Real Estate Investment Trust: "KBWY"

Based on all of the Information below and current economic events, do you predict that "KBWY" Real Estate Investment trust will rise or fall in the succeeding week? Why?

Please share observations!

There is no defined methodology to arrive at a prediction. This is solely opinion based on the attached information and also taking into account the current real world economic climate.

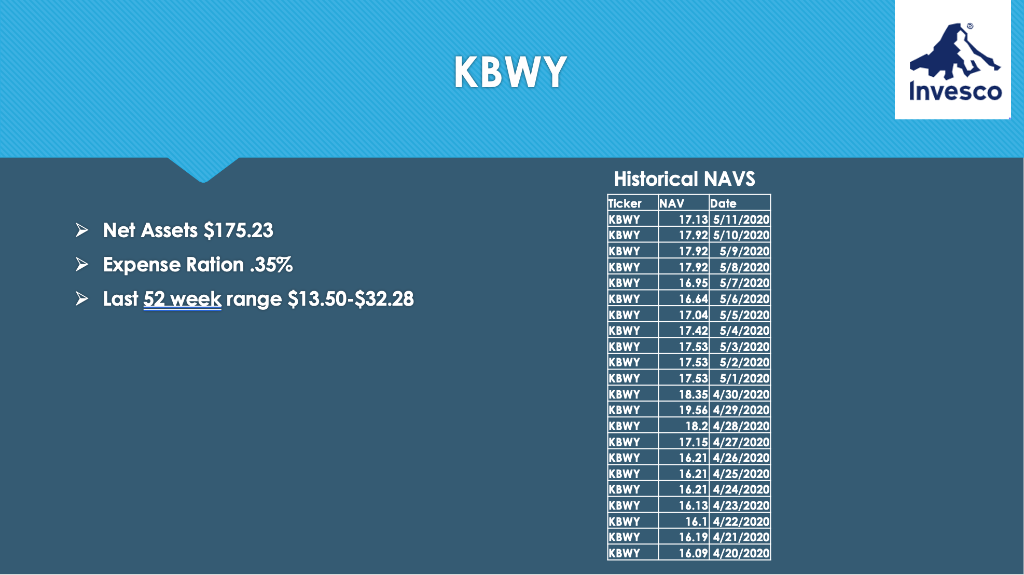

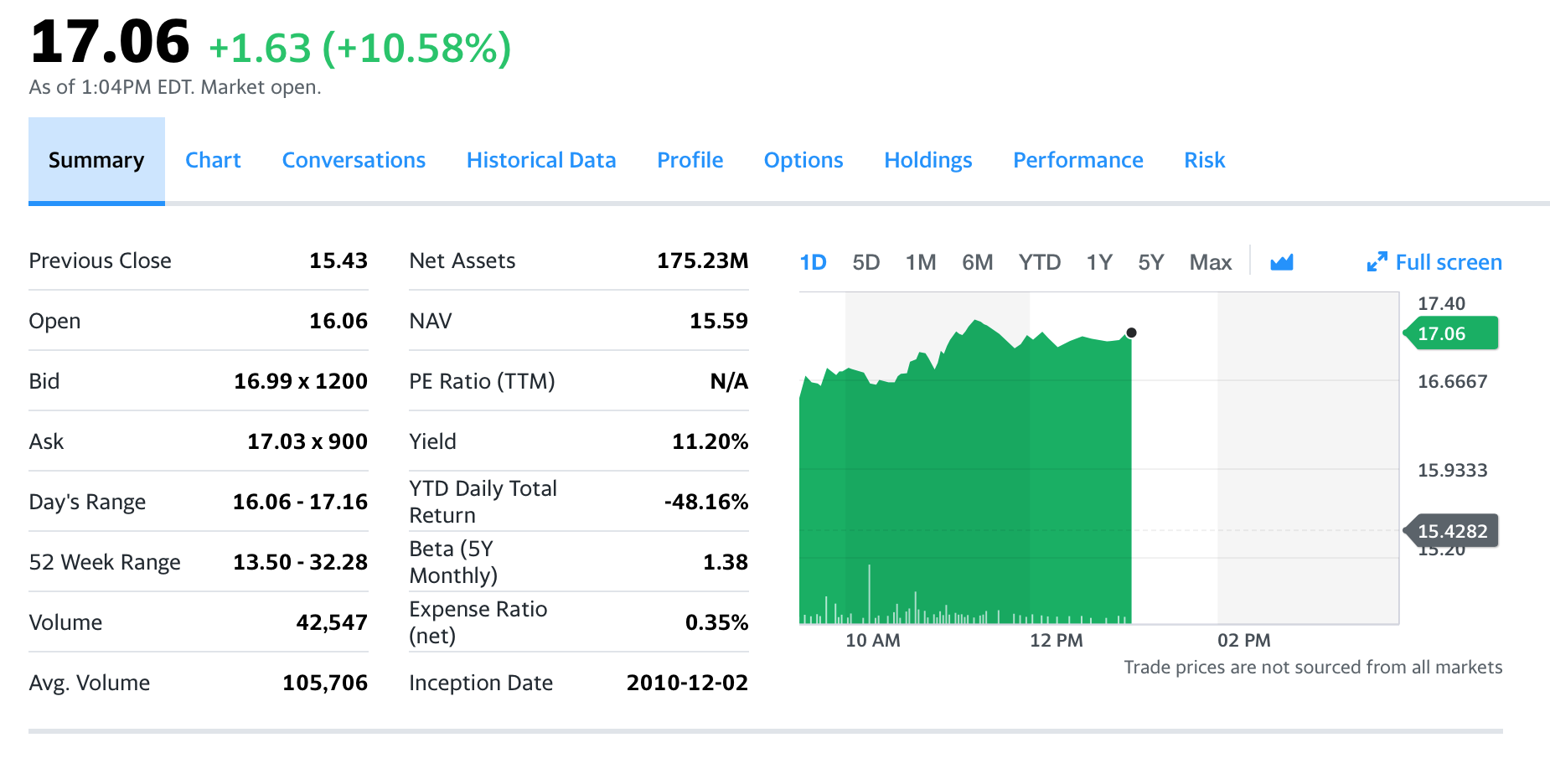

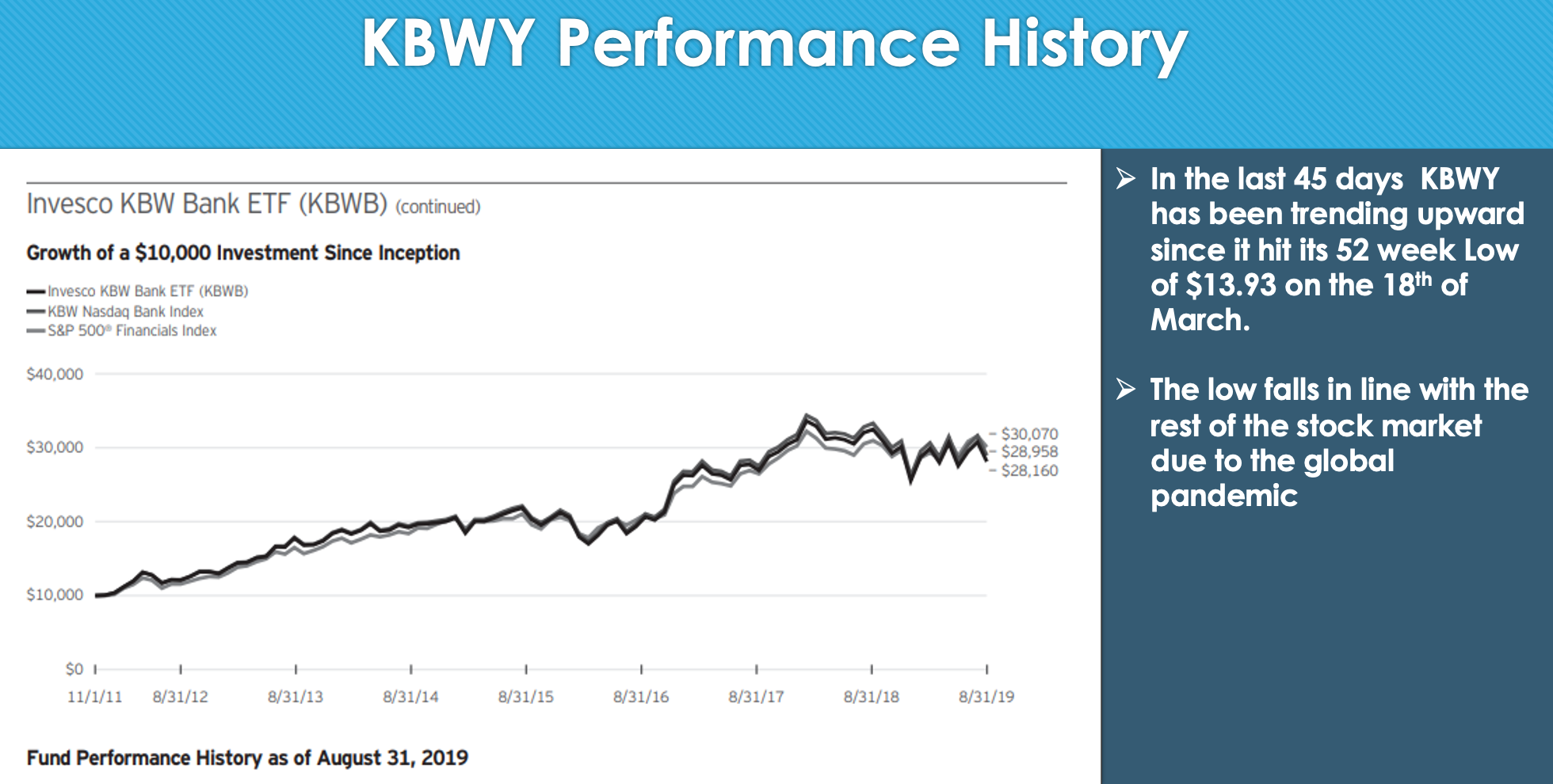

