Read the Full Year Financial Results for 2019/20 and 2020/21. At the Group level, perform the following: (a) For each of the categories - Liquidity, Leverage, Asset Management Profitability and Valuation ratios, compute and compare financial ratios (excluding inventory turnover ratio) that are important to investors for both FY 2019/20 and FY 2020/21, then analyse the changes.

(Note: The item Trade Debtors is account receivables; The share price is $5.74 for 1st Mar 2020 and $5.55 for 1st Mar 2021. The total number of shares outstanding is 1,199,851,018 for 2020 and 2,977,543,504 for 2021.) (35 marks)

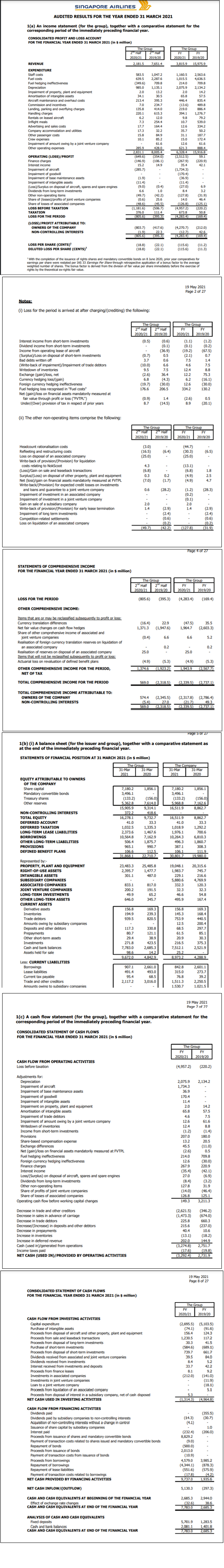

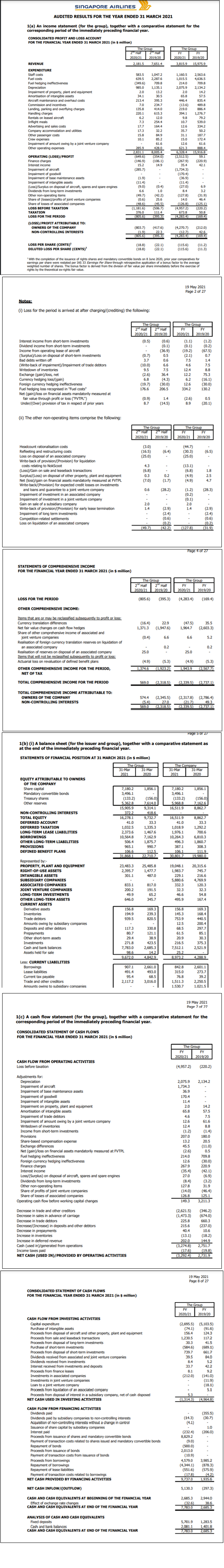

SINGAPORE AIRLINES AUDITED RESULTS FOR THE YEAR ENDED 31 MARCH 2021 1(a) An income statement (for the group), together with a comparative statement for the corresponding period of the immediately preceding financial year. CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group 2020/21 FY 2020/21 3,815.9 FY 2019/20 201920 7,651.4 2,181.5 15.975.9 REVENUE EXPENDITURE Staff costs Fuel costs Fuel hedging ineffectiveness Depreciation Impairment of property, plant and equipment Amortisation of intangible assets Aircraft maintenance and overhaul costs Commission and incentives Landing, parking and overflying charges Handling charges Rentals on leased aircraft Inflight meals Advertising and sales costs Company accommodation and utilities Other passenger costs Crew expenses Impairment of amount owing by a joint venture company Other operating expenses 583.5 639.5 (349.6) 985.0 2.0 34.1 213.4 7.0 135.8 220.1 6.2 7.3 17.7 17.3 15.8 10.1 1,047.2 2,287.6 709.8 1,135.1 13.2 30.5 395.3 234.7 414.0 615.3 12.0 254.4 164.4 32.2 84.9 85.2 61.6 428.0 8,005.4 (354.0) (106.1) 14.9 1,160.5 1,015.5 214.0 2,075.9 2.0 65.8 446.4 (13.6) 219.0 394.1 9.8 10.7 12.6 35.7 31.1 15.0 12.6 621.3 6,328.4 (2,512.5) (267.9) 35.4 (1,734.3) (170.4) (36.9) (11.4) (27.0) 8.4 (127.8) 14.0 (126.8) (4,957.2) 673.8 1.283.9 2,563.6 4,636.5 209.8 2,134.2 14.2 57.5 835.4 489.8 886.4 1,276,7 79.2 539.0 334.2 50.2 187.7 172.4 61.6 888.4 15,916.8 59.1 (220.9) 42.1 285.9 2,831.1 (649.6) (146.9) 15.2 (285.7) OPERATING (LOSS)/PROFIT Finance charges Interest income Impairment of aircraft Impairment of goodwill Impairment of base maintenance assets Impairment of intangible assets (Loss/Surplus on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of (losses)/profits of joint venture companies Share of losses of associated companies LOSS BEFORE TAXATION TAXATION LOSS FOR THE PERIOD (LOSS)/PROFIT ATTRIBUTABLE TO: OWNERS OF THE COMPANY NON-CONTROLLING INTERESTS (1.9) (11.4) (9.0) 6.6 (49.7) (0.6) (48.6) (1,181.6) 376.0 (805.6 (0.4) 1.0 (42.2) 25.6 (45.5) (506.7) 111.4 (2953) 6.9 3.2 (31.9) 46.4 (125.1) (220.2) 50.8 1697 (803.7) (1.9 (805.6 (4176) 22.3 (395.3) (4.270.7) (12.7) (212.0) 42.6 (1694) LOSS PER SHARE (CENTS) DILUTED LOSS PER SHARE (CENTS)' (18.8) (18.8) (22.1) (22.1) (1156) (115.6) (11.2) (11.3) With the completion of the issuance of rights shares and mandatory convertible bonds on 8 June 2020, prior year comparatives for earnings per share were restated per IAS 33 Earnings Per Share through retrospective application of a bonus factor to the average rights by the theoretical ex-rights of shares. The bonus factor is derived from the division of fair value per share immediately before the exercise of s fair value. 