Question

Read the following case study on TimberExcel and complete the table below the case study (30 marks) TimberExcel is a small stock market-listed Italian timber

Read the following case study on TimberExcel and complete the table below the case study (30 marks) TimberExcel is a small stock market-listed Italian timber merchant involved in forestry management, timber production, and the export of specialist woods used in the production of fine musical instruments so-called singing wood. The company, based in the mountains of Trentino in the North Italy, has a reputation as the worlds finest producer of woods for the production of concert-grade grand pianos. TimberExcel has a thirty-year contract to supply all the piano wood requirements for a leading manufacturer based in Japan, in addition to numerous small-scale contracts with master luthiers (someone who makes or repairs string instruments) around the world who specialize in producing high-quality hand-made classical stringed instruments from violins to double bass. The trees used in piano production take around sixty years to reach the required level of maturity, but the maple used for the backs of the stringed instruments takes much longer, and these trees are more susceptible to disease. This long lead time requires careful planning by the staff at TimberExcel, who face huge uncertainties about the long-term demand for such items. In addition, significant amounts of working capital are tied up in the forestry stocks because even once felled, the slow air-drying processes mean that wood cannot be sold for several years. There is also a high level of uncertainty within the companys current business environment. The primary geographic market for products is South East Asia, in the countries of Japan, Singapore, and China, but both the European and North American markets are in decline, except for cheap student-grade instruments that are now being produced in huge numbers under factory conditions in China. Chinese producers have also gained a foothold in the professional grade of instrument making, by sending staff over to train in the leading instrument-making schools of Europe, and then using these masters to train local staff back in China. The Chinese instruments are made using local, tropical woods rather than the spruce and maple commonly used in Europe, but the resulting instruments are highly rated by many professional players and are priced at less than half of their traditional equivalent. In contrast to the market for classical instruments, that for hand-made guitars is growing. In recognition of this, TimberExcel entered a joint venture arrangement in 2006 with a US-based company that supplies wood to North American luthiers. Under the terms of the joint venture agreement, in which costs, income, and profit are shared 50:50 between the two parties, TimberExcel takes responsibility for forestry management and felling, while the US party then stores, dries, prepares, and manages the sale and distribution of the wood. Due to different climatic conditions, the trees grown in the US are not the same as those in Italy, although maturity cycles are similar. The resulting tone wood is, however, very well suited to the US guitar market. Analysis of the accounts of TimberExcel for the last two years reveals the key statistics as shown in the chart.

All revenue from trade sales and transactions within mainland Europe are priced in euros, but sales to all other geographic areas are priced in local currencies. Contract prices are fixed on felling the selected trees an average of 24 months before delivery. It is common practice for luthiers to use their own experts to select trees while still growing, as the sound of the tree when knocked with a mallet indicates the quality of the core wood.

Complete the following table based on your assessment of the company 10 lines each tab

| Risk Identified | Effect on Financial Statements | Mitigation/Tools for Control |

|

|

|

|

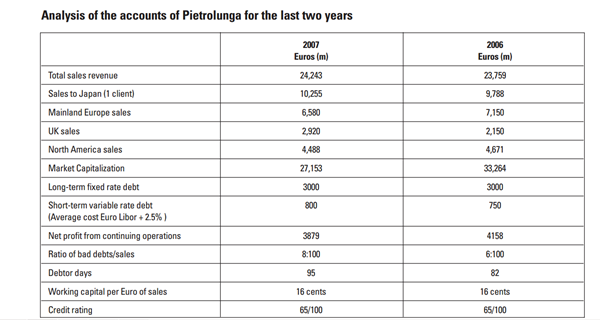

Analysis of the accounts of Pietrolunga for the last two years 2007 Euros (m) 2006 Euros (m) 24,243 23,759 10,255 9,788 6,580 2.920 7.150 2,150 4,671 27,153 33.264 3000 3000 Total sales revenue Sales to Japan (1 client) Mainland Europe sales UK sales North America sales Market Capitalization Long-term fixed rate debt Short-term variable rate debt Average cost Euro Libor + 25%) Net profit from continuing operations Ratio of bad debts/sales Debtor days Working capital per Euro of sales Credit rating 800 750 3879 4158 8:100 6:100 95 82 16 cents 16 cents 65/100 65/100 Analysis of the accounts of Pietrolunga for the last two years 2007 Euros (m) 2006 Euros (m) 24,243 23,759 10,255 9,788 6,580 2.920 7.150 2,150 4,671 27,153 33.264 3000 3000 Total sales revenue Sales to Japan (1 client) Mainland Europe sales UK sales North America sales Market Capitalization Long-term fixed rate debt Short-term variable rate debt Average cost Euro Libor + 25%) Net profit from continuing operations Ratio of bad debts/sales Debtor days Working capital per Euro of sales Credit rating 800 750 3879 4158 8:100 6:100 95 82 16 cents 16 cents 65/100 65/100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started