Question

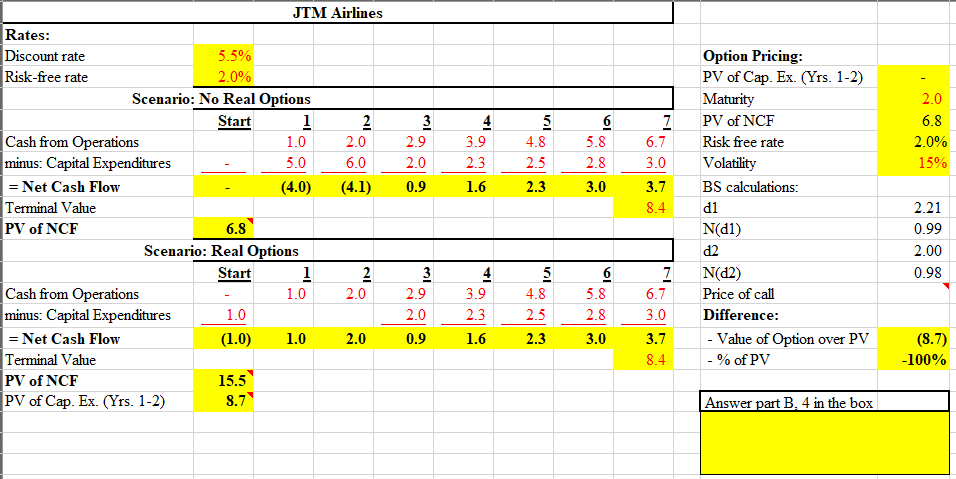

Real Options A. JTM Airlines is looking at buying more gates at their home airport. JTM's discount rate is 5.5% and the risk free rate

Real Options

A. JTM Airlines is looking at buying more gates at their home airport. JTM's discount rate is 5.5% and the risk free rate is 2.0%. What is the NPV of the gate purchases if it bought them today? Use the data in the Excel template provided.

B. After you run the numbers for part A, you remember back to the concept of real options, which means that JTM can make investment decisions as time passes:

1. Present valuing the purchase price of the gates (that is, the years 1 and 2 Capital Expenditures) separately using the risk-free rate. Once JTM decides to go ahead with the purchase, there is no risk to that expenditure.

2. Present valuing the Net Cash Flow excluding those purchase prices. This calculation will include Cap. Ex. for years 3-15 as they are part of the normal operation of the gates and are unrelated to the purchase price.

3. Use the Black-Scholes Option Pricing formula to come up with option's price assuming a 2-year maturity and a 15% price volatility for gate prices.

4. Compare the price of the call option with the NPV in the No Real Options scenario. Is the option worth it?

How do I calculate the price of the call and do the other areas look correct?

3 2.9 2.0 0.9 4 3.9 2.3 1.6 5 4.8 2.5 2.3 6 5.8 2.8 3.0 7 6.7 3.0 3.7 2.0 6.8 2.0% 15% JTM Airlines Rates: Discount rate 5.5% Risk-free rate 2.0% Scenario: No Real Options Start 1 2 Cash from Operations 1.0 2.0 minus: Capital Expenditures 5.0 6.0 = Net Cash Flow (4.0) (4.1) Terminal Value PV of NCF Scenario: Real Options Start 1 2 Cash from Operations 1.0 2.0 minus: Capital Expenditures 1.0 = Net Cash Flow (1.0) 1.0 2.0 Terminal Value PV of NCF 15.5 PV of Cap. Ex. (Yrs. 1-2) 8.7 8.4 Option Pricing: PV of Cap. Ex. (Yrs. 1-2) Maturity PV of NCF Risk free rate Volatility BS calculations: di N(dl) d2 Nd2) Price of call Difference: - Value of Option over PV - % of PV 6.8 2.21 0.99 2.00 0.98 4 3 2.9 2.0 0.9 4 3.9 2.3 1.6 5 4.8 2.5 2.3 5.8 2.8 3.0 7 6.7 3.0 3.7 8.4 (8.7) -100% Answer part B. 4 in the box 3 2.9 2.0 0.9 4 3.9 2.3 1.6 5 4.8 2.5 2.3 6 5.8 2.8 3.0 7 6.7 3.0 3.7 2.0 6.8 2.0% 15% JTM Airlines Rates: Discount rate 5.5% Risk-free rate 2.0% Scenario: No Real Options Start 1 2 Cash from Operations 1.0 2.0 minus: Capital Expenditures 5.0 6.0 = Net Cash Flow (4.0) (4.1) Terminal Value PV of NCF Scenario: Real Options Start 1 2 Cash from Operations 1.0 2.0 minus: Capital Expenditures 1.0 = Net Cash Flow (1.0) 1.0 2.0 Terminal Value PV of NCF 15.5 PV of Cap. Ex. (Yrs. 1-2) 8.7 8.4 Option Pricing: PV of Cap. Ex. (Yrs. 1-2) Maturity PV of NCF Risk free rate Volatility BS calculations: di N(dl) d2 Nd2) Price of call Difference: - Value of Option over PV - % of PV 6.8 2.21 0.99 2.00 0.98 4 3 2.9 2.0 0.9 4 3.9 2.3 1.6 5 4.8 2.5 2.3 5.8 2.8 3.0 7 6.7 3.0 3.7 8.4 (8.7) -100% Answer part B. 4 in the boxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started