19 May 2021 Page 2 of 27 Notes: Loss for the period is arrived at after charging/(crediting) the following: Interest income from short-term investments Dividend income from short-term investments Income from operating lease of aircraft (Surplus/Loss on disposal of short-term investments Bad debts written off (Write-back of impairment)/Impairment of trade debtors Writedown of inventories Exchange (gain)/loss, net Currency hedging loss/(gain) Foreign currency hedging ineffectiveness Fuel hedging loss recognised in "Fuel costs" Net (gain)/loss on financial assets mandatorily measured at fair value through profit or loss ("FVTPL") Under/Over) provision of tax in respect of prior years The Group 2 Half 2 Half 2020/21 2019/20 (0.5) (0.6) (0.1) (36.9) (0.7) 0.5 3.7 0.6 (10.0) 6.6 9.5 7.5 (2.6) 36.4 6.8 (4.3) (19.7) (30.0) 176.6 206.5 The Group FY FY 2020/21 2019/20 (1.1) (1.2) (0.1) (0.2) (19.2) (67.5) (2.1) 0.7 7.5 1.4 4.6 7.5 12.4 8.8 12.2 75.3 6.2 (16.1) 12.6 (30.0) 334.2 130.2 (0.9) 8.7 1.4 (14.5) (2.6) 8.9 0.5 (20.1) (ii) The other non-operating items comprise the following: The Group 2 Half 2 Half The Group FY FY 2020/21 2019/20 2020/21 2019/20 (3.0) (16.5) (25.0) (6.4) (44.7) (30.3) (25.0) (6.5) 4.3 (6.8) 0.3 (7.0) : (13.1) (6.8) (4.9) (4.9) 0.2 (1.7) 1.8 2.5 4.7 Headcount rationalisation costs Refleeting and restructuring costs Loss on disposal of an associated company Write-back of provision/(Provision) for liquidation costs relating to NokScoot (Loss)/Gain on sale and leaseback transactions Surplus/(Loss) on disposal of other property, plant and equipment Net (loss)/gain on financial assets mandatorily measured at PVTPL Write-back/(Provision) for expected credit losses on investments and loans and guarantee to a joint venture company Impairment of investment in an associated company Impairment of investment in a joint venture company Gain on sale of a subsidiary company Write-back of provision/(Provision) for early lease termination Impairment of long term investments Competition-related settlements Loss on liquidation of an associated company 0.6 (28.2) (28.3) (1.2) (0.2) (0.1) 2.0 1.4 - 2.0 1.4 - (2.9) (2.4) (0.6) (0.2) (42.2) (2.9) (2.4) (0.6) (0.2) (31.9) (49.7) (1278) Page 4 of 27 STATEMENTS OF COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group 2 Half 2 Half 2020/21 2019/20 The Group FY FY 2020/21 2019 20 LOSS FOR THE PERIOD (805.6) (395.3) (4,283.4) (169.4) OTHER COMPREHENSIVE INCOME: (16.4) 1,371.3 22.9 (1,947.6) (47.5) 1,964.7 35.5 (2,603.3) (0.4) 6.6 6.6 5.2. Items that are or may be reclassified subsequently to profit or loss: Currency translation differences Net fair value changes on cash flow hedges Share of other comprehensive income of associated and joint venture companies Realisation of foreign currency translation reserves on liquidation of an associated company Realisation of reserves on disposal of an associated company Items that will not be reclassified subsequently to profit or loss: Actuarial loss on revaluation of defined benefit plans OTHER