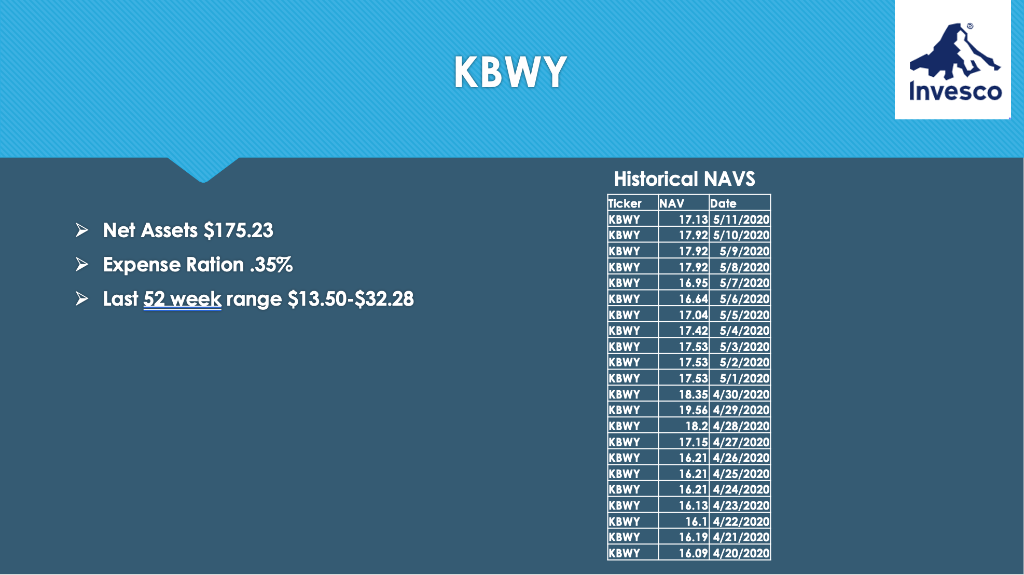

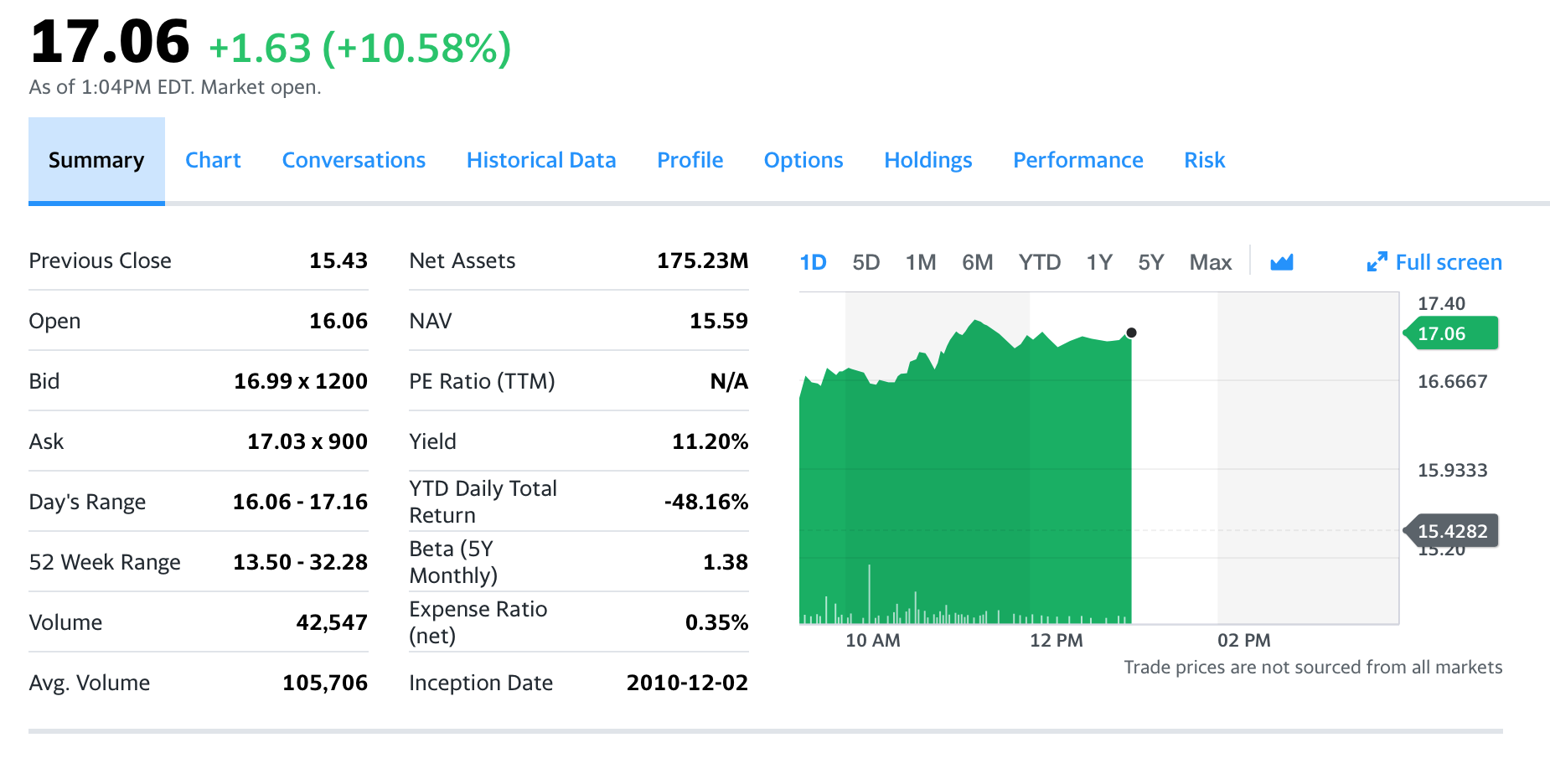

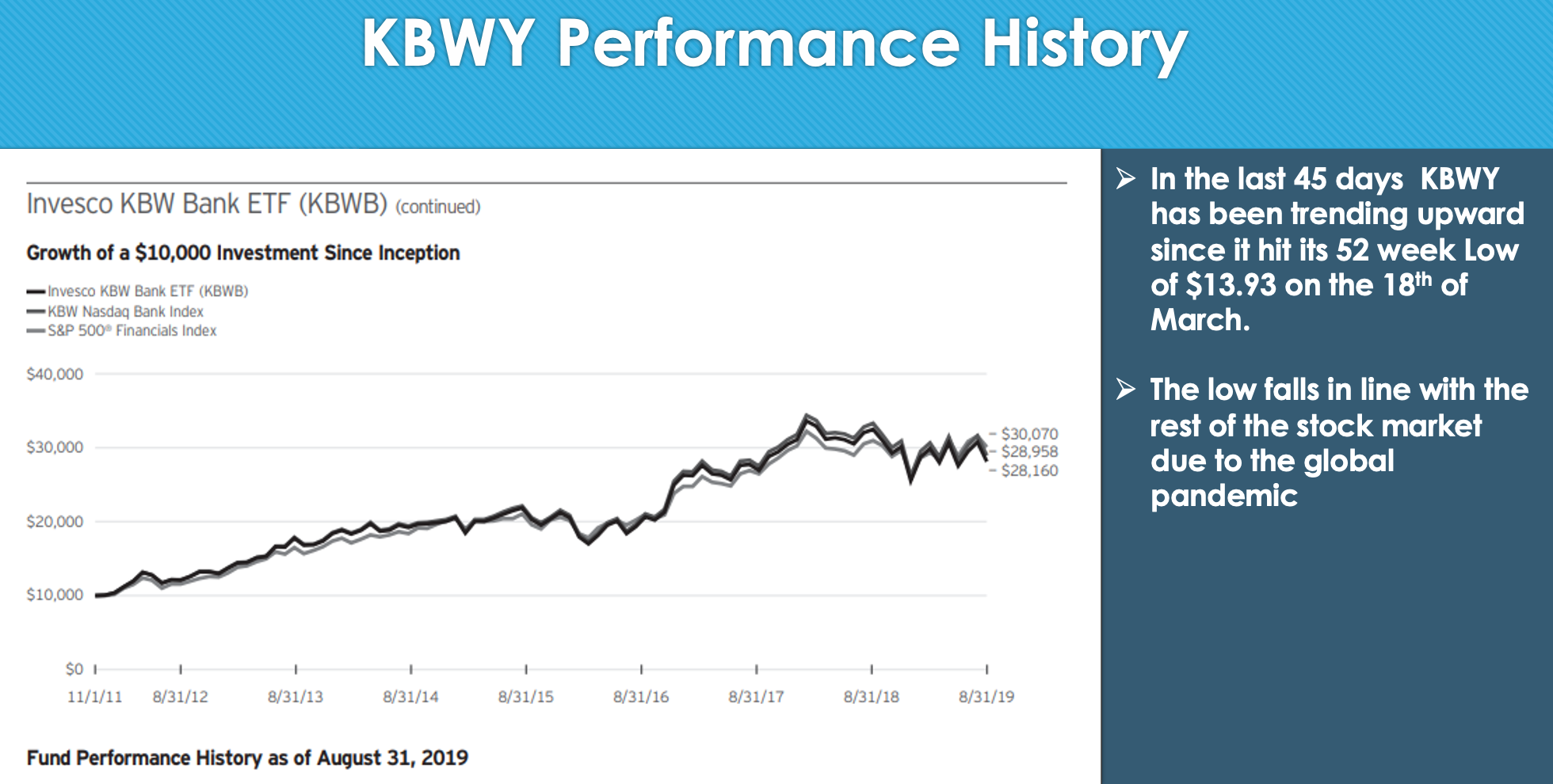

KBWY Invesco The Invesco KBW Premium Yield Equity REIT ETF (Fund) is based on the KBW Nasdaq Premium Yield Equity REIT Index (Index). > The Fund generally will invest at least 90% of its total assets in the securities of small- and mid-cap equity REITs that have competitive dividend yields and are publicly-traded in the US that comprise the Underlying Index. Keefe, > Bruyette & Woods, Inc. and Nasdaq, Inc. compile, maintain