Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help on this asset management question Question 2 ABC Pharmaceuticals is manufacturing pharmaceuticals and 2022 sales will benefit from the introduction of a

Really need help on this asset management question

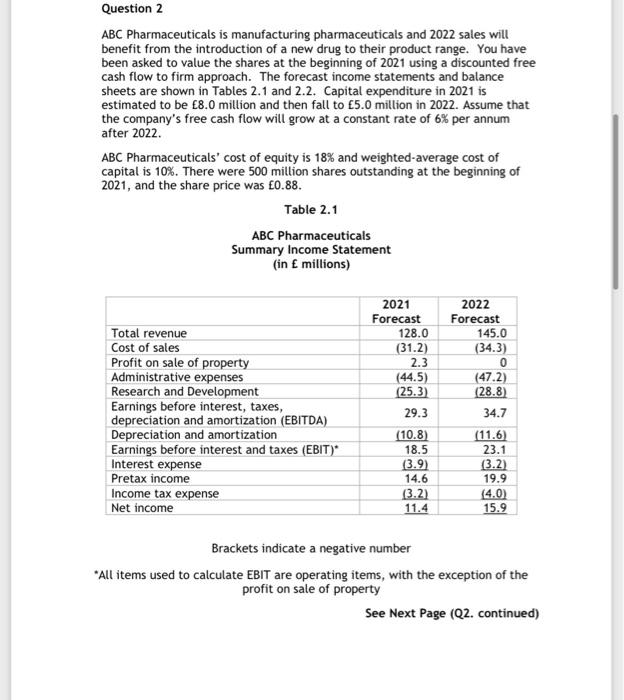

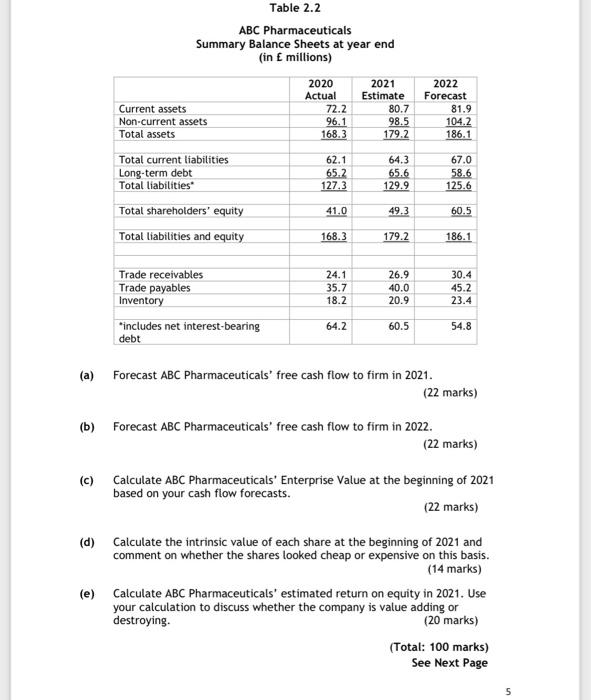

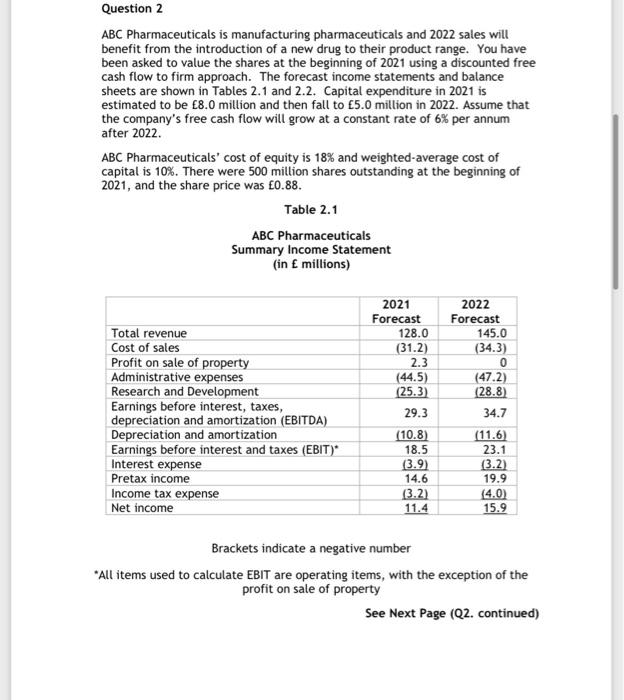

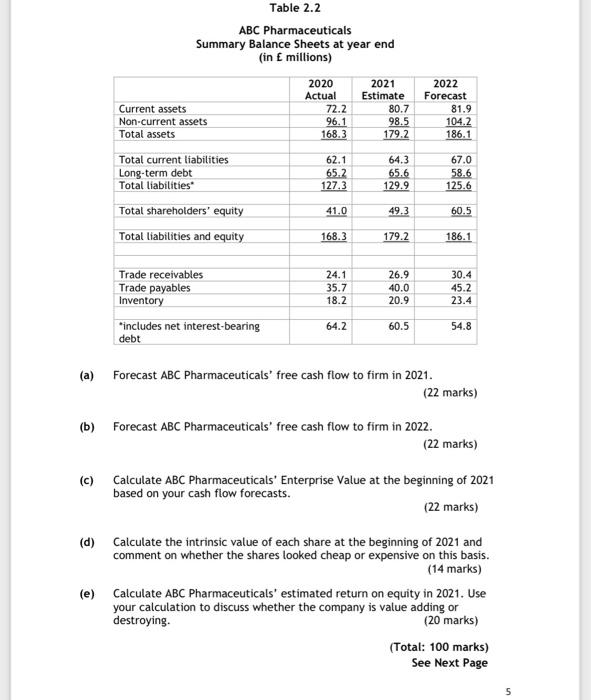

Question 2 ABC Pharmaceuticals is manufacturing pharmaceuticals and 2022 sales will benefit from the introduction of a new drug to their product range. You have been asked to value the shares at the beginning of 2021 using a discounted free cash flow to firm approach. The forecast income statements and balance sheets are shown in Tables 2.1 and 2.2. Capital expenditure in 2021 is estimated to be 8.0 million and then fall to 5.0 million in 2022. Assume that the company's free cash flow will grow at a constant rate of 6% per annum after 2022. ABC Pharmaceuticals' cost of equity is 18% and weighted average cost of capital is 10%. There were 500 million shares outstanding at the beginning of 2021, and the share price was 0.88. Table 2.1 ABC Pharmaceuticals Summary Income Statement (in millions) 2021 Forecast 128.0 (31.2) 2.3 (44.5) (25.3) 2022 Forecast 145.0 (34.3) (47.2) (28.8) 34.7 29.3 Total revenue Cost of sales Profit on sale of property Administrative expenses Research and Development Earnings before interest, taxes, depreciation and amortization (EBITDA) Depreciation and amortization Earnings before interest