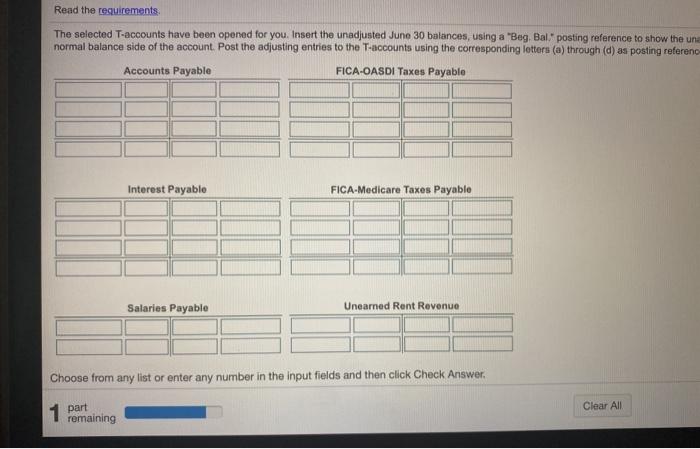

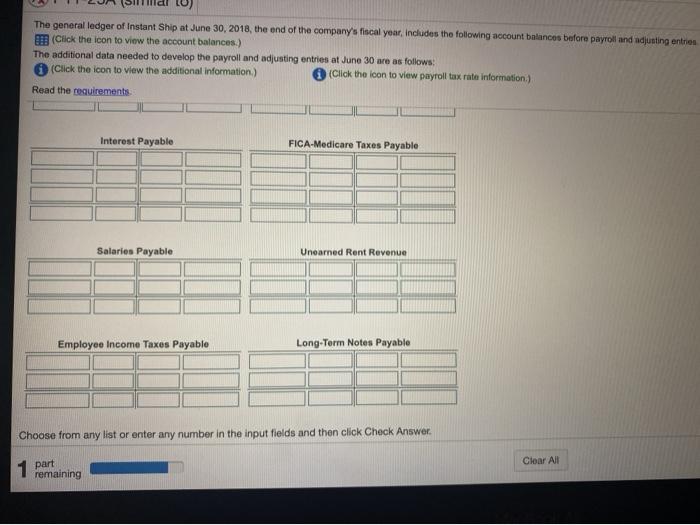

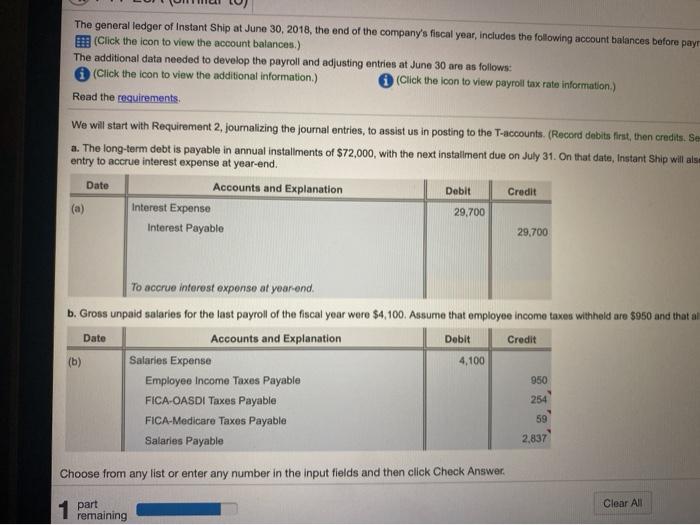

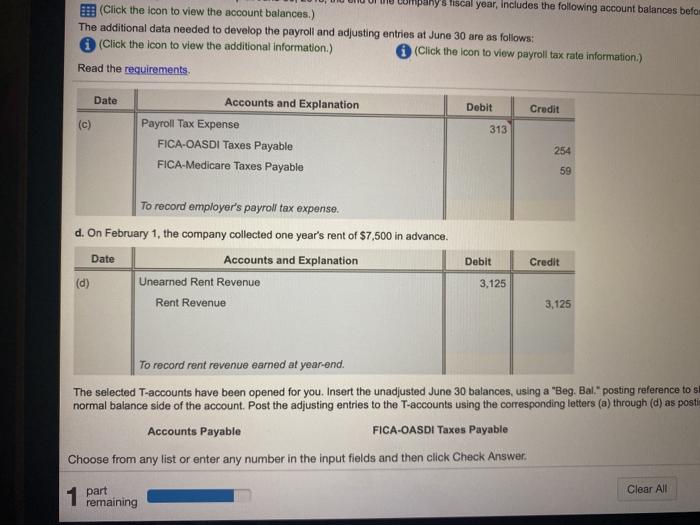

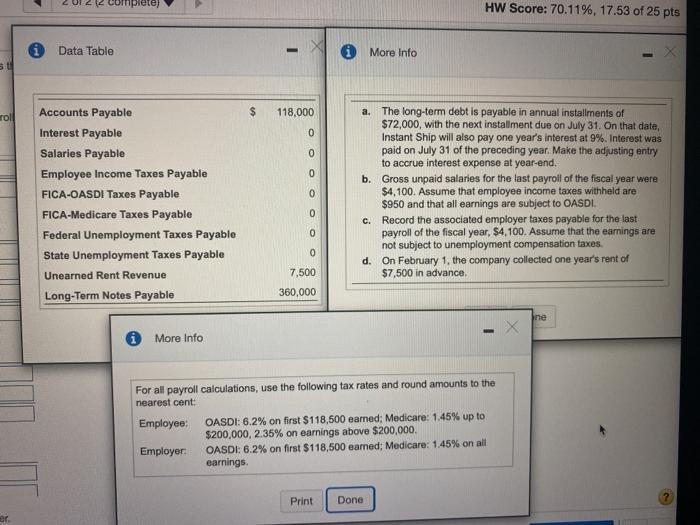

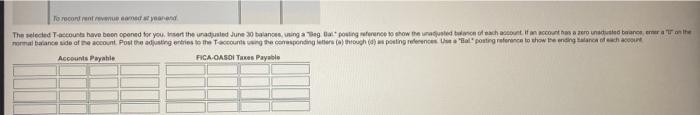

Read the requirements The selected T-accounts have been opened for you. Insert the unadjusted June 30 balances, using a "Beg Bal" posting reference to show the une normal balance side of the account. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (d) as posting referenc Accounts Payable FICA-OASDI Taxes Payable Interest Payable FICA-Medicare Taxes Payable Salaries Payable Unearned Rent Revenue Choose from any list or enter any number in the input fields and then click Check Answer. Clear All 1 part remaining The general ledger of Instant Ship at June 30, 2018, the end of the company's fiscal year. Includes the following account balances before payroll and adjusting entries (Click the icon to view the account balances.) The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: (Click the icon to view the additional information) (Click the loon to view payroll tax rate information) Read the requirements Interest Payable FICA-Medicare Taxes Payable Salaries Payable Unearned Rent Revenue Employee Income Taxes Payable Long-Term Notes Payable Choose from any list or enter any number in the input fields and then click Check Answer Clear All 1 part remaining The general ledger of Instant Ship at June 30, 2018, the end of the company's fiscal year, includes the following account balances before payr (Click the icon to view the account balances.) The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: (Click the icon to view the additional information.) (Click the icon to view payroll tax rate information) Read the requirements We will start with Requirement 2, journalizing the journal entries, to assist us in posting to the T-accounts. (Record debits first, then credits. Se a. The long-term debt is payable in annual installments of $72,000, with the next installment due on July 31. On that date, Instant Ship will als entry to accrue interest expense at year-end. Date Accounts and Explanation Credit Interest Expense 29,700 Interest Payable 29.700 Debit To accrue interest expense at year end. b. Gross unpaid salaries for the last payroll of the fiscal year were $4,100. Assume that employee income taxes withheld are $950 and that al Date Accounts and explanation Debit Credit (b) Salaries Expense 4,100 Employee Income Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable 59 Salaries Payable 2,837 950 254 Choose from any list or enter any number in the input fields