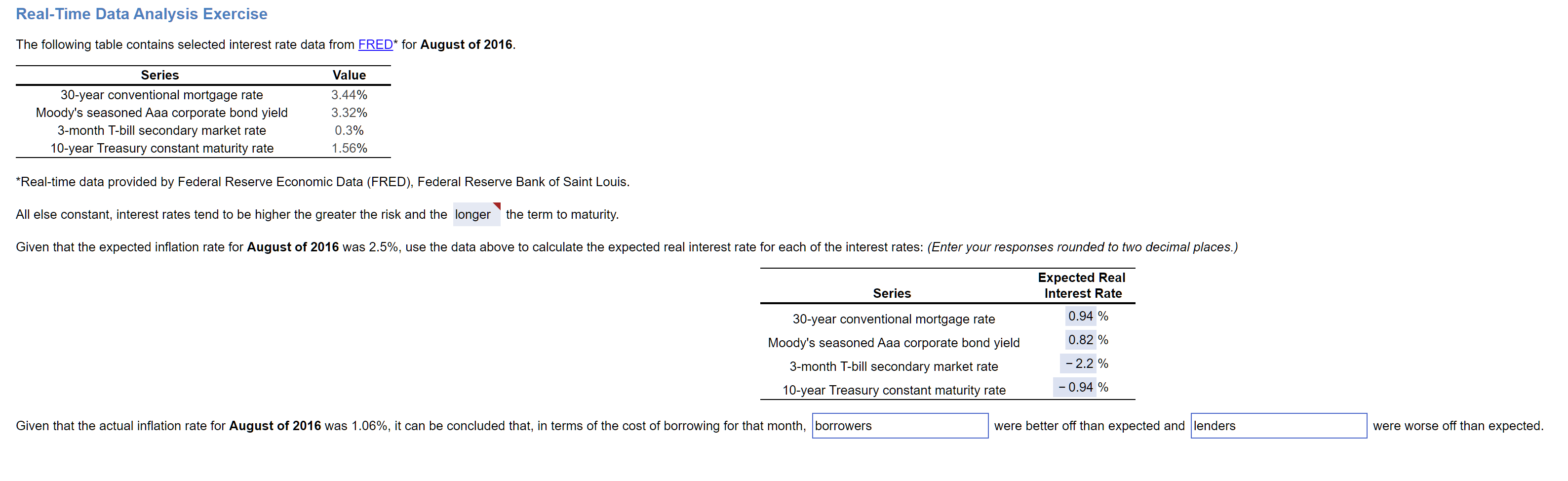

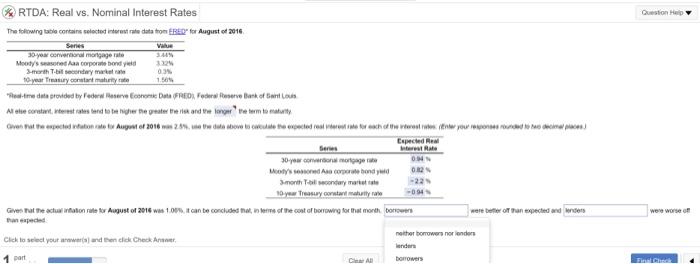

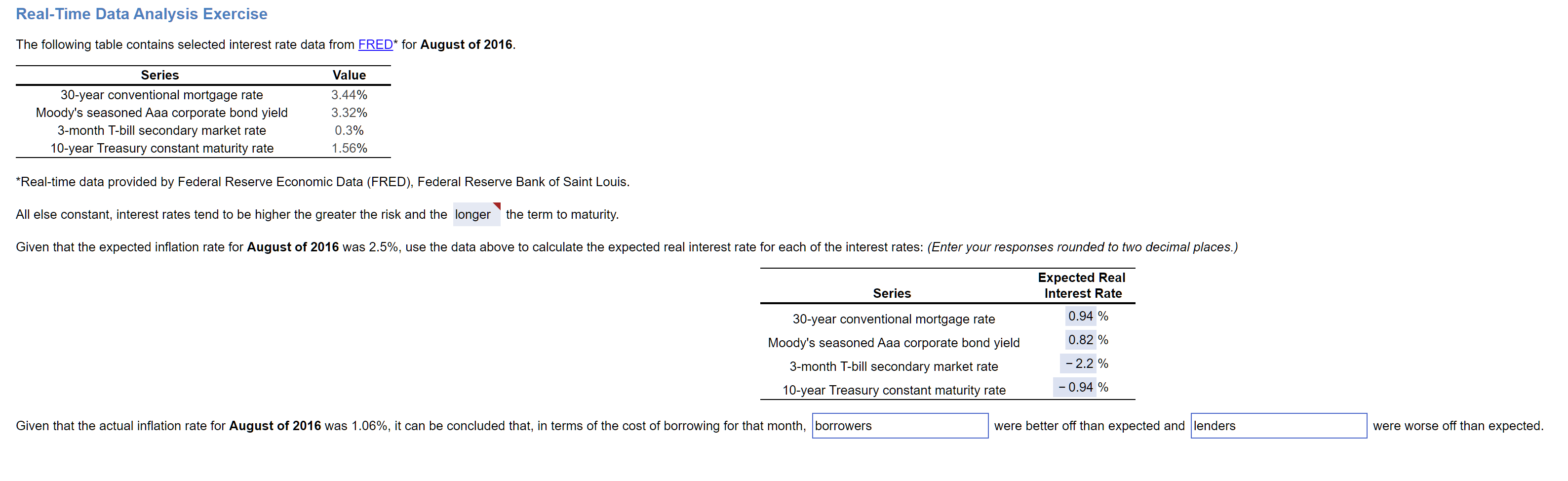

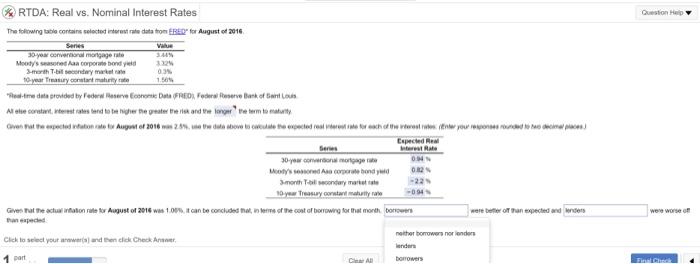

Real-Time Data Analysis Exercise The following table contains selected interest rate data from FRED* for August of 2016. Series 30-year conventional mortgage rate Moody's seasoned Aaa corporate bond yield 3-month T-bill secondary market rate 10-year Treasury constant maturity rate Value 3.44% 3.32% 0.3% 1.56% *Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. All else constant, interest rates tend to be higher the greater the risk and the longer the term to maturity. Given that the expected inflation rate for August of 2016 was 2.5%, use the data above to calculate the expected real interest rate for each of the interest rates: (Enter your responses rounded to two decimal places.) Expected Real Interest Rate Series 0.94 % 0.82 % 30-year conventional mortgage rate Moody's seasoned Aaa corporate bond yield 3-month T-bill secondary market rate 10-year Treasury constant maturity rate - 2.2 % - 0.94 % Given that the actual inflation rate for August of 2016 was 1.06%, it can be concluded that, in terms of the cost of borrowing for that month, borrowers were better off than expected and lenders were worse off than expected. Question ARTDA: Real vs. Nominal Interest Rates The following table contains selected interest rate data from ERED for August of 2016 Senes soy conversional mortgage rate Moody's stan corporate bond yes 32 merth T-bil secondary market 0 19.yout Teaty constant mattyate te data provided by www.verone D FRED Pode server of Gant Alte constaterest rates and to be higher the greater there and the long term to maturity cm Plochodowe August of 2016 m2, www we rected rear wheel tow you pre cient per Espected Real Interest Rate 30 con OHN Moy's discote hond uit 02 -22 1 year Trasy constar muity nale Gaver Tat the actual raton rule v August of 2016 was 1. It can be concluded that, here of the cost of borowing for that month bottom -04 Wereworso