Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help with this. I've posted it a couple of times but the answers have been wrong. I will thumbs up if correct. The

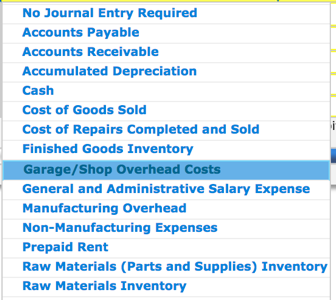

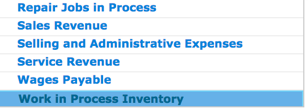

Really need help with this. I've posted it a couple of times but the answers have been wrong. I will thumbs up if correct. The journal entry options are listed below

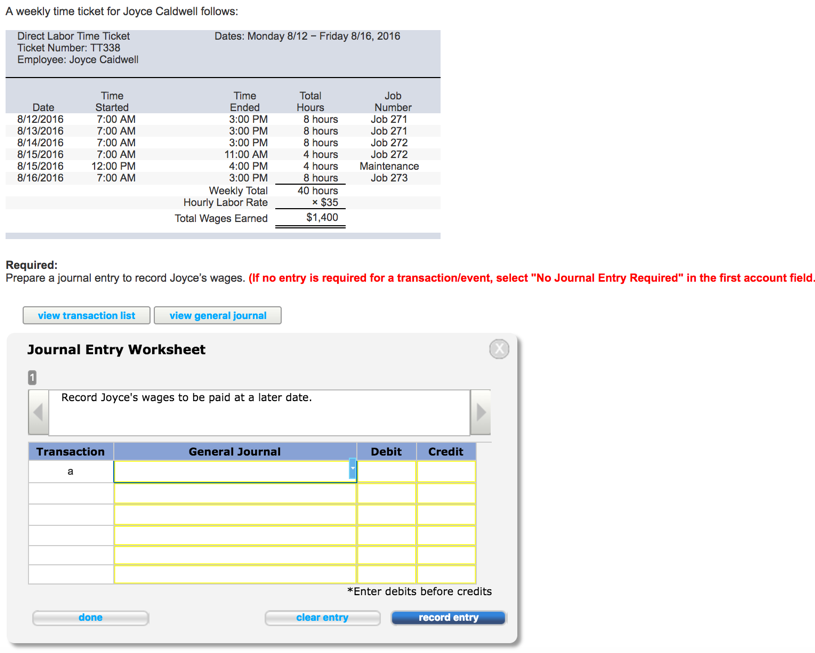

A weekly time ticket for Joyce Caldwell follows: Direct Labor Time Ticket Dates: Monday 8/12 Friday 8/16, 2016 Ticket Number: TT338 Employee: Joyce Caidwell Time Time Total Job Date Started Ended Hours Number 8/12/2016 7:00 AM 8/13/2016 7:00 AM 3:00 PM 8 hours Job 271 3:00 PM 8 hours Job 271 7:00 AM 8/14/2016 3:00 PM 8 hours Job 272 Job 272 8/15/2016 7:00 AM 11:00 AM 4 hours 4:00 PM 8/15/2016 12:00 PM 4 hours Maintenance 7:00 AM 3:00 PM 8 hours Job 273 8/16/2016 Weekly Total 40 hours Hourly Labor Rate x $35 $1,400 Total Wages Earned Required Prepare a journal entry to record Joyce's wages. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. view transaction list view general journal Journal Entry Worksheet Record Joyce's wages to be paid at a later date. Transaction General Journal Debit Credit *Enter debits before credits clear entry record entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started