and then click Check Answer Clear All 1 part remaining any's liscal year, Includes the following account balances befom (Click the icon to view the account balances.) The additional data needed to develop the payroll and adjusting entries at June 30 are as follows: i (Click the icon to view the additional information.) (Click the icon to view payroll tax rate information.) Read the requirements. Date Debit Credit Accounts and Explanation Payroll Tax Expense FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable 313 254 59 To record employer's payroll tax expense. d. On February 1, the company collected one year's rent of $7,500 in advance. Accounts and Explanation Unearned Rent Revenue Rent Revenue Date Debit Credit 3,125 3,125 To record rent revenue earned at year-end. The selected T-accounts have been opened for you. Insert the unadjusted June 30 balances, using a "Beg. Bal" posting reference to s normal balance side of the account. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (d) as postin Accounts Payable FICA-OASDI Taxes Payable Choose from any list or enter any number in the input fields and then click Check Answer. Clear All 1 part remaining omplete) HW Score: 70.11%, 17.53 of 25 pts Data Table * More Info sti $ 118,000 roll 0 0 0 0 Accounts Payable Interest Payable Salaries Payable Employee Income Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Unearned Rent Revenue Long-Term Notes Payable a. The long-term debt is payable in annual installments of $72,000, with the next installment due on July 31. On that date, Instant Ship will also pay one year's interest at 9%. Interest was paid on July 31 of the preceding year. Make the adjusting entry to accrue interest expense at year-end. b. Gross unpaid salaries for the last payroll of the fiscal year were $4,100. Assume that employee income taxes withheld are $950 and that all earnings are subject to OASDI c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,100. Assume that the earnings are not subject to unemployment compensation taxes. d. On February 1, the company collected one year's rent of $7,500 in advance. 0 0 0 7,500 360,000 ne More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000 Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings Print Done To reconnue comedy The selected accounts have been opened for yourse the uradjusind June 30 anos, galing forence to show the world and chat account has a role as a one normal balance side of the count Post the adjusting entries to the account the corresponding there through () posling references al posting reference to show the ingrecht Accounts Payable FICA OASI Taxes Payable