Question

Read the financial statements and relevant footnotes of China Evergrande Group for the year 2020 and answer the following questions: (1) Calculate the following ratios:

Read the financial statements and relevant footnotes of China Evergrande Group for the year 2020 and answer the following questions:

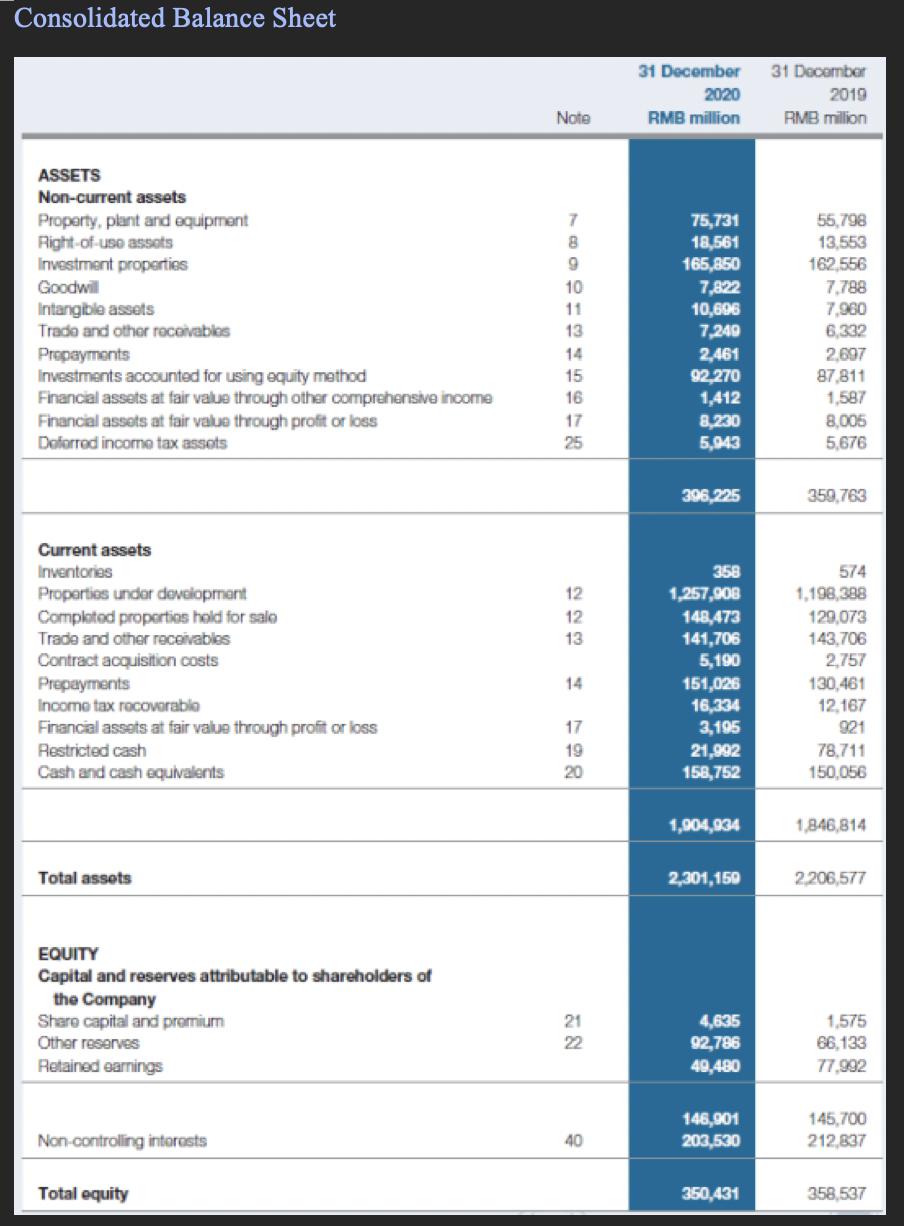

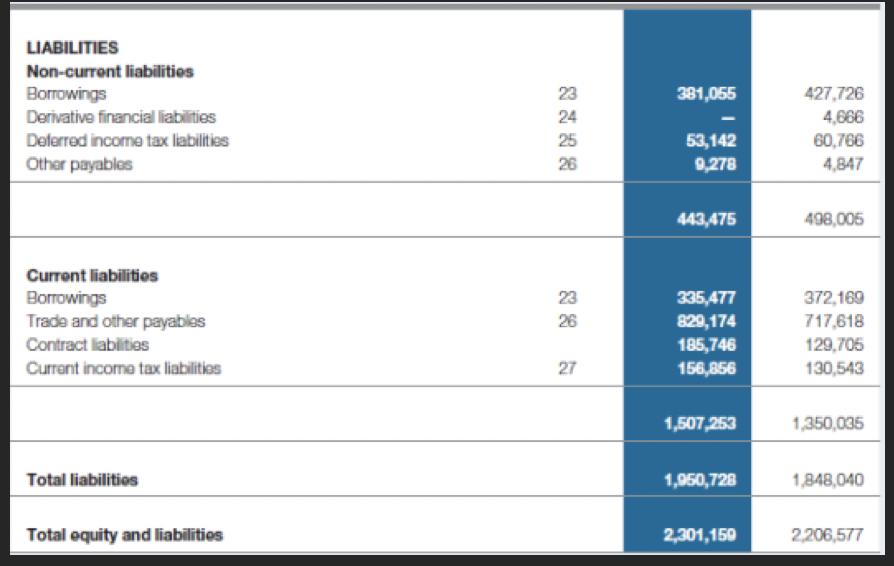

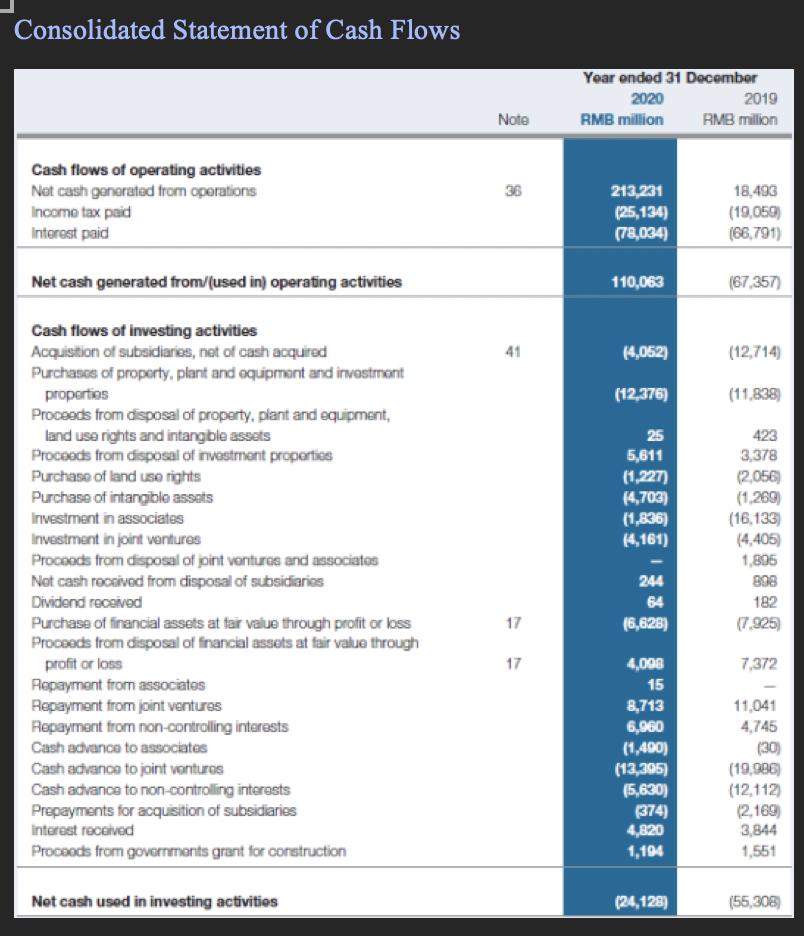

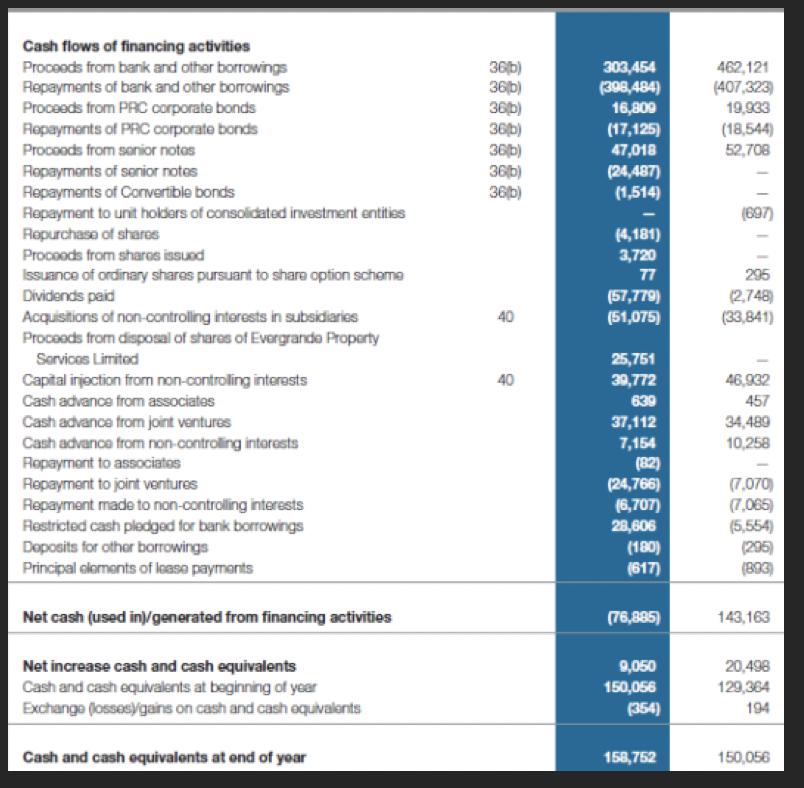

