Question

Reagan Corporation computed income from continuing operations before income taxes of $4,600,000 for 2013. The following material items have not yet been considered in the

| Reagan Corporation computed income from continuing operations before income taxes of $4,600,000 for 2013. The following material items have not yet been considered in the computation of income: |

| 1. | The company sold equipment and recognized a gain of $54,000. The equipment had been used in the manufacturing process and was replaced by new equipment. |

| 2. | In December, the company received a settlement of $1,200,000 for a lawsuit it had filed based on antitrust violations of a competitor. The settlement was considered to be an unusual and infrequent event. |

| 3. | Inventory costing $440,000 was written off as obsolete. Material losses of this type were incurred twice in the last eight years. |

| 4. | It was discovered that depreciation expense on the office building of $54,000 per year was not recorded in either 2012 or 2013. |

| In addition, you learn that included in revenues is $440,000 from installment sales made during the year. The cost of these sales is $286,000. At year-end, $110,000 in cash had been collected on the related installment receivables. Because of considerable uncertainty regarding the collectibility of receivables from these sales, the company's accountant should have used the installment sales method to recognize revenue and gross profit on these sales. |

| Also, the company's income tax rate is 38% and there were 1 million shares of common stock outstanding throughout the year. |

| Required: |

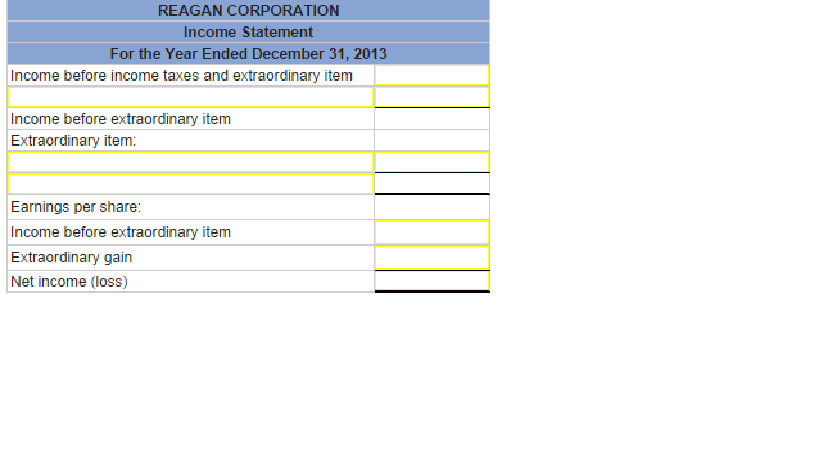

| Prepare an income statement for 2013 beginning with income from continuing operations before income taxes. Include appropriate EPS disclosures. (Round your "EPS" answer to 2 decimal places.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started