Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read through the ethical scenario below. Refer back to prior chapters and your own individual research to answer part 1 as it relates to

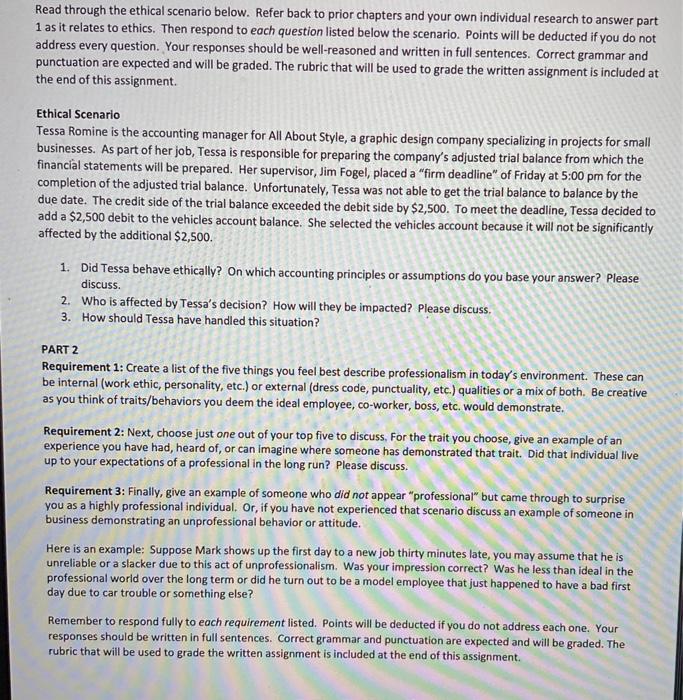

Read through the ethical scenario below. Refer back to prior chapters and your own individual research to answer part 1 as it relates to ethics. Then respond to each question listed below the scenario. Points will be deducted if you do not address every question. Your responses should be well-reasoned and written in full sentences. Correct grammar and punctuation are expected and will be graded. The rubric that will be used to grade the written assignment is included at the end of this assignment. Ethical Scenario Tessa Romine is the accounting manager for All About Style, a graphic design company specializing in projects for small businesses. As part of her job, Tessa is responsible for preparing the company's adjusted trial balance from which the financial statements will be prepared. Her supervisor, Jim Fogel, placed a "firm deadline" of Friday at 5:00 pm for the completion of the adjusted trial balance. Unfortunately, Tessa was not able to get the trial balance to balance by the due date. The credit side of the trial balance exceeded the debit side by $2,500. To meet the deadline, Tessa decided to add a $2,500 debit to the vehicles account balance. She selected the vehicles account because it will not be significantly affected by the additional $2,500. 1. Did Tessa behave ethically? On which accounting principles or assumptions do you base your answer? Please discuss. 2. Who is affected by Tessa's decision? How will they be impacted? Please discuss. 3. How should Tessa have handled this situation? PART 2 Requirement 1: Create a list of the five things you feel best describe professionalism in today's environment. These can be internal (work ethic, personality, etc.) or external (dress code, punctuality, etc.) qualities or a mix of both. Be creative as you think of traits/behaviors you deem the ideal employee, co-worker, boss, etc. would demonstrate. Requirement 2: Next, choose just one out of your top five to discuss. For the trait you choose, give an example of an experience you have had, heard of, or can imagine where someone has demonstrated that trait. Did that individual live up to your expectations of a professional in the long run? Please discuss. Requirement 3: Finally, give an example of someone who did not appear "professional" but came through to surprise you as a highly professional individual. Or, if you have not experienced that scenario discuss an example of someone in business demonstrating an unprofessional behavior or attitude. Here is an example: Suppose Mark shows up the first day to a new job thirty minutes late, you may assume that he is unreliable or a slacker due to this act of unprofessionalism. Was your impression correct? Was he less than ideal in the professional world over the long term or did he turn out to be a model employee that just happened to have a bad first day due to car trouble or something else? Remember to respond fully to each requirement listed. Points will be deducted if you do not address each one. Your responses should be written in full sentences. Correct grammar and punctuation are expected and will be graded. The rubric that will be used to grade the written assignment is included at the end of this assignment.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Ethical Analysis of Tessa Romines Decision 1 Ethical Assessment of Tessas Behavior Tessas decision to add a 2500 debit to the vehicles account to balance the trial balance was unethical This action vi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started