Readers Digest has asked you to analyze an investment proposal that it has received. This proposal relates to Readers Digest producing a CD-ROM version that

Reader’s Digest has asked you to analyze an investment proposal that it has received. This proposal relates to Reader’s Digest producing a CD-ROM version that will contain the text of all of the articles published in the magazine since its inception. You have also been given the following information from the proposal:

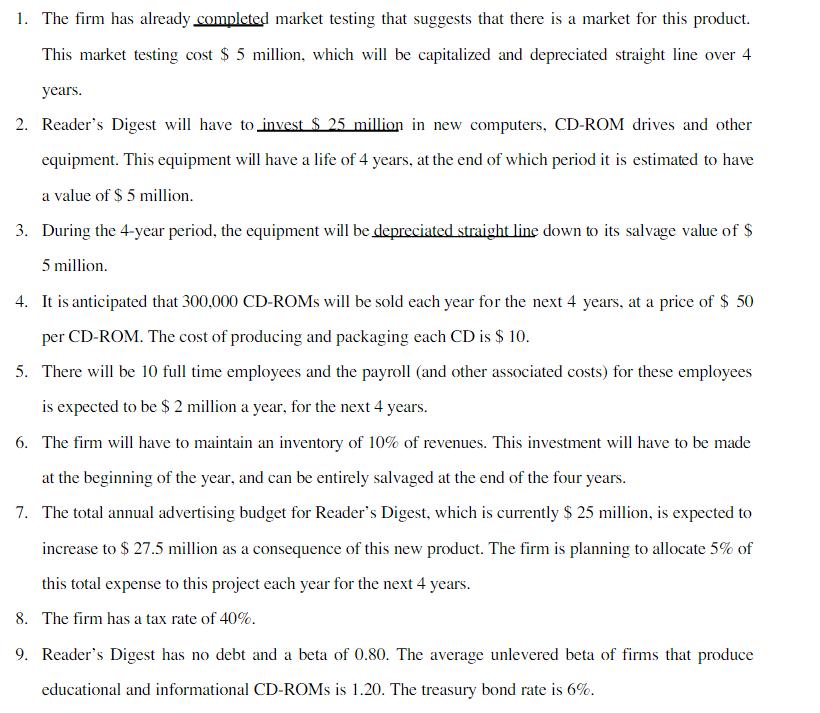

1. The firm has already completed market testing that suggests that there is a market for this product. This market testing cost $ 5 million, which will be capitalized and depreciated straight line over 4 years. 2. Reader's Digest will have to invest $ 25 million in new computers, CD-ROM drives and other equipment. This equipment will have a life of 4 years, at the end of which period it is estimated to have a value of $ 5 million. 3. During the 4-year period, the equipment will be depreciated straight line down to its salvage value of $ 5 million. 4. It is anticipated that 300,000 CD-ROMS will be sold each year for the next 4 years, at a price of $ 50 per CD-ROM. The cost of producing and packaging each CD is $ 10. 5. There will be 10 full time employees and the payroll (and other associated costs) for these employees is expected to be $ 2 million a year, for the next 4 years. 6. The firm will have to maintain an inventory of 10% of revenues. This investment will have to be made at the beginning of the year, and can be entirely salvaged at the end of the four years. 7. The total annual advertising budget for Reader's Digest, which is currently $ 25 million, is expected to increase to $ 27.5 million as a consequence of this new product. The firm is planning to allocate 5% of this total expense to this project each year for the next 4 years. 8. The firm has a tax rate of 40%. 9. Reader's Digest has no debt and a beta of 0.80. The average unlevered beta of firms that produce educational and informational CD-ROMS is 1.20. The treasury bond rate is 6%.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

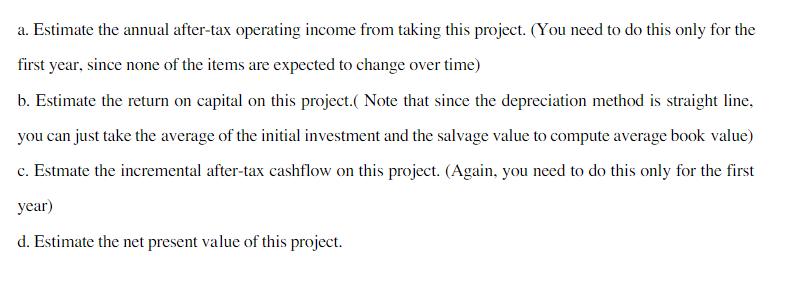

a Operating Income after taxes 1425000 b Return on Capital 814 c After tax cashflow ATCF 6500000 d Net Present Value NPV 2960620 Stepbystep explanatio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started