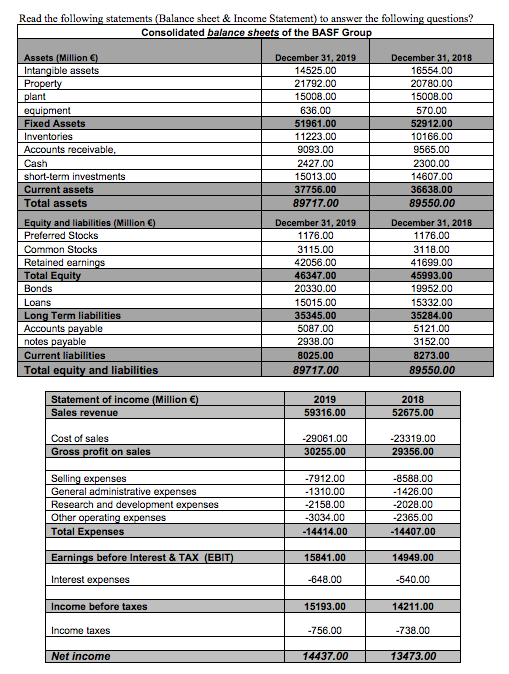

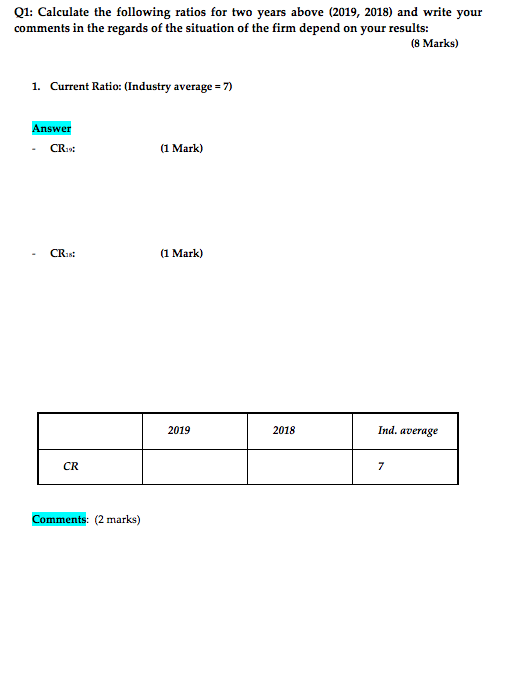

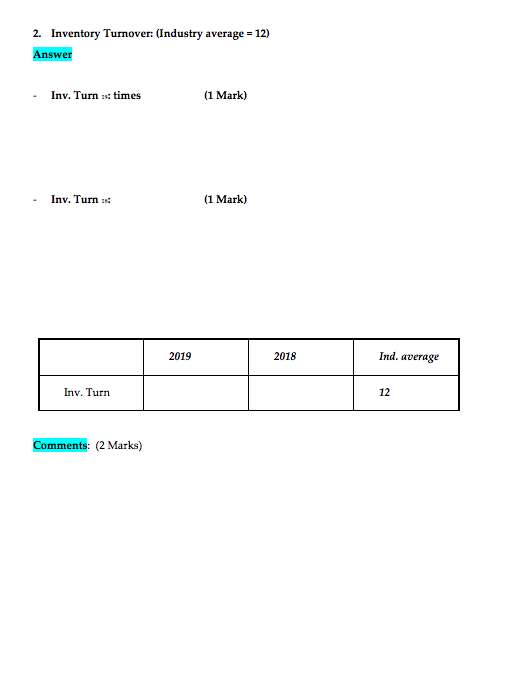

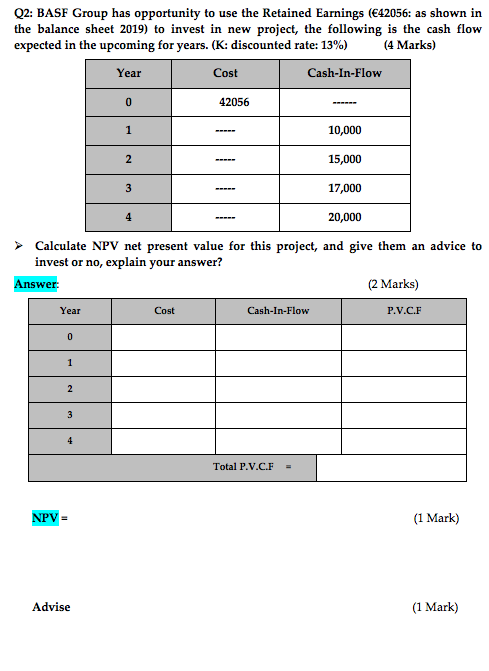

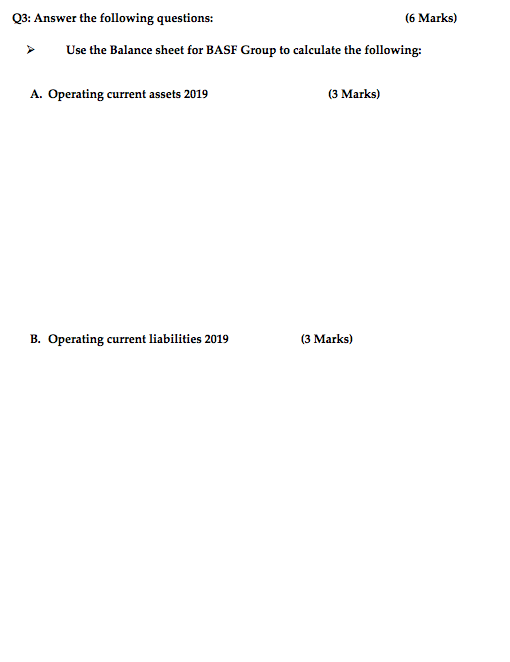

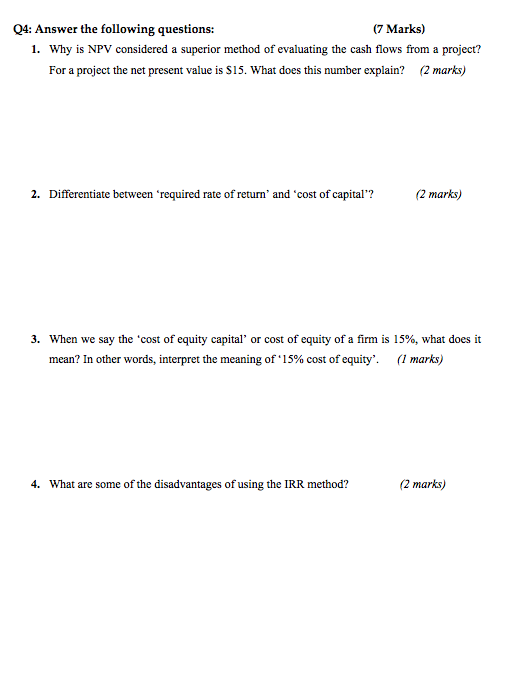

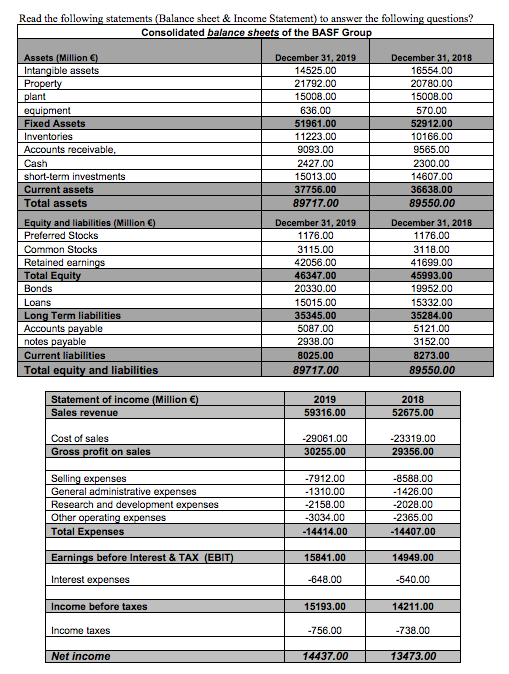

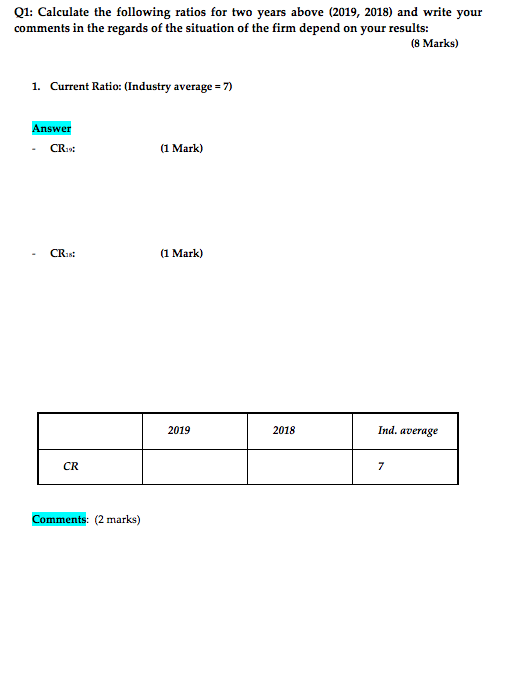

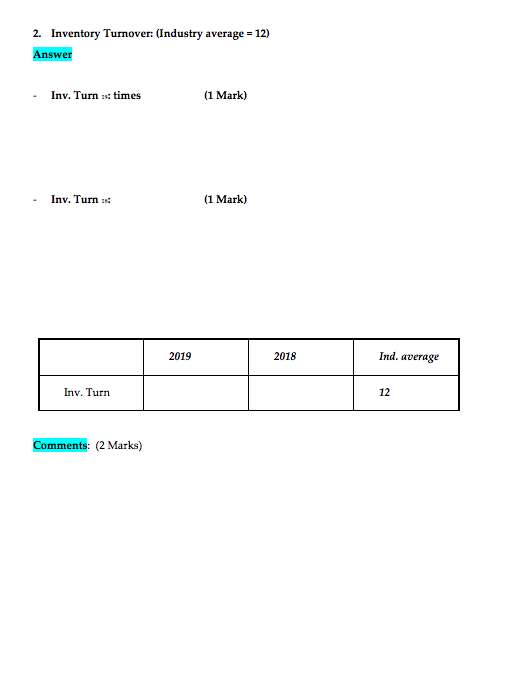

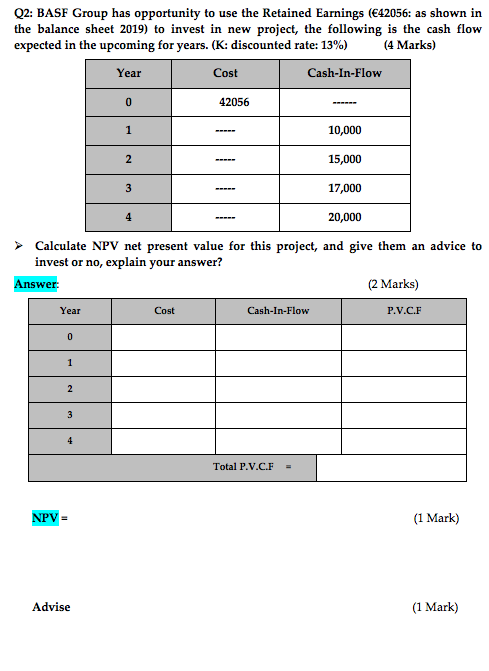

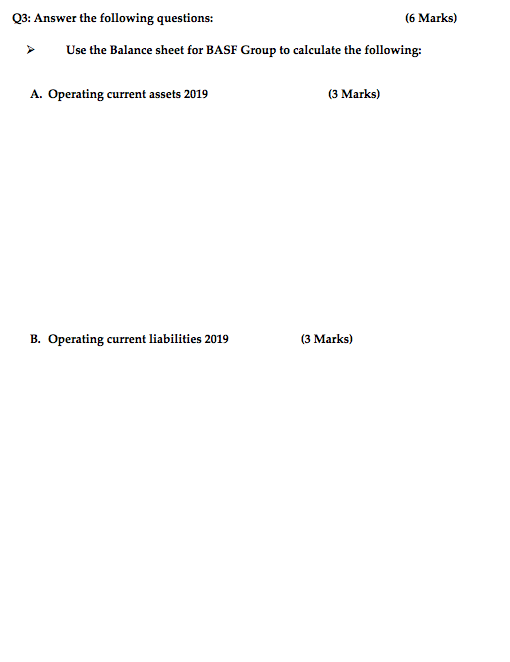

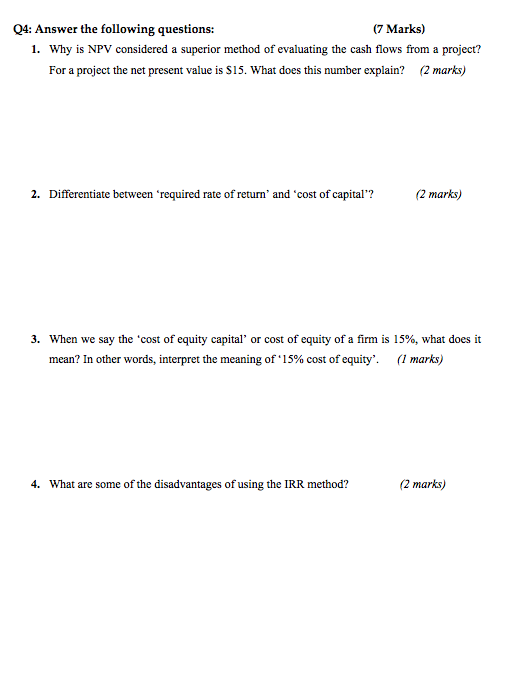

Read the following statements (Balance sheet & Income Statement) to answer the following questions? Consolidated balance sheets of the BASF Group December 31, 2018 16554.00 20780.00 15000.00 570.00 52912.00 10166.00 9565.00 2300.00 14607.00 36638.00 89550.00 Assets (Million Intangible assets Property plant equipment Fixed Assets Inventories Accounts receivable Cash short-term investments Current assets Total assets Equity