and calculate the underlying Index, which is a modified-dividend yield-weighted index that seeks to reflect the performance of such companies. The Fund generally invests in all of the securities comprising the underlying Index in proportion to their weightings in the Underlying Index. The Fund and the Index are rebalanced and reconstituted on the third Friday of March, June, September and December. KBWY Invesco > Net Assets $175.23 Expense Ration.35% Last 52 week range $13.50-$32.28 Historical NAVS Ticker NAV Date KBWY 17.13 5/11/2020 KBWY 17.92 5/10/2020 KBWY 17.92 5/9/2020 KBWY 17.92 5/8/2020 KBWY 16.95 5/7/2020 wenn KBWY 16.64 5/6/2020 KBWY 17.04 5/5/2020 Cow KBWY 1 Cow 17.42 5/4/2020 KBWY 17.53 5/3/2020 12e binnen KBWY 17.53 5/2/2020 KBWY Pour 17.53 5/1/2020 KBWY 18.35 4/30/2020 KBWY w KBWY 18.2 4/28/2020 ww KBWY 17.15 4/27/2020 KBWY 16.21 4/26/2020 KBWY 16.21 4/25/2020 KBWY 16.21 4/24/2020 KBWY 16.13 4/23/2020 KBWY 16.1 4/22/2020 KBWY 16.19 4/21/2020 KBWY 16.094/20/2020 19.56 4/29/2000 17.06 +1.63 (+10.58%) As of 1:04PM EDT. Market open. Summary Chart