COMPREHENSIVE INCOME FOR THE PERIOD, NET OF TAX 0.2 0.2 25.0 25.0 (4.9) (5.3) (4.9) (5.3) 1,374.6 (1.923.2) 1,943.9 (2.5677) TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 569.0 (2,318.5) (2.339.5) (2.737.1) TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO: OWNERS OF THE COMPANY NON-CONTROLLING INTERESTS 574.4 (5.4) 569.0 (2,345.5) 27.0 (385) (2,317.8) (2,786.4) (21.7) 49.3 12,339.5 (2.737,1) Page 5 or 27 1(b) (0) A balance sheet (for the issuer and group), together with a comparative statement as at the end of the immediately preceding financial year. The Company 31-Mar 2021 2020 31-Mar 1,856.1 7,180.2 3,496.1 (133.2) 5.968.8 16,511.9 (156.0) 7,162,6 8,862.7 7,162.9 16,511.9 41.0 1,018.9 1,976.1 10,264.3 496.3 387.1 106.1 30.801.7 8,862.7 33.3 1,292.2 700.6 6,810.3 1,860.7 308.3 111.9 19.980.0 112.5 STATEMENTS OF FINANCIAL POSITION AT 31 MARCH 2021 (in $ million) The Group 31-Mar 31-Mar 2021 2020 EQUITY ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital 7,180.2 1,856.1 Mandatory convertible bonds 3,496.1 Treasury shares (133.2) (156.0) Other reserves 5.3628 7,614.0 15,905.9 9,314.1 NON-CONTROLLING INTERESTS 372.2 418.6 TOTAL EQUITY 16,278.1 9,732.7 DEFERRED ACCOUNT 41.0 33.3 DEFERRED TAXATION 1,032.5 1,335.3 LONG-TERM LEASE LIABILITIES 2,373.6 1,467.6 BORROWINGS 10,564.8 OTHER LONG-TERM LIABILITIES 506.4 1,875.7 PROVISIONS 965.1 990.7 DEFINED BENEFIT PLANS 106.6 31.868.1 22.710.7 Represented by:- PROPERTY, PLANT AND EQUIPMENT 23,483.3 25,485.8 RIGHT-OF-USE ASSETS 2,395.7 1,477.7 INTANGIBLE ASSETS 301.1 487.0 SUBSIDIARY COMPANIES ASSOCIATED COMPANIES 833.1 817.0 JOINT VENTURE COMPANIES 200.2 191.5 LONG-TERM INVESTMENTS 49.9 65.2 OTHER LONG-TERM ASSETS 646.0 345.7 CURRENT ASSETS Derivative assets 156.8 169.3 Inventories 194.9 239.3 Trade debtors 939.5 820.5 Amounts owing by subsidiary companies Deposits and other debtors 117.3 330.8 Prepayments 80.7 121.1 Other short-term assets 29.4 38.9 Investments 271.8 423.5 Cash and bank balances 7,783.0 2,685.3 Assets held for sale 98.6 14,2 9672.0 4.842.9 Less: CURRENT LIABILITIES Borrowings 907.1 2,661.0 Lease liabilities 491.4 493.0 Current tax payable 95.4 68.5 Trade and other creditors 2,117.2 3,016.0 Amounts owing to subsidiary companies 19,048.1 1,983.7 229.1 5,880.6 332.3 32.3 46.6 495.9 20,315.6 745.7 216.6 4,769.9 120.3 32.3 54.8 167.4 156.8 145.3 753.9 12.5 68.5 61.5 20.9 216.5 7,512.1 25.2 8,973.2 169.3 168.4 440.5 200.4 297.7 85.1 30.3 375.3 2,521.9 4,288.9 842.8 315.0 76.8 1,511.3 1.530.7 2,601.1 273.7 39.2 2,250.5 1.021.5 19 May 2021 Page 7 of 27 1(c) A cash flow statement (for the group), together with a comparative statement for the corresponding period of the immediately preceding financial year. CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group FY FY 2020/21 2019/20 CASH FLOW FROM OPERATING ACTIVITIES Loss before taxation (4,957.2) (220.2) 2,134.2 Adjustments for: Depreciation Impairment of aircraft Impairment of base maintenance assets Impairment of goodwill Impairment of intangible assets Impairment on property, plant and equipment Amortisation of intangible assets Impairment of trade debtors Impairment of amount owing by a joint venture company Writedown of inventories