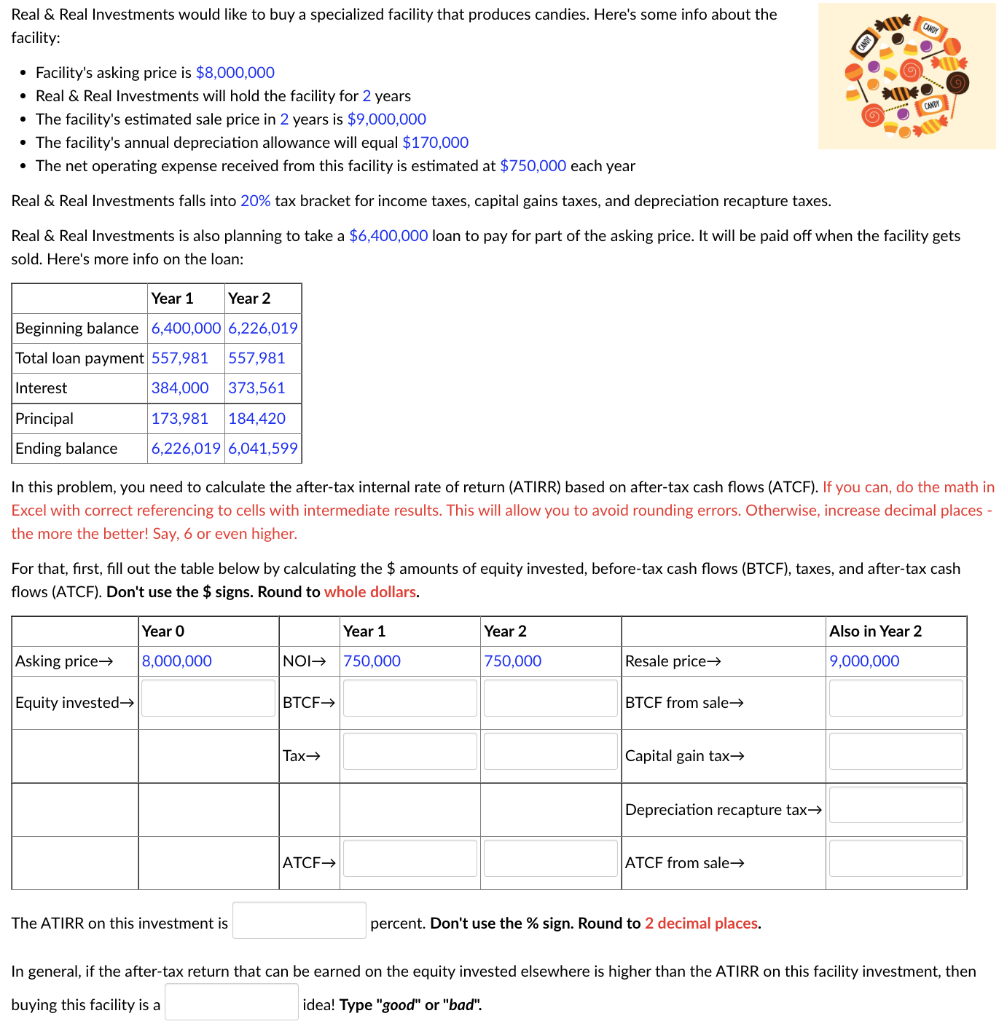

Real \& Real Investments would like to buy a specialized facility that produces candies. Here's some info about the facility: - Facility's asking price is $8,000,000 - Real \& Real Investments will hold the facility for 2 years - The facility's estimated sale price in 2 years is $9,000,000 - The facility's annual depreciation allowance will equal $170,000 - The net operating expense received from this facility is estimated at $750,000 each year Real \& Real Investments falls into 20% tax bracket for income taxes, capital gains taxes, and depreciation recapture taxes. Real \& Real Investments is also planning to take a $6,400,000 loan to pay for part of the asking price. It will be paid off when the facility gets sold. Here's more info on the loan: In this problem, you need to calculate the after-tax internal rate of return (ATIRR) based on after-tax cash flows (ATCF). If you can, do the math i Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places the more the better! Say, 6 or even higher. For that, first, fill out the table below by calculating the $ amounts of equity invested, before-tax cash flows (BTCF), taxes, and after-tax cash flows (ATCF). Don't use the $ signs. Round to whole dollars. The ATIRR on this investment is percent. Don't use the \% sign. Round to 2 decimal places. In general, if the after-tax return that can be earned on the equity invested elsewhere is higher than the ATIRR on this facility investment, then buying this facility is a idea! Type "good" or "bad". Real \& Real Investments would like to buy a specialized facility that produces candies. Here's some info about the facility: - Facility's asking price is $8,000,000 - Real \& Real Investments will hold the facility for 2 years - The facility's estimated sale price in 2 years is $9,000,000 - The facility's annual depreciation allowance will equal $170,000 - The net operating expense received from this facility is estimated at $750,000 each year Real \& Real Investments falls into 20% tax bracket for income taxes, capital gains taxes, and depreciation recapture taxes. Real \& Real Investments is also planning to take a $6,400,000 loan to pay for part of the asking price. It will be paid off when the facility gets sold. Here's more info on the loan: In this problem, you need to calculate the after-tax internal rate of return (ATIRR) based on after-tax cash flows (ATCF). If you can, do the math i Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places the more the better! Say, 6 or even higher. For that, first, fill out the table below by calculating the $ amounts of equity invested, before-tax cash flows (BTCF), taxes, and after-tax cash flows (ATCF). Don't use the $ signs. Round to whole dollars. The ATIRR on this investment is percent. Don't use the \% sign. Round to 2 decimal places. In general, if the after-tax return that can be earned on the equity invested elsewhere is higher than the ATIRR on this facility investment, then buying this facility is a idea! Type "good" or "bad