and liabilities (Million ) Preferred Stocks Common Stocks Retained earnings Total Equity Bonds Loans Long Term liabilities Accounts payable notos payable Current liabilities Total equity and liabilities December 31, 2019 14525.00 21792.00 15008.00 636.00 51961.00 11223.00 9093.00 2427.00 15013.00 37756.00 89717.00 December 31, 2019 1176.00 3115.00 42056.00 46347.00 20330.00 15015.00 35345.00 5087.00 2938.00 8025 0 89717.00 Common Stocks December 31, 2018 1176.00 3118.00 41699.00 45993.00 19952.00 15332.00 35284.00 5121.00 3152.00 8273.00 89550.00 Statement of income (Million ) Sales revenue 2019 59316.00 2018 52675.00 Cost of sales Gross profit on sales -29061.00 30255.00 -23319.00 29356.00 Selling expenses General administrative expenses Research and development expenses Other operating expenses Total Expenses -7912.00 -1310.00 -2158.00 -3034.00 -14414.00 -8588.00 -1426.00 -2028.00 2365.00 -14407.00 Earnings before Interest & TAX (EBIT) 15841.00 14949.00 Interest expenses -648.00 Income before taxes 15193.00 14211.00 Income taxes -756.00 -738.00 Net income 14437.00 13473.00 Q1: Calculate the following ratios for two years above (2019, 2018) and write your comments in the regards of the situation of the firm depend on your results: (8 Marks) 1. Current Ratio: (Industry average = 7) Answer CR (1 Mark) CR (1 Mark) 2019 2018 Ind. average Comments: (2 marks) 2. Inventory Turnover: (Industry average = 12) Answer Inv. Turn times (1 Mark) Inv. Turn (1 Mark) 2019 2018 Ind. average Inv. Turn 12 Comments: (2 Marks) Q2: BASF Group has opportunity to use the Retained Earnings (42056: as shown in the balance sheet 2019) to invest in new project, the following is the cash flow expected in the upcoming for years. (K: discounted rate: 13%) (4 Marks) Year Cost Cash-In-Flow 42056 10,000 15,000 - 3 --- 17,000 20,000 Calculate NPV net present value for this project, and give them an advice to invest or no, explain your answer? Answer: (2 Marks) Year Cost Cash-In-Flow P.V.CF 0 Total P.V.C.F - NPV = (1 Mark) Advise (1 Mark) Q3: Answer the following questions: (6 Marks) > Use the Balance sheet for BASF Group to calculate the following: A. Operating current assets 2019 (3 Marks) B. Operating current liabilities 2019 (3 Marks) Q4: Answer the following questions: (7 Marks) 1. Why is NPV considered a superior method of evaluating the cash flows from a project? For a project the net present value is $15. What does this number explain? (2 marks) 2. Differentiate between 'required rate of return' and 'cost of capital'? (2 marks) 3. When we say the cost of equity capital' or cost of equity of a firm is 15%, what does it mean? In other words, interpret the meaning of '15% cost of equity' (1 marks) 4. What are some of the disadvantages of using the IRR method? (2 marks)