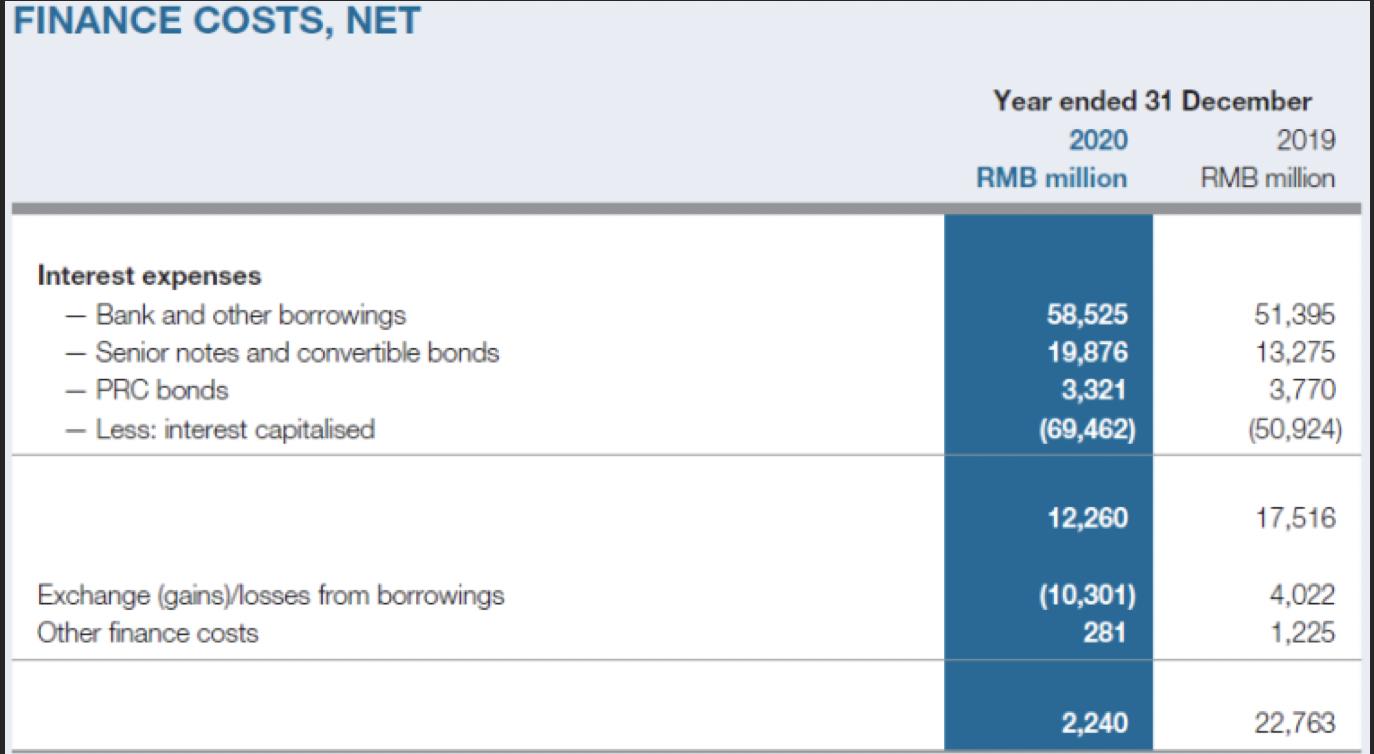

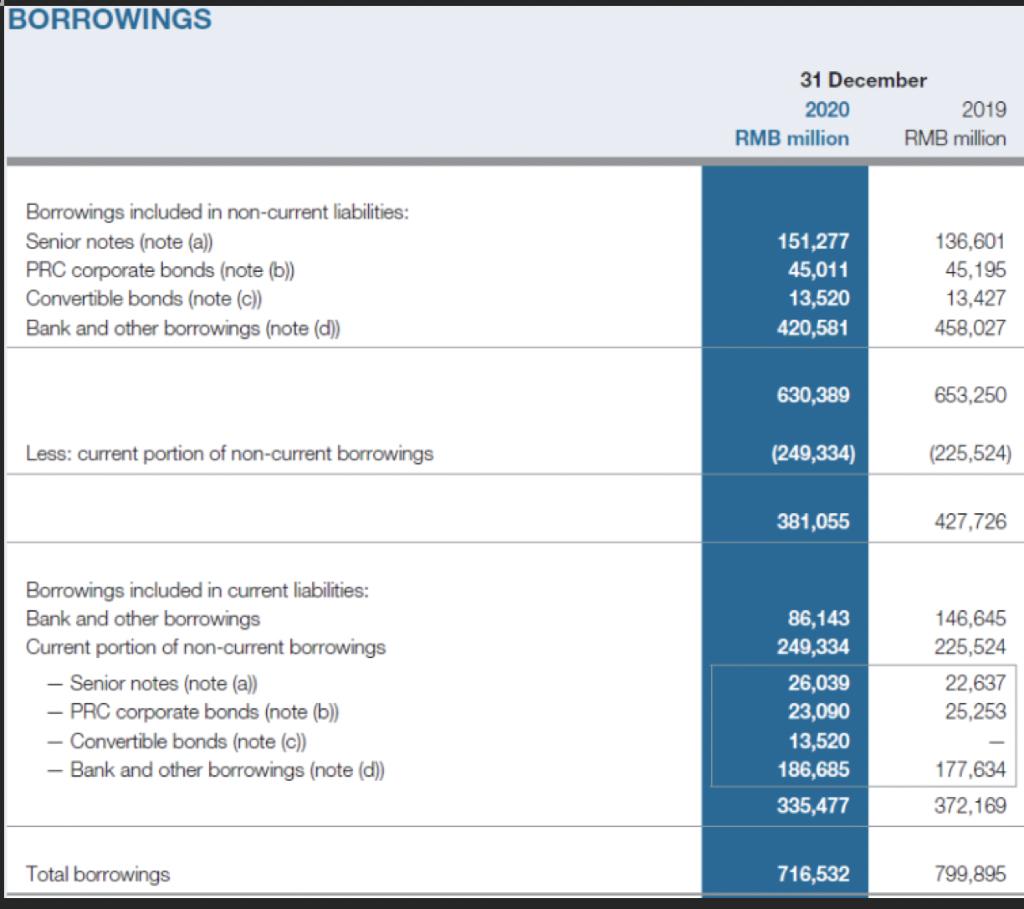

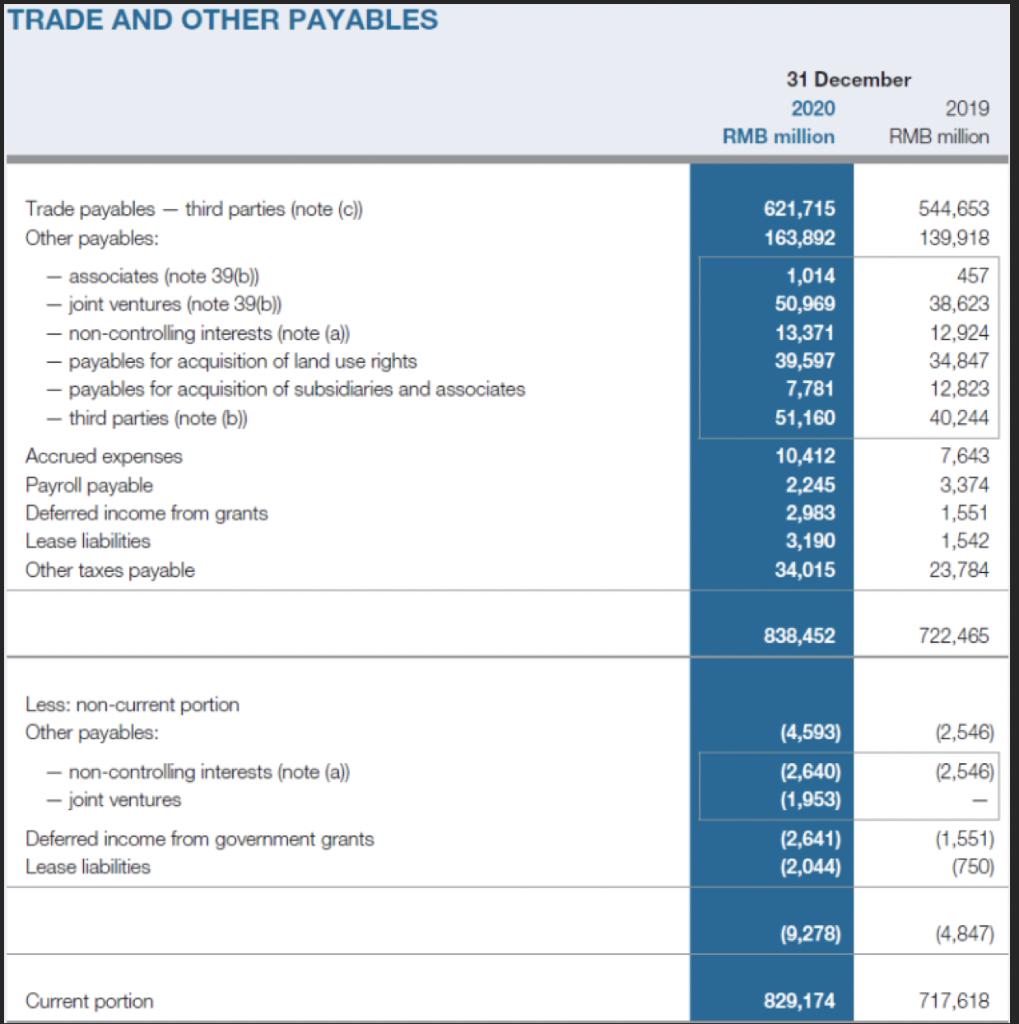

(1) Calculate the following ratios: (a) current ratio; (b) current cash debt coverage; (c) debt to assets ratio; (d) cash debt coverage; (e) times interest earned. (15 points)

(2) What are the major sources of financing (i.e. where does the company get its cash)? (2 points)

(3) What is the amount of “senior notes” included in “non-current liabilities”? What is the amount of “convertible bonds” included in “current liabilities”? (2 points)

(4) What are the balances of “trade payables”, “accrued expenses” and “payroll payable”? (3 points)

.

.

