500 million unsecured revolving line of credit and a commitment to provide up to $5.5 billion to help finance certain MetroPCS third-party financing transactions. The latter could include resellers of MetroPCS's prepaid services such as and other retailers who sign up customers. Figure 11.2 illustrates the deal structure. MetroPCS's Lindquist argued that the ownership distribution in Newco between MetroPCS more attractive BestBuy shareholders and Deutsche-Telekom was favorable based on the relative contribution of MetroPCS and T-Mobile to the value of Newco. A simple average of enterprise and equity values for each firm as a percent of Newco's value indicated that MetroPCS contributed 24.3% of the value of Newco (Table 11.6). Yet, the MetroPCS board of director was able to negotiate approximate 26% stake in Newco, perhaps reflecting the perception that MetroPCS would con tribute more to projected cost synergies than T-Mobile. Newco's valuation depended an on the assumption that industry average valuation multiples trading at an average of five times EBITDA. MetroPCS's and T-Mobile's enterprise values (equity plus net debt) were estimated by multiplying this price to EBITDA multiple by each firm's EBITDA over the prior 12 months. Equity values for each firm were calculated by deducting net debt (i.e., total debt less cash and marketable securities) from the estimated enterprise values. MetroPCS's enter- prise value was further reduced by the cash payment made to its shareholders, since this cash could be applied to valuing the combined firms. At the time, wireless carriers were considered an actual sale of the business. Consequently, the deal is tax free to Deutsche- Telekom. See Chapter 12 for a more detailed discussion of this matter. The Newco shares held by MetroPCS shareholders would trade on a While not impacting Newco's market value, the reverse stock split would reduce the number of Newco shares outstanding following the exchange of 74% of MetroPCS postsplit shares for all of T-Mobile shares. The 26% of the Newco shares held by former MetroPCS shareholders would be public stock exchange. publicly traded. Thus, the intent of the reverse split may have been to support the value of the publicly traded Newco shares by boosting earnings per share to mitigate any selling pressure on the stock. That is, for a given level of earnings, EPS increases when shares outstanding decrease, making such shares theoretically Deutsche-Telekom also agreed to transfer T-Mobile's debt owed to Deutsche-Telekom (so- called intercompany debt) into new $15 billion senior unsecured notes to be paid off by Newco. It also agreed to provide Newco with a $500 million unsecured revolving line of credit and a commitment to provide up to $5.5 billion to help finance certain MetroPCS third-party financing transactions. The latter could include resellers of MetroPCS's prepaid services such as and other retailers who sign up customers. Figure 11.2 illustrates the deal structure. MetroPCS's Lindquist argued that the ownership distribution in Newco between MetroPCS more attractive BestBuy shareholders and Deutsche-Telekom was favorable based on the relative contribution of MetroPCS and T-Mobile to the value of Newco. A simple average of enterprise and equity values for each firm as a percent of Newco's value indicated that MetroPCS contributed 24.3% of the value of Newco (Table 11.6). Yet, the MetroPCS board of director was able to negotiate approximate 26% stake in Newco, perhaps reflecting the perception that MetroPCS would con tribute more to projected cost synergies than T-Mobile. Newco's valuation depended an on the assumption that industry average valuation multiples trading at an average of five times EBITDA. MetroPCS's and T-Mobile's enterprise values (equity plus net debt) were estimated by multiplying this price to EBITDA multiple by each firm's EBITDA over the prior 12 months. Equity values for each firm were calculated by deducting net debt (i.e., total debt less cash and marketable securities) from the estimated enterprise values. MetroPCS's enter- prise value was further reduced by the cash payment made to its shareholders, since this cash could be applied to valuing the combined firms. At the time, wireless carriers were 26% ownership 74% ownership Deutsche Telekom (DT) MetroPCS shareholders $1.5 billion in cash $15 billion in debt Newco (T-Mobile & MetroPCS) FIGURE 11.2 Deal structure. TABLE 11.6 MetroPCS Ownership Analysis MetroPCS T-Mobile MetroPCS as % Newco Newco Firm value/EBITDA NA NA 5 5x 2013 Estimated EBITDA ($millions) $1,359 $5,132 $6,491 NA $6,795 $32,455 Enterprise firm value ($millions) $25,660 20.9% Less net debt ($millions) $(2,147) $(17,461) Less cash owed for spectrum ($millions) $(1,500) $11,347 Equity value ($millions) $3,148 $8,199 27.7% Estimated average MetroPCS ownership percentage 24.3% NA, not applicable. "Calculated as a simple average of MetroPCS as a percent of Newco's enterprise and equity values. TABLE 11.7 Comparison of Newco Peers Leverage and Credit Ratings Based on Last 12 Months EBITDA MetroPCS Leap Sprint Newco (Postmerger) T-Mobile (Premerger) Gross leverage (total debt/EBITDA) 5.5x 5.5x 3.6x 3.1x 3.6x Net leverage (net debt/EBITDA) 3.4x 4.4x 3.0x 2.4x 3.6x S&P rating + B + BB NA (part of Deutsche-Telekom Critics of the proposed deal raised concerns about the amount of leverage Newco would have following