Income from short-term investments Provisions Share-based compensation expense Exchange differences Net (gain)/loss on financial assets mandatorily measured at FVTPL Fuel hedging ineffectiveness Foreign currency hedging ineffectiveness Finance charges Interest income Loss/(Surplus) on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of profits of joint venture companies Share of losses of associated companies Operating cash flow before working capital changes 2,075.9 1,734.3 36.9 170.4 11.4 2.0 65.8 4.6 12.6 12.4 (1.2) 207.0 13.2 45.5 (2.6) 214.0 12.6 267.9 (35.4) 27.0 (8.4) 127.8 (14.0) 126.8 149.3 14.2 57,5 7.5 61.6 8.8 (1.4) 180.0 20.5 (11.0) 0.5 709.8 (30.0) 220.9 (42.1) (6.9) (3.2) 31.9 (46.4) 125.1 3,211.3 Decrease in trade and other creditors Decrease in sales in advance of carriage Decrease in trade debtors Decrease/(Increase) in deposits and other debtors Decrease in prepayments Increase in inventories Increase in deferred revenue Cash (used in)/generated from operations Income taxes paid NET CASH (USED IN)/PROVIDED BY OPERATING ACTIVITIES (2,621.5 (1,473.3) 225.8 215.6 40.4 (13.1) 202.0 (3,274.8) (17.6) (3,292.4 (346.2) (674.0) 660.3 (237.0) 10.6 (18.2) 144.9 2,751.7 (19.8) 2,731.9 19 May 2021 Page 8 of 27 CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group FY 2020/21 2019/20 (689.1) CASH FLOW FROM INVESTING ACTIVITIES Capital expenditure Purchase of intangible assets Proceeds from disposal of aircraft and other property, plant and equipment Proceeds from sale and leaseback transactions Proceeds from disposal of long-term investments Purchase of short-term investments Proceeds from disposal of short-term investments Dividends received from associated and joint venture companies Dividends received from investments Interest received from investments and Proceeds from finance leases Investments in associated companies Investments in joint venture companies Loan to a joint venture company Proceeds from liquidation of an associated company Proceeds from disposal of interest in a subsidiary company, net of cash disposed NET CASH USED IN INVESTING ACTIVITIES (2,695.5) (5,103.5) (74.1) (91.6) 156.4 124.3 1,230.5 117.2 30.3 41.5 (584.6) 739.7 661.7 39.5 84.0 8.4 5.2 33.7 42.2 8.1 9.2 (212.0) (141.0) (11.9) (18.1) 5.1 5. (1,314,3 (4.964,8 (355.5) (30.7) (14.3) (4.1) 1.0 (206.0) (232.4) 8,829.2 (9.0) (500.0) CASH FLOW FROM FINANCING ACTIVITIES Dividends paid Dividends paid by subsidiary companies to non-controlling interests Acquisition of non-controlling interests without a change in control Issuance of share capital by subsidiary companies Interest paid Proceeds from issuance of shares and mandatory convertible bonds Payment of transaction costs related to shares issued and mandatory convertible bonds Repayment of bonds Proceeds from issuance of bonds Payment of transaction costs from issuance of bonds Proceeds from borrowings Repayment of borrowings Repayment of lease liabilities Payment of transaction costs related borrowings NET CASH PROVIDED BY FINANCING ACTIVITIES NET CASH INFLOW/COUTFLOW) 2,013.0 3,9852 (878.3) (10.9) 4,579.0 (4,344.1) (551.6) (17.8) 9,737.0 (575.9) (4.2) 1935.6 5,130.3 (297.3) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE FINANCIAL YEAR Effect of exchange rate changes CASH AND CASH EQUIVALENTS AT END OF THE FINANCIAL YEAR 2,6185.3 (326) 1,783.0 2,944.0 38.6 2,685.3 ANALYSIS OF CASH AND CASH EQUIVALENTS Fixed deposits Cash and bank balances CASH AND CASH EQUIVALENTS AT END OF THE FINANCIAL YEAR 5,701.9 2,0181.1 7,783.0 1,283. 