Real world case 12-1

Intermediate Accounting 6th edition spiceland

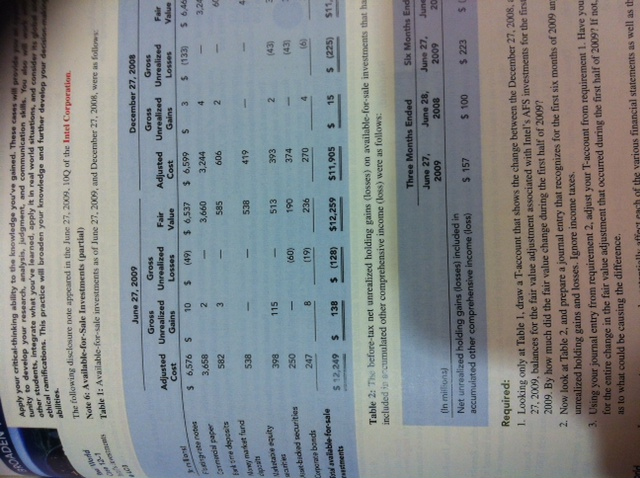

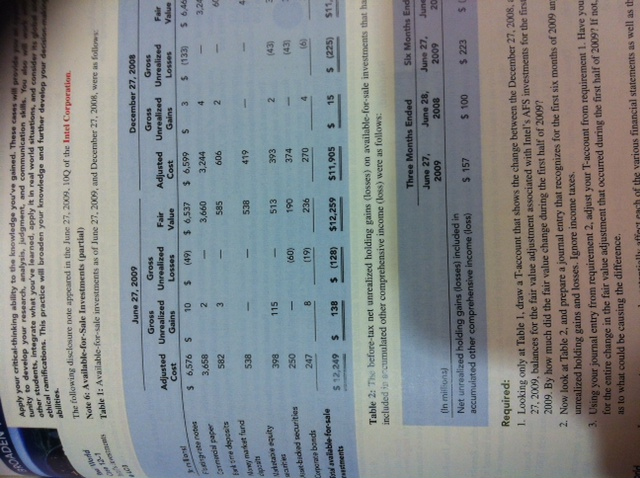

Apply your critical-thinking ability to the knowledge you've gained. These cases will provide your to develop your research, analysis, judgment, and communication skills. You also will other students, Integrate what you've learned, apply it in real world situations, and consider its ethical ramifications. This practice will broaden your knowledge and further develop your decision abilities. The following disclosure note appeared in the June 27,2009,10Q of the Intel Corporation. Available-for-Sale Investments (partial) Available-for-sale investments as of June 27,2009, and December 27, 2008, were as follows: The before-tax net unrealized holdings gains (losses) on available- for -sale investments that has included in accumulated other comprehensive income(loss) were as follows: Required: Looking only at Table 1, draw a T -account that shows the change between the December 27, 2008, 27,2009, balances for the fair value change during the first half of 2009? Now look at Table 2, and prepare a journal entry that recognizes for the first six months of 2009 and unrealized holdings gains and losses, Ignore income taxes. Using your journal entry from requirement 2, adjust your T-account from requirement1. Have you for the entire change in the fair value adjustment that occurred during the first half of 2009? If not as to what could be causing the difference. The various financial statements as well as Apply your critical-thinking ability to the knowledge you've gained. These cases will provide your to develop your research, analysis, judgment, and communication skills. You also will other students, Integrate what you've learned, apply it in real world situations, and consider its ethical ramifications. This practice will broaden your knowledge and further develop your decision abilities. The following disclosure note appeared in the June 27,2009,10Q of the Intel Corporation. Available-for-Sale Investments (partial) Available-for-sale investments as of June 27,2009, and December 27, 2008, were as follows: The before-tax net unrealized holdings gains (losses) on available- for -sale investments that has included in accumulated other comprehensive income(loss) were as follows: Required: Looking only at Table 1, draw a T -account that shows the change between the December 27, 2008, 27,2009, balances for the fair value change during the first half of 2009? Now look at Table 2, and prepare a journal entry that recognizes for the first six months of 2009 and unrealized holdings gains and losses, Ignore income taxes. Using your journal entry from requirement 2, adjust your T-account from requirement1. Have you for the entire change in the fair value adjustment that occurred during the first half of 2009? If not as to what could be causing the difference. The various financial statements as well as