closing. However, as shown in Table 11.7, MetroPCS's financial leverage following closing peers. Note that net debt is gross or total debt less cash and marketable securities. higher than its was in line with its peers. In addition, its S&P credit rating of BB was Selecting a Restructuring Strategy The reverse merger was undertaken in lieu of a direct sale of T-Mobile to a strategic buyer an initial public offering. Why? Since regulators had disallowed the proposed AT&T takeover of T-Mobile, it was or unlikely that there would be a strategic buyer big enough to buy the firm. IPOs 48 could be administratively cumbersome and expensive. Furthermore, since Deutsche-Telekom unwilling to invest additional capital into T-Mobile to achieve the necessary size to be com- petitive with Verizon and AT&T, it was est. Consequently creation of a new wireless company with the scale to make it competitive without Deutsche- Telekom investing additional funds. In time, the combined firms could become more attractive was unlikely that an IPO would attract much investor inter- a reverse merger seemed to be a reasonable option, since it would enable the to potential investors enabling Deutsche-Telekom to exit the business at a much higher price than could be achieved at that time. In a reverse merger, shareholders of a private firm exchange their shares for shares in a public firm, with the public firm surviving the merger. Although it technically is a takeover of the pri- vate firm by the public firm, the public firm becomes an often changes its name to that of the privately held firm. That is, T-Mobile was merged into MetroPCS, with MetroPCS surviving. Subsequently, MetroPCS was renamed T-Mobile US, Inc. and trades under the ticker symbol TMUS on the NASDAQ stock exchange. See Chapter 10 for a more detailed discussion of reverse mergers. entirely new operating company and Prologue T-Mobile US, the fourth biggest US wireless company, rose 6% in its first day of trading public company to $16.52. T-Mobile's Chief Executive Officer John Legere noted "It will be fun to have people voting on the stock every day." True to his word, T-Mobile has been shaking up the industry. Late last year, the firm started allowing customers to upgrade their phones twice a year and introduced no-money down plans for new competitors to introduce similar programs. In early 2014, T-Mobile announced that it would pay termination fees of up to $350 for Verizon, Sprint, to T-Mobile. Furthermore, T-Mobile offered a credit of as much as $300 toward a new as a phones, such as the popular IPhone, forcing or AT&T customers dropping their contracts with these carriers and switching phone, without having to sign a 2-year contract. In place of a 2-year contract, customers pay monthly installments for the phone they get up front and lower international roaming rates. AT&T and Verizon followed suit with similar no-money down plans, although unlike T-Mobile they do not offer any discount on the monthly price of the plan. During 2013, T-Mobile signed tomers versus 109 million for AT&T and 101 million for Verizon and 55 million for Sprint. Largely because of its aggressive marketing strategies, T-Mobile's operating margins significantly less than those of its much larger competitors Verizon and AT&T. Indeed, the US wireless phone market could increasingly resemble the market in Europe and Asia, where long- new subscribers faster than its competition. At year-end, T-Mobile US had 47 million cus- are term contracts are rare, international calls are cheap and consumers pay for their phones directly either up front or in installments. Also, carrier profit margins in Europe and Asia tend to be lower than those in the United States. Consequently, the trend toward commoditization of the US wireless industry is likely to continue

Read the Chapter 11 Case: "T-Mobile and Metropcs Complete a Multibillion Dollar Merger" and the Chapter 12 Case: "Softbank Places a Big Bet on the U.S. Telecom Market" from the textbook. In a minimum of 500 words, reference the cases and the findings in the assigned article, "Corporate Financing Decisions When Investors Take The Path of Least Resistance," with regards to stock-for-stock mergers. Provide an explanation of how their data compare with concepts presented in the textbook reading. Provide specific examples to support your statement. Prepare this assignment according to the guidelines found in the APA Style Guide, located in the Student Success Center. An abstract is not required. This assignment uses a grading rubric. Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.

Read the Chapter 11 Case: "T-Mobile and Metropcs Complete a Multibillion Dollar Merger" and the Chapter 12 Case: "Softbank Places a Big Bet on the U.S. Telecom Market" from the textbook. In a minimum of 500 words, reference the cases and the findings in the assigned article, "Corporate Financing Decisions When Investors Take The Path of Least Resistance," with regards to stock-for-stock mergers. Provide an explanation of how their data compare with concepts presented in the textbook reading. Provide specific examples to support your statement. Prepare this assignment according to the guidelines found in the APA Style Guide, located in the Student Success Center. An abstract is not required. This assignment uses a grading rubric. Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.