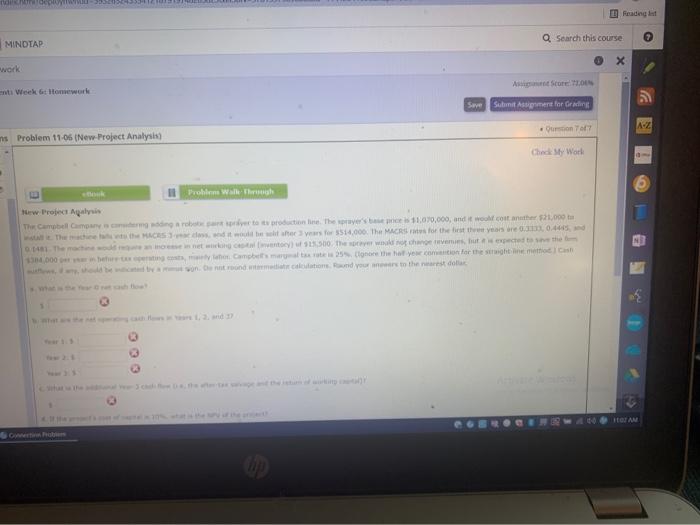

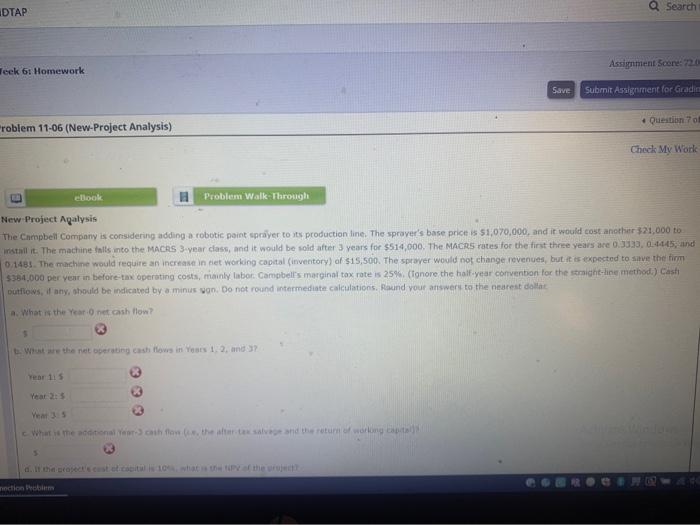

Reading at Q Search this course MINDTAP X work ni Week 6 Homework Save SabonetAssimers for Grace . Outono AZ m Problem 11.06 New Project Analysis Check Sy Work Proin wallet New Project Ayala The Call Camerettiline the permis 11.070,000, and two costante 21.000 The Stars 3514,000. The MARS for the three years or 0.4415 1481 the machine way to the who change om utspected to the 000 ingest, Campbell the ho you can for the theme annen met een and your to the rest dolu BOJAN Q Search DTAP Assignment Score: 220 Teek 6: Homework Save Submit Assignment for Gradim Question 70 roblem 11-06 (New-Project Analysis) Check My Work ebook Problem Walk Through New Project Agalysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The spraver's base price is $1,070,000, and it would cost another 321,000 to install it. The machine falls into the MACRS 3 year class, and it would be sold after 3 years for $514,000. The MACRS rates for the first three years are 0.3333, 0.1445, and 0.1481. The machine would require an increase in niet working capital inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $384.000 per year in before the operating costs, mainly labor. Campbell's marginal tax rate is 25% (onore the half-year convention for the straight line method.) Casti outflows any, should be indicated by a minus von. Do not round intermediate calculations. Round your answer to the nearest cola a. What the Year net cash flow? Witwe the net operating cash flow in a 1.2, and Year 115 Year 25 Ya 33 What is mentional cather to save and the return of working capital nection Problem Reading at Q Search this course MINDTAP X work ni Week 6 Homework Save SabonetAssimers for Grace . Outono AZ m Problem 11.06 New Project Analysis Check Sy Work Proin wallet New Project Ayala The Call Camerettiline the permis 11.070,000, and two costante 21.000 The Stars 3514,000. The MARS for the three years or 0.4415 1481 the machine way to the who change om utspected to the 000 ingest, Campbell the ho you can for the theme annen met een and your to the rest dolu BOJAN Q Search DTAP Assignment Score: 220 Teek 6: Homework Save Submit Assignment for Gradim Question 70 roblem 11-06 (New-Project Analysis) Check My Work ebook Problem Walk Through New Project Agalysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The spraver's base price is $1,070,000, and it would cost another 321,000 to install it. The machine falls into the MACRS 3 year class, and it would be sold after 3 years for $514,000. The MACRS rates for the first three years are 0.3333, 0.1445, and 0.1481. The machine would require an increase in niet working capital inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $384.000 per year in before the operating costs, mainly labor. Campbell's marginal tax rate is 25% (onore the half-year convention for the straight line method.) Casti outflows any, should be indicated by a minus von. Do not round intermediate calculations. Round your answer to the nearest cola a. What the Year net cash flow? Witwe the net operating cash flow in a 1.2, and Year 115 Year 25 Ya 33 What is mentional cather to save and the return of working capital nection