1,401.8 2,68583 SINGAPORE AIRLINES AUDITED RESULTS FOR THE YEAR ENDED 31 MARCH 2021 1(a) An income statement (for the group), together with a comparative statement for the corresponding period of the immediately preceding financial year. CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group 2020/21 FY 2020/21 3,815.9 FY 2019/20 201920 7,651.4 2,181.5 15.975.9 REVENUE EXPENDITURE Staff costs Fuel costs Fuel hedging ineffectiveness Depreciation Impairment of property, plant and equipment Amortisation of intangible assets Aircraft maintenance and overhaul costs Commission and incentives Landing, parking and overflying charges Handling charges Rentals on leased aircraft Inflight meals Advertising and sales costs Company accommodation and utilities Other passenger costs Crew expenses Impairment of amount owing by a joint venture company Other operating expenses 583.5 639.5 (349.6) 985.0 2.0 34.1 213.4 7.0 135.8 220.1 6.2 7.3 17.7 17.3 15.8 10.1 1,047.2 2,287.6 709.8 1,135.1 13.2 30.5 395.3 234.7 414.0 615.3 12.0 254.4 164.4 32.2 84.9 85.2 61.6 428.0 8,005.4 (354.0) (106.1) 14.9 1,160.5 1,015.5 214.0 2,075.9 2.0 65.8 446.4 (13.6) 219.0 394.1 9.8 10.7 12.6 35.7 31.1 15.0 12.6 621.3 6,328.4 (2,512.5) (267.9) 35.4 (1,734.3) (170.4) (36.9) (11.4) (27.0) 8.4 (127.8) 14.0 (126.8) (4,957.2) 673.8 1.283.9 2,563.6 4,636.5 209.8 2,134.2 14.2 57.5 835.4 489.8 886.4 1,276,7 79.2 539.0 334.2 50.2 187.7 172.4 61.6 888.4 15,916.8 59.1 (220.9) 42.1 285.9 2,831.1 (649.6) (146.9) 15.2 (285.7) OPERATING (LOSS)/PROFIT Finance charges Interest income Impairment of aircraft Impairment of goodwill Impairment of base maintenance assets Impairment of intangible assets (Loss/Surplus on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of (losses)/profits of joint venture companies Share of losses of associated companies LOSS BEFORE TAXATION TAXATION LOSS FOR THE PERIOD (LOSS)/PROFIT ATTRIBUTABLE TO: OWNERS OF THE COMPANY NON-CONTROLLING INTERESTS (1.9) (11.4) (9.0) 6.6 (49.7) (0.6) (48.6) (1,181.6) 376.0 (805.6 (0.4) 1.0 (42.2) 25.6 (45.5) (506.7) 111.4 (2953) 6.9 3.2 (31.9) 46.4 (125.1) (220.2) 50.8 1697 (803.7) (1.9 (805.6 (4176) 22.3 (395.3) (4.270.7) (12.7) (212.0) 42.6 (1694) LOSS PER SHARE (CENTS) DILUTED LOSS PER SHARE (CENTS)' (18.8) (18.8) (22.1) (22.1) (1156) (115.6) (11.2) (11.3) With the completion of the issuance of rights shares and mandatory convertible bonds on 8 June 2020, prior year comparatives for earnings per share were restated per IAS 33 Earnings Per Share through retrospective application of a bonus factor to the average rights by the theoretical ex-rights of shares. The bonus factor is derived from the division of fair value per share immediately before the exercise of s fair value. 