and taxes (EBIT)* Interest expense Pretax income Income tax expense Net income (10.8) 18.5 (3.9) 14.6 (3.21 11.4 (11.6) 23.1 (3.2) 19.9 (4.0) 15.9 Brackets indicate a negative number "All items used to calculate EBIT are operating items, with the exception of the profit on sale of property See Next Page (Q2. continued) Table 2.2 ABC Pharmaceuticals Summary Balance Sheets at year end (in millions) 2020 Actual 72.2 96.1 168.3 2021 Estimate 80.7 98.5 179.2 2022 Forecast 81.9 104.2 186.1 Current assets Non-current assets Total assets Total current liabilities Long-term debt Total liabilities 62.1 65.2 127.3 64.3 65.6 129.9 67.0 58.6 125.6 41.0 49.3 60.5 Total shareholders' equity Total liabilities and equity 168.3 179.2 186.1 24.1 35.7 18.2 26.9 40.0 20.9 Trade receivables Trade payables Inventory *includes net interest-bearing debt 30.4 45.2 23.4 64.2 60.5 54.8 (a) Forecast ABC Pharmaceuticals' free cash flow to firm in 2021. (22 marks) (b) Forecast ABC Pharmaceuticals' free cash flow to firm in 2022. (22 marks) (c) Calculate ABC Pharmaceuticals' Enterprise Value at the beginning of 2021 based on your cash flow forecasts. (22 marks) (d) Calculate the intrinsic value of each share at the beginning of 2021 and comment on whether the shares looked cheap or expensive on this basis. (14 marks) (e) Calculate ABC Pharmaceuticals' estimated return on equity in 2021. Use your calculation to discuss whether the company is value adding or destroying. (20 marks) (Total: 100 marks) See Next Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started