Question

Read the following case study about DRW Technologies, discuss, and answer the questions below. Please discuss your thoughts on the case study and answer the

Read the following case study about DRW Technologies, discuss, and answer the questions below.

Please discuss your thoughts on the case study and answer the following questions:

1) Explain the fact that no contracts have been submitted to Claiborne.

2) Assuming that the procurement managers are deliberately not following the policy, why would they ignore it?

3) Are there flaws in the policy leading to failure?

4) Is there anyone else at DRW who might bear some responsibility for the apparent failure of the policy?

5) What should Claiborne do now?

6) How might this situation have been avoided?

7) What solutions do you propose to this scenario?

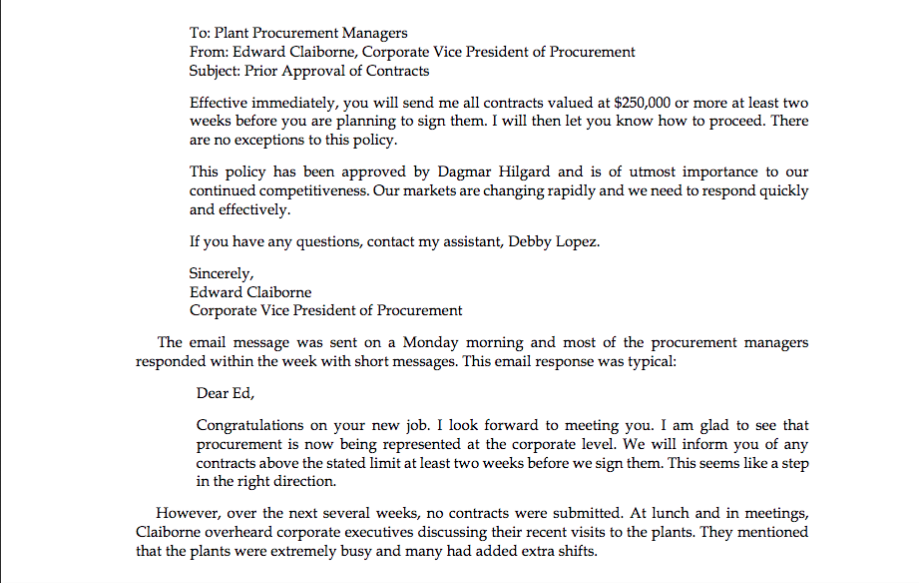

DRW Technologies DRW Technologies, a defense and aerospace company with 21 manufacturing plants in the U.S. Southeast, Midwest, and West Coast, made advanced electronic systems for the U.S. military and commercial aircraft manufacturers. The company had a reputation for innovation and was consistently profitable. However, an anticipated decline in the U.S. defense budget and increasing use of fixed-price contracts were forcing defense industry contractors to try to lower costs. In addition, some industry analysts were predicting a drop in demand in the commercial aviation market. Organization of DRW Technologies The corporate headquarters of DRW Technologies was responsible for strategy, human resources, corporate finance and accounting, marketing and sales, shareholder relations, legal services, and government and public relations. The plants operated with a high degree of autonomy: they had their own human resources and finance and accounting departments along with product development, procurement, and manufacturing. In addition to production contracted through corporate marketing and sales, the DRW plants produced rush or custom orders for high-priority customers such as the U.S. military's Special Operations Command. These orders, which represented approximately 10% of annual sales and had been trending upward, typically were not profitable, but plant management regarded them as a way to maintain strong relationships with loyal customers. In DRW Technologies' decentralized organization, each plant prepared an annual budget that was approved by corporate and included a target for contribution to the firm's profits. In the previous three years, several of the plants had missed their targets, in part because of costs the company had to absorb under fixed-price contracts. However, the general feeling among the plant executives was that temporary circumstances, predominantly external, had caused the shortfalls.

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution This is an unsymmetric astable multivi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started