Answered step by step

Verified Expert Solution

Question

1 Approved Answer

really need help!! :) thank you!! BAFN370 Fall 2021 For the following 5 questions: CDCC is considering an expansion project that requires an initial Tied

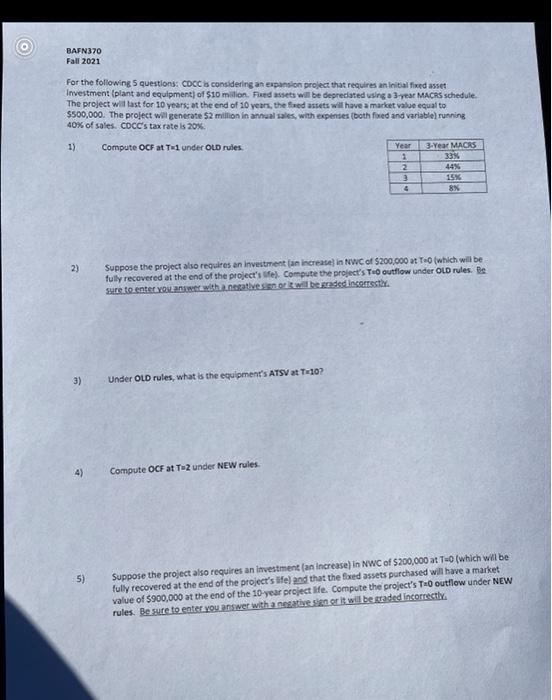

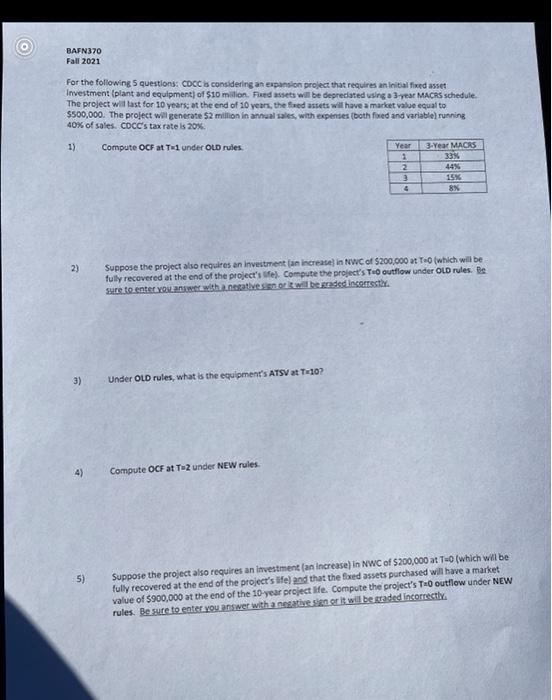

really need help!! :) thank you!!  BAFN370 Fall 2021 For the following 5 questions: CDCC is considering an expansion project that requires an initial Tied asset Investment plant and equipment of $10 milion. Fred assets will be deprecated using a year MACRS schedule. The project will last for 10 years at the end of 10 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% 1) Compute OCF at T under OLD rules. Year 3-Year MACRS 1 33% 44% 15% 8% 2 3 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Tufwhich will be fully recovered at the end of the project's fes Compute the project's Te outflow under OLD rules. De sure to enter your wer with a negative sent will be graded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-10? 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at T-(which will be fully recovered at the end of the project's life and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative sing it will be readed incorrectly BAFN370 Fall 2021 For the following 5 questions: CDCC is considering an expansion project that requires an initial Tied asset Investment plant and equipment of $10 milion. Fred assets will be deprecated using a year MACRS schedule. The project will last for 10 years at the end of 10 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% 1) Compute OCF at T under OLD rules. Year 3-Year MACRS 1 33% 44% 15% 8% 2 3 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Tufwhich will be fully recovered at the end of the project's fes Compute the project's Te outflow under OLD rules. De sure to enter your wer with a negative sent will be graded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-10? 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at T-(which will be fully recovered at the end of the project's life and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative sing it will be readed incorrectly

BAFN370 Fall 2021 For the following 5 questions: CDCC is considering an expansion project that requires an initial Tied asset Investment plant and equipment of $10 milion. Fred assets will be deprecated using a year MACRS schedule. The project will last for 10 years at the end of 10 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% 1) Compute OCF at T under OLD rules. Year 3-Year MACRS 1 33% 44% 15% 8% 2 3 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Tufwhich will be fully recovered at the end of the project's fes Compute the project's Te outflow under OLD rules. De sure to enter your wer with a negative sent will be graded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-10? 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at T-(which will be fully recovered at the end of the project's life and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative sing it will be readed incorrectly BAFN370 Fall 2021 For the following 5 questions: CDCC is considering an expansion project that requires an initial Tied asset Investment plant and equipment of $10 milion. Fred assets will be deprecated using a year MACRS schedule. The project will last for 10 years at the end of 10 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% 1) Compute OCF at T under OLD rules. Year 3-Year MACRS 1 33% 44% 15% 8% 2 3 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Tufwhich will be fully recovered at the end of the project's fes Compute the project's Te outflow under OLD rules. De sure to enter your wer with a negative sent will be graded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-10? 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at T-(which will be fully recovered at the end of the project's life and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative sing it will be readed incorrectly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started