nother borrowers onders Click to select your and then click Check port CA borrowers Real-Time Data Analysis Exercise The following table contains selected interest rate data from FRED* for August of 2016. Series 30-year conventional mortgage rate Moody's seasoned Aaa corporate bond yield 3-month T-bill secondary market rate 10-year Treasury constant maturity rate Value 3.44% 3.32% 0.3% 1.56% *Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. All else constant, interest rates tend to be higher the greater the risk and the longer the term to maturity. Given that the expected inflation rate for August of 2016 was 2.5%, use the data above to calculate the expected real interest rate for each of the interest rates: (Enter your responses rounded to two decimal places.) Expected Real Interest Rate Series 0.94 % 0.82 % 30-year conventional mortgage rate Moody's seasoned Aaa corporate bond yield 3-month T-bill secondary market rate 10-year Treasury constant maturity rate - 2.2 % - 0.94 % Given that the actual inflation rate for August of 2016 was 1.06%, it can be concluded that, in terms of the cost of borrowing for that month, borrowers were better off than expected and lenders were worse off than expected. Question ARTDA: Real vs. Nominal Interest Rates The following table contains selected interest rate data from ERED for August of 2016 Senes soy conversional mortgage rate Moody's stan corporate bond yes 32 merth T-bil secondary market 0 19.yout Teaty constant mattyate te data provided by www.verone D FRED Pode server of Gant Alte constaterest rates and to be higher the greater there and the long term to maturity cm Plochodowe August of 2016 m2, www we rected rear wheel tow you pre cient per Espected Real Interest Rate 30 con OHN Moy's discote hond uit 02 -22 1 year Trasy constar muity nale Gaver Tat the actual raton rule v August of 2016 was 1. It can be concluded that, here of the cost of borowing for that month bottom -04 Wereworso nother borrowers onders Click to select your and then click Check port CA borrowers