Really need help practising for Exams

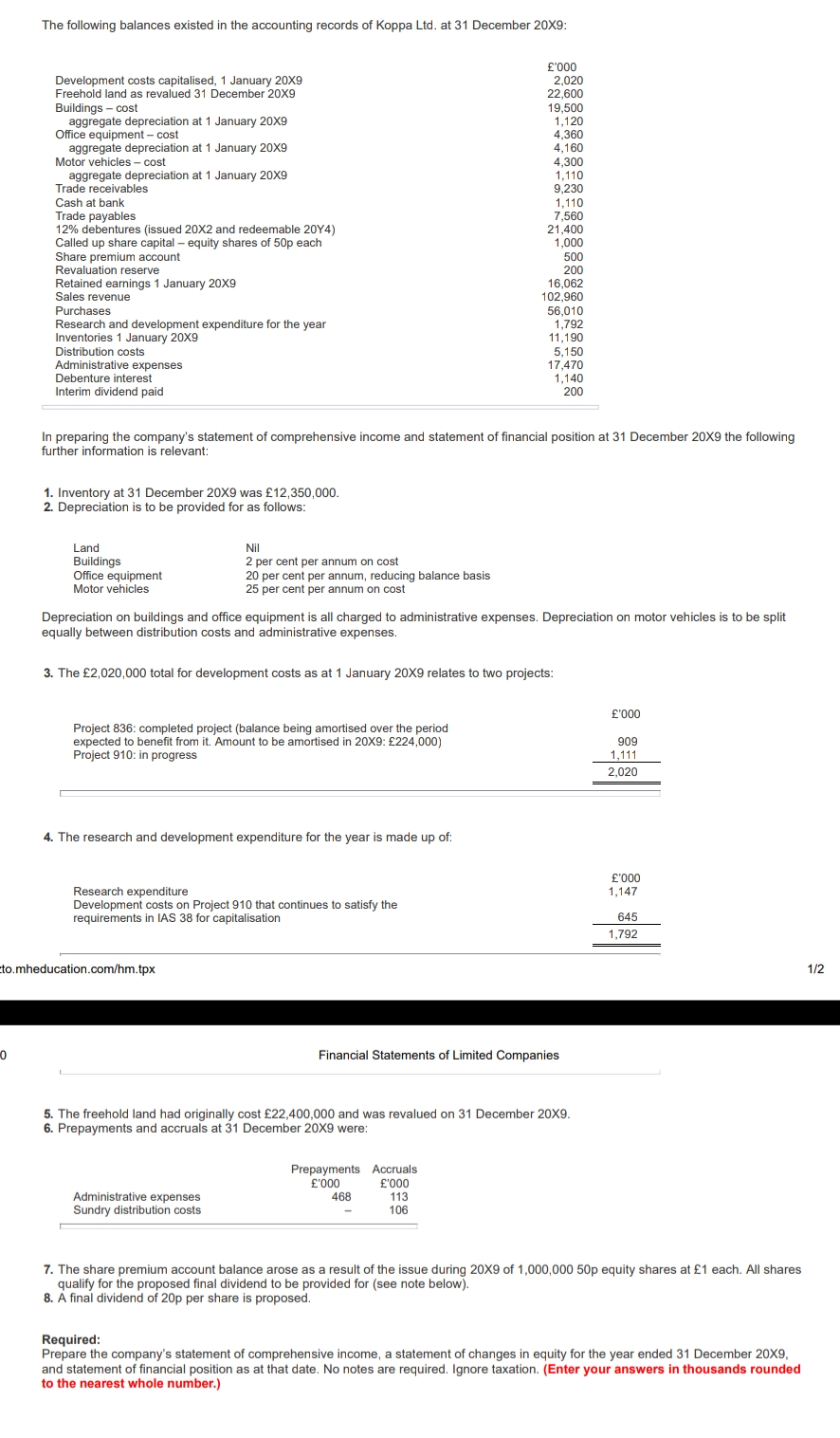

The following balances existed in the accounting records of Koppa Ltd. at 31 December 20X9: E'000 Development costs capitalised, 1 January 20X9 2,020 Freehold land as revalued 31 December 20X9 22,600 Buildings - cost 19,500 aggregate depreciation at 1 January 20X9 1,120 Office equipment - cost 4,360 aggregate depreciation at 1 January 20X9 4,160 Motor vehicles - cost 4,300 aggregate depreciation at 1 January 20X9 1,110 Trade receivables 9,230 Cash at bank 1.110 Trade payables 7,560 12% debentures (issued 20X2 and redeemable 20Y4) 21,400 Called up share capital - equity shares of 50p each 1,000 Share premium account 500 Revaluation reserve 200 Retained earnings 1 January 20X9 16,062 Sales revenue 102,960 Purchases 56,010 Research and development expenditure for the year 1,792 Inventories 1 January 20X9 11,190 Distribution costs 5,150 Administrative expenses 17,470 Debenture interest 1.140 Interim dividend paid 200 In preparing the company's statement of comprehensive income and statement of financial position at 31 December 20X9 the following further information is relevant: 1. Inventory at 31 December 209 was $12,350,000. 2. Depreciation is to be provided for as follows Land Nil Buildings 2 per cent per annum on cost Office equipment 20 per cent per annum, reducing balance basis Motor vehicles 25 per cent per annum on cost eciation on buildings and office equipment is all charged to administrative expenses. Depreciation on motor vehicles is to be split equally between distribution costs and administrative expenses. 3. The E2,020,000 total for development costs as at 1 January 20X9 relates to two projects: E'000 Project 836: completed project (balance being amortised over the period expected to benefit from it. Amount to be amortised in 20X9: [224,000) 909 Project 910: in progress 1,111 2.020 4. The research and development expenditure for the year is made up of: E'000 Research expenditure 1,147 Development costs on Project 910 that continues to satisfy the requirements in LAS 38 for capitalisation 645 1,792 to.mheducation.com/hm.tpx 1/2 Financial Statements of Limited Companies 5. The freehold land had originally cost $22,400,000 and was revalued on 31 December 20X9. 6. Prepayments and accruals at 31 December 20X9 were: Prepayments Accruals E'000 f'OOO Administrative expenses 468 113 Sundry distribution costs 106 7. The share premium account balance arose as a result of the issue during 20X9 of 1,000,000 50p equity shares at $1 each. All shares qualify for the proposed final dividend to be provided for (see note below). 8. A final dividend of 20p per share is proposed. Required: Prepare the company's statement of comprehensive income, a statement of changes in equity for the year ended 31 December 20X9, and statement of financial position as at that date. No notes are required. Ignore taxation. (Enter your answers in thousands rounded to the nearest whole number.)