Really just need the answer to part c PLEASE! Need it hand calculated not in excel because I need to understand the steps and process

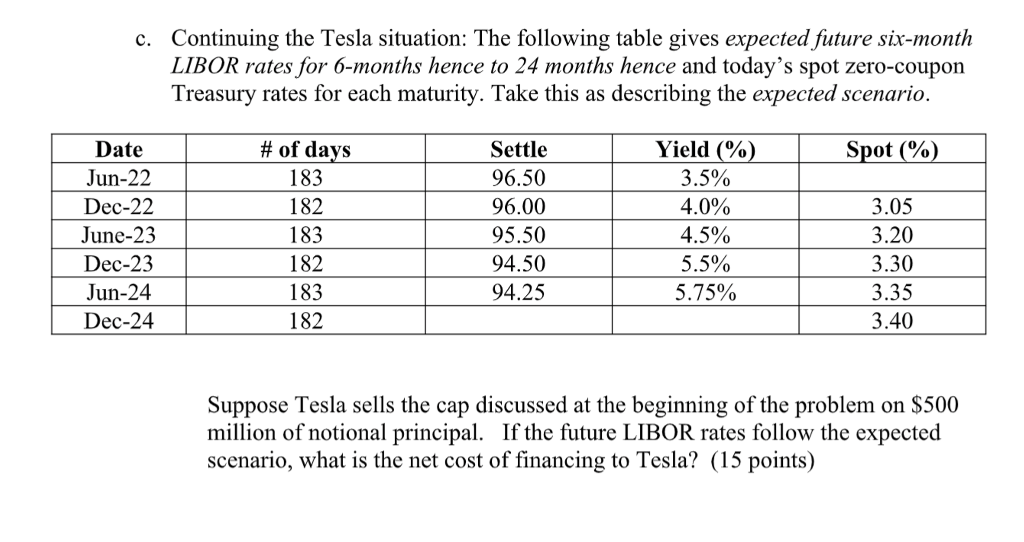

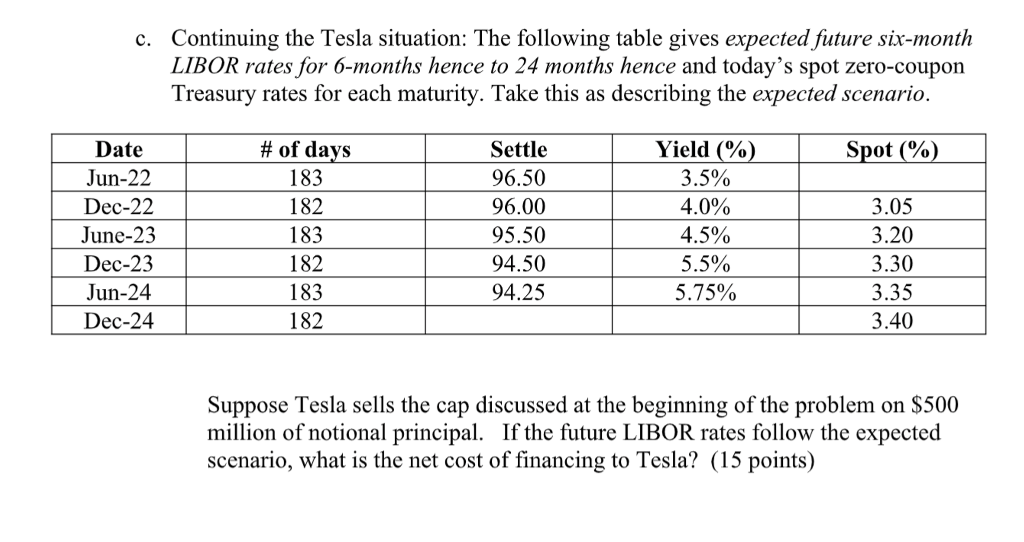

The date is June 30,2022 . Tesla, Inc. is planning to issue $500 million in two-year fixed rate debt at 5.3%. The current six-month LIBOR rate is 3.5%. They think the fixed rate they will be paying is reasonable enough, but they believe that short-term interest rates, like LIBOR, will not increase significantly over the life of the new debt. Tesla would like to use what it has learned about interest rate options to reduce its cost of borrowing. A two-year cap (with notional principal of $500 million) against six month LIBOR can be sold (to one of their banks) with a strike price of 5% where Tesla would receive premium of 150 basis points. Assume Tesla sells the cap described above. a. At a reset date, if LIBOR is less than 5%, what is the cash flow from Tesla to the bank on the cap and when does this payment take place? ( 5 points) b. At a reset date, if LIBOR is, say 7%, what is the cash flow from Tesla to the bank on the cap and when does this payment take place? (10 points) c. Continuing the Tesla situation: The following table gives expected future six-month LIBOR rates for 6-months hence to 24 months hence and today's spot zero-coupon Treasury rates for each maturity. Take this as describing the expected scenario. Suppose Tesla sells the cap discussed at the beginning of the problem on $500 million of notional principal. If the future LIBOR rates follow the expected scenario, what is the net cost of financing to Tesla? (15 points) The date is June 30,2022 . Tesla, Inc. is planning to issue $500 million in two-year fixed rate debt at 5.3%. The current six-month LIBOR rate is 3.5%. They think the fixed rate they will be paying is reasonable enough, but they believe that short-term interest rates, like LIBOR, will not increase significantly over the life of the new debt. Tesla would like to use what it has learned about interest rate options to reduce its cost of borrowing. A two-year cap (with notional principal of $500 million) against six month LIBOR can be sold (to one of their banks) with a strike price of 5% where Tesla would receive premium of 150 basis points. Assume Tesla sells the cap described above. a. At a reset date, if LIBOR is less than 5%, what is the cash flow from Tesla to the bank on the cap and when does this payment take place? ( 5 points) b. At a reset date, if LIBOR is, say 7%, what is the cash flow from Tesla to the bank on the cap and when does this payment take place? (10 points) c. Continuing the Tesla situation: The following table gives expected future six-month LIBOR rates for 6-months hence to 24 months hence and today's spot zero-coupon Treasury rates for each maturity. Take this as describing the expected scenario. Suppose Tesla sells the cap discussed at the beginning of the problem on $500 million of notional principal. If the future LIBOR rates follow the expected scenario, what is the net cost of financing to Tesla? (15 points)