Question

Read the text below, then do the following: First insert (i.e. type in) the appropriate/required input variables and then complete the necessary computations, into each

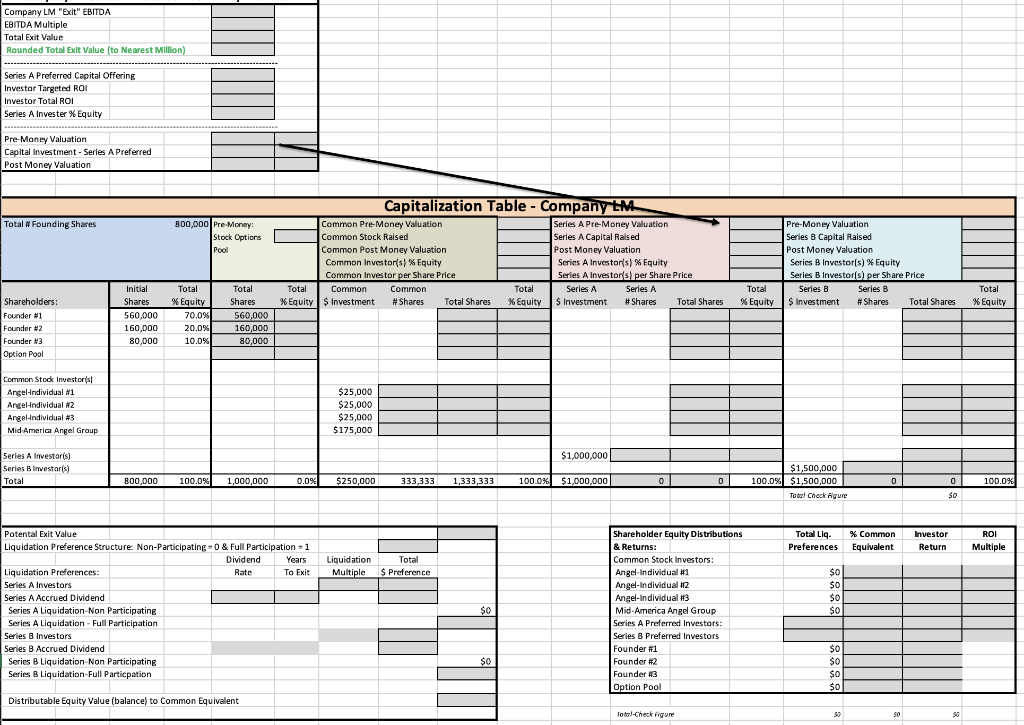

Read the text below, then do the following: First insert (i.e. type in) the appropriate/required input variables and then complete the necessary computations, into each of the required gray shaded cells, in order to compute the Series A Preferred Pre-Money Valuation. (Hint: This is the Quantitative Investor ROI Breakeven method. The computed Pre-Money Valuation then becomes the Series A Pre-Money Valuation used in the construction of the Company LM Capitalization Table.) Second enter all the appropriate/required input variables into the Valuation computations for each Investment round (i.e. the Common, Series A and Series B) and compute the % Equity and $/Share for each funding round. Third carry all previous round # shares (i.e. remember # shares remain constant) across the Cap Table and using the dilution factor for each round compute the adjusted/updated % Equity for each line itemed previous existing shareholder. Fourth for each NEW Investment round enter the newly invested capital per Investor and compute their # shares & % Equity. Fifth enter the projected Exit Value compute all Preferred Stock Preference amounts and the remaining Distributable Equity. Last compute the Liquidation Preferences for each Preferred Investor, then allocate the Distributable Equity across ALL Investors using the ending Cap Table % Equity for each Investor. Use the Check Figures to check your work.

Company LM:

Company LM (an LLC) the Kansas City based seed-stage Customer Relationship Management (CRM) software service business, with your assistance has finalized financial preparation for its equity capital offering. After some internal debate, the Company has decided to raise a nice round $1,000,000 in a Series A Preferred Unit offering. Given the Founding teams incredibly belief in the Company and its corresponding financial upside, the Founders want to take advantage of every structure feature to increase the Pre-Money Valuation in this funding. Therefore, the Team plans to offer a 1.5X Full Participating Liquidation Preference and an attractive accruable 8% Dividend Rate. Given the Financial Model projected cash flows, this Dividend will need to be accrued as cash payments are not feasible. The Series A Preferred is forecasted to be outstanding for five years before reaching a planned Exit Event. Prior to meeting with prospective new investors (i.e. several large regional Angel Groups), the Company LM Team wants to develop a defensible targeted pre-money valuation in preparation for these pending Series A Preferred negotiation. Additionally, the Team wants to be able to proactively communicate the likely dilutive impact to all the existing initial Common round Angel equity Unit Holders in order to secure their support for this Series A Preferred capital funding requirement. Therefore, the Team needs to prepare a historical & forecasted Capitalization Table. Given the extreme growth aspirations, the Team within this Capitalization Table wants to include an incremental $1,500,000 Series B Preferred. Given that the Company will be profitable at this funding point, the Team estimates that it will only be necessary to offer a 1X Full Participating Liquidation Preference and NO Dividend (i.e. 0%) at substantial uptick in the Pre-Money Valuation to $6,000,000.

Unfortunately, the Team had failed to update the Companys Capitalization Table after creating the initial one reflecting their Founder # Units and % Equity associated with the issuance of the original 800,000 Units. Therefore, you will need to retroactively construct the Capitalization Table to reflect the initial creation of a required Unit Option Pool and subsequent $250,000 completed Common Equity offering to launch the business. These original Angels investors had required the Company to form an unallocated Pre-Money Unit (i.e. Stock) Option Pool equal to 20% of the then equity ownership for utilization with future executive hires, the creation of a small corporate wide general employee equity program, and to provide for recruiting a couple of key independent Board Members in the future as the Company grows. The initial Common Equity investors included three individual Angels which each invested $25,000 and the Kansas City based Mid-America Angel Group which invested $175,000 to complete this initial $250,000 in Common which was closed a little over a year ago. The then agreed upon Pre-money Valuation was $750,000 which meant these original four Common Unit investors collectively currently own a 25% ownership position in Company LM. In order to reconcile the historical aspects of the Capitalization Table, there currently are 1,333,333 Units outstanding.

Based upon maintaining all the previously refined Income Statement and Balance Sheet assumptions, except for the recent decision to increase the equity capital raise to $1,000,000, from the previously considered $750,000 capital raise, the corresponding final Integrated Financial Model Pro-forma Income Statement is attached. Based upon independent market research of corporate industry valuation comps, you believe the appropriate Exit value EBITDA multiple will be 7.5X given the strong recurring revenue component of the business. Finally, given some early stage capital market research of similar seed stage companies, the anticipated targeted seed investor ROI multiple is estimated to be 12X given the recent positive trends in the capital markets. Round the computed ROI Total Exit Value to Millions and utilization this rounded number in computing the Pre-Money Valuation (for example use $25,000,000 if the computed Total Exit valuation was $24,734,123). Note: The required format to compute the required Series A Preferred Pre-Money Valuation is included in the #9-Assignment-Capitalization Table-Company LM. Again, please insert the required input variables and corresponding computations into the gray shaded cells.

Using all the relevant information herein, compute the quantitative Series A Preferred Unit Pre-Money Valuation, reconstruct the historical element of the Capitalization Table in order to have an update pre-Series A ownership listing, and complete the forecasted Capitalization Table and corresponding Return on Investments (ROIs) for all cash equity investors. Again manually enter all required information into the #9-Assignment (Cap Table-Multiple Funding Rounds & Returns).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started