Question

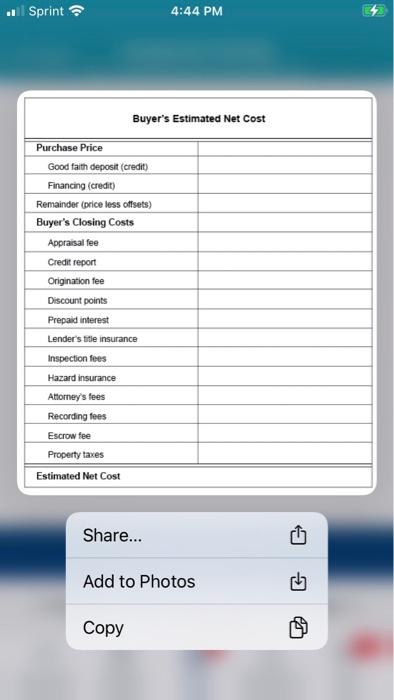

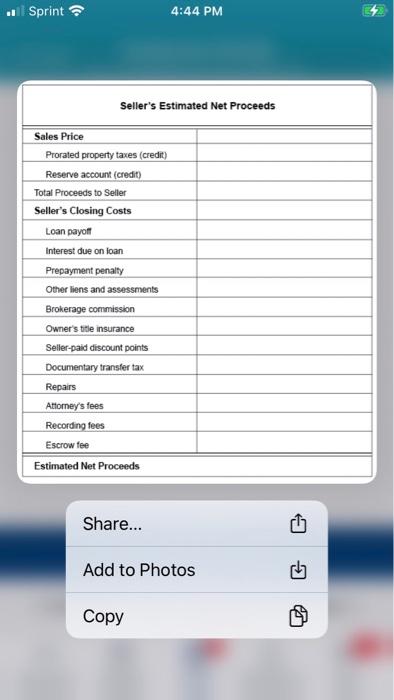

Real Estate Closing the Transaction Fill in (or re-create) the two blank worksheets, Buyers Estimated Net Cost and Sellers Estimated Net Proceeds, based on the

Closing the Transaction

Fill in (or re-create) the two blank worksheets, Buyers Estimated Net Cost and Sellers Estimated Net Proceeds, based on the information below. You must decide which amounts are credits or debits for the seller or the buyer, prorate certain expenses between the two parties, and calculate the brokers commission. (For proration purposes, use a 365-day year.)

Purchase price for the home..................................................... $500,000.00

Brokers commission................................................................................... 6%

Closing date....................................................................................... May 1st

Escrow fees......................................................................................... $500.00

Property taxes (seller has paid taxes through end of tax year) $6,500.00

Good faith deposit........................................................................ $20,000.00

Purchase loan.............................................................................. $450,000.00

Appraisal fee...................................................................................... $400.00

Credit report fee.................................................................................. $75.00

Origination fee................................................................................. $4,500.00

Discount points.............................................................................. $27,000.00

Prepaid interest............................................................................... $2,200.00

Lenders title insurance...................................................................... $900.00

Inspection fees (to be paid by buyer)............................................ $600.00

Hazard insurance............................................................................... $475.00

Buyers attorneys fees...................................................................... $350.00

Buyers recording fees......................................................................... $50.00

Existing loan reserve account credit............................................... $900.00

Existing loan payoff..................................................................... $250,000.00

Interest due on existing loan............................................................. $850.00

Prepayment penalty on existing loan................................................. $0.00

Other liens and assessments................................................................. $0.00

Owners title insurance...................................................................... $725.00

Seller-paid discount points.................................................................... $0.00

Documentary transfer tax................................................................. $550.00

Required home repairs (to be paid by seller)............................. $4,500.00

Sellers attorneys fees........................................................................... $0.00

Sellers recording fees.......................................................................... $35.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started