Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Real World Case 19-2 Per share data; stock options; antidilutive securities; disclosure note; Best Buy Co. () LO19-8 Real World Financials The 2021 annual report

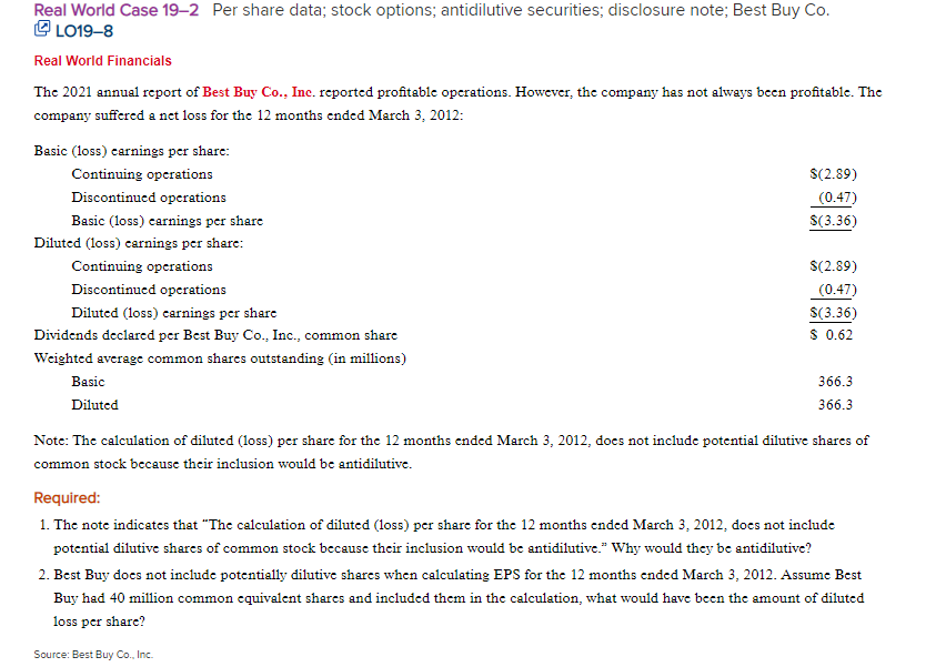

Real World Case 19-2 Per share data; stock options; antidilutive securities; disclosure note; Best Buy Co. () LO19-8 Real World Financials The 2021 annual report of Best Buy Co., Inc. reported profitable operations. However, the company has not always been profitable. The company suffered a net loss for the 12 months ended March 3, 2012: Basic (loss) earnings per share: Continuing operations $(2.89) Discontinued operations Basic (loss) earnings per share $(3.36)(0.47) Diluted (loss) earnings per share: Continuing operations Discontinued operations Diluted (loss) earnings per share Dividends declared per Best Buy Co., Inc., common share $(2.89) $(3.36)(0.47) $0.62 Weighted average common shares outstanding (in millions) Basic Diluted Note: The calculation of diluted (loss) per share for the 12 months ended March 3,2012, does not include potential dilutive shares of common stock because their inclusion would be antidilutive. Required: 1. The note indicates that "The calculation of diluted (loss) per share for the 12 months ended March 3,2012 , does not include potential dilutive shares of common stock because their inclusion would be antidilutive." Why would they be antidilutive? 2. Best Buy does not include potentially dilutive shares when calculating EPS for the 12 months ended March 3, 2012. Assume Best Buy had 40 million common equivalent shares and included them in the calculation, what would have been the amount of diluted loss per share? Source: Best Buy Co., Inc. Real World Case 19-2 Per share data; stock options; antidilutive securities; disclosure note; Best Buy Co. () LO19-8 Real World Financials The 2021 annual report of Best Buy Co., Inc. reported profitable operations. However, the company has not always been profitable. The company suffered a net loss for the 12 months ended March 3, 2012: Basic (loss) earnings per share: Continuing operations $(2.89) Discontinued operations Basic (loss) earnings per share $(3.36)(0.47) Diluted (loss) earnings per share: Continuing operations Discontinued operations Diluted (loss) earnings per share Dividends declared per Best Buy Co., Inc., common share $(2.89) $(3.36)(0.47) $0.62 Weighted average common shares outstanding (in millions) Basic Diluted Note: The calculation of diluted (loss) per share for the 12 months ended March 3,2012, does not include potential dilutive shares of common stock because their inclusion would be antidilutive. Required: 1. The note indicates that "The calculation of diluted (loss) per share for the 12 months ended March 3,2012 , does not include potential dilutive shares of common stock because their inclusion would be antidilutive." Why would they be antidilutive? 2. Best Buy does not include potentially dilutive shares when calculating EPS for the 12 months ended March 3, 2012. Assume Best Buy had 40 million common equivalent shares and included them in the calculation, what would have been the amount of diluted loss per share? Source: Best Buy Co., Inc

Real World Case 19-2 Per share data; stock options; antidilutive securities; disclosure note; Best Buy Co. () LO19-8 Real World Financials The 2021 annual report of Best Buy Co., Inc. reported profitable operations. However, the company has not always been profitable. The company suffered a net loss for the 12 months ended March 3, 2012: Basic (loss) earnings per share: Continuing operations $(2.89) Discontinued operations Basic (loss) earnings per share $(3.36)(0.47) Diluted (loss) earnings per share: Continuing operations Discontinued operations Diluted (loss) earnings per share Dividends declared per Best Buy Co., Inc., common share $(2.89) $(3.36)(0.47) $0.62 Weighted average common shares outstanding (in millions) Basic Diluted Note: The calculation of diluted (loss) per share for the 12 months ended March 3,2012, does not include potential dilutive shares of common stock because their inclusion would be antidilutive. Required: 1. The note indicates that "The calculation of diluted (loss) per share for the 12 months ended March 3,2012 , does not include potential dilutive shares of common stock because their inclusion would be antidilutive." Why would they be antidilutive? 2. Best Buy does not include potentially dilutive shares when calculating EPS for the 12 months ended March 3, 2012. Assume Best Buy had 40 million common equivalent shares and included them in the calculation, what would have been the amount of diluted loss per share? Source: Best Buy Co., Inc. Real World Case 19-2 Per share data; stock options; antidilutive securities; disclosure note; Best Buy Co. () LO19-8 Real World Financials The 2021 annual report of Best Buy Co., Inc. reported profitable operations. However, the company has not always been profitable. The company suffered a net loss for the 12 months ended March 3, 2012: Basic (loss) earnings per share: Continuing operations $(2.89) Discontinued operations Basic (loss) earnings per share $(3.36)(0.47) Diluted (loss) earnings per share: Continuing operations Discontinued operations Diluted (loss) earnings per share Dividends declared per Best Buy Co., Inc., common share $(2.89) $(3.36)(0.47) $0.62 Weighted average common shares outstanding (in millions) Basic Diluted Note: The calculation of diluted (loss) per share for the 12 months ended March 3,2012, does not include potential dilutive shares of common stock because their inclusion would be antidilutive. Required: 1. The note indicates that "The calculation of diluted (loss) per share for the 12 months ended March 3,2012 , does not include potential dilutive shares of common stock because their inclusion would be antidilutive." Why would they be antidilutive? 2. Best Buy does not include potentially dilutive shares when calculating EPS for the 12 months ended March 3, 2012. Assume Best Buy had 40 million common equivalent shares and included them in the calculation, what would have been the amount of diluted loss per share? Source: Best Buy Co., Inc Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started