Question

Ready-Parts and Advance Auto Parts Case Study You are working as a consultant for Ready-Parts Stores(RPS), a growing auto parts retailer, RPS was founded eight

Ready-Parts and Advance Auto Parts Case Study

You are working as a consultant for Ready-Parts Stores(RPS), a growing auto parts retailer, RPS was founded eight years ago by Jim and Belinda Bird and their family. The Birds started in the retail auto parts business over 20 years ago, originally working for other companies. RPS now owns a regional chain of 35 stores, primarily in the Midwest and Southeastern United States. RPS has been innovative in providing parts for newer types of vehicles, including hybrids and pure electric vehicles. In addition, RPS carries the latest Advanced Driver Assistance System(ADAS) add-on equipment kits.

The company wants to expand across the U.S. and Canada. Such a move would require substantial investments in warehouses, delivery vehicles and other infrastructure. Relatively little formal analysis has been used in its capital budgeting process. For example, the company has never attempted to determine its cost of capital, and the Birds would like you to perform the analysis. Jim and Belinda want you to use the pure play approach to estimate the cost of capital for RPS, and after some discussion, you agree that Advance Auto Parts would be a representative company.

Questions

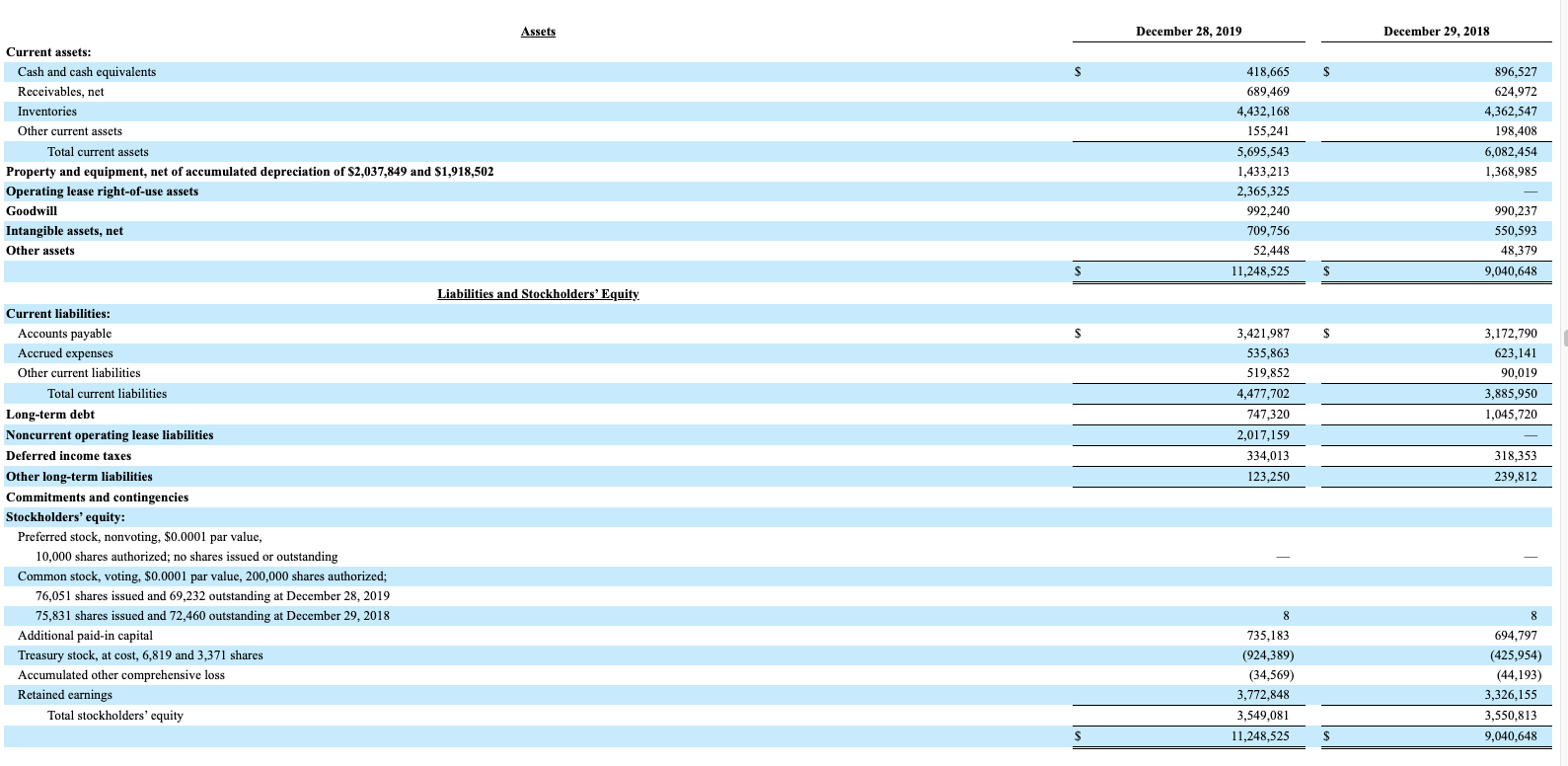

1. Find the most recent 10-Q or 10-K for Advance Auto Parts, Inc. (ticker: "AAP"). Using the balance sheet, what is the book value of long-term debt and the book value of equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started