19 May 2021 Page 2 of 27 Notes: Loss for the period is arrived at after charging/(crediting) the following: Interest income from short-term investments Dividend income from short-term investments Income from operating lease of aircraft (Surplus/Loss on disposal of short-term investments Bad debts written off (Write-back of impairment)/Impairment of trade debtors Writedown of inventories Exchange (gain)/loss, net Currency hedging loss/(gain) Foreign currency hedging ineffectiveness Fuel hedging loss recognised in "Fuel costs" Net (gain)/loss on financial assets mandatorily measured at fair value through profit or loss ("FVTPL") Under/Over) provision of tax in respect of prior years The Group 2 Half 2 Half 2020/21 2019/20 (0.5) (0.6) (0.1) (36.9) (0.7) 0.5 3.7 0.6 (10.0) 6.6 9.5 7.5 (2.6) 36.4 6.8 (4.3) (19.7) (30.0) 176.6 206.5 The Group FY FY 2020/21 2019/20 (1.1) (1.2) (0.1) (0.2) (19.2) (67.5) (2.1) 0.7 7.5 1.4 4.6 7.5 12.4 8.8 12.2 75.3 6.2 (16.1) 12.6 (30.0) 334.2 130.2 (0.9) 8.7 1.4 (14.5) (2.6) 8.9 0.5 (20.1) (ii) The other non-operating items comprise the following: The Group 2 Half 2 Half The Group FY FY 2020/21 2019/20 2020/21 2019/20 (3.0) (16.5) (25.0) (6.4) (44.7) (30.3) (25.0) (6.5) 4.3 (6.8) 0.3 (7.0) : (13.1) (6.8) (4.9) (4.9) 0.2 (1.7) 1.8 2.5 4.7 Headcount rationalisation costs Refleeting and restructuring costs Loss on disposal of an associated company Write-back of provision/(Provision) for liquidation costs relating to NokScoot (Loss)/Gain on sale and leaseback transactions Surplus/(Loss) on disposal of other property, plant and equipment Net (loss)/gain on financial assets mandatorily measured at PVTPL Write-back/(Provision) for expected credit losses on investments and loans and guarantee to a joint venture company Impairment of investment in an associated company Impairment of investment in a joint venture company Gain on sale of a subsidiary company Write-back of provision/(Provision) for early lease termination Impairment of long term investments Competition-related settlements Loss on liquidation of an associated company 0.6 (28.2) (28.3) (1.2) (0.2) (0.1) 2.0 1.4 - 2.0 1.4 - (2.9) (2.4) (0.6) (0.2) (42.2) (2.9) (2.4) (0.6) (0.2) (31.9) (49.7) (1278) Page 4 of 27 STATEMENTS OF COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group 2 Half 2 Half 2020/21 2019/20 The Group FY FY 2020/21 2019 20 LOSS FOR THE PERIOD (805.6) (395.3) (4,283.4) (169.4) OTHER COMPREHENSIVE INCOME: (16.4) 1,371.3 22.9 (1,947.6) (47.5) 1,964.7 35.5 (2,603.3) (0.4) 6.6 6.6 5.2. Items that are or may be reclassified subsequently to profit or loss: Currency translation differences Net fair value changes on cash flow hedges Share of other comprehensive income of associated and joint venture companies Realisation of foreign currency translation reserves on liquidation of an associated company Realisation of reserves on disposal of an associated company Items that will not be reclassified subsequently to profit or loss: Actuarial loss on revaluation of defined benefit plans OTHER COMPREHENSIVE INCOME FOR THE PERIOD, NET OF TAX 0.2 0.2 25.0 25.0 (4.9) (5.3) (4.9) (5.3) 1,374.6 (1.923.2) 1,943.9 (2.5677) TOTAL COMPREHENSIVE INCOME FOR THE PERIOD 569.0 (2,318.5) (2.339.5) (2.737.1) TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO: OWNERS OF THE COMPANY NON-CONTROLLING INTERESTS 574.4 (5.4) 569.0 (2,345.5) 27.0 (385) (2,317.8) (2,786.4) (21.7) 