Answered step by step

Verified Expert Solution

Question

1 Approved Answer

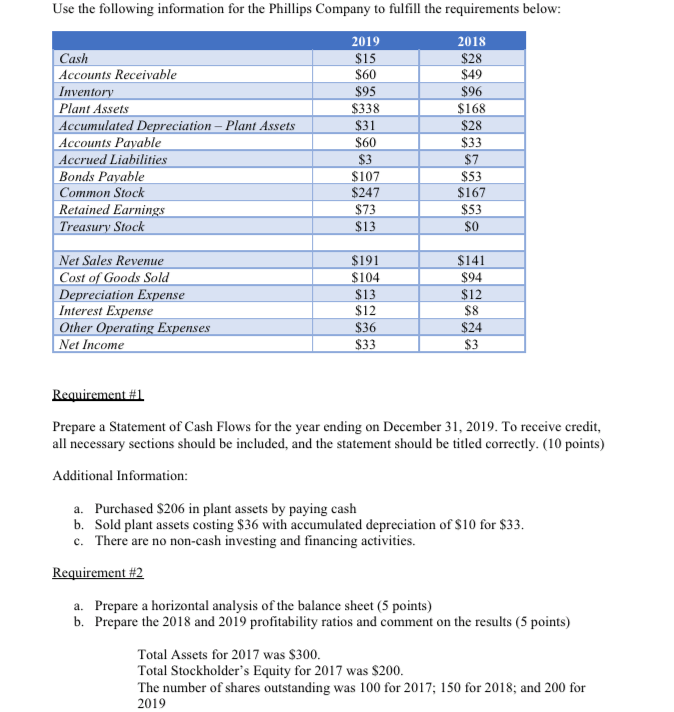

Really need help with Requirement 1 and Requirement 2! Use the following information for the Phillips Company to fulfill the requirements below: L Cash Accounts

Really need help with Requirement 1 and Requirement 2!

Use the following information for the Phillips Company to fulfill the requirements below: L Cash Accounts Receivable Inventory Plant Assets Accumulated Depreciation - Plant Assets Accounts Payable Accrued Liabilities Bonds Payable Common Stock Retained Earnings Treasury Stock 2019 $15 $60 $95 $338 $31 $60 $3 $107 $247 2018 $28 $49 $96 $168 $28 $33 $7 $53 $167 $53 $0 nince Net Sales Revenue Cost of Goods Sold epreciation Expense Interest Expense Other Operating Expenses Net Income $191 $104 $13 $12 $36 $33 $141 $94 $12 $8 $24 $3 Requirement #1 Prepare a Statement of Cash Flows for the year ending on December 31, 2019. To receive credit, all necessary sections should be included, and the statement should be titled correctly. (10 points) Additional Information: a. Purchased $206 in plant assets by paying cash b. Sold plant assets costing $36 with accumulated depreciation of $10 for $33. c. There are no non-cash investing and financing activities. Requirement #2 a. Prepare a horizontal analysis of the balance sheet (5 points) b. Prepare the 2018 and 2019 profitability ratios and comment on the results (5 points) Total Assets for 2017 was $300. Total Stockholder's Equity for 2017 was $200. The number of shares outstanding was 100 for 2017; 150 for 2018; and 200 for 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started