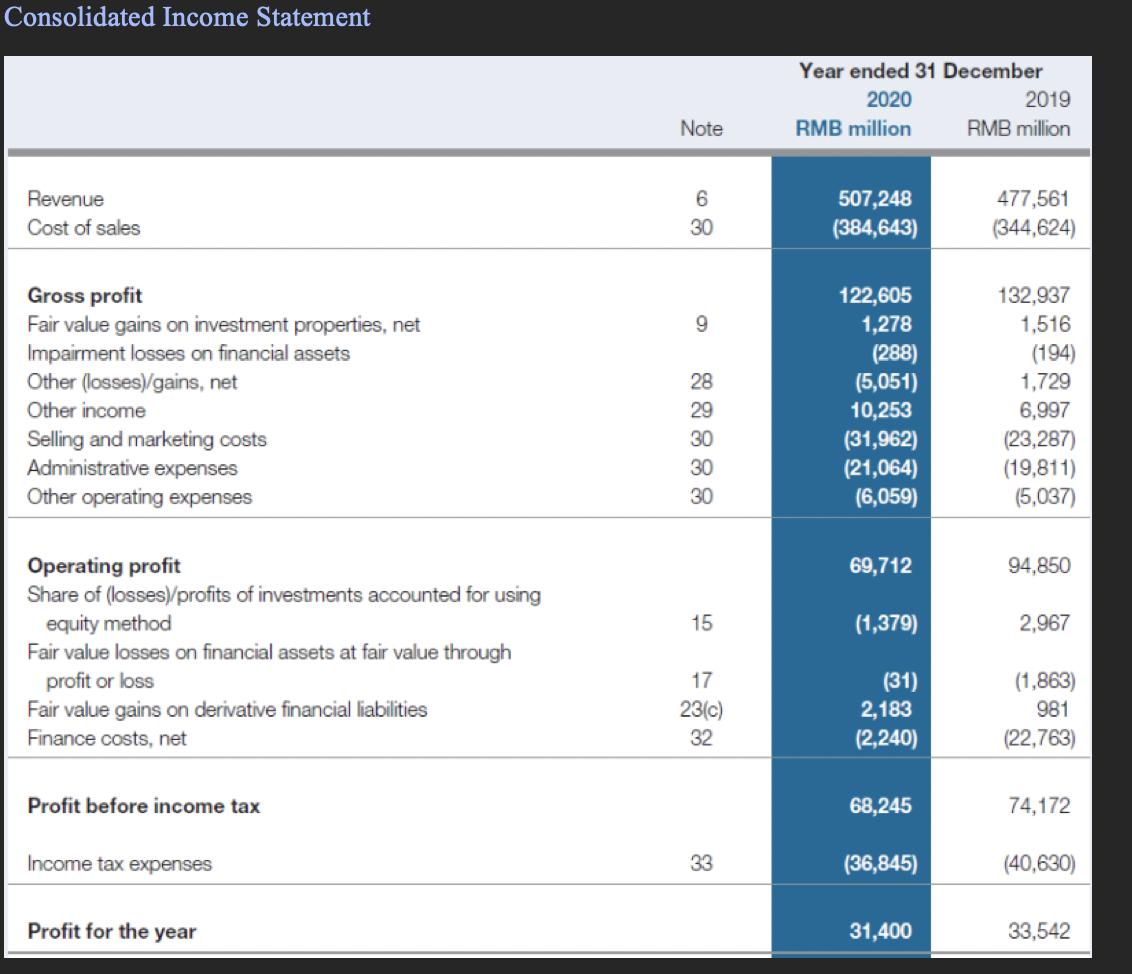

Consolidated Income Statement Year ended 31 December 2020 2019 Note RMB million RMB million Revenue 6. 507,248 477,561 Cost of sales 30 (384,643) (344,624) Gross profit Fair value gains on investment properties, net Impairment losses on financial assets Other (losses)/gains, net 122,605 1,278 132,937 9. 1,516 (194) (288) (5,051) 10,253 28 1,729 Other income 29 6,997 Selling and marketing costs Administrative expenses Other operating expenses 30 (23,287) (19,811) (5,037) (31,962) 30 (21,064) (6,059) 30 Operating profit Share of (losses)/profits of investments accounted for using equity method Fair value losses on financial assets at fair value through profit or loss Fair value gains on derivative financial liabilities 69,712 94,850 15 (1,379) 2,967 (1,863) 981 17 (31) 23(c) 2,183 Finance costs, net 32 (2,240) (22,763) Profit before income tax 68,245 74,172 Income tax expenses 33 (36,845) (40,630) Profit for the year 31,400 33,542

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 a current ratio Current Assets Current Liabilities 2020 1904934 1507253 12638 b current cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started