49.3 12,339.5 (2.737,1) Page 5 or 27 1(b) (0) A balance sheet (for the issuer and group), together with a comparative statement as at the end of the immediately preceding financial year. The Company 31-Mar 2021 2020 31-Mar 1,856.1 7,180.2 3,496.1 (133.2) 5.968.8 16,511.9 (156.0) 7,162,6 8,862.7 7,162.9 16,511.9 41.0 1,018.9 1,976.1 10,264.3 496.3 387.1 106.1 30.801.7 8,862.7 33.3 1,292.2 700.6 6,810.3 1,860.7 308.3 111.9 19.980.0 112.5 STATEMENTS OF FINANCIAL POSITION AT 31 MARCH 2021 (in $ million) The Group 31-Mar 31-Mar 2021 2020 EQUITY ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital 7,180.2 1,856.1 Mandatory convertible bonds 3,496.1 Treasury shares (133.2) (156.0) Other reserves 5.3628 7,614.0 15,905.9 9,314.1 NON-CONTROLLING INTERESTS 372.2 418.6 TOTAL EQUITY 16,278.1 9,732.7 DEFERRED ACCOUNT 41.0 33.3 DEFERRED TAXATION 1,032.5 1,335.3 LONG-TERM LEASE LIABILITIES 2,373.6 1,467.6 BORROWINGS 10,564.8 OTHER LONG-TERM LIABILITIES 506.4 1,875.7 PROVISIONS 965.1 990.7 DEFINED BENEFIT PLANS 106.6 31.868.1 22.710.7 Represented by:- PROPERTY, PLANT AND EQUIPMENT 23,483.3 25,485.8 RIGHT-OF-USE ASSETS 2,395.7 1,477.7 INTANGIBLE ASSETS 301.1 487.0 SUBSIDIARY COMPANIES ASSOCIATED COMPANIES 833.1 817.0 JOINT VENTURE COMPANIES 200.2 191.5 LONG-TERM INVESTMENTS 49.9 65.2 OTHER LONG-TERM ASSETS 646.0 345.7 CURRENT ASSETS Derivative assets 156.8 169.3 Inventories 194.9 239.3 Trade debtors 939.5 820.5 Amounts owing by subsidiary companies Deposits and other debtors 117.3 330.8 Prepayments 80.7 121.1 Other short-term assets 29.4 38.9 Investments 271.8 423.5 Cash and bank balances 7,783.0 2,685.3 Assets held for sale 98.6 14,2 9672.0 4.842.9 Less: CURRENT LIABILITIES Borrowings 907.1 2,661.0 Lease liabilities 491.4 493.0 Current tax payable 95.4 68.5 Trade and other creditors 2,117.2 3,016.0 Amounts owing to subsidiary companies 19,048.1 1,983.7 229.1 5,880.6 332.3 32.3 46.6 495.9 20,315.6 745.7 216.6 4,769.9 120.3 32.3 54.8 167.4 156.8 145.3 753.9 12.5 68.5 61.5 20.9 216.5 7,512.1 25.2 8,973.2 169.3 168.4 440.5 200.4 297.7 85.1 30.3 375.3 2,521.9 4,288.9 842.8 315.0 76.8 1,511.3 1.530.7 2,601.1 273.7 39.2 2,250.5 1.021.5 19 May 2021 Page 7 of 27 1(c) A cash flow statement (for the group), together with a comparative statement for the corresponding period of the immediately preceding financial year. CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group FY FY 2020/21 2019/20 CASH FLOW FROM OPERATING ACTIVITIES Loss before taxation (4,957.2) (220.2) 2,134.2 Adjustments for: Depreciation Impairment of aircraft Impairment of base maintenance assets Impairment of goodwill Impairment of intangible assets Impairment on property, plant and equipment Amortisation of intangible assets Impairment of trade debtors Impairment of amount owing by a joint venture company Writedown of inventories Income from short-term investments Provisions Share-based compensation expense Exchange differences Net (gain)/loss on financial assets mandatorily measured at FVTPL Fuel hedging ineffectiveness Foreign currency hedging ineffectiveness Finance charges Interest income Loss/(Surplus) on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of profits of joint venture companies Share