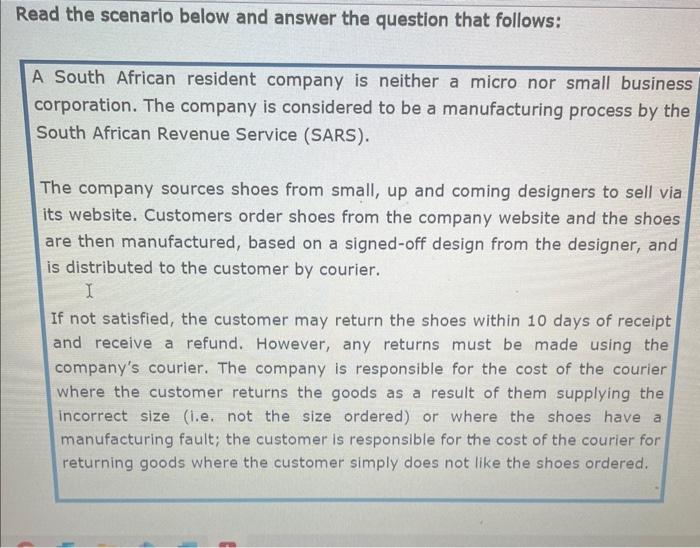

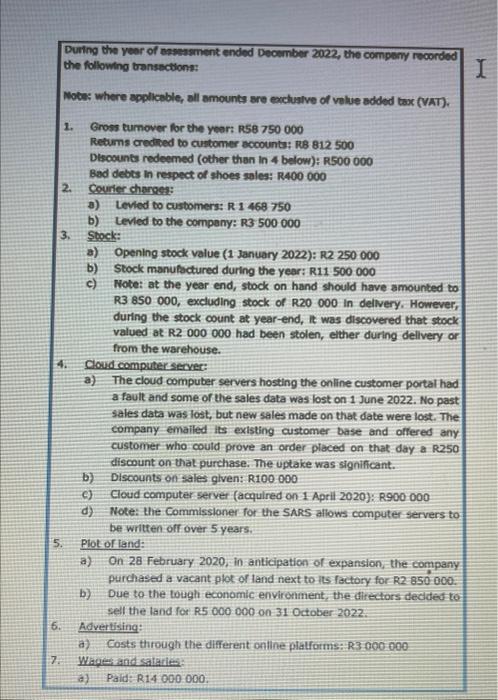

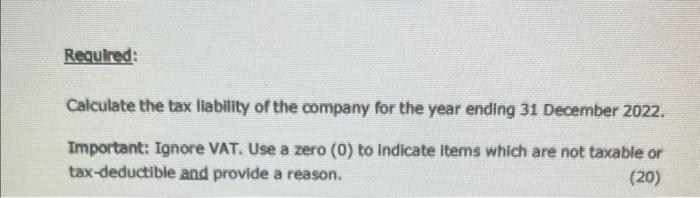

Read the scenario below and answer the question that follows: A South African resident company is neither a micro nor small busines: corporation. The company is considered to be a manufacturing process by the South African Revenue Service (SARS). The company sources shoes from small, up and coming designers to sell via its website. Customers order shoes from the company website and the shoes are then manufactured, based on a signed-off design from the designer, and is distributed to the customer by courier. If not satisfied, the customer may return the shoes within 10 days of receipt and receive a refund. However, any returns must be made using the company's courier. The company is responsible for the cost of the courier where the customer returns the goods as a result of them supplying the incorrect size (i.e. not the size ordered) or where the shoes have a manufacturing fault; the customer is responsible for the cost of the courier for returning goods where the customer simply does not like the shoes ordered. During the yeer of ensessment ended Deckmber 2022, the compeny recorded the following transectione: Mots: where applicable, all amounts are excluslve of velue added tax (VAT). 1. Gross tumover for the year: RS8 750000 Retums credived to customer accounts: RB 812500 Dtsoounts redeemed (other than in 4 below): R500 000 Bad debts in respect of shoes sales: R400000 2. Courier charge: a) Levied to customers: R1468750 b) Levled to the compony: R3 500000 3. Stock: a) Opening stock value (1 January 2022): R2250000 b) Stock manufectured during the year: R11 500000 c) Note: at the year end, stock on hand should have amounted to R3 850 000, excluding stock of R20 000 In delivery. However, during the stock count at year-end, it was discovered that stock valued at R2 000000 had been stolen, elther during dellvery or from the warehouse. 4. Cloud computer secvec: a) The cloud compuber servers hosting the online customer portal had a fault and some of the sales data was lost on 1 June 2022. No past sales data was lost, but new sales made on that date were lost. The company emailed its extsting customer base and offered any customer who could prove an order placed on that day a R250 -discount on that purchase. The uptake was significant. b) Discounts on sales given: R100 000 c) Cloud computer server (acquired on-1 April 2020): R900 -000 d) Note: the Commissioner for the SARS allows computer servers to be written off over 5 years. 5. Plot of land: a) On 28 February 2020, in anticipation of expansion, the company purchased a vacant plot of land next to its factory for R2 850000 : b) Due to the tough economic environment, the thirectors dedded to sell the land for R5 000000 on 31 October 2022 . 6. Acvertising: a) Costs through the different online platforms:-R3000-000 7. Wager and salaries: a) Paid: R14 000000 . Regulred: Calculate the tax liability of the company for the year ending 31 December 2022. Important: Ignore VAT. Use a zero (0) to indicate items which are not taxable or tax-deductible and provide a reason. (20)