Conversations Historical Data Profile Options Holdings Performance Risk Previous Close 15.43 Net Assets 175.23M 1D 5D 1M 6M YTD 1Y 5Y Max ka Full screen 17.40 Open 16.06 NAV 15.59 17.06 Bid 16.99 x 1200 PE Ratio (TTM) N/A 16.6667 Ask 17.03 x 900 Yield 11.20% 15.9333 Day's Range 16.06 - 17.16 -48.16% 15.4282 15.20 52 Week Range 13.50 -32.28 YTD Daily Total Return Beta (5Y Monthly) Expense Ratio (net) 1.38 Volume 42,547 0.35% 10 AM 12 PM 02 PM Trade prices are not sourced from all markets Avg. Volume 105,706 Inception Date 2010-12-02 KBWY Performance History Invesco KBW Bank ETF (KBWB) (continued) Growth of a $10,000 Investment Since Inception Invesco KBW Bank ETF (KBWB) -KBW Nasdaq Bank Index S&P 500 Financials Index In the last 45 days KBWY has been trending upward since it hit its 52 week Low of $13.93 on the 18th of March. $40,000 $30,000 $30,070 $28,958 $28,160 The low falls in line with the rest of the stock market due to the global pandemic $20,000 $10,000 - $0 11/1/11 8/31/12 8/31/13 8/31/14 8/31/15 8/31/16 8/31/17 8/31/18 8/31/19 Fund Performance History as of August 31, 2019