of losses of associated companies Operating cash flow before working capital changes 2,075.9 1,734.3 36.9 170.4 11.4 2.0 65.8 4.6 12.6 12.4 (1.2) 207.0 13.2 45.5 (2.6) 214.0 12.6 267.9 (35.4) 27.0 (8.4) 127.8 (14.0) 126.8 149.3 14.2 57,5 7.5 61.6 8.8 (1.4) 180.0 20.5 (11.0) 0.5 709.8 (30.0) 220.9 (42.1) (6.9) (3.2) 31.9 (46.4) 125.1 3,211.3 Decrease in trade and other creditors Decrease in sales in advance of carriage Decrease in trade debtors Decrease/(Increase) in deposits and other debtors Decrease in prepayments Increase in inventories Increase in deferred revenue Cash (used in)/generated from operations Income taxes paid NET CASH (USED IN)/PROVIDED BY OPERATING ACTIVITIES (2,621.5 (1,473.3) 225.8 215.6 40.4 (13.1) 202.0 (3,274.8) (17.6) (3,292.4 (346.2) (674.0) 660.3 (237.0) 10.6 (18.2) 144.9 2,751.7 (19.8) 2,731.9 19 May 2021 Page 8 of 27 CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE FINANCIAL YEAR ENDED 31 MARCH 2021 (in $ million) The Group FY 2020/21 2019/20 (689.1) CASH FLOW FROM INVESTING ACTIVITIES Capital expenditure Purchase of intangible assets Proceeds from disposal of aircraft and other property, plant and equipment Proceeds from sale and leaseback transactions Proceeds from disposal of long-term investments Purchase of short-term investments Proceeds from disposal of short-term investments Dividends received from associated and joint venture companies Dividends received from investments Interest received from investments and Proceeds from finance leases Investments in associated companies Investments in joint venture companies Loan to a joint venture company Proceeds from liquidation of an associated company Proceeds from disposal of interest in a subsidiary company, net of cash disposed NET CASH USED IN INVESTING ACTIVITIES (2,695.5) (5,103.5) (74.1) (91.6) 156.4 124.3 1,230.5 117.2 30.3 41.5 (584.6) 739.7 661.7 39.5 84.0 8.4 5.2 33.7 42.2 8.1 9.2 (212.0) (141.0) (11.9) (18.1) 5.1 5. (1,314,3 (4.964,8 (355.5) (30.7) (14.3) (4.1) 1.0 (206.0) (232.4) 8,829.2 (9.0) (500.0) CASH FLOW FROM FINANCING ACTIVITIES Dividends paid Dividends paid by subsidiary companies to non-controlling interests Acquisition of non-controlling interests without a change in control Issuance of share capital by subsidiary companies Interest paid Proceeds from issuance of shares and mandatory convertible bonds Payment of transaction costs related to shares issued and mandatory convertible bonds Repayment of bonds Proceeds from issuance of bonds Payment of transaction costs from issuance of bonds Proceeds from borrowings Repayment of borrowings Repayment of lease liabilities Payment of transaction costs related borrowings NET CASH PROVIDED BY FINANCING ACTIVITIES NET CASH INFLOW/COUTFLOW) 2,013.0 3,9852 (878.3) (10.9) 4,579.0 (4,344.1) (551.6) (17.8) 9,737.0 (575.9) (4.2) 1935.6 5,130.3 (297.3) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE FINANCIAL YEAR Effect of exchange rate changes CASH AND CASH EQUIVALENTS AT END OF THE FINANCIAL YEAR 2,6185.3 (326) 1,783.0 2,944.0 38.6 2,685.3 ANALYSIS OF CASH AND CASH EQUIVALENTS Fixed deposits Cash and bank balances CASH AND CASH EQUIVALENTS AT END OF THE FINANCIAL YEAR 5,701.9 2,0181.1 7,783.0 1,283. 1,401.8 2,68583